After a dismal start to the week, markets are showing signs of stabilisation as traders await the next round of trade-related headlines. Whilst volatility could once again erupt, we see potential for a sympathy bounce first.

US indices began to shrug off the tariffs as Trump proudly announced that China’s Premier Liu was “now coming to the U.S. to make a deal". In doing so, the S&P500 managed to hold above Tuesday’s low to form an inside day and the VIX failed to break high, leaving the potential for the ‘fear index’ to revert to its mean if trade talks allow. If so, we’d expect mean reversion elsewhere to the benefit of risk.

The yen remains the firmest major this week and gained the most traction against GBP, NZD and CHF. Yet given the US dollar remains the 2nd strongest major this week, we could consider longs on USD/JPY for a near-term mean reversion setup.

Obviously, given the headline risk of yen pairs, we cannot rule out another stab lower yet expect we’re drawing nearer to a bounce. But by Friday, we expect a binary outcome for sentiment and for the real moves to begin. As failure to reach a deal will see high tariffs for China and likely risk-off (strong yen / weak stocks) or a risk-on rally if a deal is made.

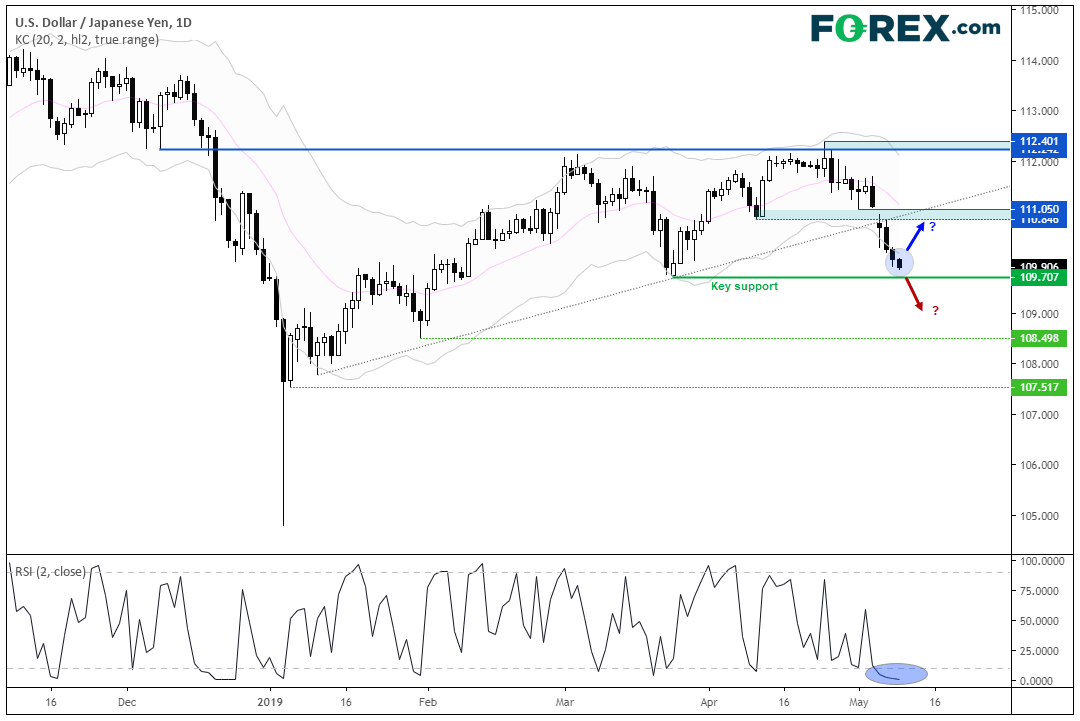

As for USD/JPY, it hasn’t quite tested the 109.71 low yet prices appear a little stretched to the downside. RSI(2) is oversold and at its lowest level this year, the volatility of bearish candles are on the decline and we’re now within the fourth session where price action has traded beneath the lower Keltner band.

A solid bounce above key support brings the 110.85-111.05 resistance zone into focus for bulls. Alternatively, bears could consider fading into moves beneath this level, or waiting for a break beneath key support. But given the lack of mean reversion, we’d prefer to step aside for short positions at present.