Despite the RBA remaining hawkish for much of the year, the AUD/USD got toasted nevertheless.

When your interest rates are among the highest in the G10 space and the central bank has no plans of cutting rates, that alone should be good enough to keep your currency strong. But when your currency is considered to be highly risk-sensitive in an environment where US stocks and Bitcoin are surging to record levels, then you would expect your currency to be among the strongest in the world. Yet, for the Aussie dollar, it was the complete opposite, with the AUD/USD turning sharply lower from the end of Q3 to fall for three consecutive months. So, one of the biggest surprises for me in 2024 was the AUD/USD. Not because of what it did, but rather because of what it didn’t do: rally.

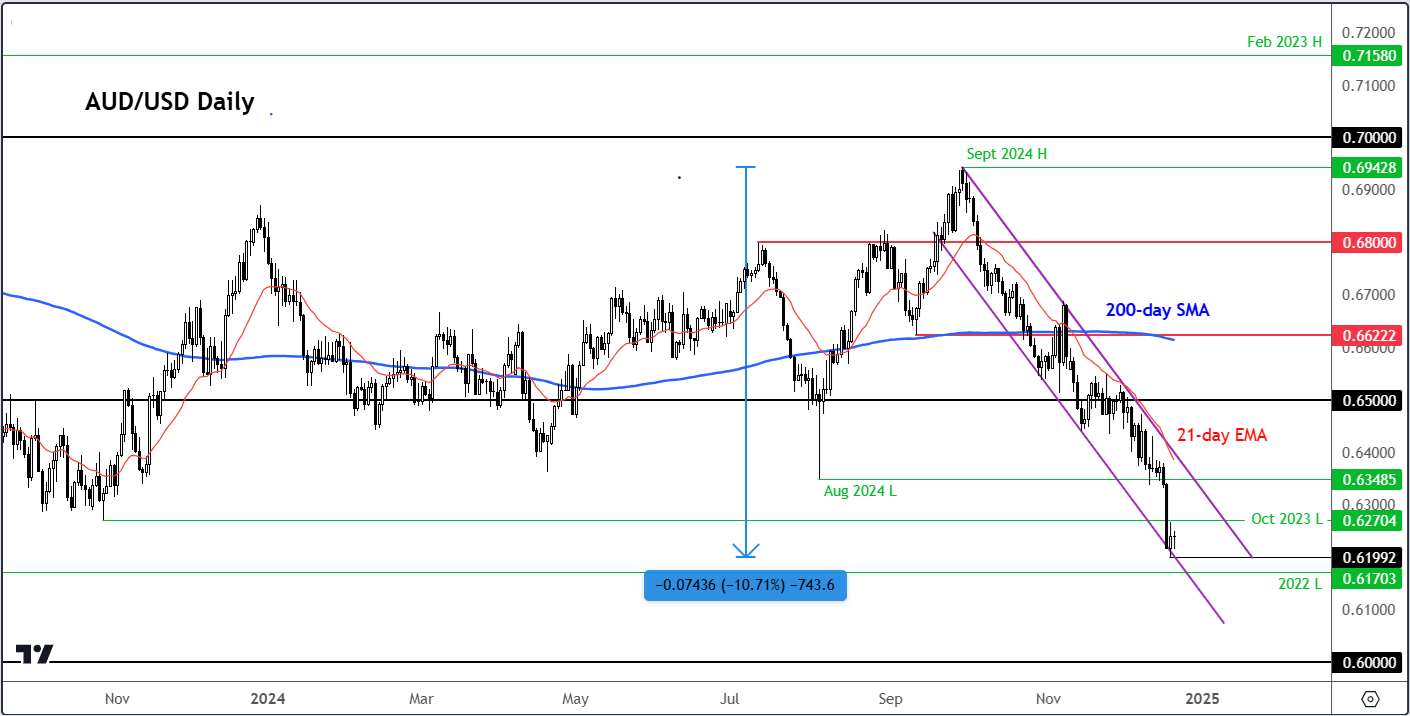

AUD/USD drops 10% from September peak

Source: TradingView.com

The AUD/USD fell more than 10% from its peak of 0.6942 in September, to a low of just below the 0.6200 handle. The AUD/USD was largely held back by a strong US dollar, which surged again when Trump won the US election. Traders bought the greenback on expectations that his polices, including tax cuts, would boost growth in the US. The losses for the Aussie were magnified because of Australia’s close ties to China. Traders worried that Trump’s introduction of tariffs could cripple China’s economic output, and in turn weigh on Aussie exports of raw materials to the world’s second largest economy.

Demand concerns in China weighed on Aussie

Australia’s largest exports market, China faced significant economic challenges in 2024, ranging from a real estate downturn, to slowing consumer spending and rising trade tensions with the US.

A depreciating yuan and a sluggish post-pandemic recovery raised concerns about demand from China for Australia’s exports of iron ore, copper and other metals. Beyond currency-related challenges, geopolitical risks also held back the Aussie. Investors figured that potential US tariffs on Chinese goods could further exacerbate the pressure on the world’s second largest economy, and therefore impact its largest trading partners.

The key takeaway point

What happens in China is super-important for the Australian dollar. Indeed, Australia last year supplied 64% of China’s iron ore and more than half its lithium needs. While Australia’s exports did weaken to China during 2024 this was mainly a reflection of weaker iron ore and lithium prices. What’s more, a pause in the Chinese central bank’s gold purchases also weighed on Australia’s metals exports. The AUD/USD could rebound in 2025 if China manages – through major stimulus measures – to stage a stronger recovery than expected. This could potentially be more of an influence than perhaps the RBA’s policy decisions.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R