- AUD/USD rose for a second week and was the strongest FX major last week

- Correlations between AUD/USD and key markets are lower

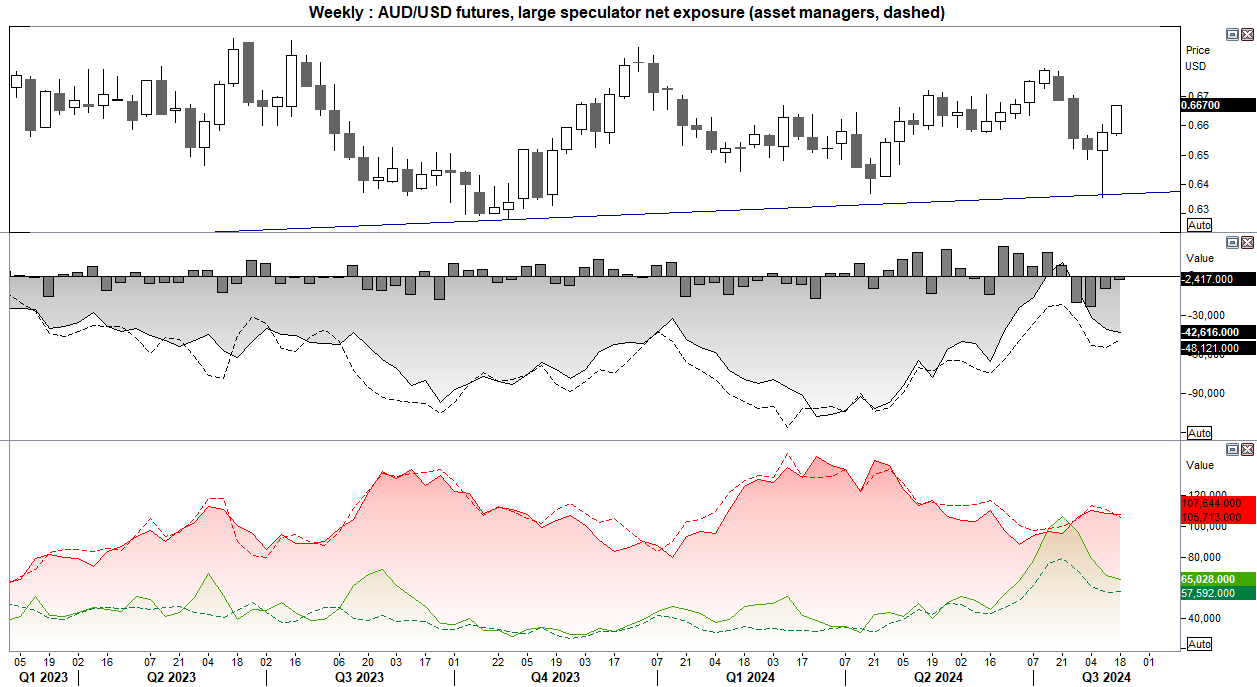

- Jerome Powell speaks at the Jackson Hole symposium this week

- RBA minutes also released

It is too soon for the RBA to even think about cutting interest rates, RBA governor Bullock told lawmakers on Friday. And that the central bank doesn’t expect to be in a position to do so over the near term. Reiterating once more that inflation remains “too high”, she noted the balancing act the RBA are trying to achieve of bringing inflation down while preserving labour market gains. I see no reason to change my long-held views; the RBA are not likely to change rates, in either direction, this year.

Money markets are pricing in RBA cuts. The RBA 30-day cash rate futures market is pricing in a 30% chance of a cut at their next meeting, and a 25bp cut is fully priced in by January (December is very close). The rate is implied to be 3.27 by January 2026, which suggests over 4.5 cuts.

The RBA minutes are released on Tuesday, although they’re likely to be a non event. I cannot see how they could deviate too far away from their well-balanced script, but result assured I’ll let you know if they do. Flash manufacturing and services PMIs are released on Thursday.

Jerome Powell speaks at Jackson Hole at midnight on Friday. Fed fund futures continue to price in multiple cuts over the next year, with one expected to arrive at their next meeting in September. It is therefore difficult to see how Powell can surprise with a dovish tone, given the dovish market pricing already in place. If there is to be a surprise at all, that means he needs to be more hawkish (or less dovish) than expected. But even then, markets will likely not believe him anyway. Regardless of the risks of it being a non event, it will likely suppress volatility levels heading into the event, which could make it a last end to the week for speculators

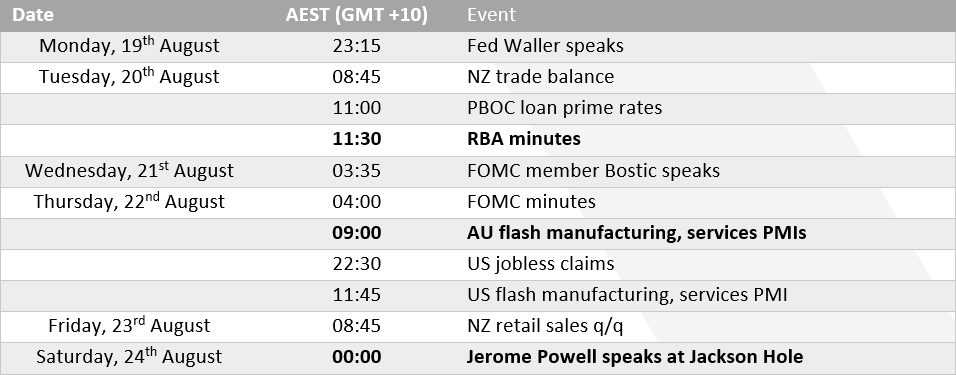

AUD/USD 20-day rolling correlation

- For the first week in a long while, none of the markets we track alongside the Aussie has had a strong 20-day correlation with AUD/USD

- WTI crude oil has the strongest positive correlation at 0.64 and the CRB commodity index at 0.6

- The AU-US 2-year spread has inverted with a negative (and low) correlation of -0.44

- With correlations less robust as they were, price action observations remain key to help decipher the next major move for AUD/USD

- And on that front, note how AUD/USD and copper prices tracked each other quite closely last week, although it is yet to show up in the lagging 20-day correlation

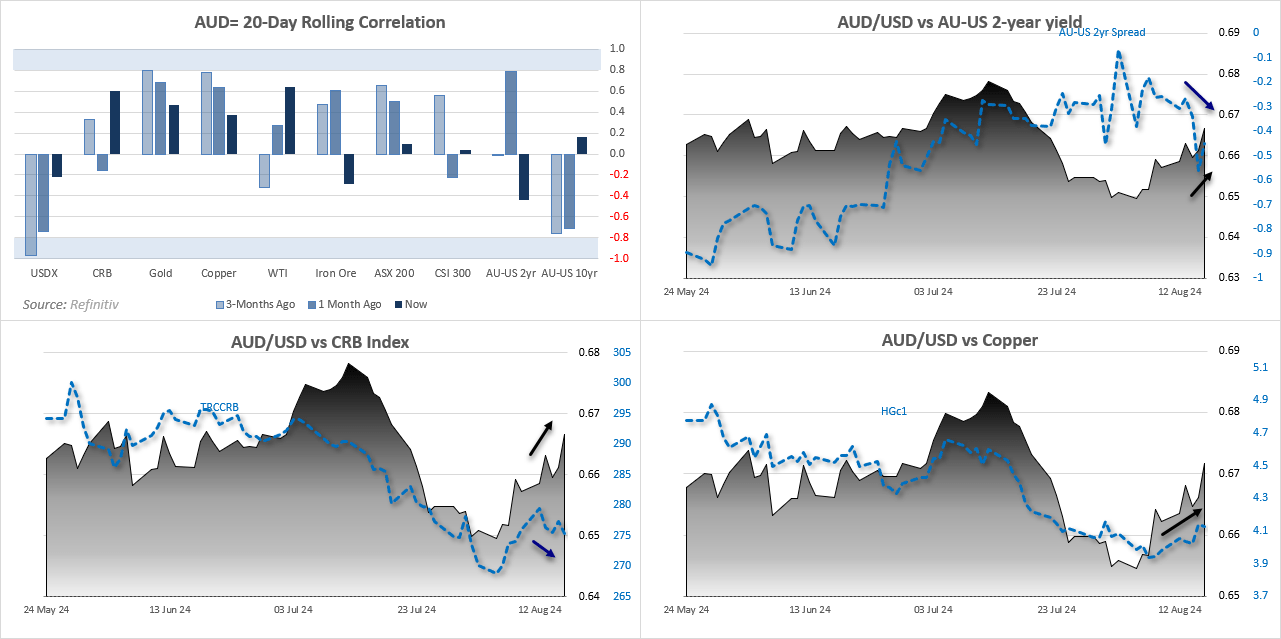

AUD/USD futures – market positioning from the COT report:

- AUD/USD rose for a second week, and was the strongest FX major of the week

- Net-short exposure among large speculators increased for a fourth week, although it was the smallest increase in 10 weeks

- Open interest among large speculators was actually lower, as both longs and shorts were scaled back

- I suspect we’ll see a decrease of net-short exposure in the next COT report

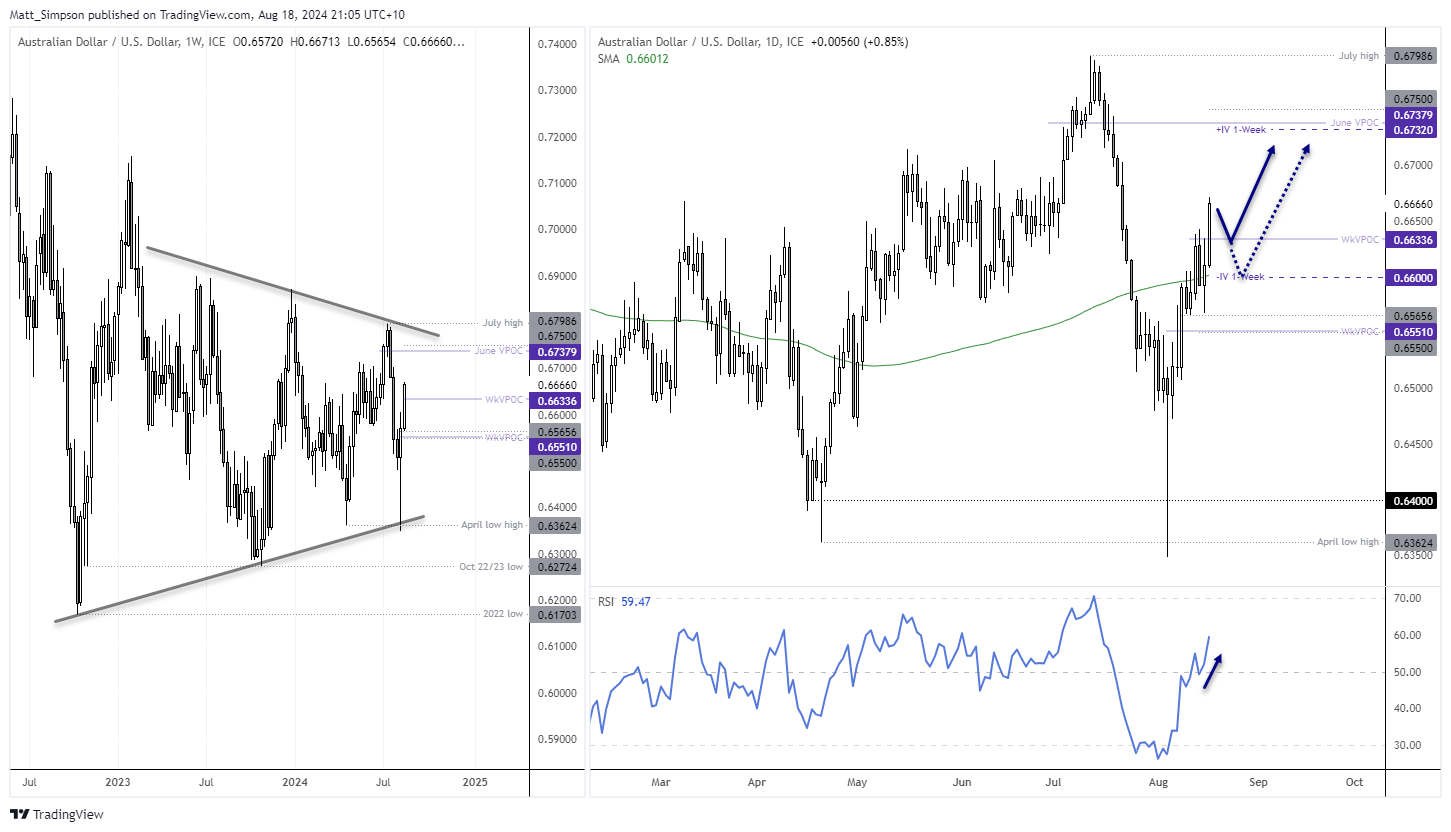

AUD/USD technical analysis

The Australian dollar remains on my ‘dip’ watchlist for several reasons. Bullish momentum remains strong, we’ve seen a clear break above the 200-day average, and RSI is above 50 and confirming bullish price action without being overbought. 67c seems an achievable target this week, although note that the upper 1-week implied volatility band sits just beneath the June VPOC (volume point of control) and 0.6738, which also makes it a target for bulls to consider. Dips towards 66c appear favourable for bulls given it is also near the 200-day MA.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge