I noted at the end of April that average returns of US stock markets were actually skewed to the upside, which flew in the face of the old adage "sell in May and go away." The seasonality matrix shows that global indices don't tend to provide negative returns until August or September, with July providing positive average returns beforehand.

We have four full trading days left in the month, and odds favour another bullish month for US indices. However, price action on the daily timeframe has alerted me to a potential pullback, while VIX futures and market positioning are also sending smoke signals to be aware of.

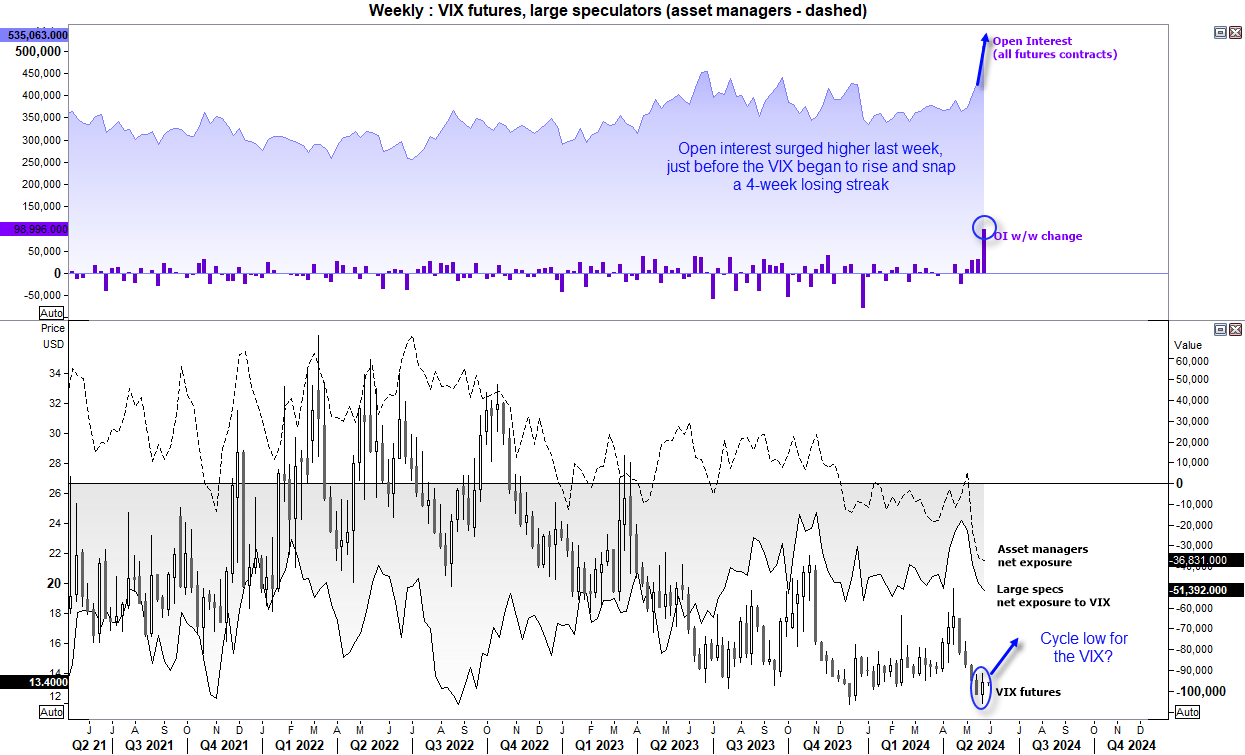

VIX market positioning from the weekly COT report

The VIX represents the implied volatility of the S&P 500 index over the next 30 days, as perceived by options traders. A lower reading suggests lower levels of expected volatility, while a higher VIX means increased levels of expected volatility. Although it is based on the S&P 500, it serves as a global benchmark for implied volatility of the stock market in general.

It is therefore interesting to note that the VIX reached a four-year low last week, just as open interest (a proxy for volume) hit its second-highest level on record, according to the commitment of traders report. As the data is accurate up to Tuesday, May 21st, and the VIX futures market subsequently rose and broke a four-week losing streak, I suspect a cycle low for volatility may be in place. If so, this suggests higher levels of volatility, which doesn't generally bode well for US indices.

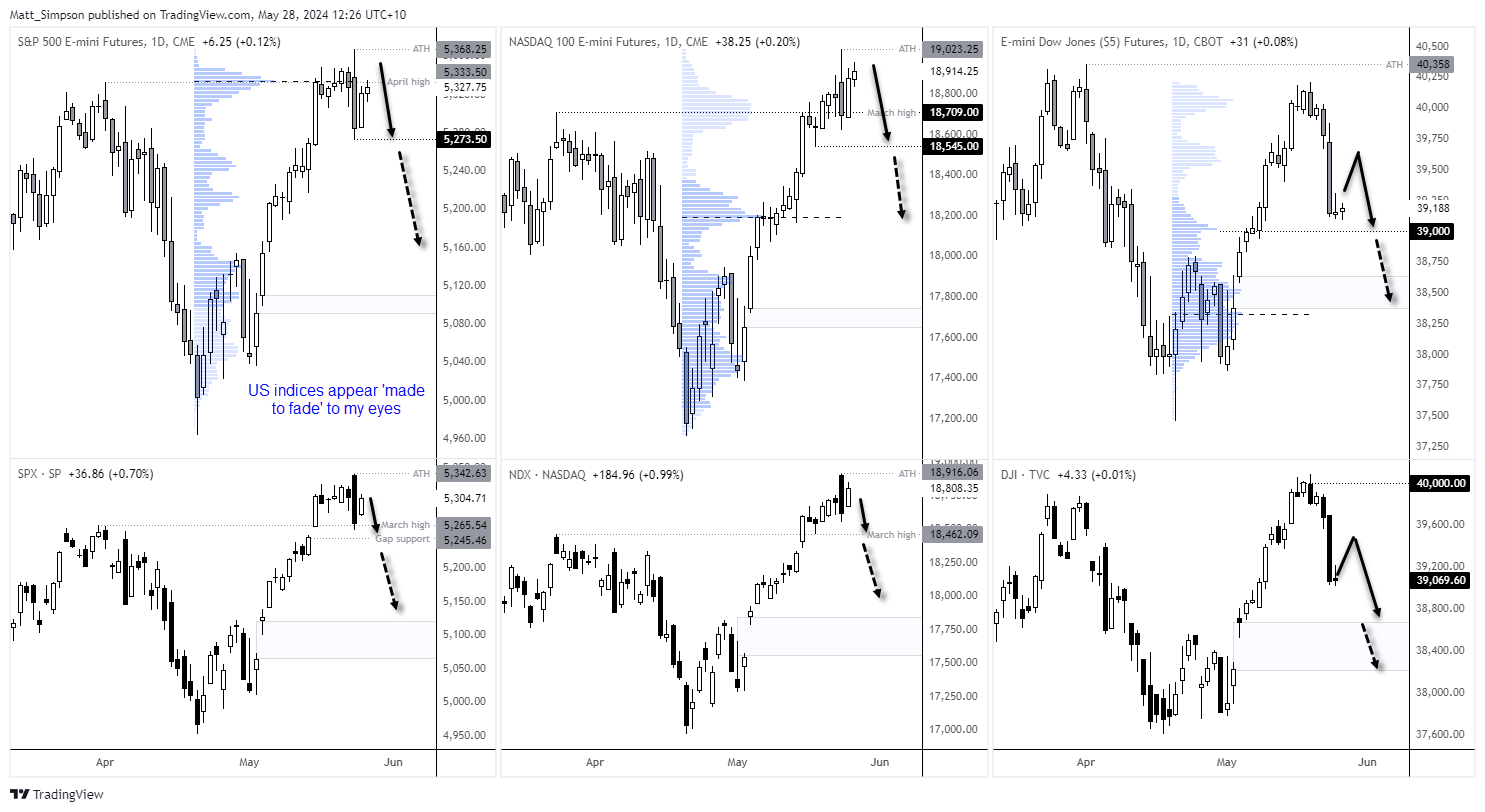

S&P 500, Nasdaq 100, Dow Jones (Futures and cash markets)

The top panels show the futures markets, the lower shows their respective cash markets. It can be useful to compare the two to provide hidden support or resistance areas between them.

S&P 500 (ES1! Futures, SPX cash):

The futures market drifted higher on Monday in a tight range, but what has really caught my eye is how the overnight high met resistance around the April high and the high-volume node of the rally from April's low. Given that the price action of the past two days remains within the body of Thursday's bearish engulfing day, my hunch is to fade into rallies beneath the all-time high upon any moves inside Thursday's upper wick.

Bears could seek an initial move back to the bearish engulfing low. However, we likely need to see the S&P 500 cash market (lower panel) break comfortably beneath its gap support level before becoming too confident about further downside in the futures market.

Nasdaq 100 (NQ1! Futures, NDX cash):

Tech stocks have the slight upper hand, as Nasdaq futures are trading in the upper wick of Thursday's bearish engulfing candle (and shortly-lived all-time high). Yet I really do not trust these early moves in thin trade, which has allowed the US dollar to drift lower, AUD/USD, EUR/USD, and the like to drift higher along with US futures. Like the S&P 500, I seem to want to fade into these drifting markets with a stop above the all-time high.

The March high of ~18,700 makes a likely target for bears, although I'd like to see the cash market break or form a daily close beneath its March high before getting too excited over a deeper correction. A break beneath the 18,545 low on Nasdaq futures opens up a run for 18,200 near the high-volume node of the rally from April's low.

Dow Jones (YM! Futures, DJI cash):

For a brief momentum in history, the Down Jones cash market traded above 40k. I am fairly certain it will break above that level in future, but for now the Dow is leading the declines on Wall Street.

Yet Dow Jones futures are trying to form a low above the 39k handle (near a high-volume node). And this paves way for a minor bounce, which may help better time shorts for the Nasdaq or S&P 500. The Dow seems likely to appeal to bears seeking swing trades, but that requires either evidence of a lower high forming – or a break below 39k to suggest bearish continuation.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge