Bitcoin futures followed their seasonal tendency to rally on Thanksgiving Day. And pattern is to hold true today, it could be set for a down day as we veer into the weekend.

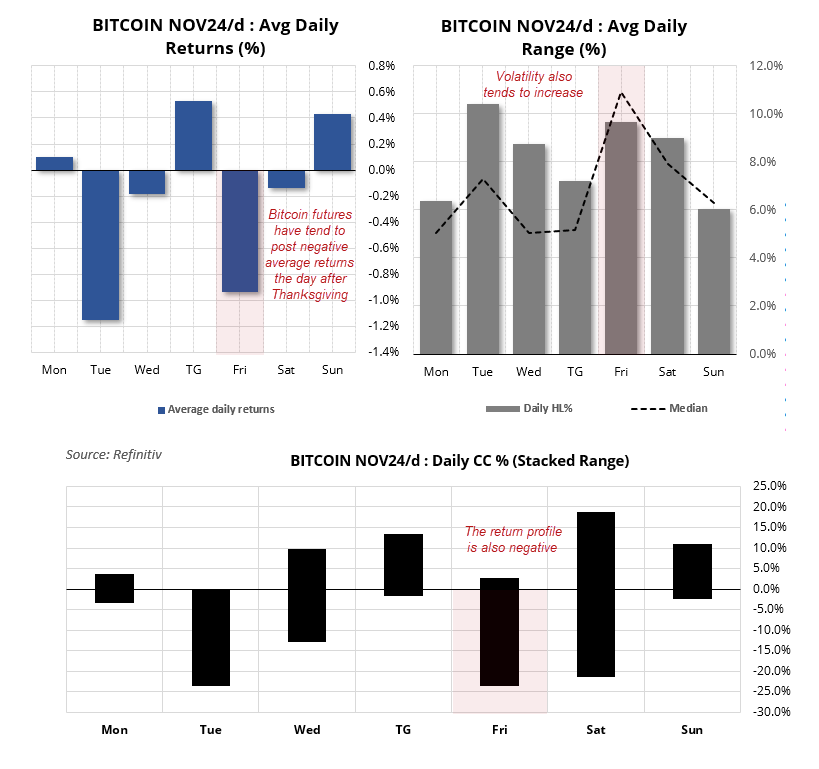

Since inception, bitcoin futures have:

- Posted negative average returns of just under -1% on the Friday following Thanksgiving (TG)

- Closed lower on Friday, four of the past five years (-5.9% average negative return, -24% total return)

- Seen the second highest daily range of the three days either side of TG (9.6% average 10.9% median)

It is a shame the stats are so bearish for Bitcoin today, because the price action appears bullish. But perhaps both camps can enjoy some of the action.

Bitcoin technical analysis:

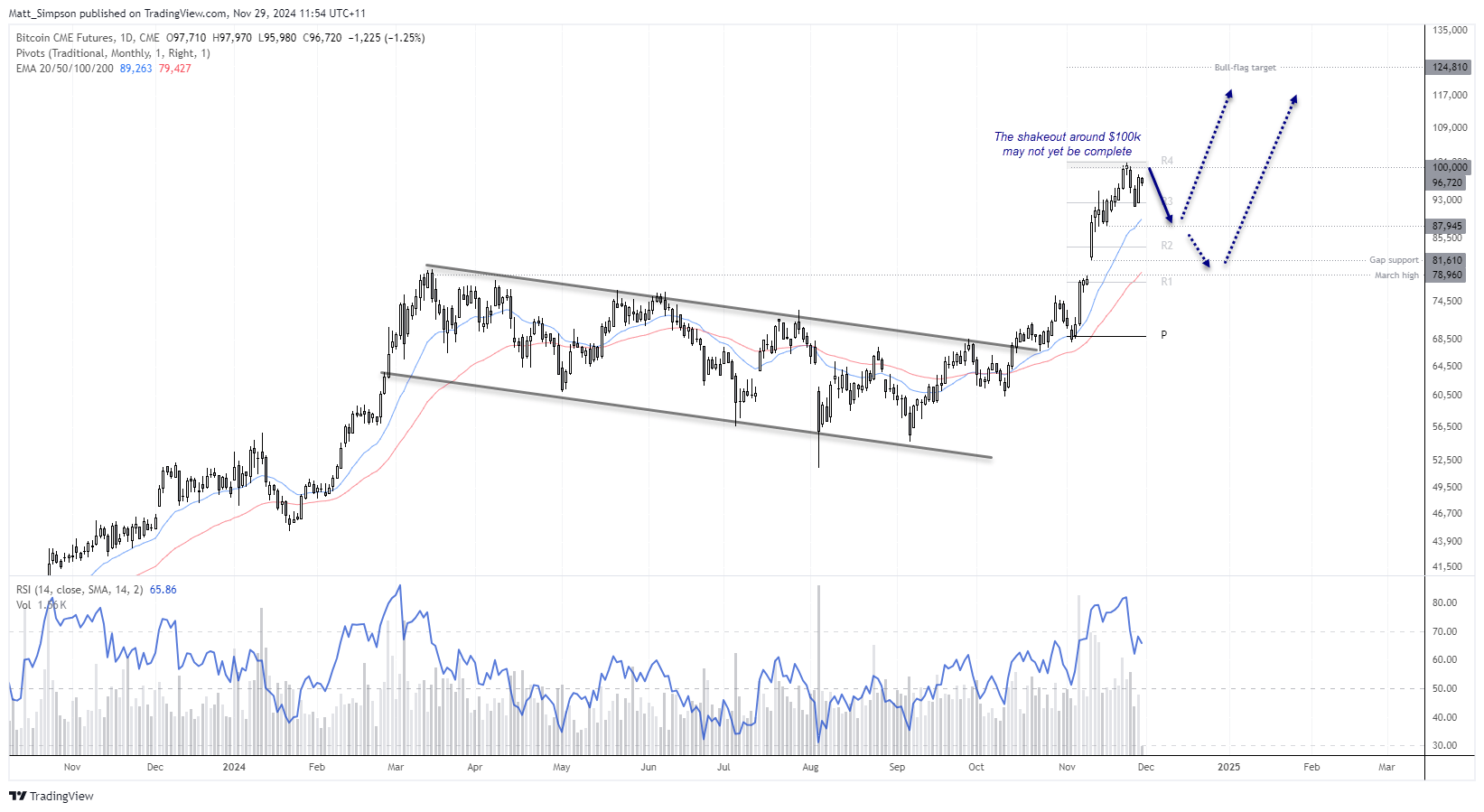

Bitcoin saw a breakout from a multi-month bull flag earlier this month, and remains on track to eventually reach my 124k target. Yet there is a bit of a shakeout around the 100k, a level early bitcoin enthusiasts were foaming at the mouth about years ago. As solid as the bullish trend is, I do not think this shakeout is done just yet.

While bitcoin aligned with its seasonal tendency to rise on the day of Thanksgiving, the bullish candle failed to recoup losses of the prior two days or retest $100k. The daily RSI is pointing lower after spending some time in the overbought zone, so perhaps a pullback to the 87,950 low / 90k handle at a minimum could be on the cards.

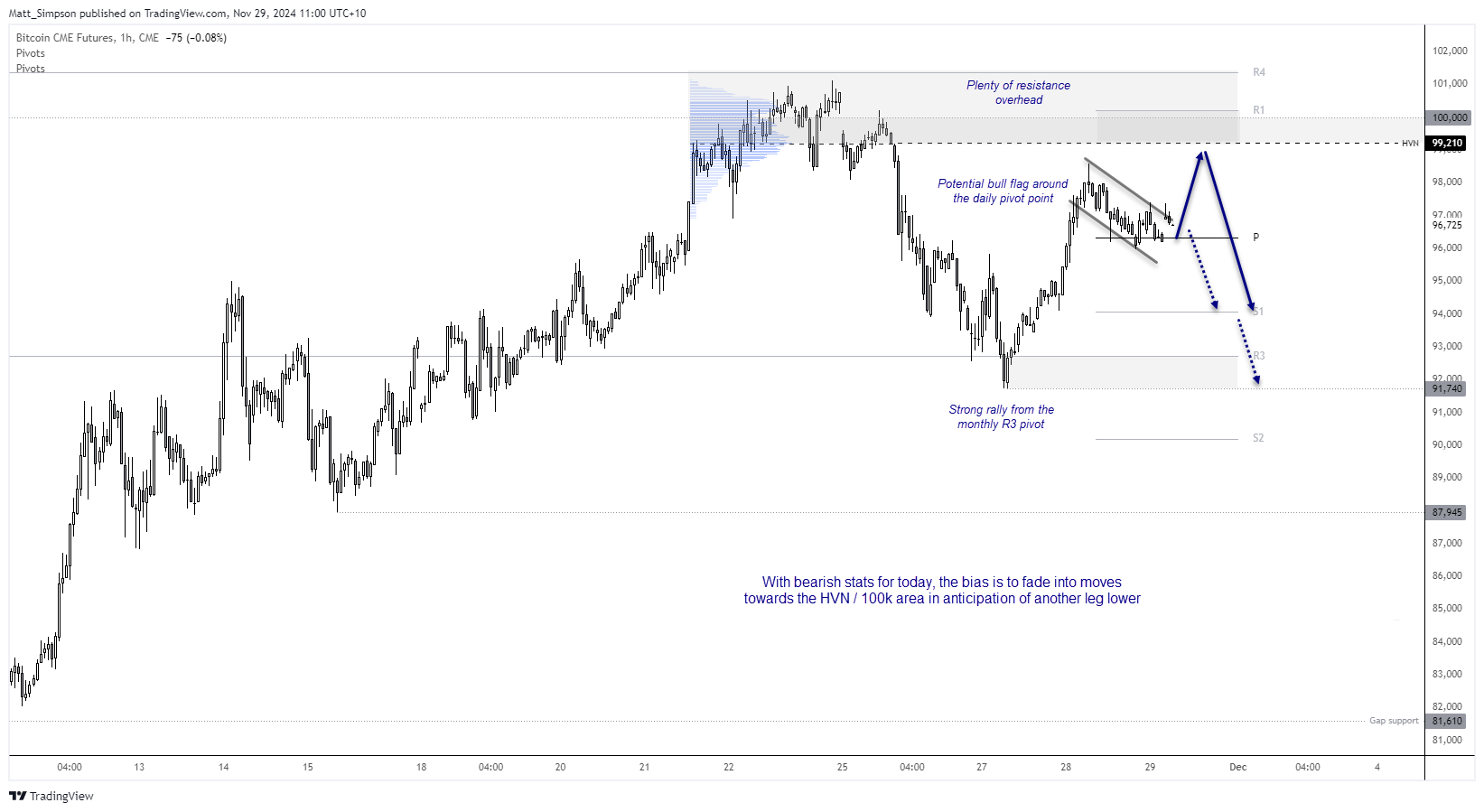

The 4-hour chart shows a potential bull flag, after posting a strong rally from the monthly R3 pivot. Perhaps this could prompt bulls to have another crack at $100k. However, given the price action clues on the daily char, my preference would be to seek shorts around the high-volume node (HVN) at 99,210 or the 100k level itself, in anticipation of its next leg lower. And given the stats are working against bulls today, any such bounce could also be ‘short’ lived.

How to trade with FOREX.com

Follow these easy steps to start trading with FOREX.com today:

- Open a Forex.com account, or log in if you’re already a customer.

- Search for the pair you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.