Notes from the RBNZ’s July meeting

- The level of the OCR is constraining spending and inflation pressure as anticipated and required

- The OCR will need to remain restrictive for the foreseeable future

- Global economic growth remains weak and inflation pressures are easing

- Global inflation rates continue to decline

- NZ inflation (and inflation expectations) are expected to continue to decline

- ….there are signs of labour market pressures dissipating and vacancies declining

- Consumer spending growth has eased and residential construction activity has declined

- …businesses are reporting slower demand for their goods and services, and weak investment intentions

- The net impact of immigration on overall capacity pressures remains uncertain

- The ongoing recovery in tourism spending is supporting demand.

- The Committee is confident that with interest rates remaining at a restrictive level for some time, consumer price inflation will return to within its target range

The RBNZ held rates as expected. But with RBNZ being one of the more feisty central banks, you feel a bit cheated when they do what the consensus expects. The RBNZ have always had a reputation of ‘going all in’ when action was concerned, and this this tightening cycle was no exception. Their twelve consecutive hikes added 525bp to their base rate, seven of which were 50bp and a single 75bp hike along the way.

The statement and minutes retained their dovish undertone overall, but they can’t not warn that inflation is still ‘too high’ as they need to contain inflation expectations. But with an economy now in recession, it’s a relatively safe bet that we’ve seen the terminal rate. And that means the next theme for investors to obsess over is when the RBNZ will begin cutting rates, which requires monitoring inflation levels and relative hawkishness of other central banks. Which means we can forget about interest rate cuts any time soon.

What does the RBNZ pause mean for the RBA and AUD/NZD?

That RBNZ’s fight against inflation was seen as a bit of a test balloon for other central banks. And many were likely concerned when inflation in New Zealand continued to rip higher despite the RBNZ’s valiant attempts to contain inflation much sooner than other central banks. So the fact that they have paused along with a relatively dovish statement provides hopes for the others.

Yet in the case of the RBA, I am less convinced. With a cash rate of 4.1% and potential for another couple of hikes, the 1.4% differential of NZ rate could diminish by 50bp over the coming months, and that could help support AUD/NZD.

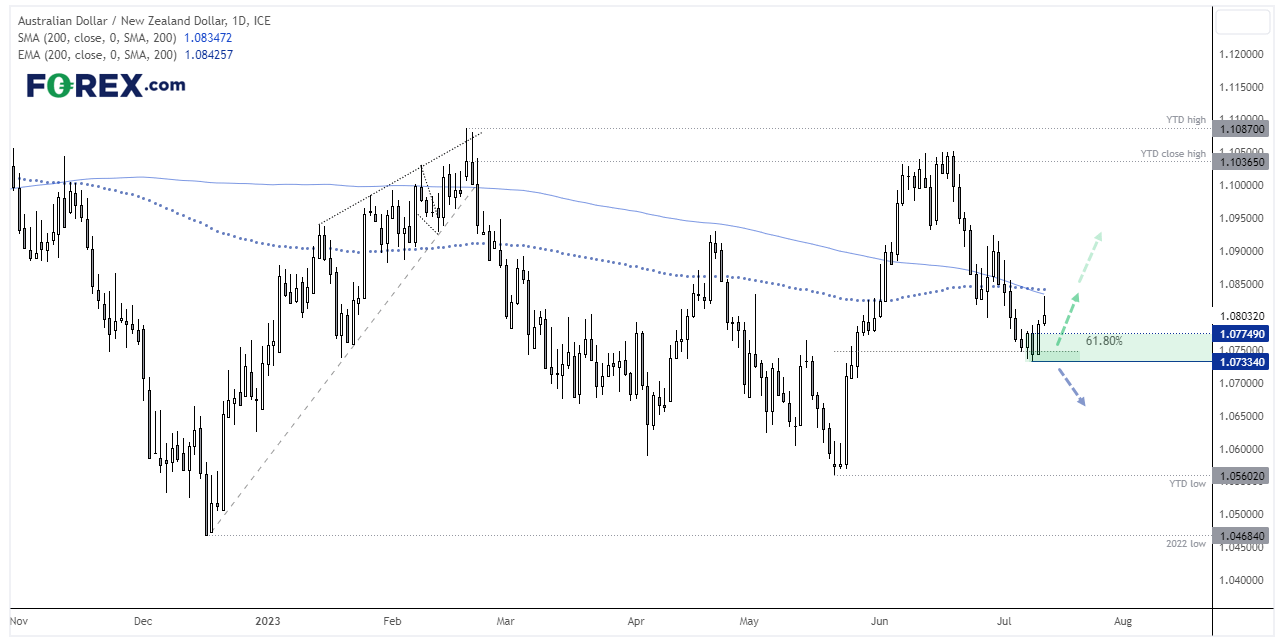

The daily chart for AUD/NZD has pulled back to the 61.8% Fibonacci ratio in three waves, and a bullish engulfing candle formed yesterday ahead of today’s rally towards the 200-day EMA and MA. It was unlikely to simply break above such a key resistance level immediately, so we now see any pullback towards the 1.0733 lows as a potential for bulls to seek a discount and eventual rally towards 1.09000 or 1.0950. A break beneath 1.07330 invalidates the near-term bullish bias.

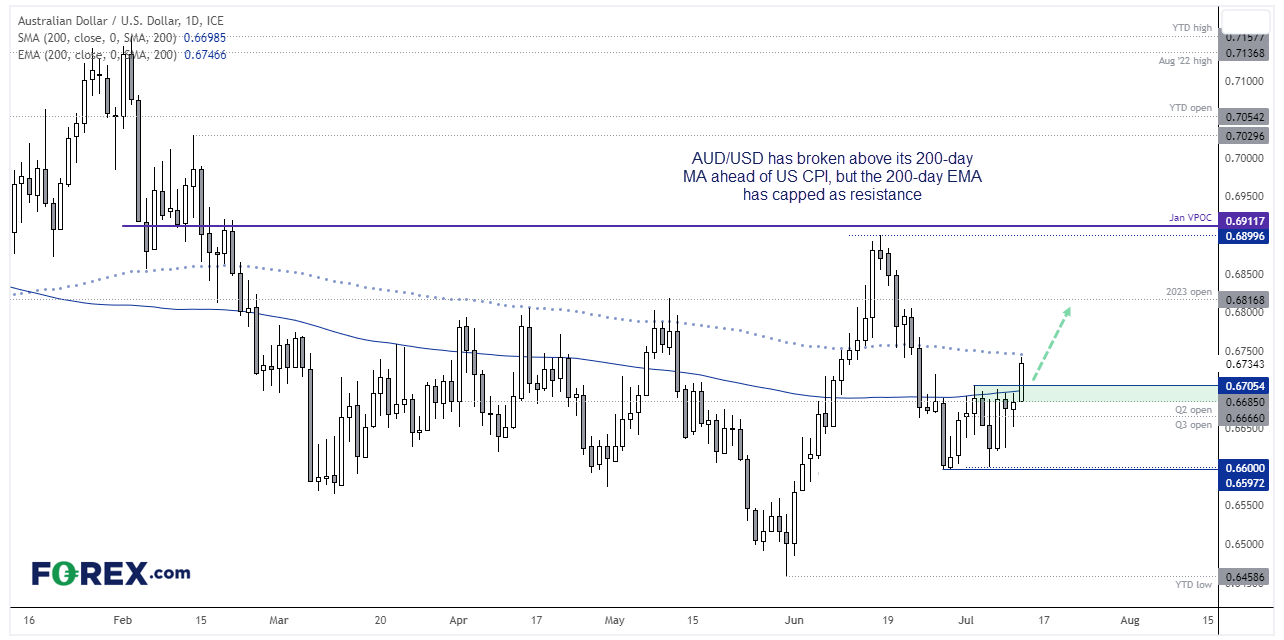

AUD/USD daily chart:

AUD/USD has not been the easiest markets to trade on the daily timeframe over the past few weeks, despite building a base with a double bottom at 66c. Yet AUD/USD managed to break above last week’s highs and the 200-day MA, likely thanks to strong loan-growth data from China and bets of a softer US inflation print.

Yet the 200-day EMA is capping as resistance, but perhaps that can provide a pullback towards the 200-day MA and another opportunity for bulls to reload ahead of US CPI (assuming the bet is for US inflation to come in softer than expected). But if it can clear the 200-day EMA around 0.6750, it opens up a run for 0.6800, whereas a break beneath 0.6660 brings 0.6600 back into focus.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge