Yesterday I outlined my reasoning for being on guard for a pullback on US indices, based on price action on the weekly chart, extremely-high open volume on VIX futures and the way that prices were drifting higher during thin trade. Today I noted a potential dead-cat bounce pattern on gold and copper prices, before raising an eyebrow over Nikkei’s price action. Perhaps I need to take my bear goggles off, but it does appear several key markets are looking for a leg or two lower, even if they’re on completely different timeframes.

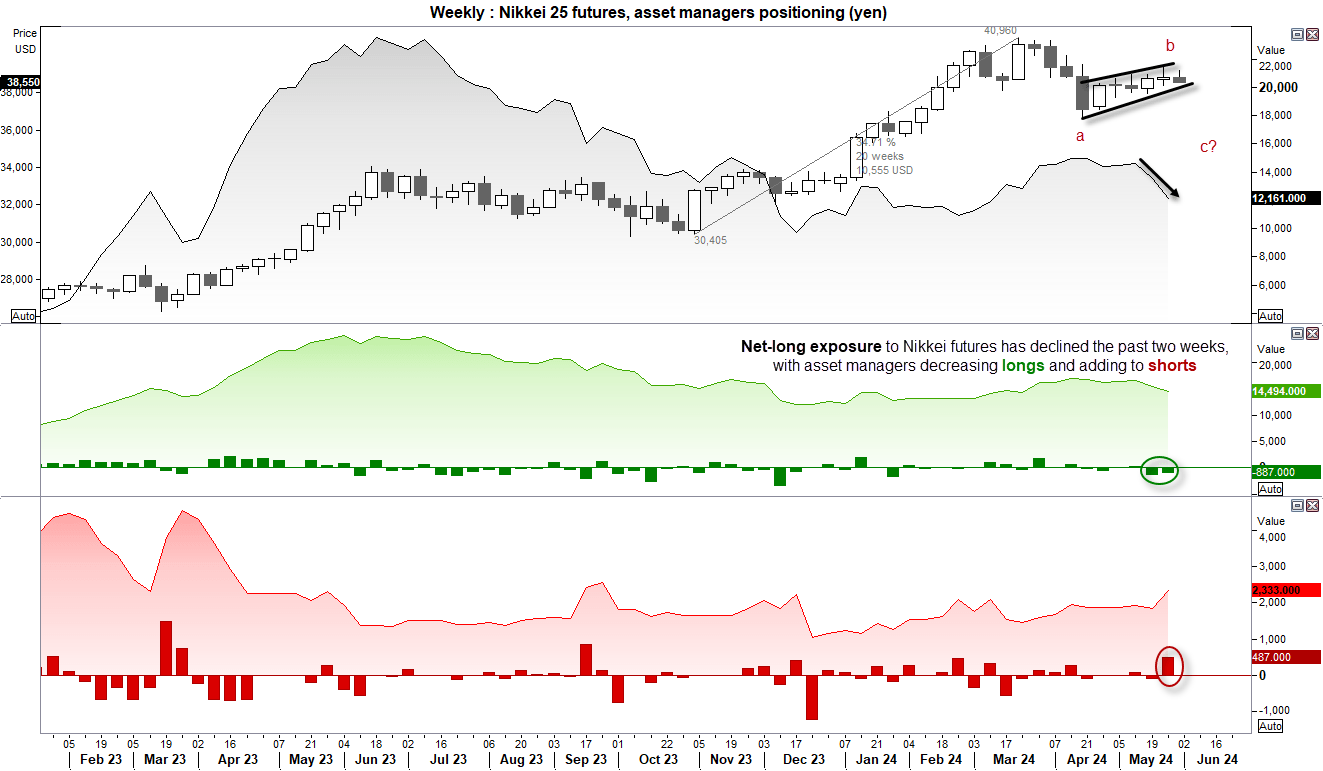

Nikkei 225 futures, asset manager positioning – from the COT report:

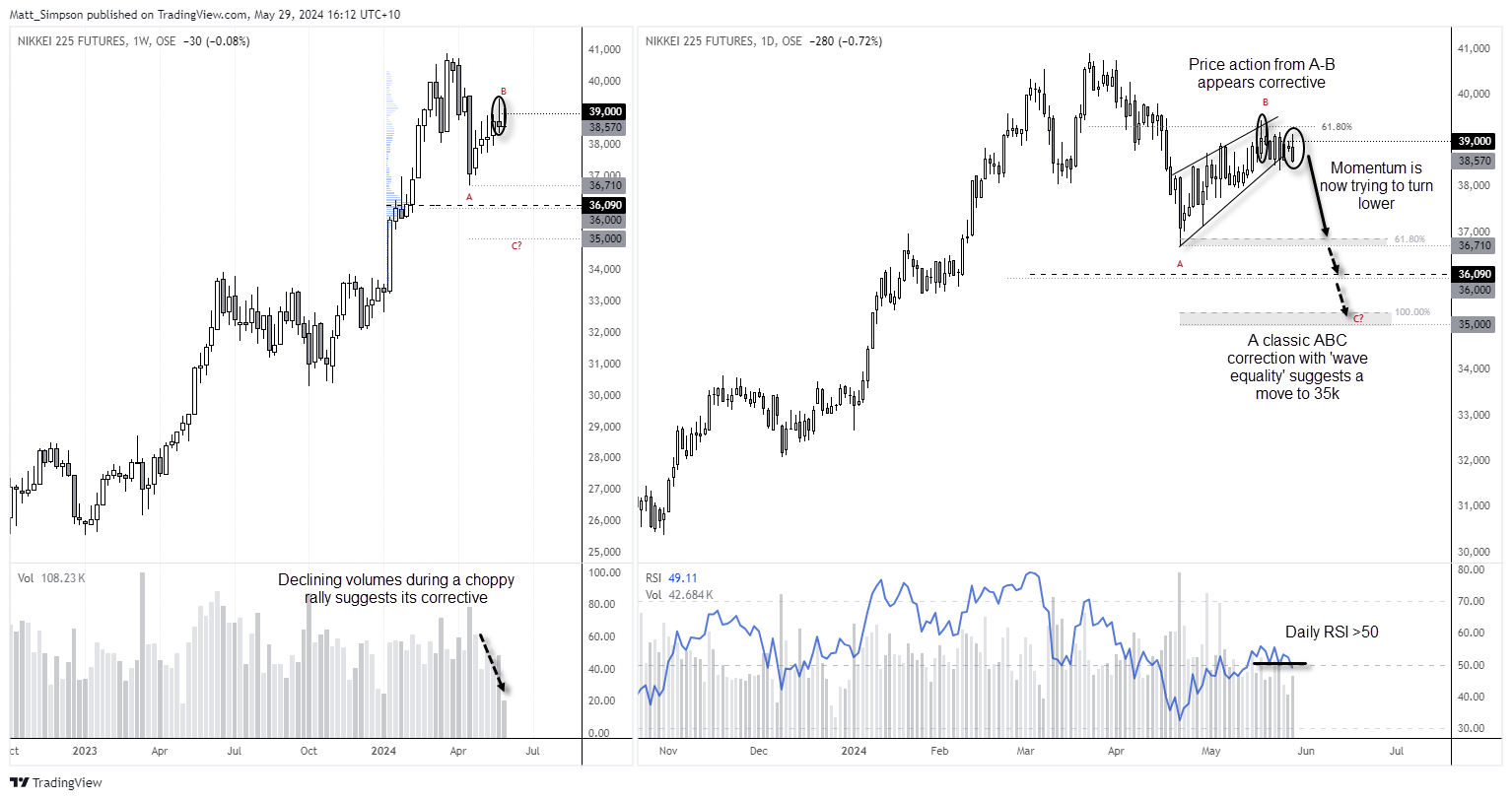

The weekly timeframe of the Nikkei caught my eye because it has been grinding higher, with overlapping candles indicating the supposed rise is corrective in nature. And that assumes at least one more leg lower. And this does not seem unreasonable given the strong surge from ~30-40k between October and March. If we are to assume a simple 3-wave correction, the gradual rise in recent weeks could simply be a ‘B’ wave of an ABC retracement lower. And that assumes another leg lower.

Furthermore, net-long exposure to the Nikkei futures contract (in yen) has fallen this last two weeks, with asset managers trimming longs and increasing shorts. The fact it was also the strongest increase in short bets w/w since September also shows that a bearish case could be building, at least among some.

Nikkei futures technical analysis:

Weekly trading volumes have also been declining whilst prices drifted higher in recent weeks, with an inverted hammer also forming last week with a false break of 39k. The daily chart also shows that the assumed ‘B’ wave stalled around the 61.8% Fibonacci level and momentum is turning lower which has forced the daily RSI (14) to dip back below 50. Today’s false break above 39k has also seen prices fall to the daily low, so perhaps we’re getting close to its next leg lower.

Bears could seek to fade into move towards today’s high or 39k in anticipation of a retest (and possible) break below 38k. Assuming a classic ABC correction with ‘wave equality’ (where the depth of wave B to C = A to B), the Nikkei could be headed for 35k over the coming weeks. Even if it only manages a 61.8% projection, it could still be headed for 37k, just above the 36,170 low near the end of wave A.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge