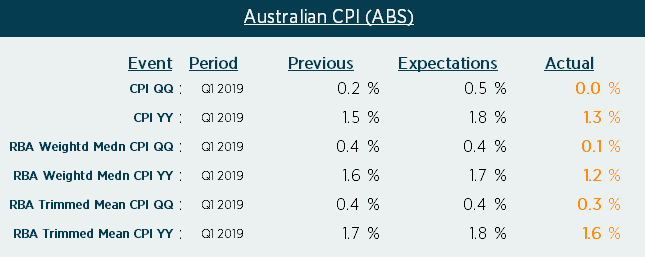

Australia’s Inflation appears to have left the building for today’s CPI report. With headline data missing expectations and moving further away from the target band, rate cut-calls are likely on the rise.

In February, the RBA downgraded Q2 CPI and trimmed mean to 2% (2.25% prior), and for CPI to average around 2% in April’s statement. With CPI dropping to 1.6% and trimmed mean hitting a 13-quarter low, today’s figures are a sore point for those outlooks, given RBA expect ‘inflation to remain stable’.

All in, its increasingly likely RBA will cut rates with the unexpected fall with inflation. Remember, the RBA outlined they could cut rates with stable inflation and unemployment trending higher in April’s minutes. Given we may have seen CPI peak and unemployment could rise (if correlation with capacity utilisation holds true), this is worse than RBA’s base-case for a cut and the ideal doomsday scenario for bears. Naturally, AUD is trading accordingly.

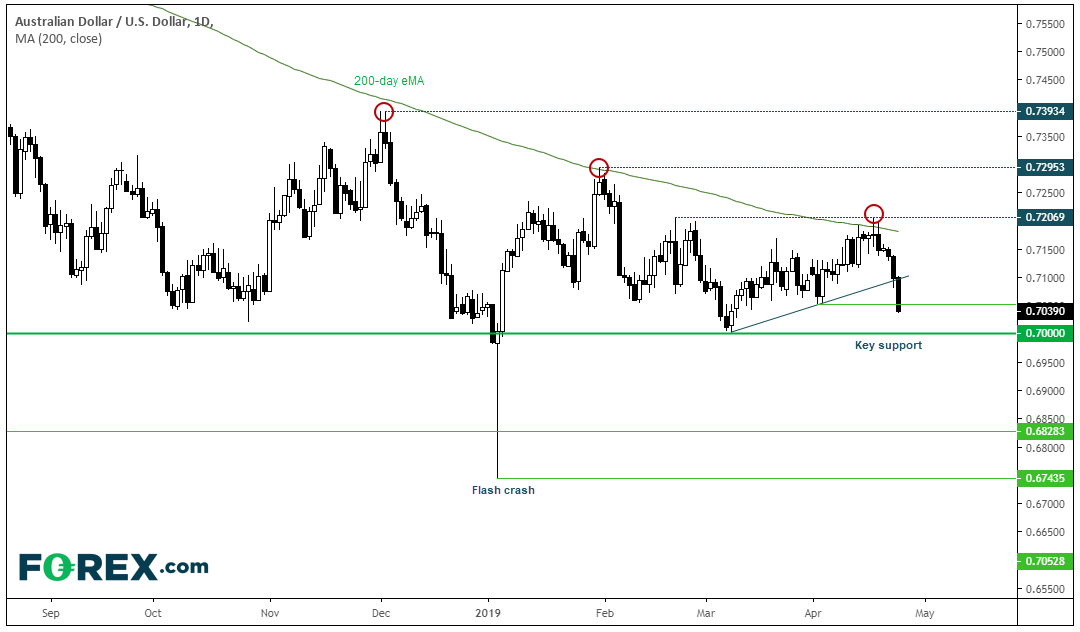

AUD/USD shed 1% after the release and made light work of its retracement line. 70c is the next obvious target, although keep in mind this level has barely been touched in in three years, barring the flash-crash early January and a 3-pip miss early March. That said, price action has produced a series of lower highs as its tracks the 200-day eMA lower and, with DXY considering a breakout of large ascending triangle, an ‘eventual’ break below 70c could be on the cards. And no doubt, the RBA would be delighted.