SPX, USD, EUR/USD, USD/JPY Talking Points:

- The risk on theme continued to run after this week’s open, with focus on the early-week driver of FOMC Chair Jerome Powell’s testimony for Tuesday and Wednesday trade.

- Markets are currently showing a 30.6% probability of a 50-basis point hike at the Fed’s next meeting on March 21-22, per CME FedWatch. Powell’s comments tomorrow and Wednesday can impact that, which then in-turn impact the USD and major currency pairs along with stocks and bonds.

- James Stanley’s first webinar for Forex.com is tomorrow at 1PM ET and will take place at the same time on Tuesdays. This link will allow for registration.

Tomorrow brings the start of Jerome Powell’s appearance in front of Congress for his twice-annual Humphrey Hawkins testimony. Powell will speak in front of the Senate Finance Committee tomorrow, followed by a Wednesday visit with the House Financial Services Committee. After the release of prepared remarks, Powell will speak with each legislative branch over the next two days with a series of questions being sent his way. This is an opportune time for the head of the FOMC to share his views on the US economy and where he thinks monetary policy will need to move in the future.The big question at this point is terminal rate, or how high the Fed thinks that they’ll need to hike rates with the aim of harnessing inflation. The inflation fight turned hopeful towards the end of last year asequity markets rallied and the US Dollar dropped, driven by the prospect of the Fed taking a softer tone with rate hikes in 2023 trade. But as data has remained rather strong, odds for another 50-basis point hike have started to tilt-higher again, currently showing a 30.6% probability of such as the next Fed meeting in a couple of weeks, per CME FedWatch.

Also of note, that Fed meeting is a quarterly meeting which means we’ll also receive updated forecasts and projections from the bank, which will further indicate how aggressively the Fed is anticipating policy to be in the remainder of the year.

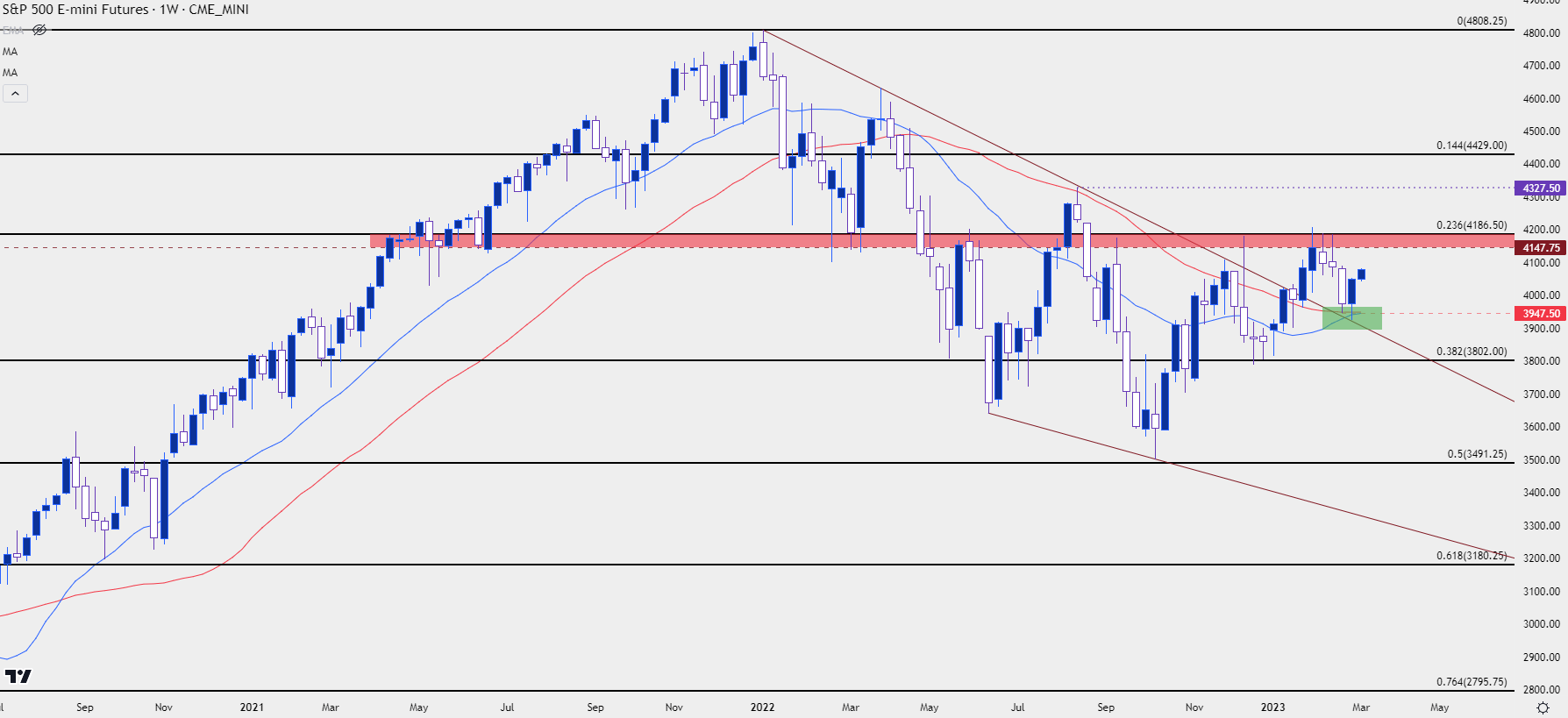

At this point, US equities are holding on to a bounce from last week. On Thursday morning, the S&P 500 tested both the 100- and 200-day moving averages, which were confluent with the projection of the 2022 bearish trendline.

This sets the stage for another resistance test in a zone that’s been frequented quite often since helping to set resistance last September. This zone runs from around 4150 up to 4187, and if bulls can finally force a breach above that area, the next resistance swing appears around 4328, which is the current ten-month-high for the index.

For bears or bearish outlays, they would probably be looking for Powell to make a statement tomorrow regarding hawkish rate policy, like what happened last August at the Jackson Hole Economic Symposium. Another hold of resistance in that zone, particularly if coupled with a lower-high inside of the 4187 Fibonacci level, keeps the door open for bearish swing potential in equities.

S&P 500 Weekly Price Chart (indicative only)

Chart prepared by James Stanley; data from Tradingview, not available on Forex.com US platforms

Chart prepared by James Stanley; data from Tradingview, not available on Forex.com US platforms

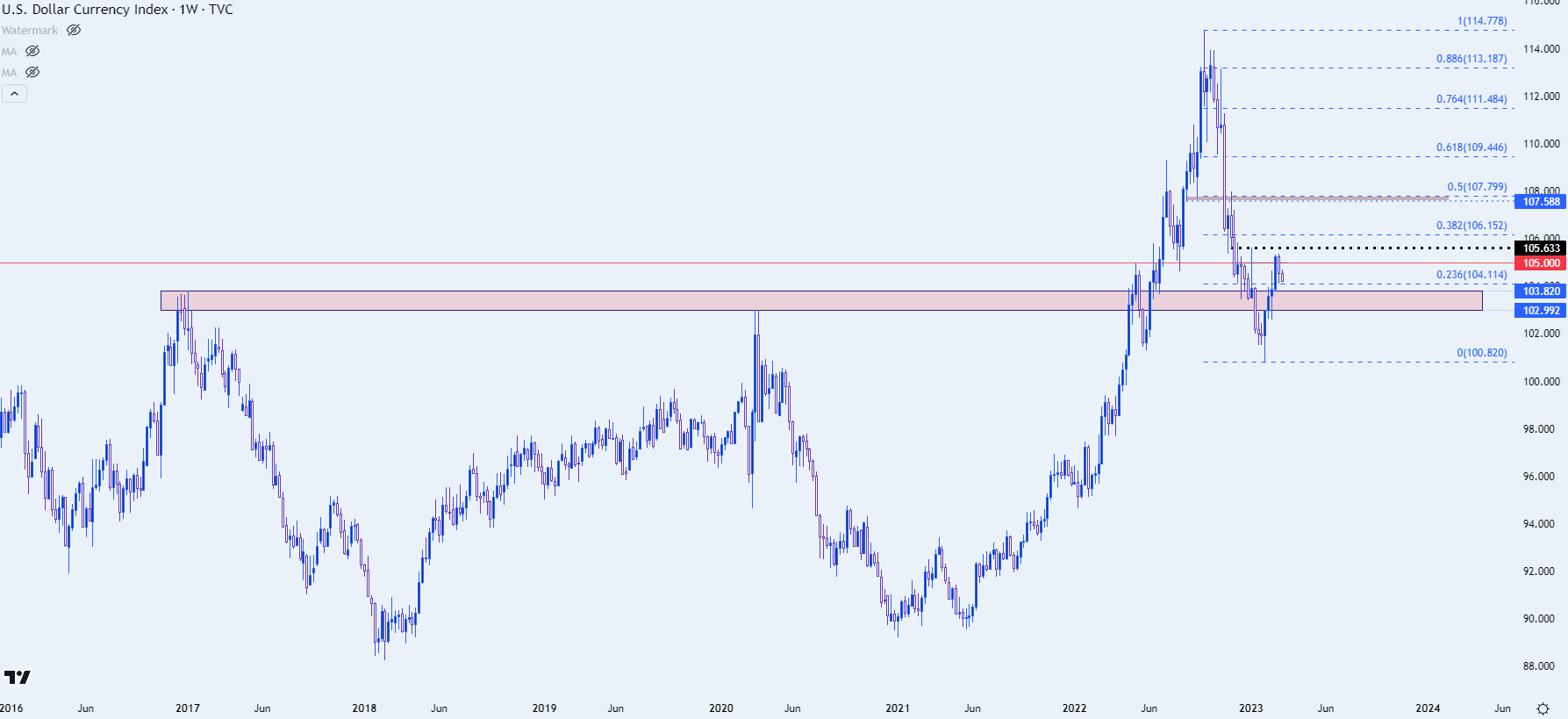

Dollar Drop – USD Support Test

I had looked at this going into the weekend, but the USD broke its streak of four consecutive weekly gains last week. Price had held the 23.6% Fibonacci retracement of the sell-off that started in September and this week’s early trade is seeing sellers make a push for another test of that level.

There’s additional context for support in USD/DXY, and that’s coming from the 103.82 level. This was the 2017 swing high and more recently, it’s come back as an area of resistance-turned-support. I’m tracking that down to the 103.00 handle as a ‘zone’ of potential support in the DXY.

US Dollar Weekly Price Chart (indicative only)

Chart prepared by James Stanley; data from Tradingview, not available on Forex.com US platforms

Chart prepared by James Stanley; data from Tradingview, not available on Forex.com US platforms

EUR/USD Resistance

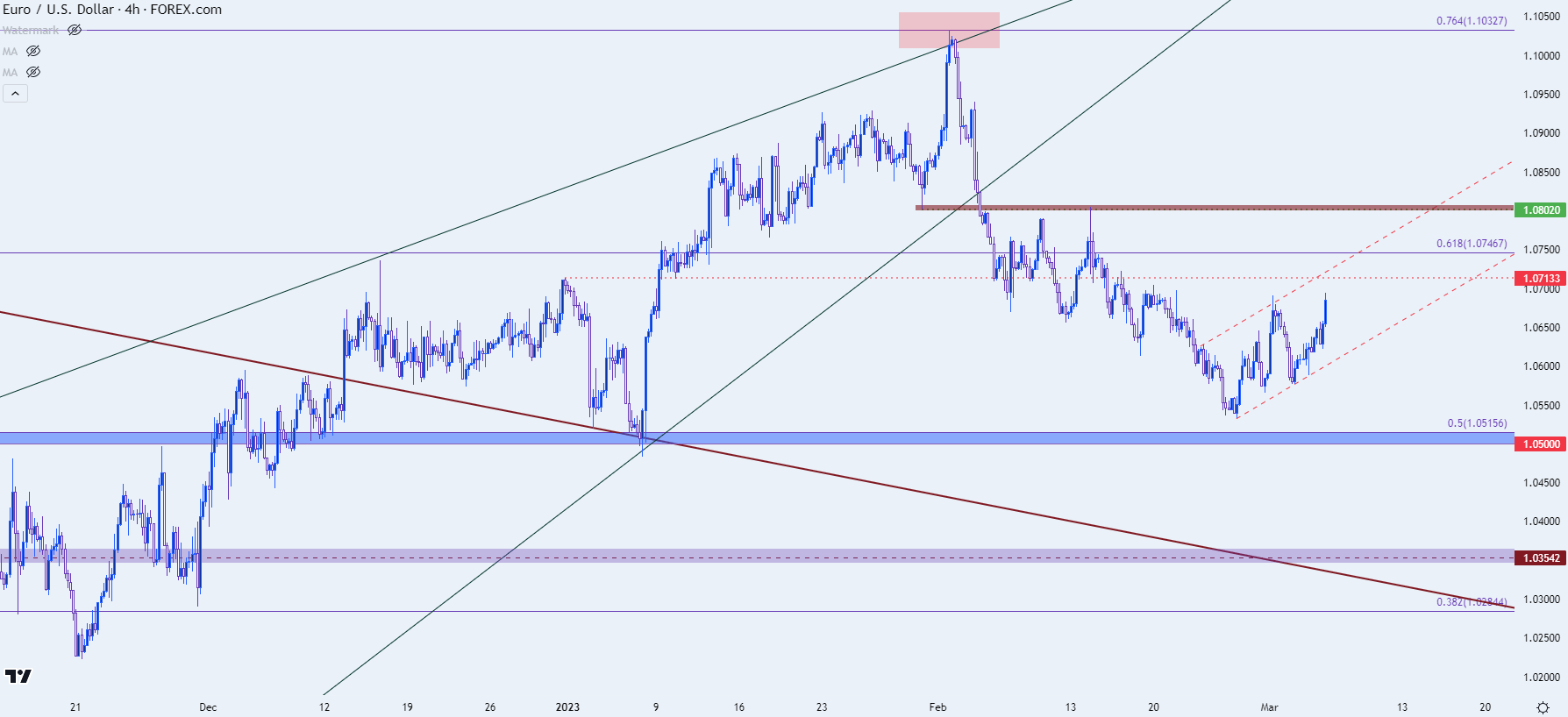

With the Euro making up 57.6% of the DXY basket, USD dynamics can often share some element of relation with the EUR/USD pair. And much as we saw with USD last week, the pair put in a counter-trend move that I had highlighted on Friday, taking the form of a bear flag formation.

That bullish move is extending in early trade to start this week, with EUR/USD currently testing a fresh weekly high. But, as I had written in the weekend piece the resistance of note is a little higher on the pair, with a price swing around 1.0713 after which a Fibonacci level plot just inside of the 1.0750 level. The 1.0800 level is where the currently monthly high resides and if bulls can force a breach there, next resistance shows up at the 1.0933 level followed by 1.1033 which helped to mark the high in early-February.

EUR/USD Four-Hour Chart

Chart prepared by James Stanley, EUR/USD on Tradingview

Chart prepared by James Stanley, EUR/USD on Tradingview

USD/JPY

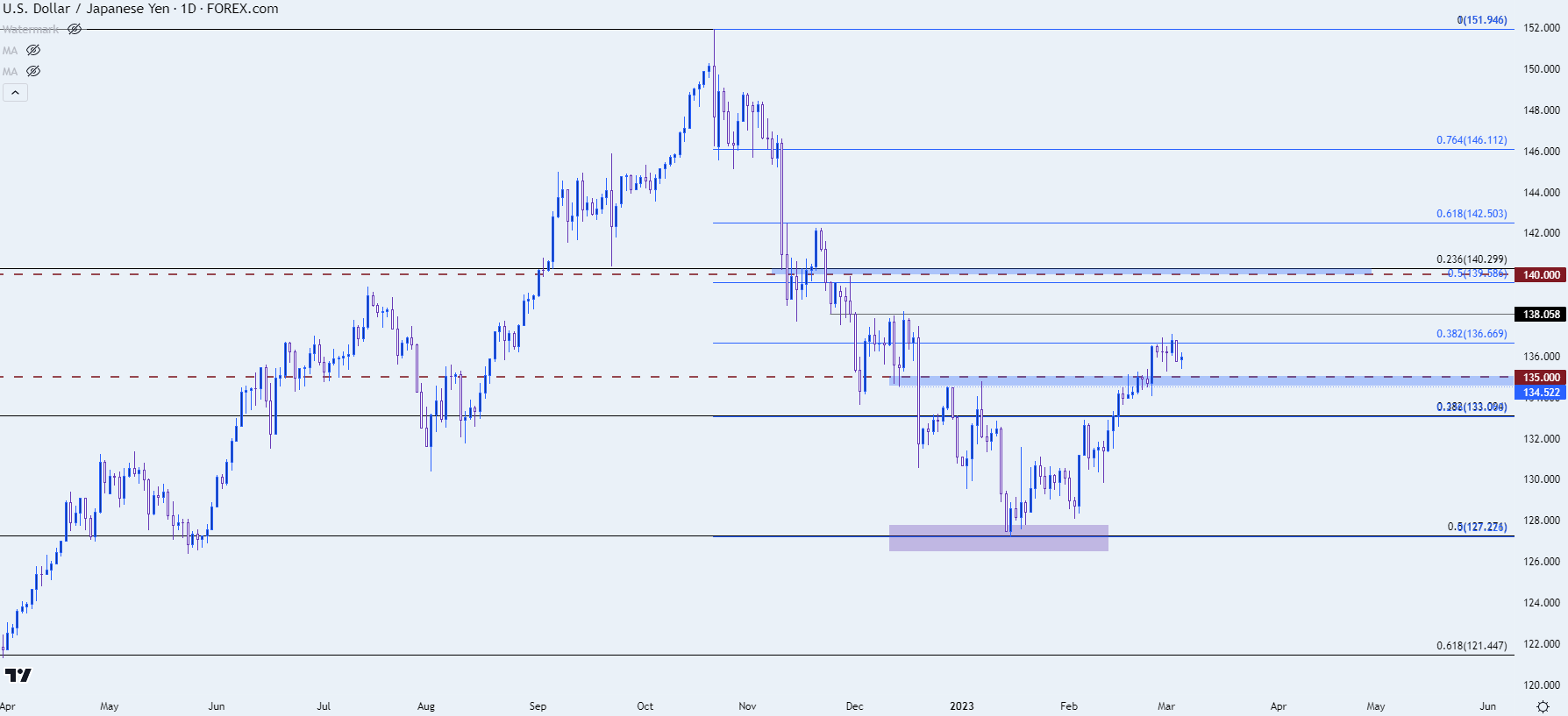

While EUR/USD has been showing a counter-trend theme over the past few trading days, going along with dynamics in the USD, USD/JPY has largely held the bullish trend that started to spark again last month. This is an item that can remain of interest to USD bulls as this is indication of JPY-weakness which made a loud statement the week before last. As I had discussed in the Monday article regarding the Yen, the rates relationship can continue to keep the currency in the spotlight.

From the daily chart below, we can see the current bullish structure as highlighted by recent higher-highs and lows. There’s support potential just a little lower, around an area of prior resistance that spans from the swing high of 134.45 up to the 135.00 psychological level. Below that, the 133.09 level can function as a secondary level of support potential. Atop USD/JPY price action, the 138 handle is the next spot of resistance, after which key resistance shows around the 140 level which is confluent with the 23.6% retracement of the 2021-2022 major move in USD/JPY.

USD/JPY Daily Price Chart

Chart prepared by James Stanley, USD/JPY on Tradingview

Chart prepared by James Stanley, USD/JPY on Tradingview

--- written by James Stanley, Senior Strategist

Follow James on Twitter @JStanleyFX