US futures

Dow future 0.19% at 44,342

S&P futures 0.40% at 6061

Nasdaq futures 0.64% at 21508

In Europe

FTSE 0.4% at 8310

Dax 0.01% at 20349

- US stocks rise after CPI data cemented December rate cut expectations

- US CPI rose 2.7% YoY up from 2.6%

- Macy's plunged 10% after lowering its profit forecast

- Oil rises for a third straight day

CPI rises – December’s rate cut is priced in

U.S. stocks are heading to a higher open. US inflation data brought no surprises and bolstered expectations that the Fed would cut rates again next week.

U.S. CPI rose by 2.7% in November, in line with forecasts and up slightly from 2.6% in October. Automatically reading CPI climbed to 0.3%, which is in line with forecasts and above the 0.2% seen in the previous month.

Core inflation, which excludes more volatile items like food and fuel, rose by 3.3% in the year to November, also in line with economists' expectations.

The data cemented expectations that the Federal Reserve would cut interest rates by 25 basis points in the December meeting. Prior to the release, the market was pricing in an 85% probability of a Fed rate cut and is now pricing in a 98% probability.

The Fed has cut rates by 75 basis points since kicking off its rate-reducing cycle in September. The market also believes that the central Bank rate will end 2025 at 3.4%, or 125 basis points from its current level.

Equities are in demand with the market more certain of a rate cut, and the US dollar is virtually unchanged.

Corporate news

Macy's is set to open 9% lower after reducing its fiscal year forecast. The department store now sees EPS of between $2.25 and $2.5, down from the previous guidance of $2.34 to $2.69.

Duolingo shares slip 2% after being downgraded to neutral from the Bank of America.

GameStop is rising over 3% premarket after posting an unexpected profit in the recent quarter. GameStop posted a net income of $17.4 million in Q3 compared to a net loss of $3.1 million in the same period last year.

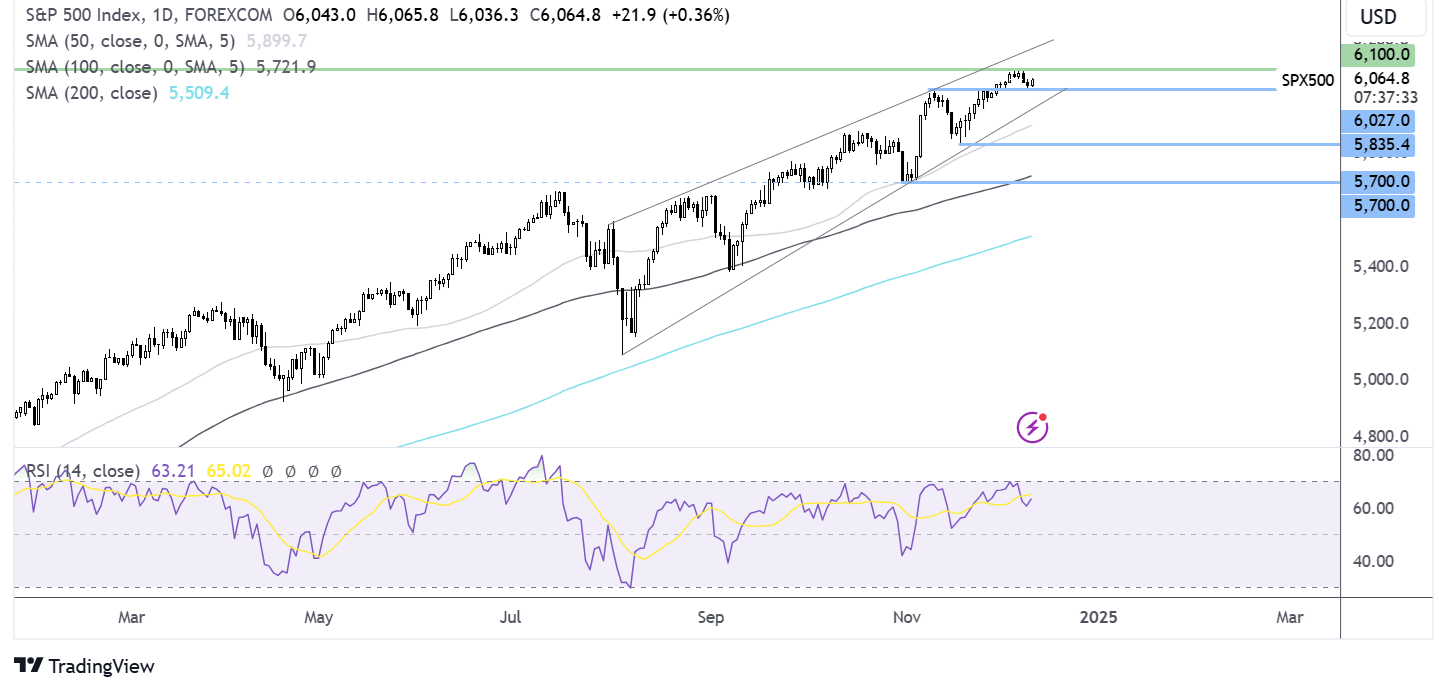

S&P 500 forecast – technical analysis.

The S&P 500 has eased from its record high of 6100, finding support yesterday at 6030, the November high. Buyers will look to extend the bullish uptrend, taking out 6100 to fresh record highs. Support is at 6030 and 5950, the rising trendline support. A break below 5830 creates a lower low.

FX markets – USD rises, USD/CAD falls

The USD is rising for a fourth straight day as investors digest the latest US CPI data, which was in line with forecasts and brought few surprises. The USD has barely moved following the release.

EUR/USD is holding steady after US data as attention turns to tomorrow's ECB rate decision. The central bank is expected to cut rates by 25 basis points on Thursday and reduce rates by 150 basis points between now and the end of next year.

USD/CAD is inching lower ahead of the BoC rate decision later today. The central bank is expected to cut rates by 25 basis points, but the market also sees the chance of a 50 basis point cut. The uncertainty heading into the reading means that it could create some volatility.

Oil rises for a third day

Oil prices rising for a third straight day, bested by optimism surrounding China's plans to ease monetary policy in the coming year to boost economic growth.

On Monday, China announced it would adopt a looser monetary policy in 2025 for the first time in 14 years, which could help increase consumer spending and drive oil consumption.

Meanwhile, OPEC's monthly report is due, which will provide more insight into the supply and demand outlook.

Yesterday's API data showed that US crude stock tiles rose by 499k last week, and gasoline inventories rose by 2.85 million. EIA inventory data is due later today.