The S&P 500 appears poised to extend its rally following a strong performance in the first half of this week. Wednesday’s gains, spurred by slightly cooler inflation data suggesting a potential rate cut in July from the Federal Reserve, have energized the market. The technical S&P 500 analysis is also looking a lot healthier after the big recovery, but traders will now be eyeing upcoming data releases and earnings reports to gauge whether the index can sustain this upward momentum.

Earnings, Data and Yields in the Spotlight

Investors are closely monitoring key macroeconomic indicators, including jobless claims and retail sales data today, for clues about the health of the US economy and the Fed’s policy trajectory. For as long as we don’t see big surprises, mildly positive surprises in these areas could reinforce the market’s optimism and provide further fuel for the S&P 500. Additionally, the earnings season is intensifying. Major players in the financial sector like Goldman Sachs, Bank of America and Morgan Stanley have reported forecast-beating results. Robust earnings from financial heavyweights could are addition additional support to the index. But watch those bond yields as they are starting to creep back higher after Wednesday’s data-driven drop. So far, investors have taken rising yields in their stride, but it is something that could ultimately haunt markets at some later point in time.

For now, sentiment remains cautiously optimistic. In Europe, markets were bolstered by Richemont’s impressive performance, as the luxury goods maker’s shares surged nearly 20% on strong jewellery sales. This bullish outlook was complemented by Taiwan Semiconductor Manufacturing’s projections, which have raised hopes for sustained AI-driven growth in the tech sector. US investors will be watching closely to see if this momentum carries into Wall Street trading.

Geopolitics and Fed Commentary

Geopolitics probably also played a pivotal role in the stock market recovery, with Gaza ceasefire and hostage deal set to take effect on January 19, potentially marking a step toward regional stability. This progress, while not directly market-related, may contribute to improved global risk sentiment.

On the monetary policy front, recent comments from Federal Reserve officials have provided a clearer picture of the central bank’s outlook. Fed’s Williams noted that rising bond yields do not necessarily signal a shift in inflation expectations, while Fed’s Goolsbee highlighted progress in controlling inflation. These measured statements suggest the Fed is cautiously optimistic, reinforcing the market’s belief in a potential rate cut around summer.

Technical S&P 500 analysis: Key Levels to Watch

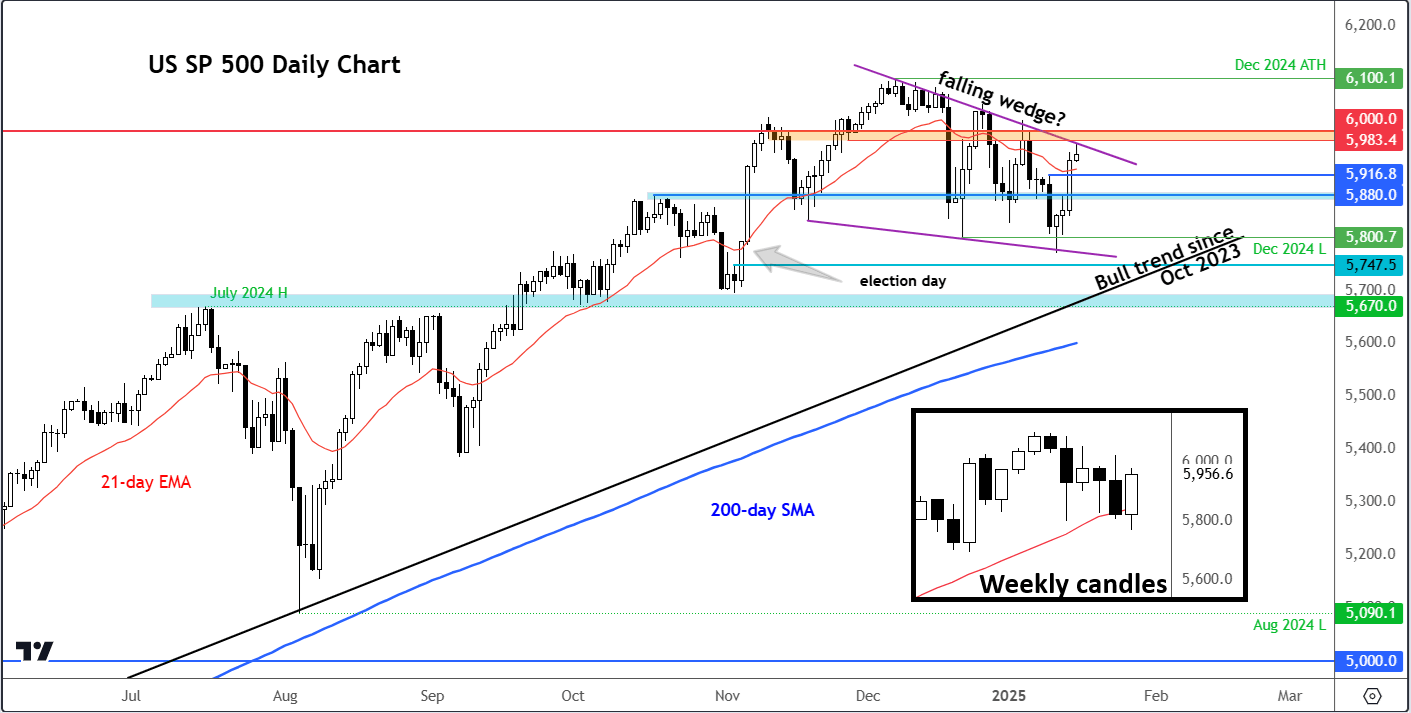

Source: TradingView.com

The S&P 500 technical outlook has been bolstered somewhat following Wednesday’s rally, which further eroded the bears’ control. Now, the index is testing the resistance trendline of a falling wedge continuation pattern just beneath the key 5,983 to 6,000 resistance area. This pattern, often seen as bullish, has traders speculating on the potential for a breakout. However, the lower highs observed in recent weeks signal caution.

Support levels to watch include 5,916, which acted as a strong resistance last Friday when robust jobs data weighed on markets. Should this level falter, the focus shifts to 5,880, Tuesday’s high. A decisive break below this threshold would be bearish.

Conversely, breaking above that 5983-6,000 resistance range could open the door for further gains, potentially paving the way to a new record high.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R