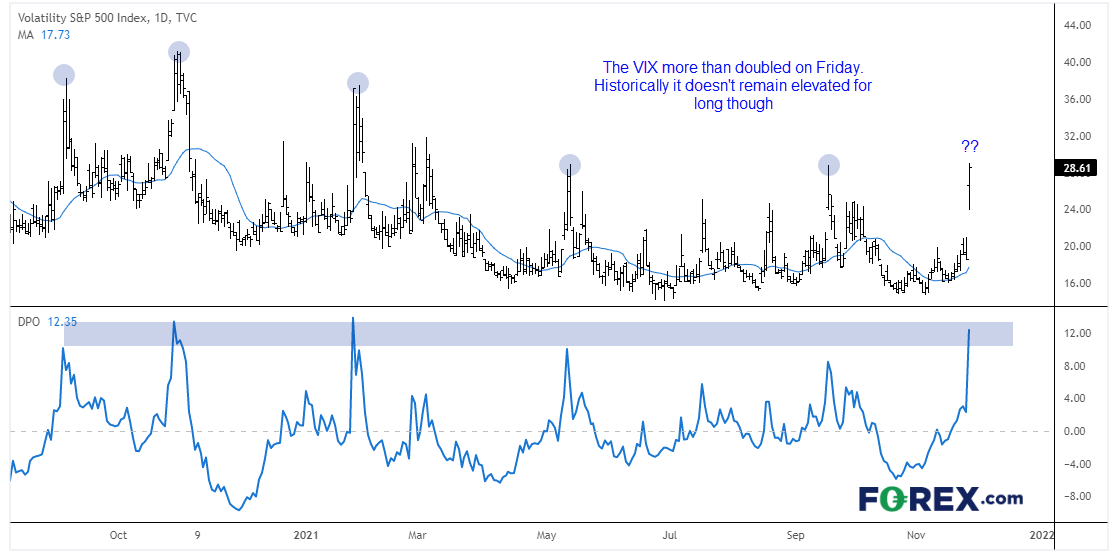

The VIX (or volatility index) is a global benchmark for portfolio risk, despite being centred around the S&P 500 index. A rising VIX usually means that investors are wary of the future and the premiums to hedge are also higher, so the stock market shares an inverse correlation with it. However, when it rises at a particularly fast rate the bearish volatility for equity markets also increase. On Friday the VIX rose 10.04 points (or 54%) which was its fourth biggest daily rally since inception in 1991.

However, if you look at the daily chart three things stand out. At 28.61 it is around levels seen at the May and September tops, and that its DPO (detrended price oscillator) is also at a historical resistance level. Furthermore, the VIX doesn’t stay elevated for long with several 1-day tops on the chart with others generally being around 2-3 days before it moves lower.

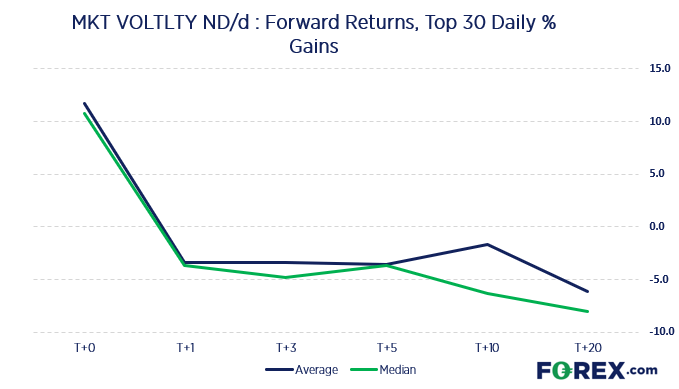

Forward returns for the 30 most bullish days on the VIX are negative, on average

The chart below shows forward returns using its 30-most bullish days. We listed the 30 most bullish days, measured returns the following 1, 2, 3, 5, 10 and 20 days, then plotted the average of those returns. For comparison it also shows T+0 which represents Friday’s gain of the VIX.

It clearly shows that average (and median) returns are negative across all timeframes. This should not be a surprise for the 10 and 20 days measured because we already know that the VIX spends more of its time at low levels. But it is interesting to see T1 – T5 (the following trading day and week) printing negative returns overall. In fact, it closed lower 66% of the time on T+1, 73% on the time on T+2, 67% on T+3 and 63% on T+5 (a week later). And if the VIX closes lower on average it means the S&P 500 closes higher on average.

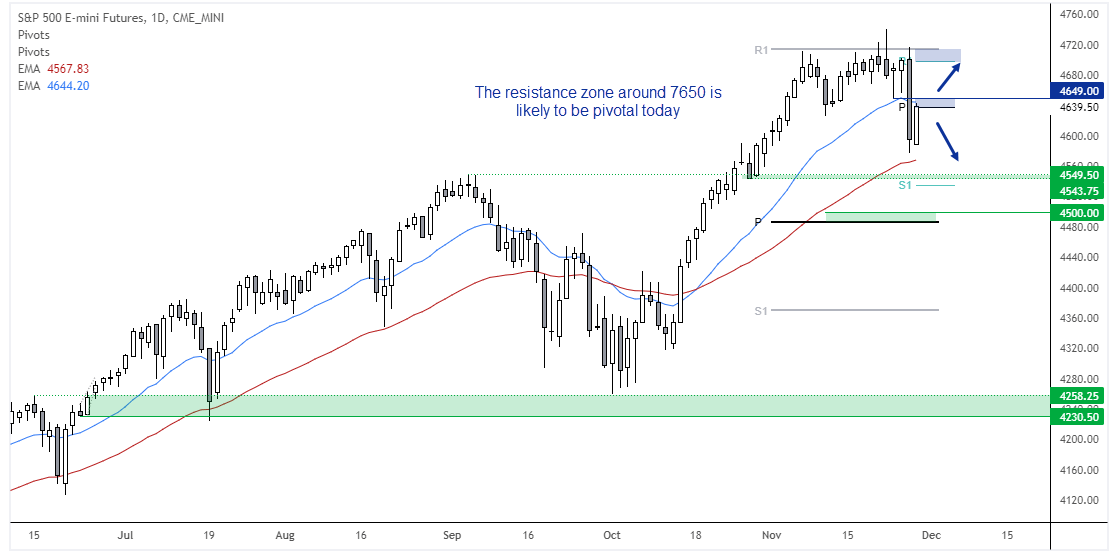

S&P 500 pares Friday’s losses during Asian trade

The S&P E-mini futures contracts have retraced around half of Friday’s losses overnight during thin trade. It held above its 50-day eMA although has found resistance below 4650 where the 20-dy eMA, monthly pivot and Wednesday’s low reside. We therefore expect the resistance zone around 4750 to be pivotal today. Clearly there will be covid headline risk but that can work both ways. Should more reports of Omicron symptoms being mild surface it could help support prices. Conversely, we could just as easily see the index roll over once more should case get out of quarantine and into communities across the globe, which could prompt some governments to throw the dreaded ‘lockdown’ word around.

The S&P E-mini futures contracts have retraced around half of Friday’s losses overnight during thin trade. It held above its 50-day eMA although has found resistance below 4650 where the 20-dy eMA, monthly pivot and Wednesday’s low reside. We therefore expect the resistance zone around 4750 to be pivotal today. Clearly there will be covid headline risk but that can work both ways. Should more reports of Omicron symptoms being mild surface it could help support prices. Conversely, we could just as easily see the index roll over once more should case get out of quarantine and into communities across the globe, which could prompt some governments to throw the dreaded ‘lockdown’ word around.

How to trade with FOREX.com

Follow these easy steps to start trading with FOREX.com today:

- Open a Forex.com account, or log in if you’re already a customer.

- Search for the pair you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.