Summary of the RBA’s December statement:

- The RBA raised rates by 25bp from 2.85% to 3.1%

- Inflation in Australia is too high

- A further increase in inflation is expected over the months ahead

- Medium-term inflation expectations remain well anchored, and it is important that this remains the case

- Economic growth is expected to moderate as the global economy slows

- The labour market remains very tight

- There has been a substantial cumulative increase in interest rates since May

- Policy operates with a lag and the full effect hikes are yet to be felt in mortgage payments

- Household spending is expected to slow over the period ahead

- The board expects to increase interest rates further over the period ahead

- It is closely monitoring the global economy, household spending and wage and price-setting behaviour.

The RBA hiked their overnight cash rate by the 25bp, taking the OCR to 3.1% - its highest level since 2012. It is their eighth hike in as many meetings, which has seen the rate rise from a record low of 0.1% and rise by 300bp.

On one hand, a case for a pause has been building as some of the RBA’s own measures of inflation expectations have turned lower, and the monthly inflation print suggests CPI may have peaked at 7.4% y/y. Yet the statement doesn’t suggest we’re any closer to one – barring the fact that they do not meet again until February. And with the RBA expecting inflation to continue higher and household spending remaining strong as ever, then the RBA may well hike by another 25bp in February and March before reassessing.

Household spending remains robust

Australian household spending rose 20.7% y/y in October, which includes a 34.2% y/y rise for services and 9.3% rise for goods. Transport and hotels, cafes and restaurants increased by around 40% with clothing and footwear rising over 32%. The RBA are keeping a close eye on household spending as it remains a key uncertainty for the central bank. But with strong numbers like this, it seems possible that the Australian economy can achieve a soft landing and allow the RBA to continue hiking in 25bp increments until people stop buying things or something breaks.

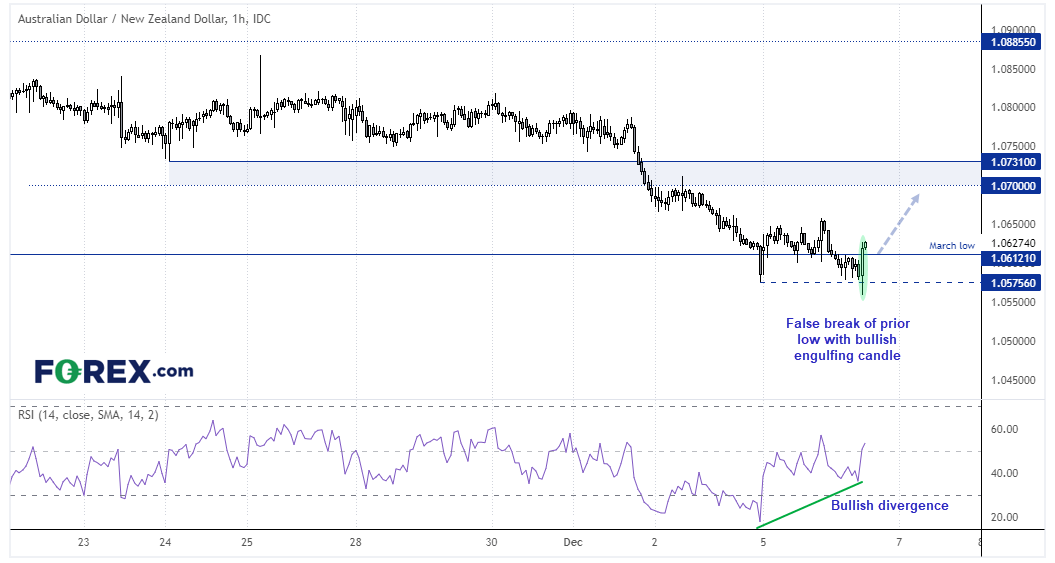

AUD/NZD 1-hour chart:

The AUD/NZD cross is now within its third month lower after we correctly anticipated a trend reversal above 1.1400. With RBNZ still expected to have a higher terminal rate than the RBA, its possible we could still see this pair move lower. Yet as today’s statement was not as dovish as I’d originally hoped (with no real mention of a pause), AUD/NZD looks oversold over the near-term and vulnerable to a countertrend move.

The 1-hour chart shows a false break of its previous swing low, a bullish engulfing candle has formed with a bullish divergence on the RSI (14). The bias is now for prices to retrace higher towards 1.0700, at which point we can reassess its potential to print a swing high or form a deeper retracement.

How to trade with FOREX.com

Follow these easy steps to start trading with FOREX.com today:

- Open a Forex.com account, or log in if you’re already a customer.

- Search for the pair you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade