- US 2-year Treasury yields just saw their largest two-day increase since May

- Buyers have capped yields on pushes towards 4.5% recently

- The correlation between US 2-year yields with gold and USD/JPY has been strong in recent days

- A reversal in yields may spark a reversal in gold and JPY

A blowout payrolls report, another pushback from Jerome Powell against excessive rate cut bets and a surprise reacceleration in US service sector activity has seen the short end of the US Treasury curve come roaring back to life with yields surging higher, bringing back memories of the bond rout witnessed in the September quarter last year prior to the Fed’s pivot.

For yield sensitive assets such as gold and USD/JPY, has created an opportunity for traders, allowing positions to be established either looking for a continuation or reversal of the latest bond bloodbath. The answer may come down to whether the obvious reacceleration in the economy can be sustained beyond the short-term.

US 2-year yields see largest gain since May

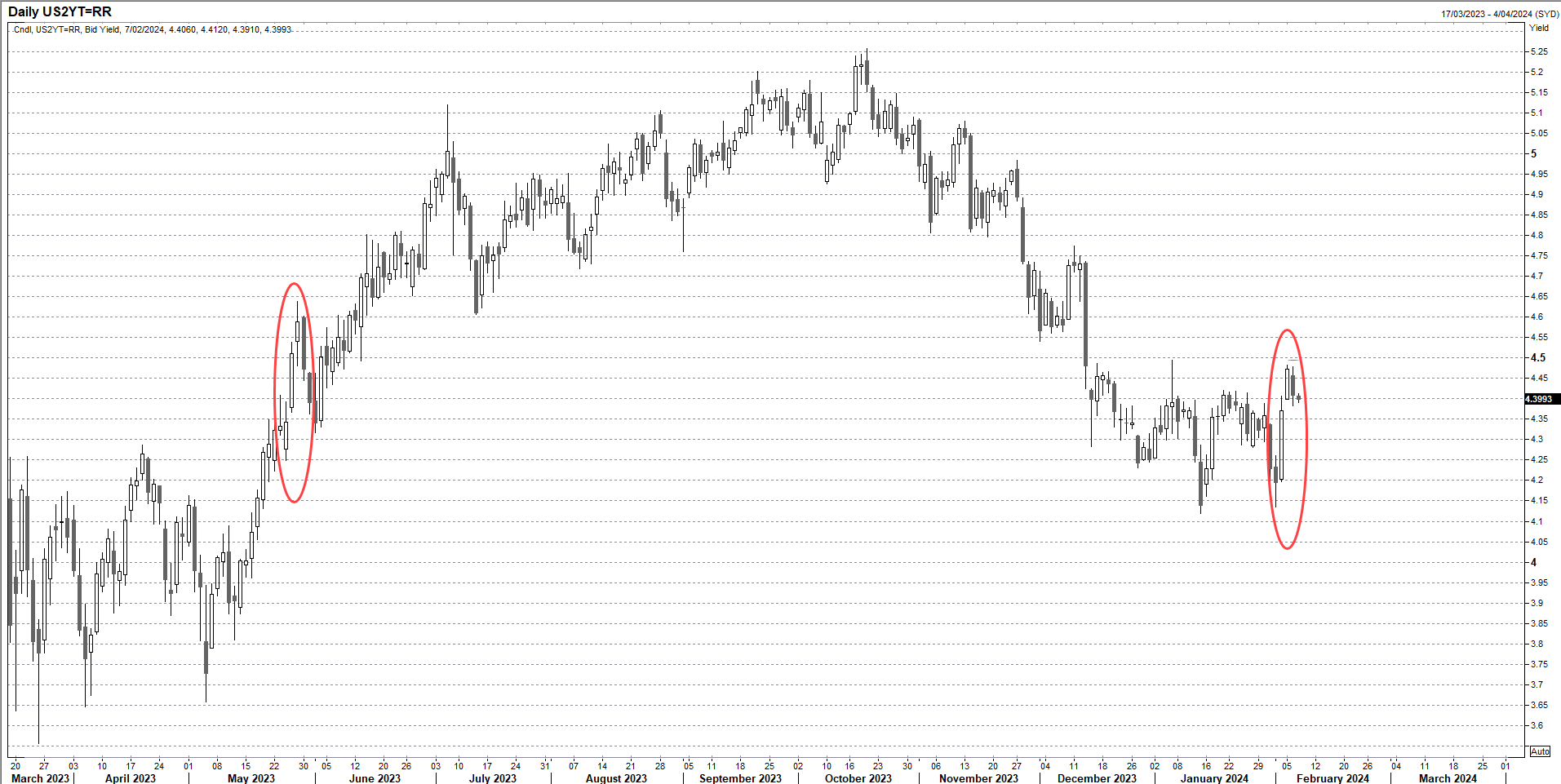

You can see the bounce in US two-year Treasury Note yields below. From the lows to highs, the two-day increase over Friday and Monday was the largest in basis points since late May.

Source: Refinitiv

But that move has seen yields hit levels where buyers have moved in

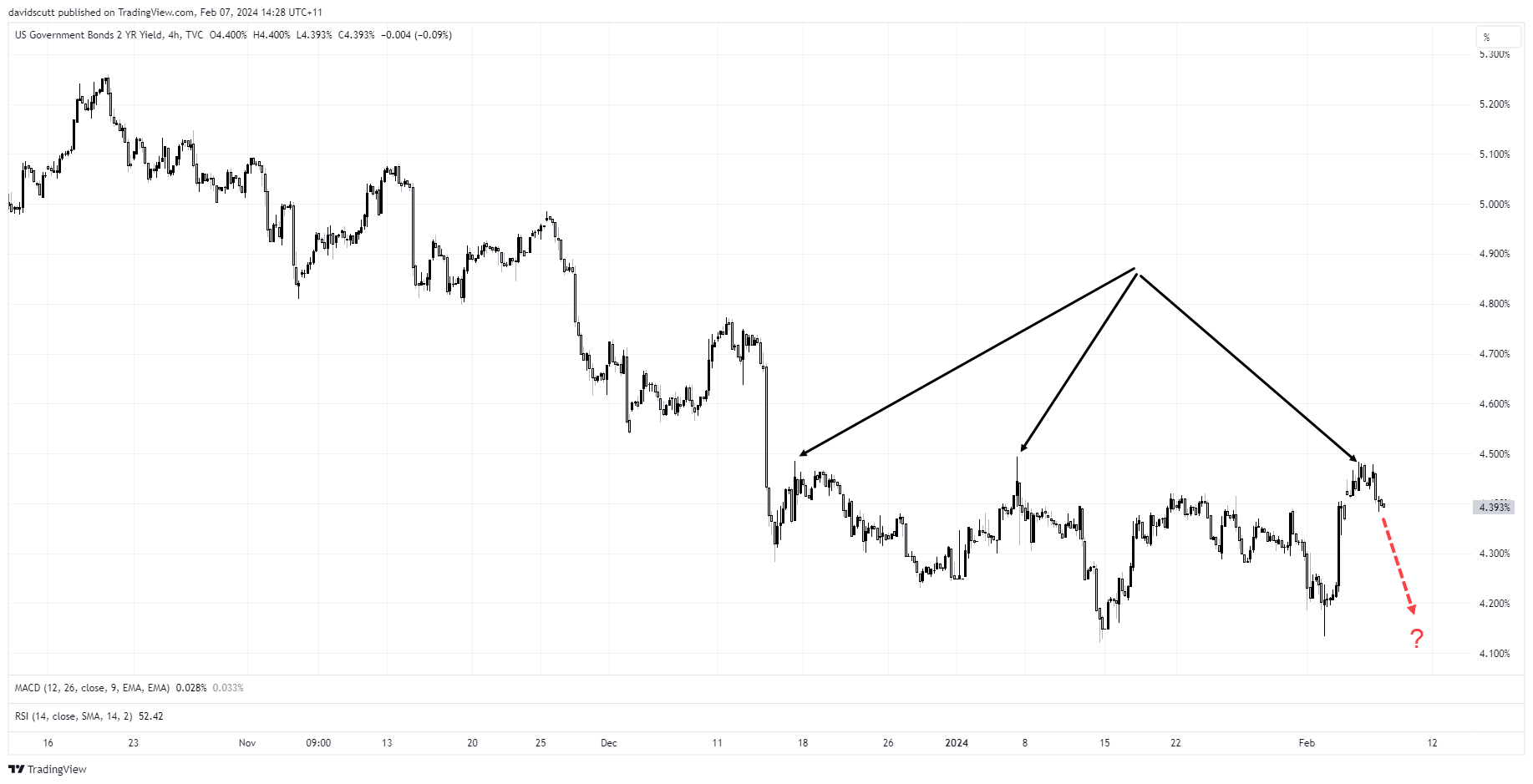

Zooming in using a four hourly chart, not only does the abruptness of the move stand out but also that yields topped out at a similar level to where they did in December and January. While I don’t believe in technical analysis on bond yields, demand for shorter-dated Treasuries is there when yields approach 4.5% right now. If that remains the case, you could argue downside pressure on gold, and upside pressure on USD/JPY, may have run its course. It could also be deemed an opportunity to fade the recent moves.

I checked the three-day correlation between US two-year yields with gold and USD/JPY on the four hourly charts. Gold was -0.95 with USD/JPY at 0.9, so there’s both look to be taking their cues from swings in shorter-date Treasuries for now. With the Fed having already pivoted, and following the recent move highs, the path of least resistance for yields looks to be lower than these levels.

For gold, that suggests price risks may be skewing higher.

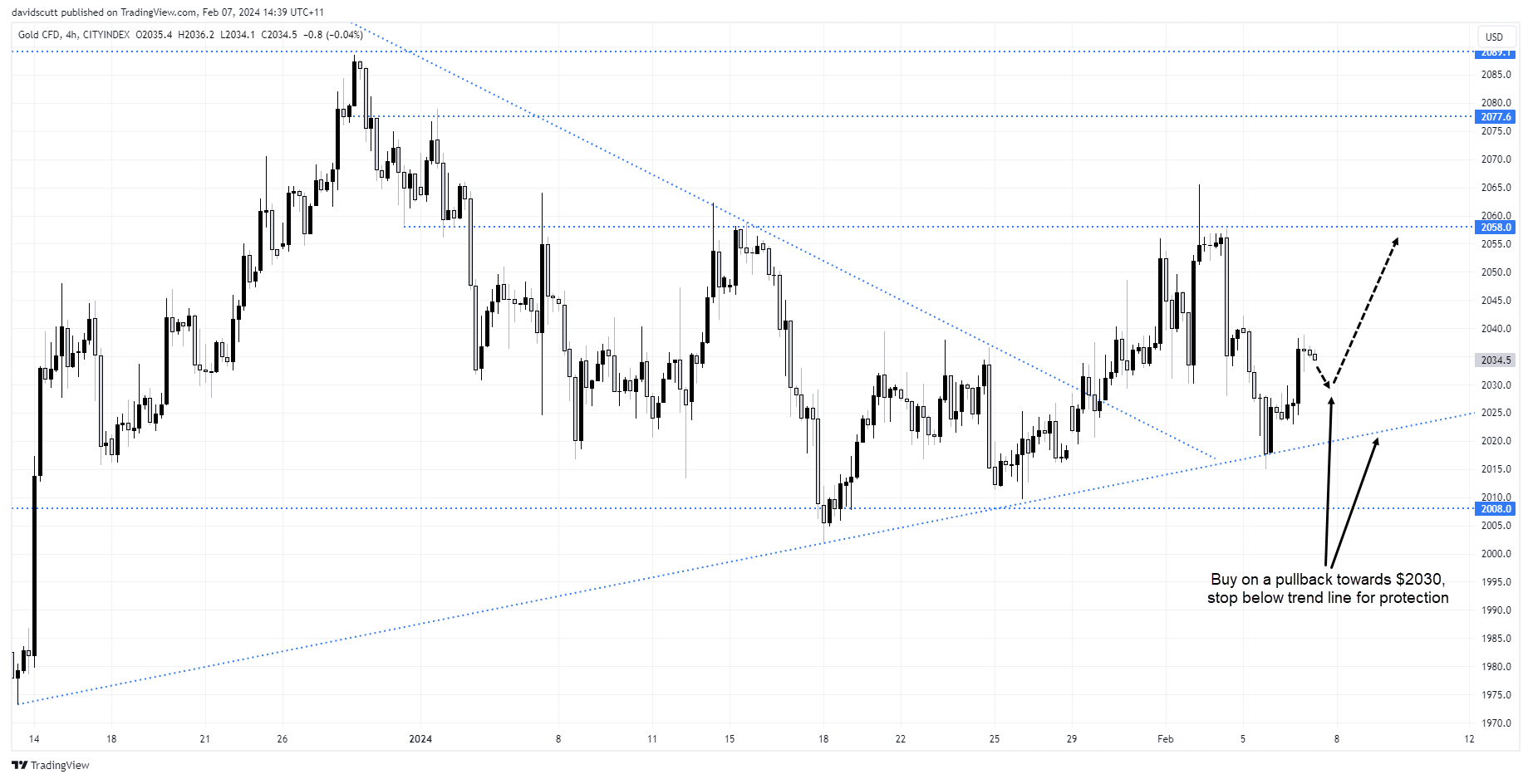

Gold has held up despite the move in yields

Looking on the four-hourly, a pullback towards $2030 – a level where gold has attracted buyers and sellers in recent weeks – will improve the risk-reward for traders considering entering long positions. A stop below uptrend support would offer protection targeting a move to $2058, where rallies have stalled this year.

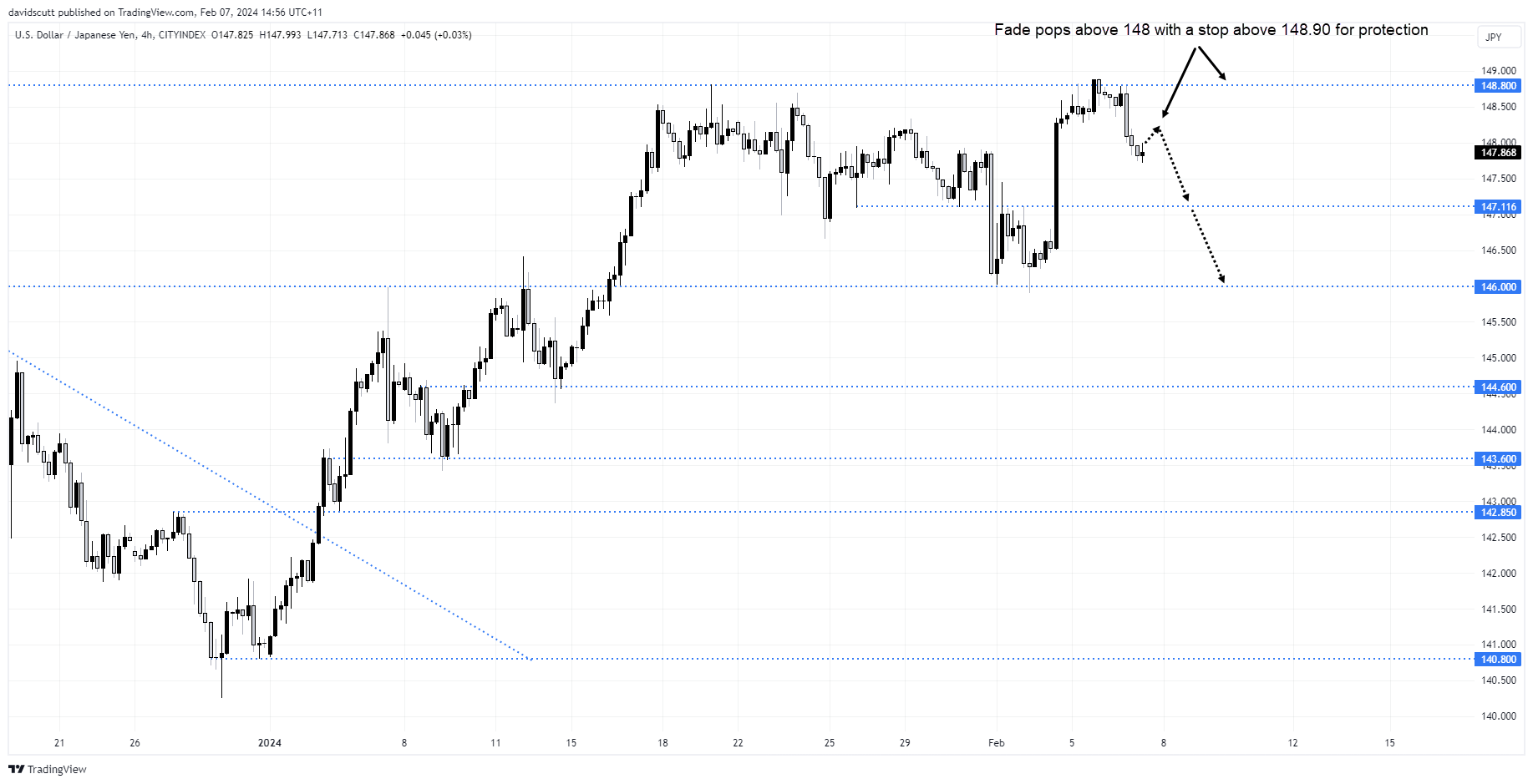

USD/JPY has struggled above 148

For USD/JPY, pops above 148.00 will provide an opportunity to reset shorts targeting a reversal to 146.00, where the pair traded prior to the latest leg higher in yields. In between, support may be encountered around 147.10. A stop above 148.90 would provide protection.

-- Written by David Scutt

Follow David on Twitter @scutty