- RBNZ moves closer to cutting rates, delivering unexpectedly dovish July statement

- Markets favour first rate cut in August, October deemed a lock

- Next week’s New Zealand inflation report now a major risk event

- NZD/USD tumbles as much as 0.8%

- US June CPI data could see the Fed join the RBNZ in turning dovish, creating reversal risk

Overview

The Reserve Bank of New Zealand (RBNZ) is not far off cutting interest rates, as long as domestic inflationary pressures allow. That means next week’s June quarter consumer price inflation report could sow the seeds for the RBNZ to begin lowering rates as soon as August. NZD/USD has fallen heavily in response.

RBNZ unleashes the doves

The RBNZ set the tone for the policy statement early, choosing the headline “Inflation Approaching Target Range” as opposed to “Official Cash Rate to remain restrictive” in May.

Fitting with the dovish tweak, the RBNZ said restrictive monetary policy had “significantly reduced consumer price inflation”, a noticeable deviation from six weeks ago when it stated it had simply “lowered” inflation. It now expects headline inflation will return to within its 1-3% target range in the second half of the year, less specific than May when it forecast the end of the calendar year. Again, another step towards rate cuts.

The were dovish remarks sprinkled throughout the statement with the committee noting “government spending will restrain overall spending in the economy” while there were “signs inflation persistence will ease in line with the fall in capacity pressures and business pricing intentions.” Two new and important additions relative to views communicated six weeks earlier.

While the RBNZ continued to suggest that policy needs to remain restrictive, it put a caveat on that guidance, acknowledging “the extent of this restraint will be tempered over time consistent with the expected decline in inflation pressures”.

Rate cuts loom in New Zealand

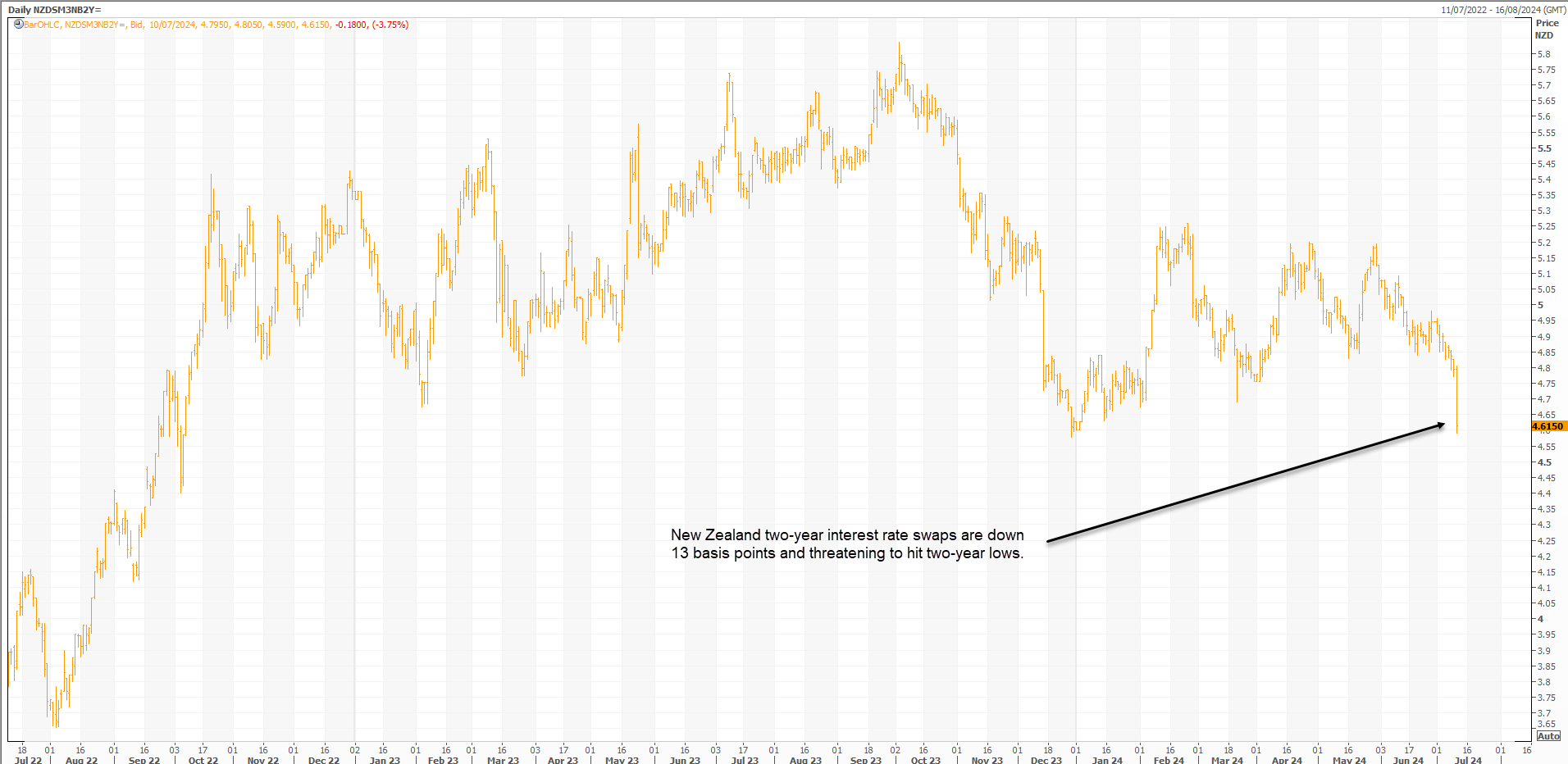

Source: Refinitiv

With price stability being the RBNZ’s primary mandate, that essentially translates to when it sees further evidence that it will meet its mandate, it will reduce the level of restriction. That means rate cuts.

It also means the RBNZ could be easing as soon as next month should it find that evidence in next Wednesday’s June quarter consumer price inflation report. Interest rates markets think so, shifting the probability of a cut on August 14 from around a one-in-three chance to around 60%.

New Zealand two-year interest rate swaps which are influenced by RBNZ rate expectations plunged on the statement, tumbling 13 basis points to 4.665% as at the time of writing, well below the 5.5% level of the cash rate.

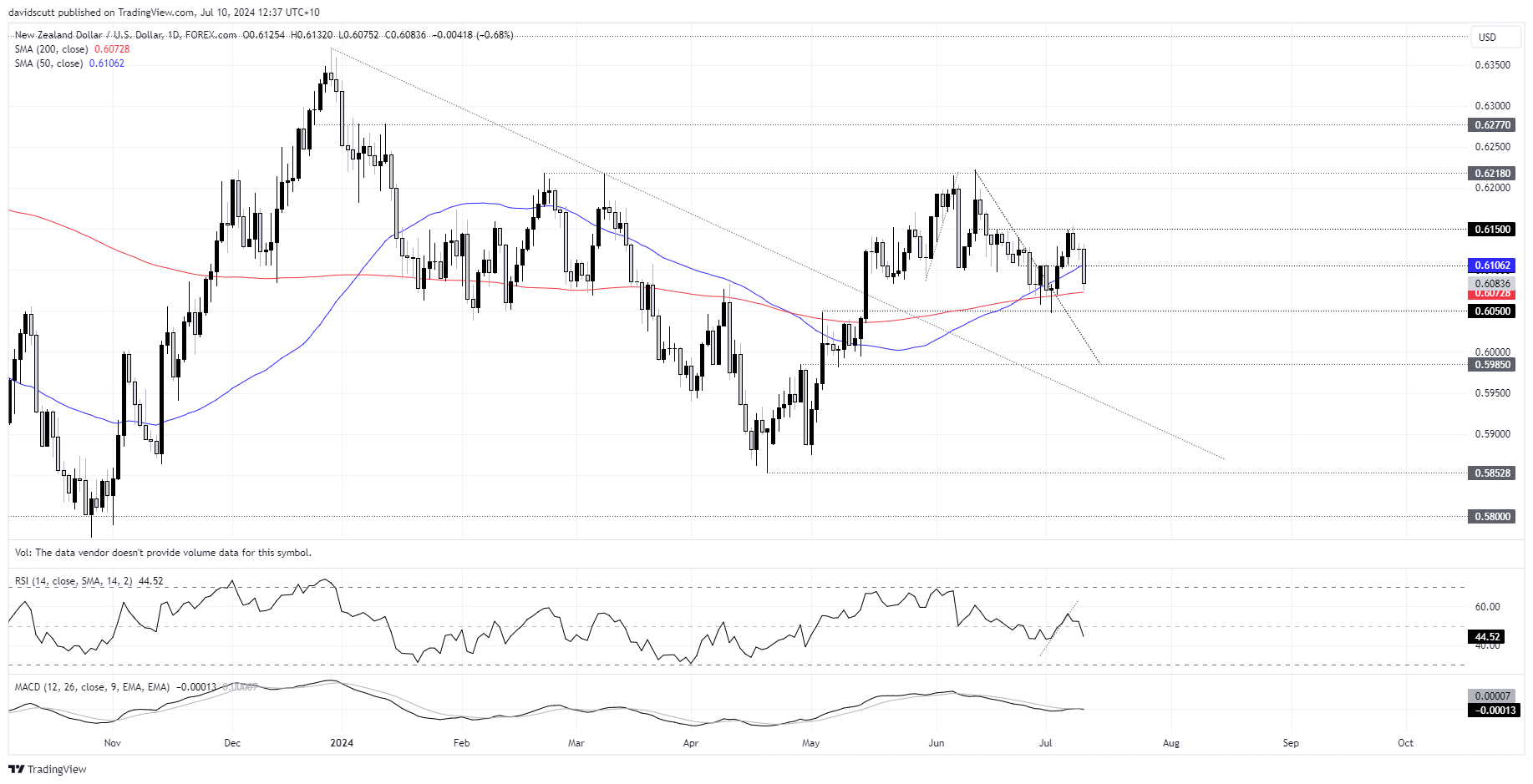

NZD/USD plunge stalls at 200DMA

NZD/USD fell sharply on the dovish RBNZ shift, losing as much as 0.8% before stalling ahead of the 200-day moving average at .60728, an important level that has encouraged buying in the past. Below, .6050 is the next layer of support before a trip back into the 50c region looms. Above, resistance is found at .6105, .6150 and .6218.

While the momentum is to the downside, I wonder whether it’ll stick. On Thursday we receive the next US consumer price inflation report for June. If we see another soft underlying print of 0.2% or less, it’s likely the Fed will join the RBNZ in shifting towards a less restrictive stance. If the Fed signals looming rates cuts, it’s doubtful NZD/USD will be trading lower.

-- Written by David Scutt

Follow David on Twitter @scutty