The Kiwi dollar was yet again the strongest major by yesterday’s close. October’s credit card spending rose 9.5% for the month, which is taking spending back to levels not seen since before the pandemic, according to Statistics New Zealand. It is also the largest monthly increase since June 2020. Durables accounted for the baulk of spending, with only retail consumables (take-outs) being the only slight negative on the month.

Overall, NZ data has beaten expectations.

Unemployment fell to a record low of 3.4% in Q3, down from 4% in Q2 and smashing expectations of 3.9%. Job growth also rose by 2%. This also followed on from a strong inflation report which saw CPI rise to 4.9% y/y, more than double their 2% target and much higher than Q2’s 3.3%.

We could go on, but the easiest way to see how strong New Zealand’s economic data has been of late is to look at the CESI (City Economic Surprise Index). Sitting near record highs, the CESI shows that data on aggregate has far exceeded forecasts. Furthermore, the CitiFX inflation surprise indicator is at a record high for New Zealand, which piles further pressure on RBNZ to act at their next meeting on November 23rd.

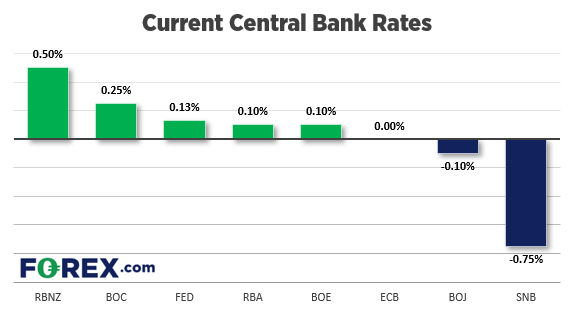

RBNZ could soon increase the yield differential advantage for NZD pairs

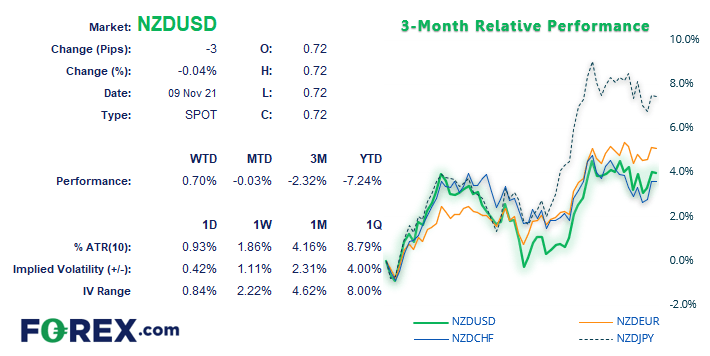

As things stand, RBNZ already have the highest base rate among the FX major banks and this give NZD the advantage of yield differentials during times of risk-on. However, as expectations for another hike are rising, bond yields are also rising at a faster pace than their peers, which is providing another pillar of strength for NZD pairs.

Should expectations for a hike remain and appetite risk remain favourable then traders are likely to take advantage of carry trades, where they buy the currency with the higher interest rate and short currencies with lower (or even negative) interest rates. So, from this logic, short EUR/NZD or long NZD/JPY and NZD/CHF seems a sensible choice.

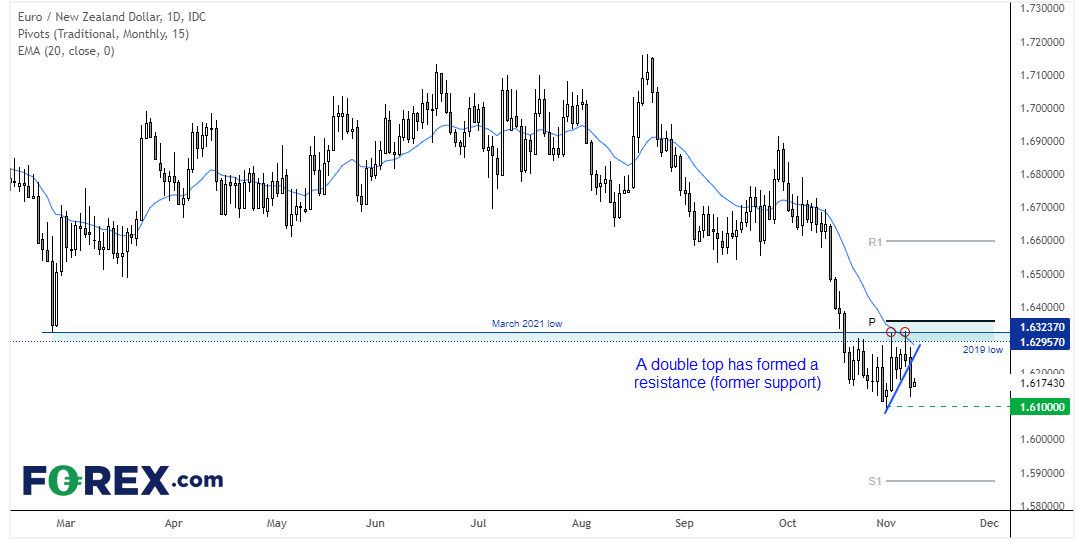

EUR/NZD also ticks a few boxes for bears from a technical perspective. The cross remains in an established downtrend and is within a consolidation phase after breaking beneath the March 2019 and Feb 2021 lows. Two upper spikes have formed a double top at resistance (previous support), with a bearish hammer forming at the 20-day eMA and below the monthly pivot point. Furthermore, yesterday’s selloff is part of a 3-bar bullish reversal called an evening start pattern.

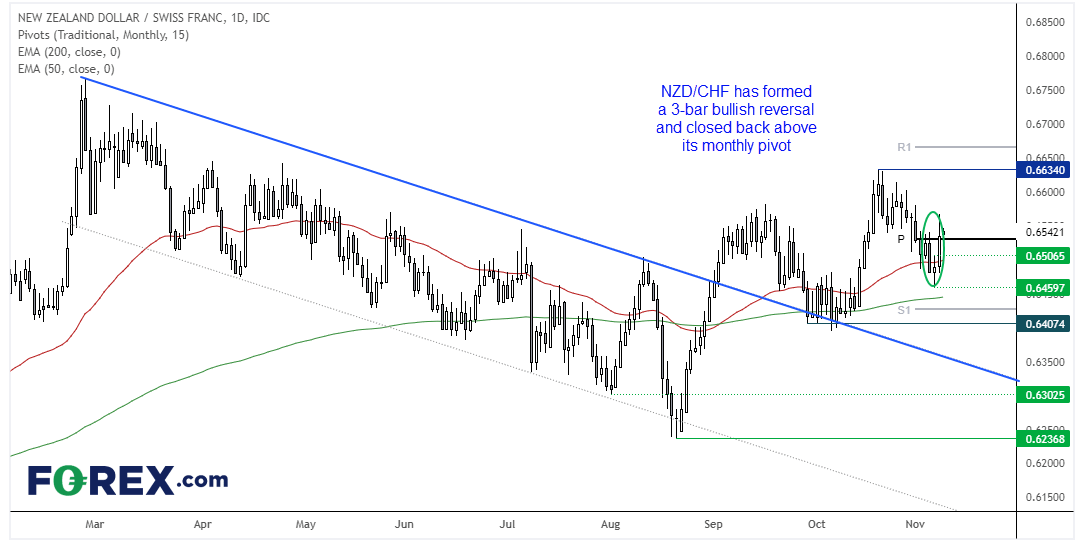

NZD/CHF appears to have formed a corrective low. The cross established a base around its 200-eMA after breaking out of its bullish channel, and its recent pullback has now printed a 3-bar bullish reversal above the 200-day eMA which shows an increase in momentum. Due to the deeper pullbacks on this pair is seems to be more suited to a swing trading style. Our bias is bullish above the retracement ow with initial target back near the cycle high at 0.6634.

How to trade with FOREX.com

Follow these easy steps to start trading with FOREX.com today:

- Open a Forex.com account, or log in if you’re already a customer.

- Search for the pair you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.