Nikkei futures market positioning – COT report

If market positioning is anything to go by, an extended rally on the Nikkei seems unlikely. Even if it shows the potential to extend its bounce a little further. The data looks at asset managers on the CME exchange, specifically in yen terms. And what is shows overall is that this set of traders have been reducing their exposure overall, since net-long exposure peaked in Q2 2023.

It therefore seems unlikely that we’ll be seeing a record high on the Nikkei any time soon. Furthermore, last week shows that asset managers decreased longs and shorts have been increased two of the past three weeks. This makes sense as it coincides with the bearish Marabuzo week (large engulfing candle with little upper or lower wicks).

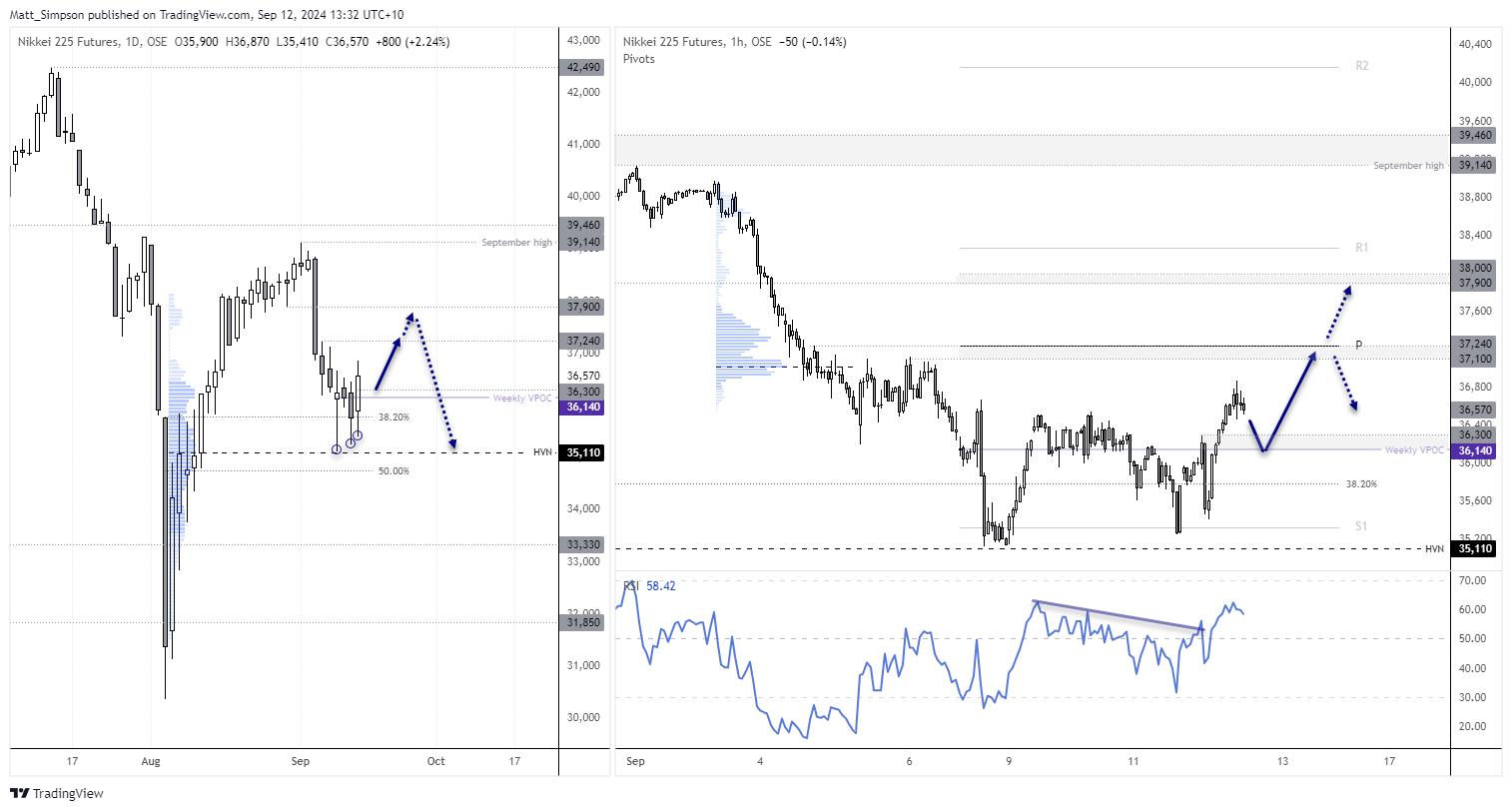

Nikkei 225 futures technical analysis

The daily chart shows that prices have held above Monday’s bullish pinbar, and its low perfectly respected the high-volume node (HVN) just above 35k. Two lower wicks have also formed, each part of a higher low relative to the pinbar. Also note that the open and close prices have held above the 38.2% Fibonacci level.

The 1-hour chart shows how bullish momentum ramped up, although it seems to have peaked for now and points towards a pullback on this timeframe. Bulls could seek evidence of a swing low to form above the 36k area, which includes a weekly VPOC (volume point of control) at 36,300 and swing high at 36,300.

- Bulls could target 37,100, just beneath the monthly pivot point and prior swing high

- A break above 37,300 takes prices into the upper half of the weekly marabuzo, where volumes were thin (this could help the rally extend)

- However, I would then be seeking evidence of a swing high and for momentum to return in line wit the bearish move from its record high on the weekly chart

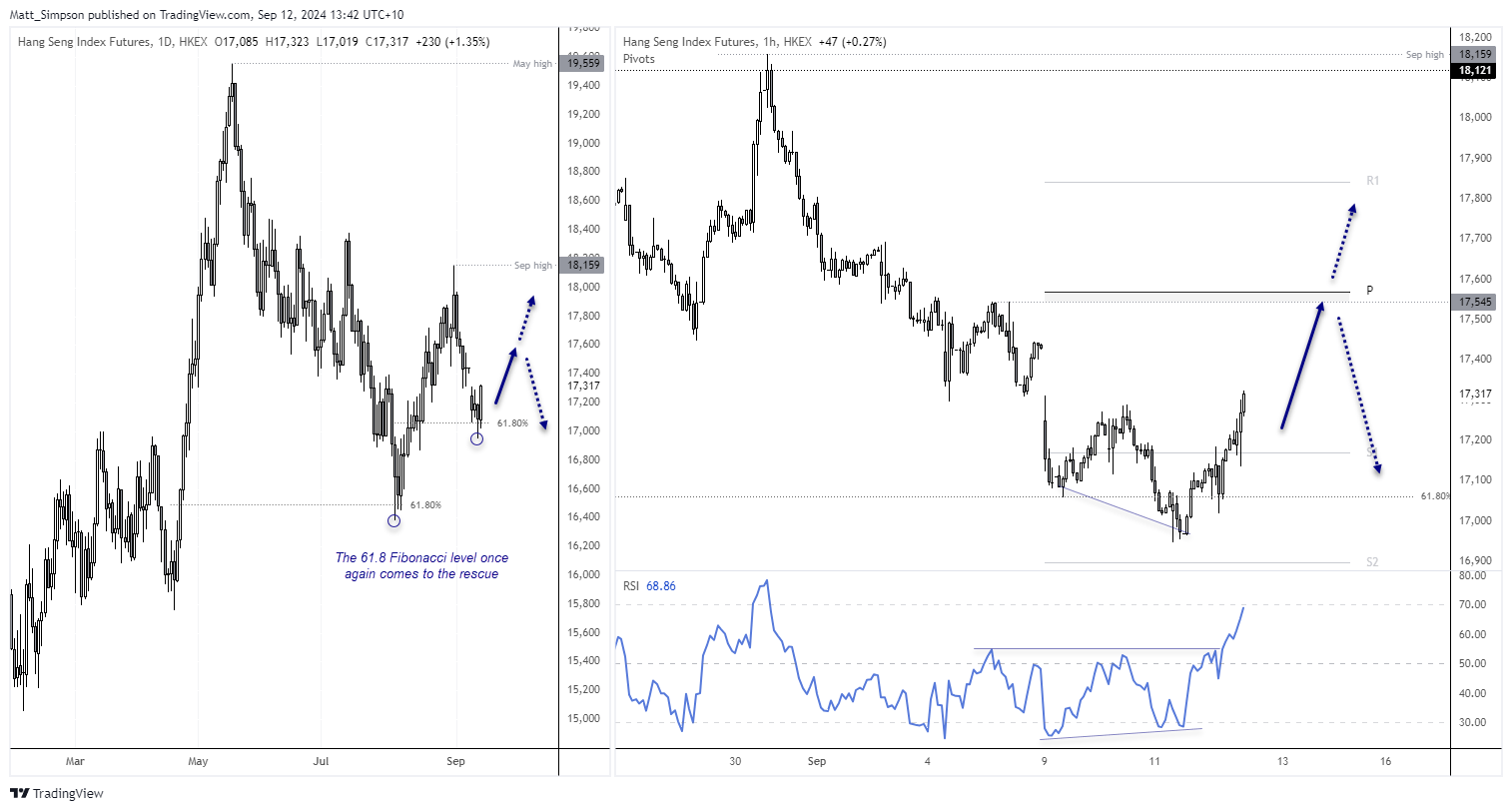

Hang Seng technical analysis

In some ways a similar setup, Hang Seng futures are also suggest a swing low has formed on the daily chart. What I find particularly interesting is how it has formed around a 61.8% Fibonacci ratio. It is unclear whether it will simply reach for the September high, and such a move might require a broad risk-on rally for global stocks or a hefty level of stimulus from Beijing. But it might be able to muster up the strength for at least a smaller rally from current levels.

A bullish divergence formed on the 1-hour chart ahead of this week’s swing low. Prices have since recovered above the monthly S1 and respected it as support. The RSI (14) is nearing overbought, so perhaps a pullback may be due on this timeframe. Bulls could consider dips within yesterday’s range while prices hold above 17,000 and target the 17,500 area near cycle highs and the monthly pivot point.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge