- Japan’s Nikkei 225 faces key technical test on Wednesday

- USD/JPY grinds higher despite yield differentials compressing, an unusual development

- BOJ intervention risk may be determined by speed of FX moves, not underlying market drivers

- US CPI creates major event risk on Wednesday

Nikkei faces important technical test

Japan’s Nikkei 225 faces an important technical test, pushing back to towards a resistance zone it’s been unable to break for weeks. With risk appetite rampant and softer yen helping to juice the earnings outlook for exporters, if Nikkei bulls can’t reclaim the ascendancy today, when will they ever?

As discussed in a note late last week, the Nikkei’s recent performance has been anything but convincing from a technical perspective, attempting to push back towards record highs struck earlier in the year without really going anywhere. Volumes are declining and upside momentum lacks the impressive thrust seen earlier in the year. Curiously, the strong positive correlations with USD/JPY and US 10-year bond yields evident over recent years have vanished.

As seen on the daily, another roadblock frustrating bulls has been downtrend resistance running from the record highs, constantly thwarting attempts at topside breaks since late March. One failure after the next has seen futures slide and hold below the 50-day moving average, along with horizontal resistance at 38900.

However, over the past week, dips below 38000 have been bought, seeing bulls reset for another attempt at a bullish breakout today.

Nikkei 225 trade setups

I don’t have a strong view on directional risks, other than the price action has been unconvincing. But if futures were to pierce and hold above the downtrend, that would change the picture considerably. So, I wait to see how the price action evolves before deciding on the appropriate course of action.

Should futures fail again at the downtrend, shorts could be initiated with a stop above the level for protection. As noted, bids below 38000 have limited losses to this point, making that an appropriate initial trade target. Below, 37750 and 37000 are the next support level after that.

If futures were to break and hold above the uptrend, traders may want to consider initiating longs with a stop-loss order below the level for protection. 38900-38950 would be the first trade target, a zone including horizontal support and 50-day moving average. Should that go, there’s not a lot of resistance beyond 40000 before we’re back at record highs.

In both ideas, if the price action were to move in your favour, consider pushing your stops to entry level, providing a free hit.

Nikkei 225 correlation with USD/JPY breaks down

In what should fundamentally be helping the Nikkei, the Japanese yen continues to weaken against a basket of major trading partners including the United States, seeing USD/JPY move back towards the multi-decade highs struck in late April.

However, the strong daily correlation that previously existed between Nikkei and USD/JPY has gone AWOL over the past month, with no meaningful relationship evident. Contrast that to earlier this year where the two variables ran with correlations of more than 0.9 over a rolling one-month period.

USD/JPY upside no longer driven by widening yield differentials

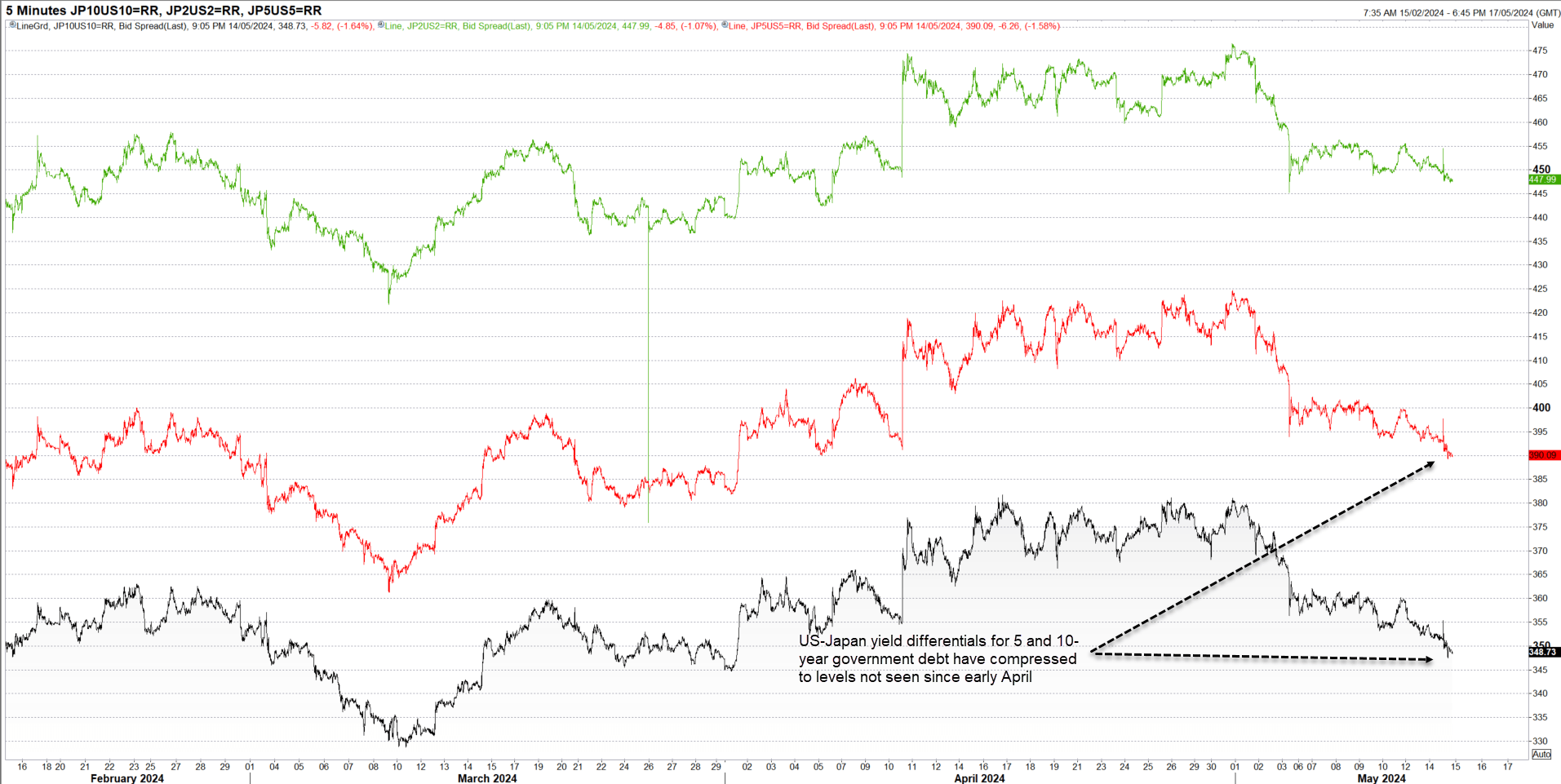

Nor has prior strong positive relationship between USD/JPY and US bond yields reasserted itself with yen selling off hard despite yield differentials between the US and Japan compressing to levels not seen since the start of April. Earlier in the year, narrowing differentials would have weighed on USD/JPY but that’s not the case right now.

Source: Refinitiv

BOJ intervention risk determined by speed?

Following the suspected intervention episode (or episodes, although I’m not convinced about the second one) from the Bank of Japan on behalf of Japan’s Ministry of Finance, there has been no discernable escalation in concerns from policymakers about the renewed weakening in the yen.

The readthrough seems to suggest the government will only intervene to support the yen if the moves are deemed rapid, regardless of what’s happening with traditional underlying drivers. That opens the door for traders continue buying USD/JPY, building confidence the intervention threat will only become apparent if the move becomes disorderly.

US CPI to drive near-term directional risks

You can see that mindset evident in the price action on the USD/JPY four hourly chart, gradually grinding higher after holding above key support at 152 last week. On the topside, resistance is likely to be encountered at 157 and 158, with a move beyond there opening the door to a retest of 160.22. Below, support is noted at 155.27, 154 and 152.

Even though the positive relationship between US bond yields has weakened recently, it’s highly likely Wednesday’s US consumer price inflation report will be highly influential on USD/JPY, with a hotter reading likely to promote further upside with an undershoot likely to do the opposite. As a reminder, the core inflation reading is likely to be more influential than the headline print. On that front, an increase of 0.3% is expected.

-- Written by David Scutt

Follow David on Twitter @scutty