US futures

Dow future -0.26% at 39320

S&P futures 0.2% at 5458

Nasdaq futures 0.3% at 19575

In Europe

FTSE -0.48% at 8258

Dax -10% at 18156

- Nvidia rises, lifting chip stocks

- US consumer confidence data & Fed speakers are due

- Oil looks to API inventory data

Nvidia rises after dropping 13% in 3 sessions

U.S. stocks point to a higher open on Tuesday as Nvidia and other AI stocks rise following yesterday's sell-off and as investors wait for further clues over monetary policy from Federal Reserve officials.

While technology and other high-growth stocks have lifted the S&P 500 and the NASDAQ to record highs this year, the more value-focused Dow Jones continues to lag behind its peers, highlighting concerns over the rally's breadth.

The US economic calendar is relatively light, focusing on consumer confidence, which is expected to increase slightly to 100, down from 102. However, the main focus this week will be Friday's PCE index, the Fed's preferred gauge for inflation. This index could provide further insight as to whether the Federal Reserve is likely to cut interest rates on several occasions this year or just once, as was projected at the latest Fed meeting.

The market is pricing in a 61% probability of a 25 basis point rate cut in September and still expects two rate cuts by the end of the year. However, Fed official Michelle Bowman said she doesn’t see any rate reductions this year.

Corporate news

Nvidia is rebounding after falling 7% on Monday, one of its steepest one-day falls since late April, as investors pulled out of AI-linked stocks. Nvidia, the poster child for AI, lost nearly 13% and $430 billion in market value over the last three trading days. However, today’s move higher has moved its market cap back above the key $3 trillion threshold. Other chip stocks are also rising.

Spirit Aero System is set to open 3% lower on a report indicating that Boing has offered to acquire the airplane fuselage maker in a deal that values the supplier at $35 per share.

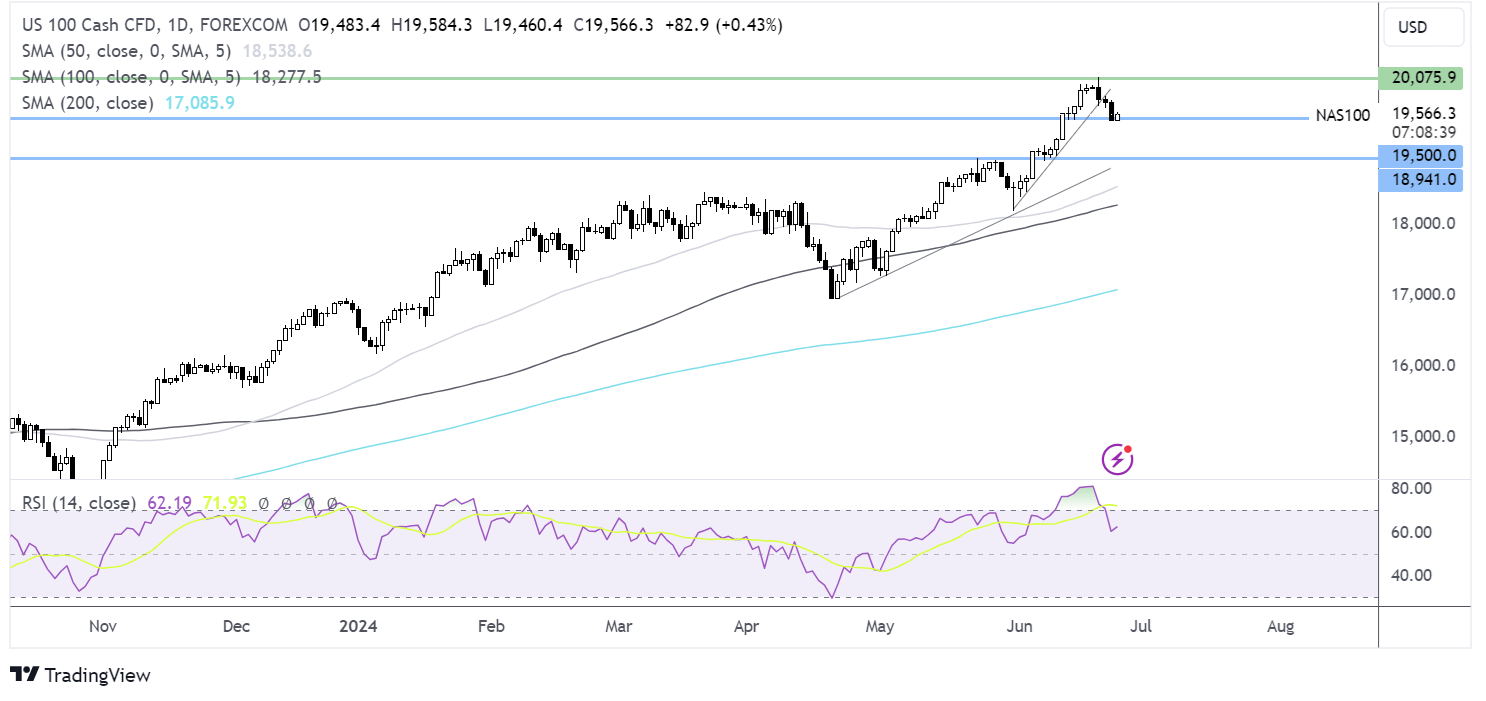

Nasdaq 10 forecast – technical analysis.

The Nasdaq found support around 19500 and is attempting to push higher. The fall away from the ATH above 20k has brought the RSI out of overbought territory. Buyers will look to extend gains back towards 20k. Sellers will need to take out 19500to extend the selloff towards 18950, the May high.

FX markets – USD rises, GBP/USD falls

The USD is rising after losses yesterday as investors continue to weigh up Federal Reserve rate cut expectations. Mid-tie data and Fed speakers in focus

EUR/USD is under pressure amid political uncertainty and concerns over the economic outlook in the region. The French elections will take place on June 30th, and concerns over political upheaval and spending plans are weighing on the common currency. Meanwhile, data yesterday showed that German economic business sentiment unexpectedly deteriorated, raising concerns the economic recovery is losing momentum.

USD/CAD has fallen after Canadian inflation came in hotter than expected at 2.9% versus the forecast of 2.6%. The Bank of Canada's July implied rate cut odds immediately fell to 50%, down from 70% ahead of the data. Figures, after the Bank of Canada cut interest rates by 25 basis points earlier this month.

Oil holds steady ahead of API stockpile data.

Oil prices are unchanged after solid gains in recent weeks, as investors become increasingly optimistic about an improved demand outlook this summer. Ongoing geopolitical tensions are also keeping the oil price well supported.

Meanwhile, concerns over a stronger dollar and interest rates remaining high for longer keep any gains in check.

An optimistic demand outlook and reduced US inventories triggered the recent surge in oil prices. API crude stockpiles will be released shortly and are expected to have fallen by three million barrels in the week ending June 21st.