Key Events

- Nasdaq eyes a 1,000-point rally following the 20,760-breakout

- EURUSD’s 2022 bull trend is at critical support levels

- US CPI: key market catalyst for next week

- Technical Analysis on DXY, EURUSD, Nasdaq

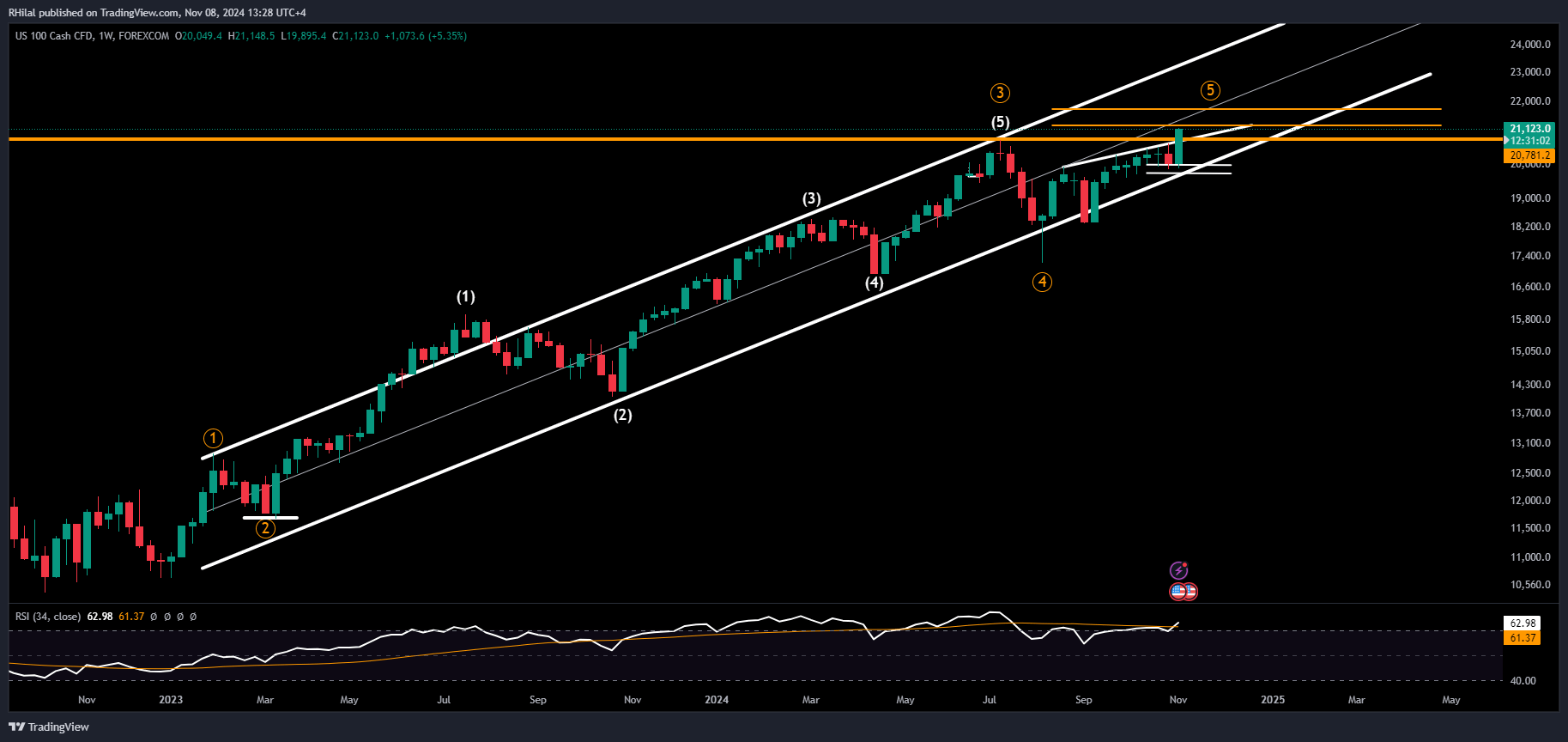

Nasdaq Outlook

Optimism surrounding the haven attributes of the tech sector alongside a Trump victory has boosted investor confidence in the Nasdaq, though inflation risks and the prospect of prolonged higher interest rates remain factors. With the latest breakout above the July high (20,760), Nasdaq is eyeing a potential 1,000-point rally toward 21,780.

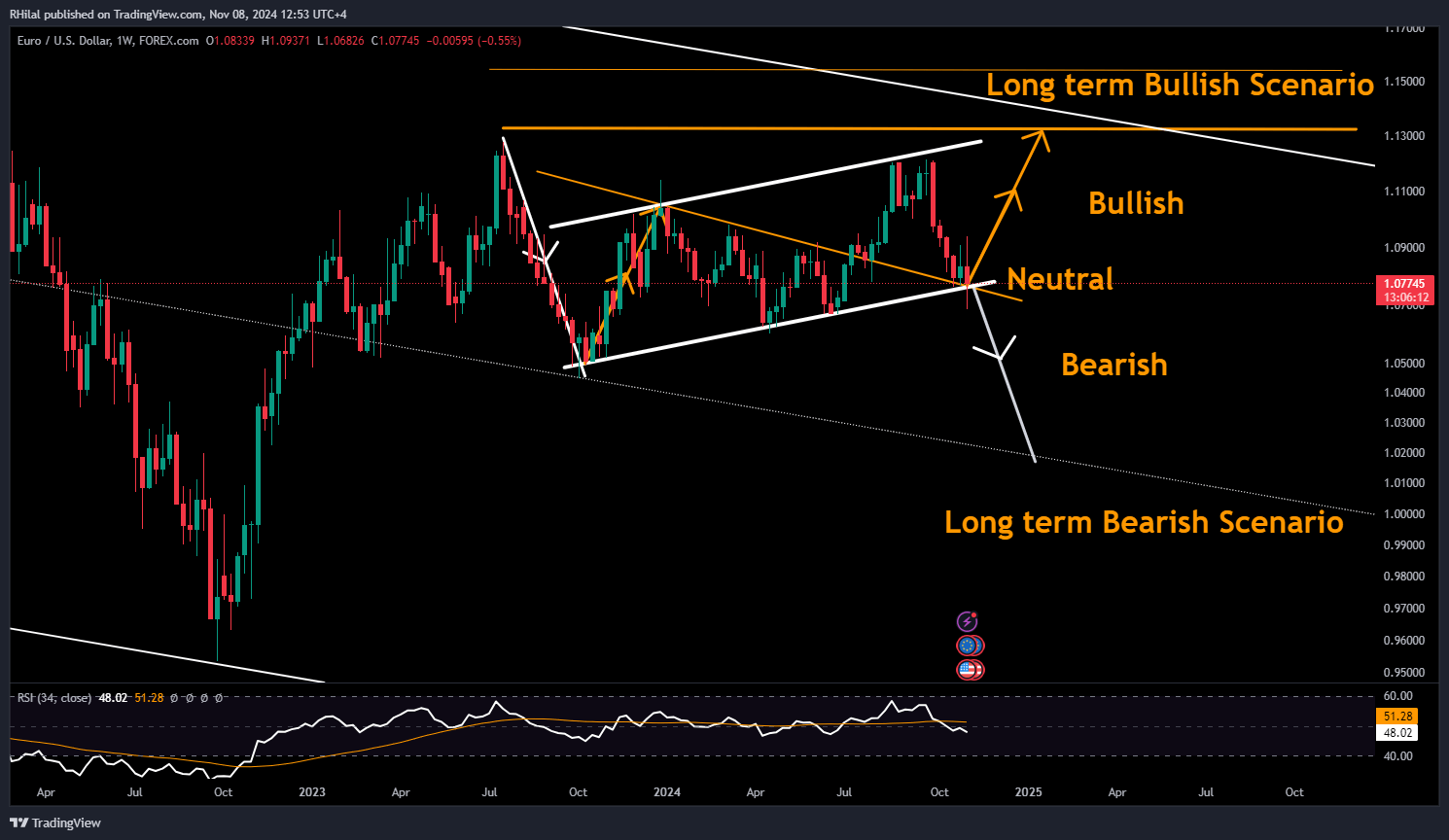

EURUSD Outlook

The EURUSD experienced headwinds from a dollar rally post-election but managed to hold above the critical 1.0680 support following the Fed's rate cut. In a primary uptrend from the 2022 low (0.9530), EURUSD is currently in a consolidation phase. It now sits at a critical juncture, determining whether the uptrend will continue or reverse.

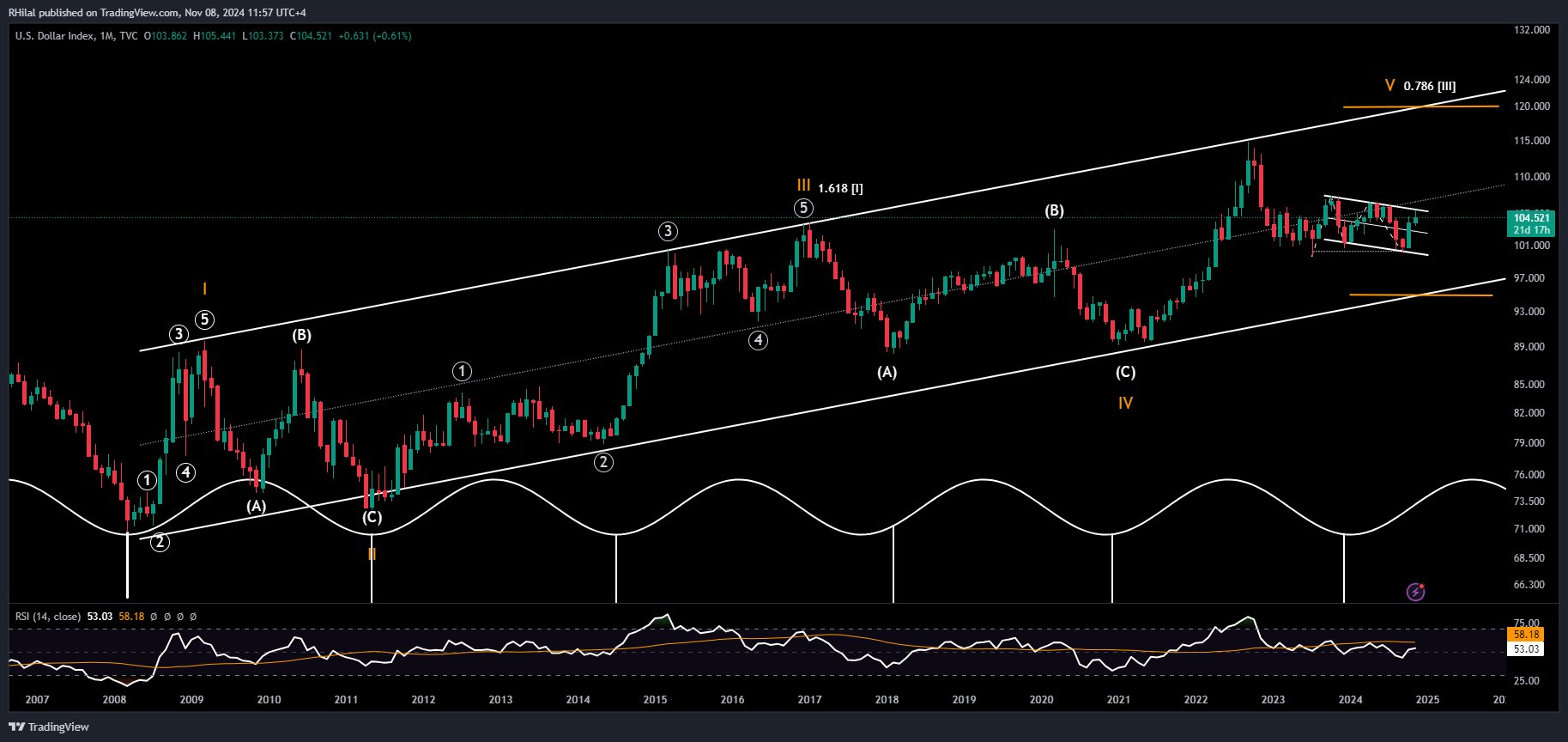

DXY Analysis: Monthly Time Frame

Source: Tradingview

On a monthly scale, the DXY remains on bullish ground. Time cycles show lows aligning with trend support dating back to 2008, while the RSI has rebounded from the neutral 50 zone. The latest consolidation’s lows align with the 0.610 Fibonacci retracement of the uptrend from May 2021 to September 2022.

A breakout above 106 could reinforce a long-term bearish scenario for EURUSD and US indices due to inflation concerns, whereas a sustained downtrend and dip below the July 2023 lows would support the longer term EURUSD uptrend.

EURUSD Analysis: Weekly Time Frame - Log Scale

Source: Tradingview

The EURUSD pair is reflecting volatility at a crucial point, where a bearish breakout below the 1.0660 level can extend the Euro’s drop towards 1.05 and possibly back towards 1.01.

On the upside, respecting the current triangle thrust and established uptrend since the lows of 2022, the EURUSD’ uptrend is expected to realign with resistance levels 1.10, 1.1140 and 1.1220 before extending a firm bull run above the 1.1320 and 1.15 levels.

Nasdaq Analysis: Weekly Time Frame – Log Scale

Source: Tradingview

Nasdaq’s significant 20,760 level has shifted to support, setting the stage for a potential 1,000-point rally towards 21,780. From an Elliott Wave perspective, the index is in the fifth wave of its primary uptrend established since October 2022 lows, with possible resistance around 21,300 before extending to 21,780.

On the downside, the primary uptrend’s parallel channel is positioned to support any pullbacks, with the main support level at 20,700, and an extended pullback can drop towards 20,400, 20,100, and 19,900-19,800 respectively, before confirming a longer-term bearish reversal for the index.

--- Written by Razan Hilal, CMT – on X: @Rh_waves