US index futures edged higher in early European trading, but after a strong two-day rally, momentum might slow ahead of the Federal Reserve’s rate decision. With a 25-basis-point rate cut fully priced in, the focus will shift to the Fed's tone on future cuts. If the Fed hints at slowing rate cuts in response to Trump’s pro-growth policies, bond yields could remain elevated, potentially cooling investor enthusiasm for stocks in the short term. For now, the Nasdaq 100 forecast is positive with markets still buzzing from the post-election rally, but as the initial excitement fades, a pullback may be in the cards.

Much of the buying might have already taken place

The US presidential election’s quick results caught the markets by surprise, sparking an early rally. Investors, already anticipating a Trump victory, quickly bought in, pushing the S&P 500 up 2.5% in its best post-election day on record, while the Nasdaq 100 hit a new high. Trump’s policies favouring tax cuts and deregulation are fuelling optimism, but much of this buying might have already played out. Now, as the dust settles, investors may prefer to wait for markets to dip before potentially buying again, especially with the Fed decision looming.

Key concerns on the horizon

While Trump’s policies are viewed as business-friendly, potential headwinds remain. Markets may start weighing the impact of his stance on tariffs, especially on China and Europe, which could dampen global sentiment and, by extension, Wall Street. Another looming issue is the federal debt limit, set to be reinstated on January 2nd. With rising yields, there’s concern about the sustainability of US debt under Trump’s borrowing and tax cut plans. If not managed carefully, this could increase the risk of a credit rating downgrade, a scenario that could undermine equity markets. Furthermore, with most tech earnings in, which have been mixed overall, the tech sector may face a slowdown. Questions about the sustainability of AI-driven revenue growth could influence future market sentiment, especially as retail investors assess how much longer tech stocks will benefit from this hype.

Fed set to deliver a 25 basis point cut today

Attention now returns to the Fed, as today’s FOMC meeting will shed light on the central bank’s next steps. Markets are betting on a rate cut, with most expecting a 25-basis-point reduction. Chair Powell may steer clear of any commitment to a rapid easing cycle, especially if he believes Trump’s policies could drive inflation. Any indication of hawkishness could boost bond yields further, which would likely weigh on growth stocks. Even though rate expectations have shifted, significant changes in market trends are unlikely in the immediate term. However, over the coming quarters, rising US yields could strengthen the dollar, adding pressure on other economies while supporting the US market’s broader trend.

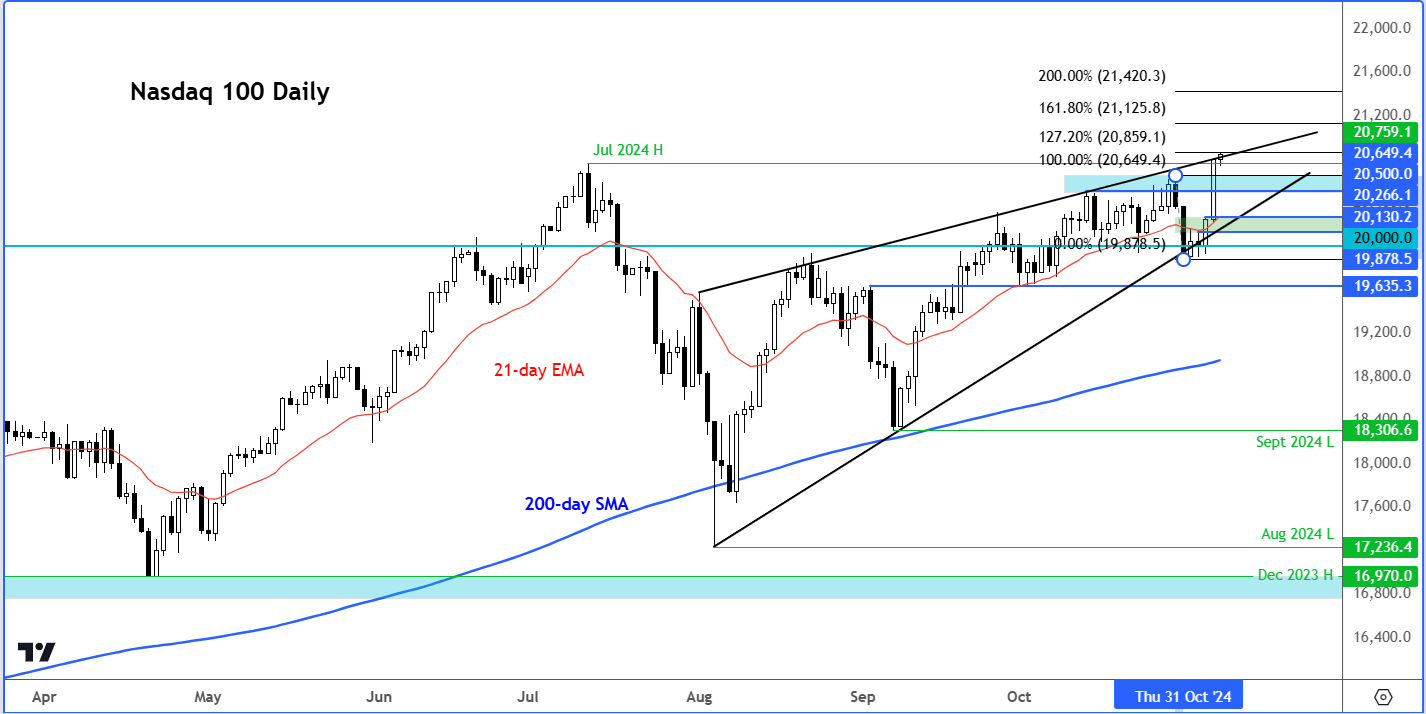

Nasdaq 100 Forecast: Technical Levels to Watch

Source: TradingView.com

At record highs, you can’t and shouldn’t be bearish on the Nasdaq or S&P 500 chart from a technical point of view. That’s unless the breakout fails, but so far that doesn’t seem to be the case. For now, it is worth keeping an eye on key short-term support levels to gauge the market’s strength. One such support sits around 20,500. If that level falters, a drop to the 20,130 – 20,266 range may be next, marking the base of this week’s breakout. Below that 20,000 is now the last significant support in the short-term that will need to hold to keep the bulls happy – break that and we could see the onset of a correction. On the upside, the resistance trend along the wedge pattern was being tested at the time of writing. Failure to break through it may slow down any additional rally attempts. Still, I wouldn’t rule out a continuation of the rally towards 21,000 initially ahead of the Fibonacci extension levels shown on the chart, next.

In summary…

Traders may feel a “buy the dip” instinct kicking in with the Nasdaq at new highs, but caution is warranted. Trump’s policies may favour stocks in the long run, but uncertainties around tariffs, debt management, and Fed policy could prompt short-term corrections. For now, keeping an eye on key technical levels and adjusting strategies as new information unfolds will be essential for navigating the months ahead.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R