Nasdaq 100 Key Points

- The Nasdaq 100 is bouncing back with the help of strong earnings from the likes of Palantir (+13%) and Uber (+10%).

- Watch for an NDX close either above the 18,400 level (which could come as soon as today) or a close below the 200-day MA near 17,800 to tip the odds in one direction or another.

At least for the moment, it seems like we’ve passed the moment of peak market panic yesterday morning. For a couple of hours, traders were wondering whether the global economy was on the verge of imminently tipping into recession after a soft jobs report and seemingly ambivalent Fed, exacerbated by the rapid unwind of the crowded yen carry trade.

“Turnaround Tuesday” is a named phenomenon for a reason: After spending a whole weekend thinking about which positions they’ll put on in the new week, traders often push markets too far in one direction on Mondays, setting the stage for a reversal of the extreme move on Tuesdays as cooler heads prevail.

I must admit though, it was hard to see how US indices, highlighted by the Nasdaq 100s -6% drop at one point yesterday morning, would be able to muster a meaningful rally. The tech-heavy index bounced solidly off its lows yesterday and with the help of strong earnings from the likes of Palantir (+13%) and Uber (+10%), the index has now almost entirely erased yesterday’s losses to trade near unchanged on the week.

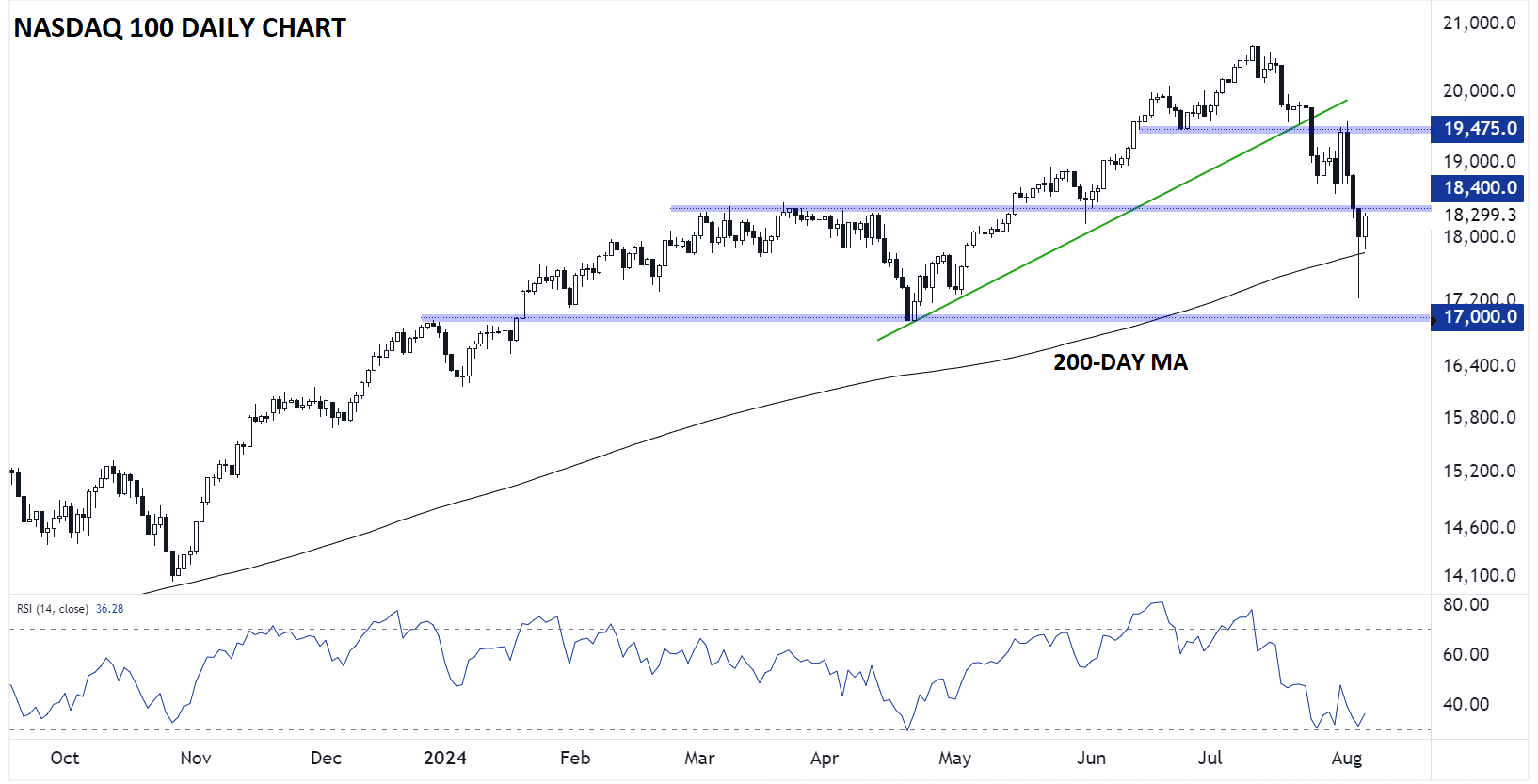

Nasdaq 100 Technical Analysis – NDX Daily Chart

Source: TradingView, StoneX

Looking at the chart above, the Nasdaq 100 remains below the key level of previous support/resistance at 18,400, and short-term bulls will be hesitant to buy back into the market aggressively as long as prices remain below that zone. On the bright side for long-term bulls though, NDX did hold above its 200-day MA, marking (for now) the third successful test of that key trend barometer going back to the start of the Nasdaq 100’s uptrend in early 2023.

Taking those two technical barriers together, we’re left with a neutral-to-bearish near-term outlook against a still-intact long-term bullish outlook. Rather than guessing which of those is more likely to win out now, readers may want to wait for a close either above the 18,400 level (which could come as soon as today) or a close below the 200-day MA near 17,800 to tip the odds in one direction or another.

-- Written by Matt Weller, Global Head of Research

Check out Matt’s Daily Market Update videos on YouTube and be sure to follow Matt on Twitter: @MWellerFX