US futures

Dow future 0.03% at 42761

S&P futures 0.04% at 5819

Nasdaq futures 0.09% at 20183

In Europe

FTSE 0.81% at 8263

Dax -0.35% at 19568

- Stocks steady after yesterday's fall

- Earnings in focus amid a quiet economic calendar

- MS rises as dealmaking boosts earnings

- Oil falls further after a 4% decline yesterday

Stocks steady after yesterday’s hit

U.S. stocks are pointing to a subdued open after yesterday's selloff in tech and oil stocks. Investors are also digesting the latest quarterly earnings from corporate America, including Morgan Stanley.

Amid a quiet U.S. economic calendar, earnings and corporate news are directing the market mood.

Investors continue to digest yesterday's chipmaker sell-off. Chip stocks fell sharply after key equipment supplier ASML’s guidance disappointed the market, sparking a global route in the sector. The warning from Dutch ASML halted a rally that had seen the Nasdaq rise to a three-month high. Meanwhile, Nvidia tumbled 5% on Tuesday, moving away from its record close earlier in the week on concerns over production issues with its newest AI product.

US elections are also coming more into focus. With polling day less than three weeks away, traders appear to be reviving bets on a Trump win. According to Goldman Sachs, stocks that are set to benefit from Republican policies are gaining, and Trump media, which most investors appear to be using as a proxy, has been rising for the past few weeks.

Corporate news

Morgan Stanley is rising after the bank posted a rise in profits in Q3 amid a rebound in dealmaking. EPS rose to $1.88 up from $1.38 a year earlier.

Nvidia is rising 0.7% as the chip mount maker steadies following an almost 5% slump yesterday on reports the Biden administration was considering capping AI chip exports by U.S. companies.

ASML fell 3.5%, adding to yesterday's 16% losses after the world's largest chip-making equipment manufacturer slashed its guidance for the coming year.

United Airlines is set to rise 1% on the open after reporting Q3 earnings ahead of forecasts and after announcing a $1.5 billion share buyback programme.

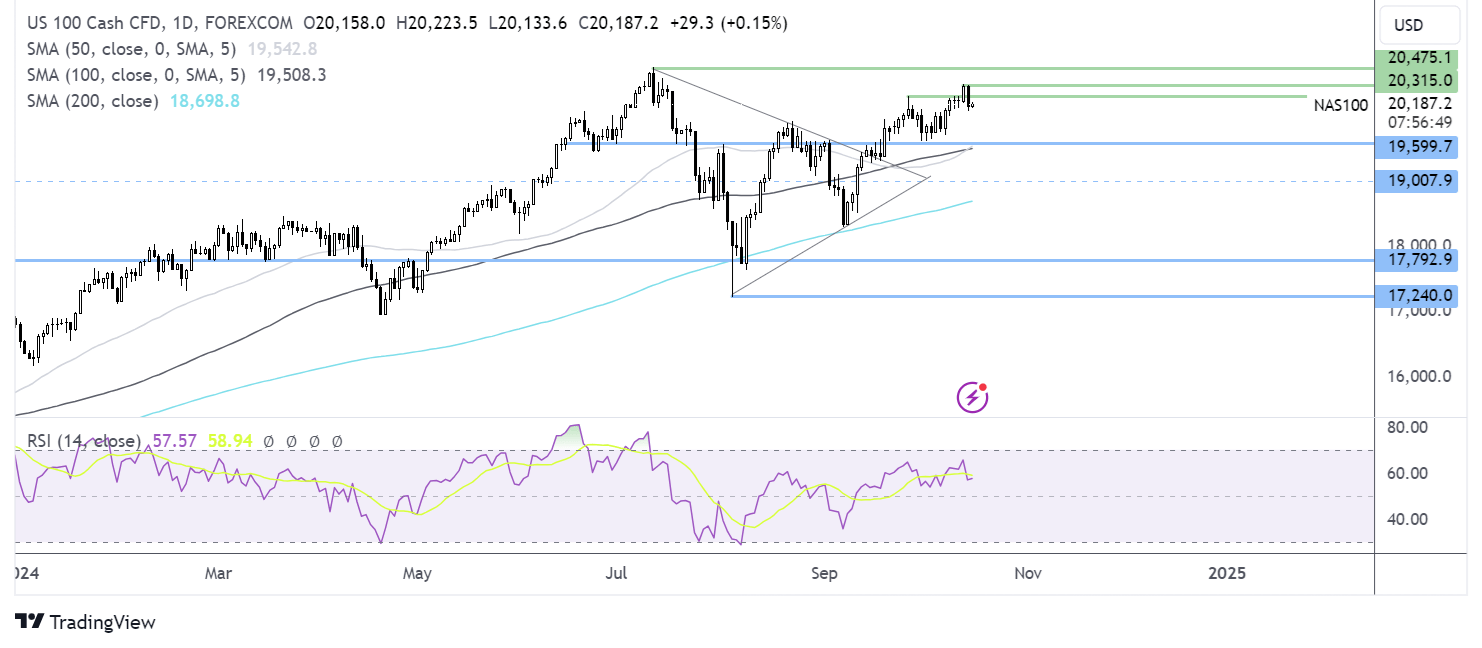

Nasdaq 100 forecast – technical analysis.

Having broken out of its symmetrical triangle, Nasdaq 100 rallied into resistance at 20,500, before correcting lower back below 20k. The uptrend remains in tact and buyers will look to retake 20k to open the door to 20.5k and 20.75k. Sellers would need to break below 19555 to create a lower low.

FX markets – USD holds steady, GBP/USD falls

USD is holding steady as it hovers around 2 1/2-month highs, supported by expectations that the Federal Reserve will cut interest rates more gradually. The economic calendar is quiet, and attention is turning to tomorrow's retail sales.

EUR/USD is unchanged as the market awaits the ECB interest rate decision tomorrow. The ECB is expected to cut interest rates by 25 basis points and could continue cutting rates heading into 2025 as inflation is below the 2% target level.

GBP/USD is falling after UK inflation eased to 1.7%, down from 2.2%, marking its lowest level in three years. Service sector inflation also eased to 4.9% from 5.6% - the largest decline since 2020 and paving the way for the Bank of England to cut interest rates in the November meeting.

Oil falls further after 4% losses yesterday

Oil prices are falling for the fourth straight day, heading towards $70.00 a barrel, having lost almost 7% so far this week.

Oil fell over 4% yesterday and remains under pressure in response to a weak demand outlook and reports that Israel would not strike Iranian oil infrastructure, calming concerns of supply disruptions. As a result, the risk premium has eased somewhat.

Meanwhile, the prospect of OPEC+ unwinding output cuts in the coming months could keep oil prices under pressure.

On the demand side, OPEC and the IEA cut their 2024 global oil demand forecast, amid concern over growth in China.

API inventories are due later.