US futures

Dow future -0.11% at 43925

S&P futures -0.23% at 5976

Nasdaq futures -0.29% at 20990

In Europe

FTSE 0.57% at 8064

Dax 1.57% at 19272

- US PPI rose 3.1% YoY, up from 2.8%

- US jobless claims remain low

- Fed Chair Powell to speak later

- Oil steadies after losses earlier in the week

US PPI rises, jobless claims fall, Powell up next

U.S. stocks have opened lower after hotter-than-expected US inflation data and ahead of a speech by Federal Reserve chair Jerome Powell.

PPI came in hotter than expected, rising to 3.1%, up from 2.8% and ahead of forecasts of 3%. The data comes after sticky consumer price inflation yesterday, which saw CPI rise to 2.6%. Given the strength of recent U.S. economic data and the incoming Trump administration, the market may start to get slightly nervous about the outlook for rate cuts next year.

However the markets are still pricing in around an 85% probability of a 25 basis point rate cut at the December meeting. Powell will provide an update this afternoon the market will watch closely for clues over the outlook for interest rate cuts.

His comments come after several policymakers have alluded to a higher neutral rate as they shift their attention back to inflation risks. Trump's administration is widely expected to add inflationary pressure.

Overnight, news came that the Republican Party will be in control of both houses of Congress, which will give him a strong platform to push his agenda of cutting taxes and deregulating.

US 10-year treasury yields have ticked up to the highest level since July, which could limit gains in equities.

Corporate news

Disney is rising after beating both earnings and revenue forecasts. It posted EPS of 1.14 versus 1.1 expected on revenue of 22.57 billion versus 22.45 billion expected. Revenue from the entertainment sector, which includes streaming films and traditional TV, rose 14%.

Cisco S that are open over 3% lower after the working equipment manufacturer gave a disappointing full-year outlook and reported a fourth straight quarter of falling revenue.

Advanced Micro Devices rose 1% after the chipmaker said it would lay off 4% of its global staff, cutting costs as it looks to shift towards growing artificial intelligence chips.

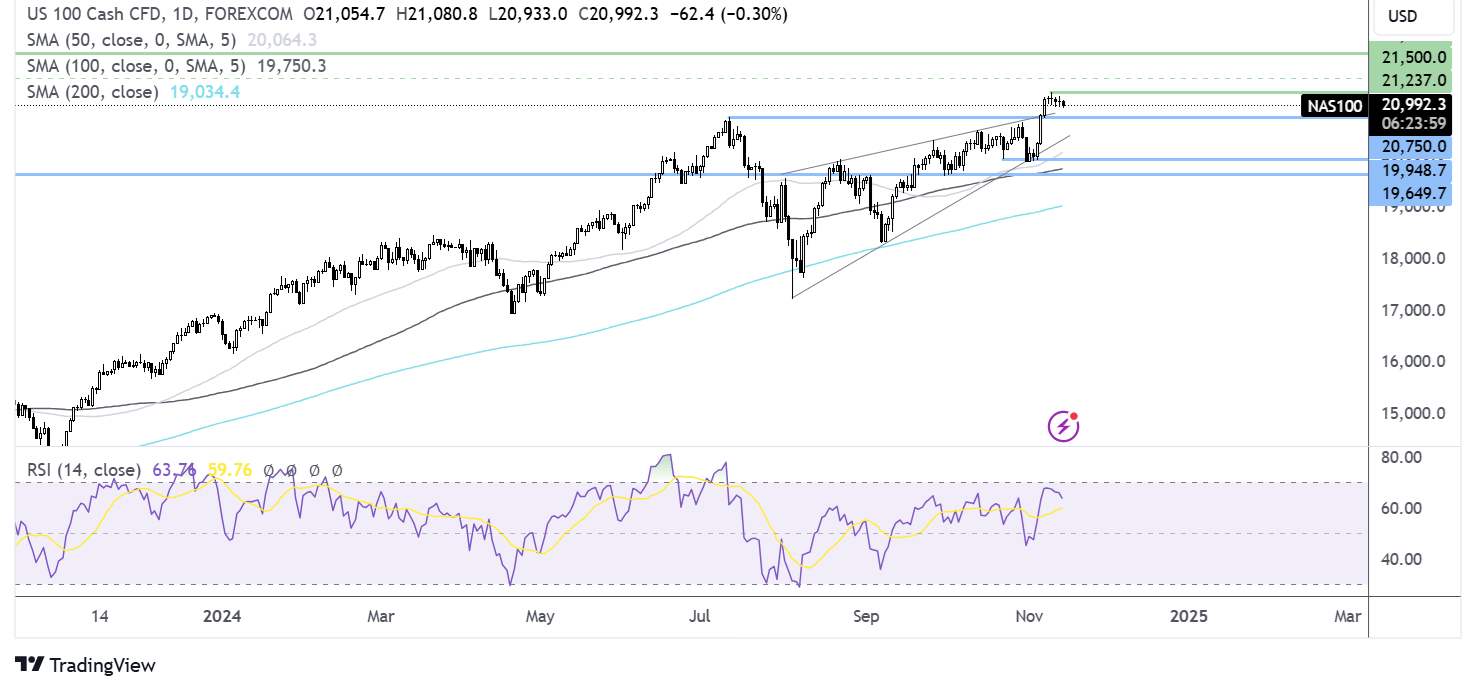

Nasdaq100 forecast – technical analysis.

The Nasdaq 100 has eased back from its record high, bringing the RSI away from overbought territory. While the price remains above 20,750, the uptrend remains intact. Below here, the price action turns neutral. Sellers would need to take out 19.9k on the downside to create a lower low.

FX markets – USD rises, EUR/USD falls

The USD is rising to its highest level this year after the Republicans won the house, giving them a quivering sweep, fueling the Trump Trade, and after the PPI was hotter than expected.

EUR/USD has fallen to its lowest level this year despite GDP confirming the preliminary reading of 0.4%. Trump trade tariffs continue to drive the euro to levels last seen in 2023, amid fears the ECB will be forced to cut rates more aggressively.

GBP/USD is falling to a 3-month low amid U.S. dollar strength and ahead of a speech by Bank of England governor Andrew Bailey later today. The market will be looking for clues about the outlook for interest rates and growth. The market is only pricing in a 15% chance of a December rate cut after the central bank reduced rates by 25 basis points in November, and Bailey sounded cautious about cutting rates too soon after labor’s budget, which is expected to be inflationary.

Oil steadies after losses earlier in the week

Oil prices are holding steady on Thursday after losing ground earlier in the week due to a significantly stronger U.S. dollar and concerns over supply.

The U.S. dollar is trading at 2024 or higher, putting pressure on oil prices and making it more expensive for buyers with foreign currencies.

Meanwhile, concerns about oil supply also weighed on the price after the International Energy Agency (IEA) said that global oil supply will exceed demand in 2025 even if OPEC cuts remain in place. The IEA raised its demand growth forecast by 60,000 barrels for 2024 but left its 2025 oil demand cost demand forecast unchanged. OPEC pushed back the 8-unwinding of its oil output cuts from December amid concerns of a soft market.

With lingering concerns over China's demand outlook, bullish factors for the oil market appeared to be in short supply.

.