US futures

Dow future -0.10% at 42463

S&P futures 0.47% at 5823

Nasdaq futures 0.8% at 20226

In Europe

FTSE 0.66% at 8310

Dax 0.5% at 19478

- Stocks recover from yesterday’s losses

- Fed rate cuts & US election uncertainty remain

- Tesla beats earnings forecasts & margins improve

- Oil rises as geopolitical tensions rise

Stocks rise, recovering after losses yesterday

U.S. stocks are rising after declines on Wednesday and as investors cheered Tesla earnings while looking ahead to the latest PMI data.

U.S. stock futures fell yesterday as treasury yields rose to a three-month high in signs the market is expecting economic data to remain strong and the US presidential elections to persuade the Federal Reserve to cut interest rates at a slower pace.

Donald Trump has gained a slight advantage in the presidential election race, leading by two percentage points in the Wall Street Journal survey. Trump's policies are considered inflationary which could result in more gradual Fed rate cuts.

Looking ahead, US PMI figures are in focus and are expected to show the services PMI eased to 55 in October from 55.2, whilst manufacturing PMI is expected to increase to 47.5, up from 47.3. Recent data from the US has been solid, highlighting the resilience of the economy.

US jobless claims are also in focus and are expected to remain steady at around 241,000. Given the Fed's shift in focus toward the labour market, investors will be watching these figures closely.

Corporate news

Tesla is rising over 10% after third-quarter results beat Wall Street estimates. Net income rose by 8% to $2.5 billion, ahead of forecasts of $2.1 billion, thanks to a fall in operating expenses and price drops which boosted demand. Revenue rose by 8% to $25.2 billion, slightly under estimates. Gross margins, which are watched closely, rose to 17.05%, up from 14.7% in the previous quarter, thanks to declining manufacturing costs and freight expenses.

Boeing remains in focus as the striking workers have rejected a revised contract offer extending the crippling labour action. 64% voted no to the new offer, which would have raised their pay by 35% over the next four years. Union bosses have called for a 40% pay increase.

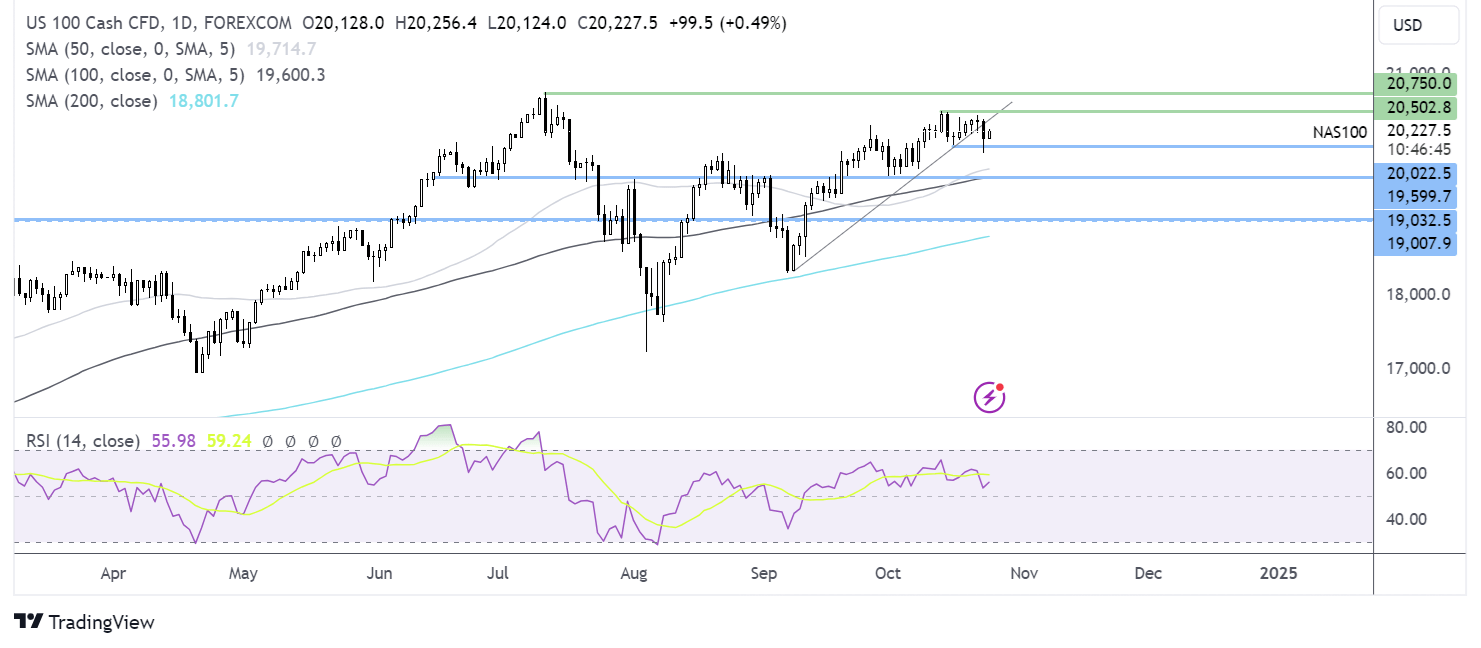

Nasdaq 100 forecast – technical analysis.

The Nasdaq is consolidating between 20,500 on the upside and 20,000 on the lower side. The long lower wick on yesterday's candle suggests there was little demand at the lower levels. Buyers will look to rise above 20,500 to bring 20, 750, and fresh all-time highs into play. Sellers will look to break below 20,000 to bring support at 19600, the October low into focus.

FX markets – USD rises, EUR/USD falls

The USD is falling amid profit-taking after reaching a fresh almost three-month high yesterday and booking strong gains across October. The dollar is being boosted by expectations of more gradual Fed rate cuts and uncertainty surrounding the US election.

EUR/USD is rising but remains below 1.08 after falling sharply across October. Eurozone PMI data showed business activity remained in contraction territory again in October potentially paving the way for more rate cuts from the ECB.

GBP/USD is rising, capitalizing on the weaker dollar despite UK PMI data showing a slowdown in UK business growth to an 11-month low. Hiring also shrank for the first time in a year amid uncertainty ahead of next week's budget.

Oil falls after stockpiles rise

Oil prices are rising, recovering yesterday's losses as geopolitical tensions rise not only in the Middle East but also between Russia and Ukraine.

Oil prices have rebounded 4% this week after falling 7% in the previous

Tensions are once again escalating in the Middle East amid heavy firing between Israel and Hezbollah which has raised supply concerns. Meanwhile, North Korea has sent 3000 troops to Russia for potential deployment to Ukraine.

Oil inventory data yesterday showed a jump in inventories.