US futures

Dow future 0.21% at 44400

S&P futures 0.05% at 6008

Nasdaq futures 0.04% at 21120

In Europe

FTSE -0.84% at 8050

Dax -1.07% at 19240

- Stocks pause as attention turns to data

- US inflation data & Fed speakers are in focus

- Bitcoin eases from 89.5k record high

- Oil steadies after falling 5% yesterday

Attention turns towards economic data

U.S. stocks are set to open muted, easing from record highs as attention shifts away from the elections and back towards economic data.

The three major indices hit record highs yesterday as investors bought in on optimism that President-elect Donald Trump’s tax cuts and deregulation policies would boost equities. The market has rallied hard since the election, and bulls are pausing for breath. Stocks like Tesla, which has been an outperformer in the Trump trade, up 40% since the election, are falling back 1% today.

Attention is now turning to US inflation data due tomorrow. This is the first of several data releases this week and could provide further direction over the federal reserves policy path.

Investors have tempered expectations for interest rate cuts over the coming year, citing strong economic data and the possible inflationary impact of some of Trump's core policies.

The market is pricing in a 69% chance of a 25 basis point rate cut in the December meeting down from 80% a week ago. This will be the last meeting before the new Trump administration takes office with an economic policy that could change the outlook for inflation and growth.

Today's economic calendar is quiet, but Fed officials Christopher Waller Thomas Barkin, Neel Kashkari, and Patrick Harker are scheduled to speak today.

Corporate news

Home Depot is set to open modestly higher after the home improvement chain raised its annual same-store sale forecast. The chain is betting on resilient demand from professional contractors, which it sees offsetting weak spending by households on projects such as kitchen renovations.

Coinbase is falling modestly as it hands back massive gains following Bitcoin's rally to record highs. Yesterday, Bitcoin gained 10%, reaching just shy of 90,000.

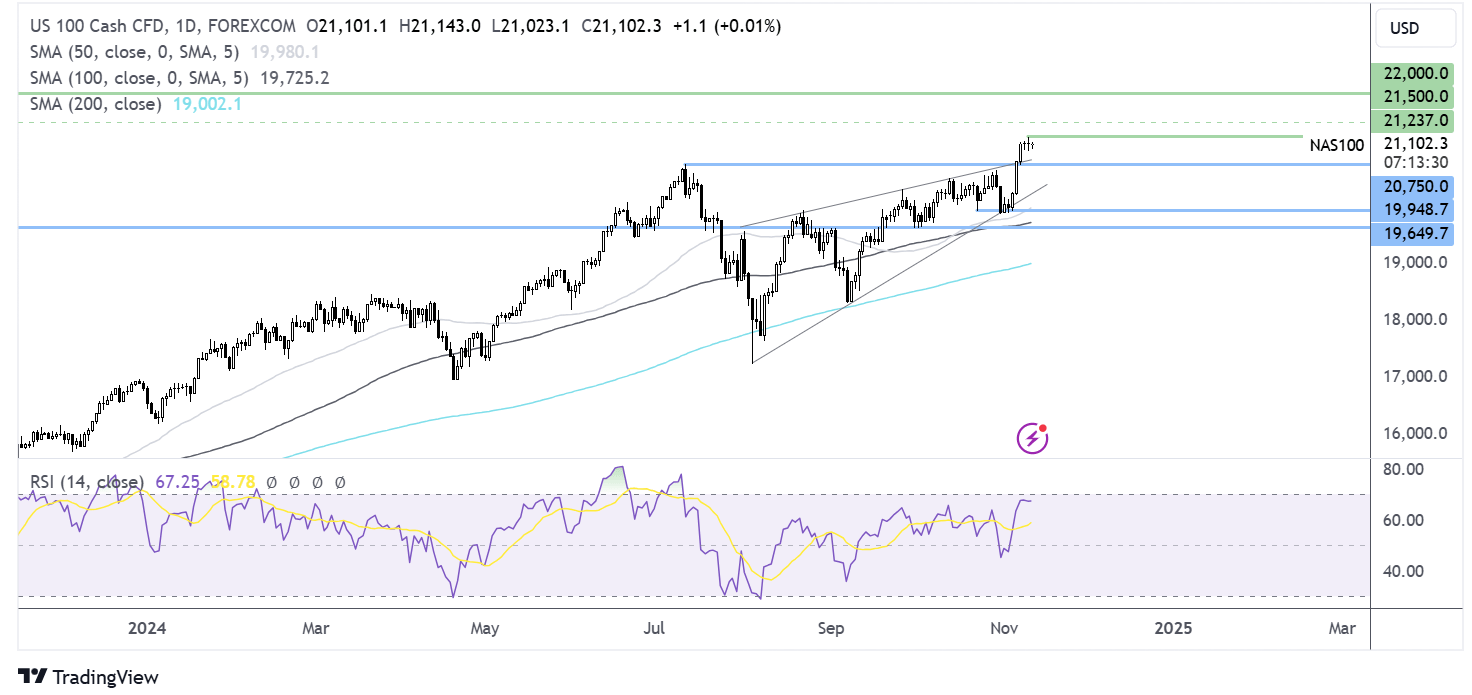

Nasdaq 100 forecast – technical analysis.

The Nasdaq 100 is holding steady below its ATH of 21,239, pulling the RSI away from overbought. Buyers will look to extend the uptrend towards 21,500 and 22k as the next logical targets. Support can be seen at 20,750, with a break below here negating the near-term uptrend, bringing 20k back into focus.

FX markets – USD rises, EUR/USD falls

The USD is extending gains on trade at its highest level since July as the Trump trade continues fueling expectations that the Fed cut rates at a slower pace. Fed speakers and US inflation data tomorrow could provide the next catalyst for the dollar.

EUR/USD has tumbled to a seven-month low on worries over the potential impact of Trump trade tariffs. These tariffs could impact growth, causing the ECB to cut rates more aggressively. German ZEW economic sentiment was weaker than expected on tariff concerns under political certainty in Germany.

GBP/USD has fallen to a four-month low after UK jobs data was weaker than expected. Unemployment rose to 4.3%, up from 4%, vacancies fell, and payrolls dropped by 9,000. Wage growth is also at its lowest level in over two years. However, Bank of England chief economist Huw Pill warned that it's still too high for further rate cuts.

Oil steadies after 5% losses yesterday.

Oil prices are edging higher after falling 5% to a 12-day low yesterday. OPEC cut its global forecast for oil demand growth for the fourth straight month on Monday, owing to a slowdown in China, the world's top consumer.

OPEC trimmed Chinese demand growth to 450,000 barrels a day this year and 310,000 next year amid ongoing concerns over the economic picture in China despite recent stimulus measures from Chinese authorities.

While China unveiled $1.4 trillion in stimulus over the weekend, this fell short of what the market was hoping for.