Nasdaq 100 Key Points

- The “Magnificent Seven” are projected to report an 18.1% year-over-year earnings increase, while the remaining 493 S&P 500 companies anticipate minimal growth of just 0.1%.

- Political risks to the Magnificent Seven are on the rise – geopolitical tensions and the possibility of a renewed trade war are worth watching.

- The Nasdaq 100 is rising within an ascending wedge, with a break below 19,900 potentially targeting the 200-day MA near 19,000 next.

As has been the case for the past couple of years, the "Magnificent 7" tech giants — Alphabet, Amazon, Apple, Meta Platforms, Microsoft, NVIDIA, and Tesla — are once again set to drive the S&P 500's earnings growth for Q3 2024.

NVIDIA and Alphabet, in particular, are expected to be among the top contributors, with NVIDIA leading due to surging demand for its AI-related chips. Collectively, these companies are projected to report an 18.1% year-over-year earnings increase, while the remaining 493 S&P 500 companies anticipate minimal growth of just 0.1%, underscoring the index's heavy reliance on these firms.

Source: FactSet

However, analysts foresee a shift over the next year or so quarters, predicting that both the Magnificent 7 and the rest of the S&P 500 will achieve double-digit earnings growth. This convergence hints at broadening market strength and a potential reduction in dependence on a handful of mega-cap tech companies, perhaps as the much ballyhooed “AI Revolution” finally starts to boost profits at large and midsized companies.

In any technological revolution, the hype eventually outpaces the fundamental impact of the technology, and some traders are starting to wonder if we’re nearing that inflection point when it comes to AI. Over the last few months, several prominent analysts have raised warning flags about the level of capital expenditures related to AI, questioning whether these “investments” will have a payback period that remotely justifies the cost or whether executives have simply been afraid to be left behind competitors in their investments, without considering the end use cases or ultimate return on investment.

Separately, political risks to the Magnificent Seven are on the rise. While not likely a major impact on this past quarter’s earnings, the risk of tariffs and additional regulations on semiconductor chips could weigh on the Magnificent Seven as a whole, limiting the tech behemoths’ ability to continue growing earnings rapidly in the future, especially with Donald Trump’s perceived election odds on the rise. As a result, the companies’ guidance and outlooks into 2025 will be a key theme this earnings season.

Below, we highlight the earnings dates and the market’s expectations for each of the Magnificent Seven stocks in order of their reporting dates:

- Tesla – October 23. EPS expected at $0.46.

- Facebook/Meta Platforms – October 30. EPS expected at $5.17.

- Microsoft – October 30. EPS expected at $3.13.

- Alphabet/Google – October 29. EPS expected at $1.83.

- Amazon – October 31. EPS expected at $1.14.

- Apple – October 31. EPS expected at $1.54.

- Nvidia – November 14. EPS expected at $0.69.

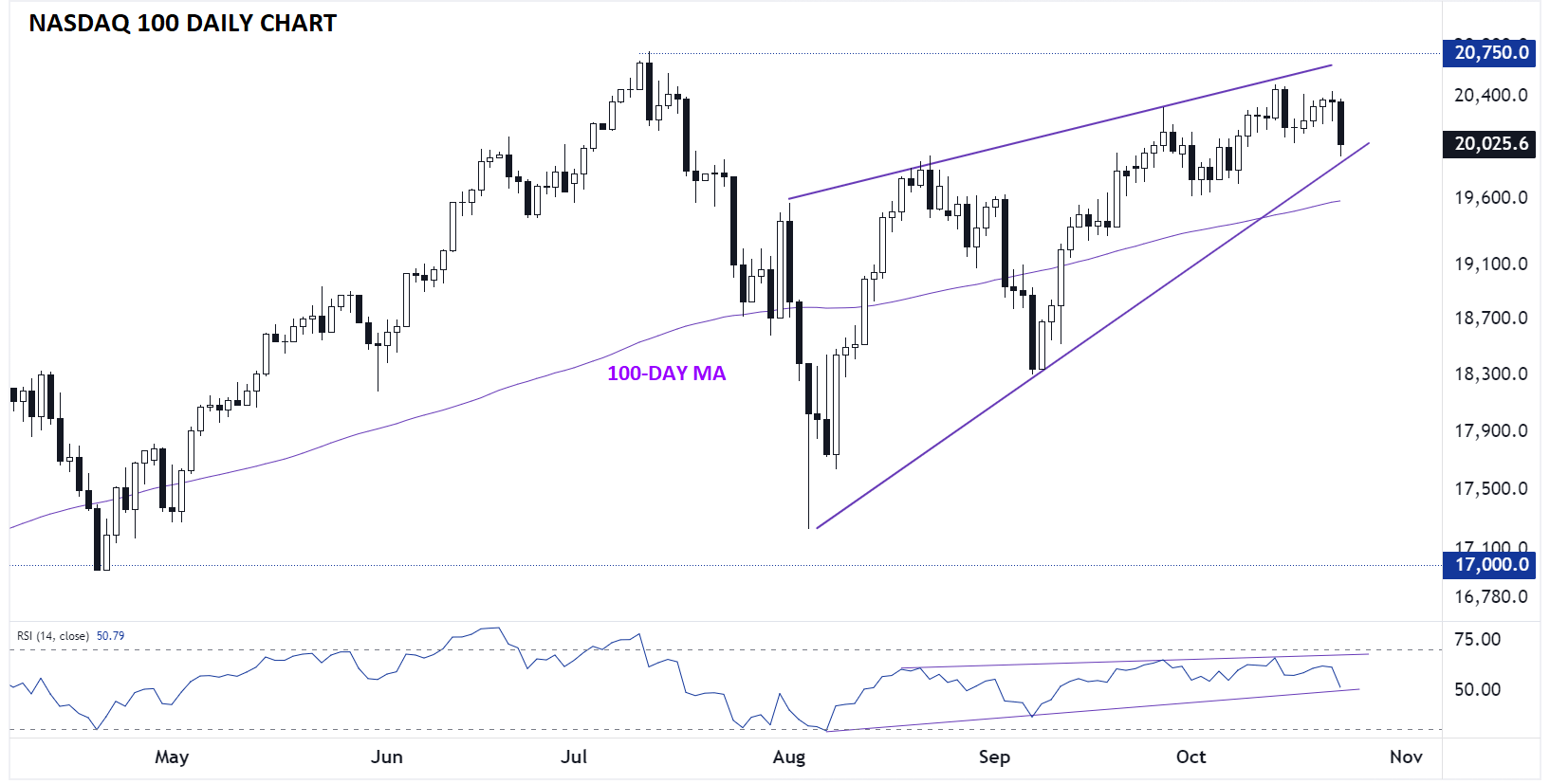

Nasdaq 100 Technical Analysis – NDX Daily Chart

Source: TradingView, StoneX

With the Magnificent Seven making up nearly 40% of the Nasdaq 100, the key earnings reports over the next couple of weeks will have a big impact on where the tech-heavy index goes next. As the chart above shows, the Nasdaq 100 is currently rising within an ascending wedge formation, which is generally seen as a bearish setup, especially if/when prices break below the lower trend line (currently near 19,900 as of writing.

If NDX does break below support, a continuation down to the 200-day MA near $19K becomes likely. On the other hand, a stronger-than-expected run of earnings could push NDX back to record highs above 20,750.

-- Written by Matt Weller, Global Head of Research

Check out Matt’s Daily Market Update videos on YouTube and be sure to follow Matt on Twitter: @MWellerFX