The US stock markets are closed today in observance of a National Day of Mourning for former President Jimmy Carter. US futures ended mixed, unable to find support from a firmer European market. All the attention will turn to the US jobs report on Friday, details of which can be found HERE. With not much in the way of macro factors to watch until the nonfarm payrolls report is released, I will provide some in-depth technical Nasdaq 100 analysis first before looking at some macro influences that could shape the markets in the weeks and months ahead.

Nasdaq 100 technical analysis

From a technical point of view, the Nasdaq has entered a more neutral territory over the last couple of weeks, even if the long-term trend is still undoubtedly bullish. Therefore, I wouldn’t rule out the possibility of further weakness in the short-term outlook, but the bears will need to step up here if they want to gain full control – and fast.

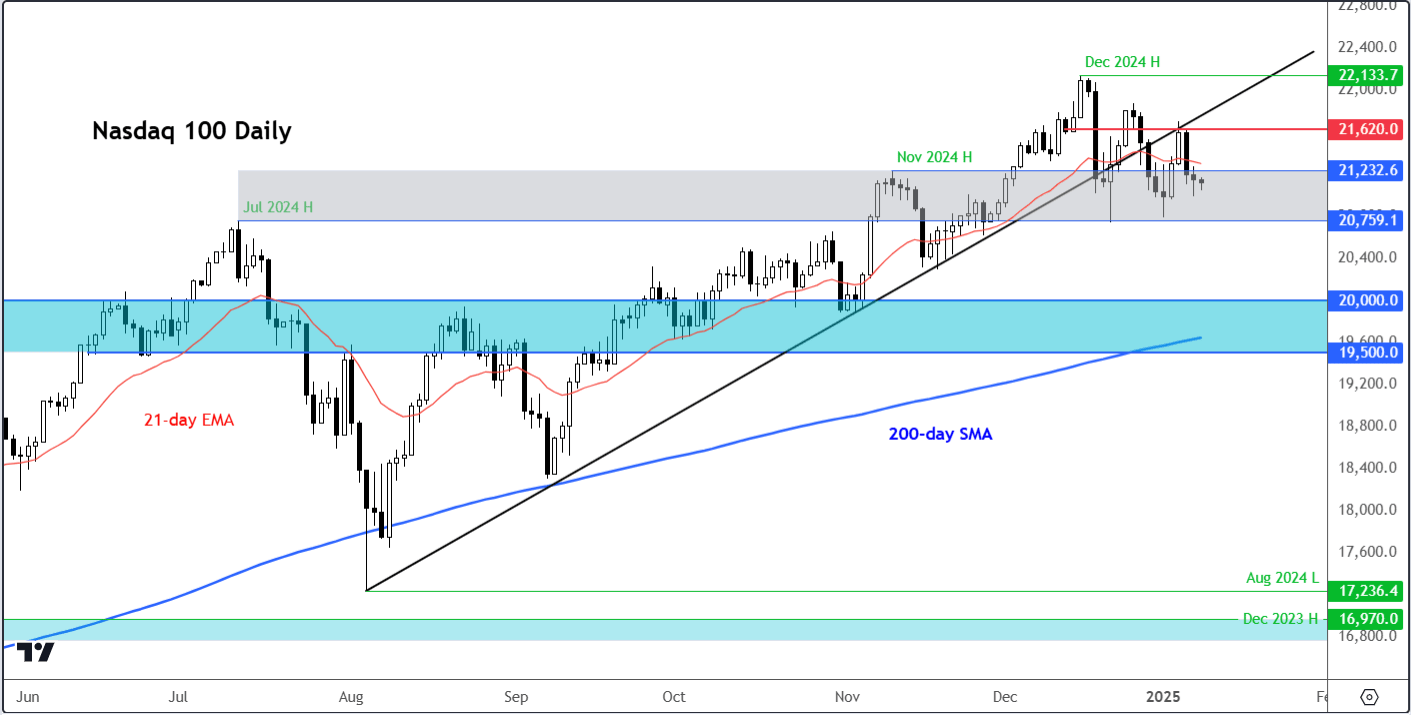

Nasdaq 100 analysis: Key levels to watch on the daily chart

The loss of bullish momentum in recent weeks has caused the Nasdaq to break its bullish trend line that had been in place since August, as can be seen on the daily chart of the index, below. The index has also broken below its 21-day exponential moving average, objectively pointing to a bearish shift in the near-term outlook. That said, key support zone between 20760 to 21,232 remains intact for the time being. This area is shaded in grey on the chart, and marks the previous highs made in July and November. Should we see a break below this important support zone, only then will the bears have something to work with.

In the event of a breakdown below the abovementioned support area, the next downside targets include the next support zone between 19,500 to 20,000. The 200-day average also comes in around the lower end of this range.

In terms of key resistance to watch, 21,620 is now a significant level, marking the high from Tuesday and the backside of the broken trend line. A potential close above this level would be a bullish scenario.

Note that there was also a large bearish engulfing candle on the chart of Nvidia stock on Tuesday, which also needs to be monitored given its importance for the Nasdaq and S&P 500.

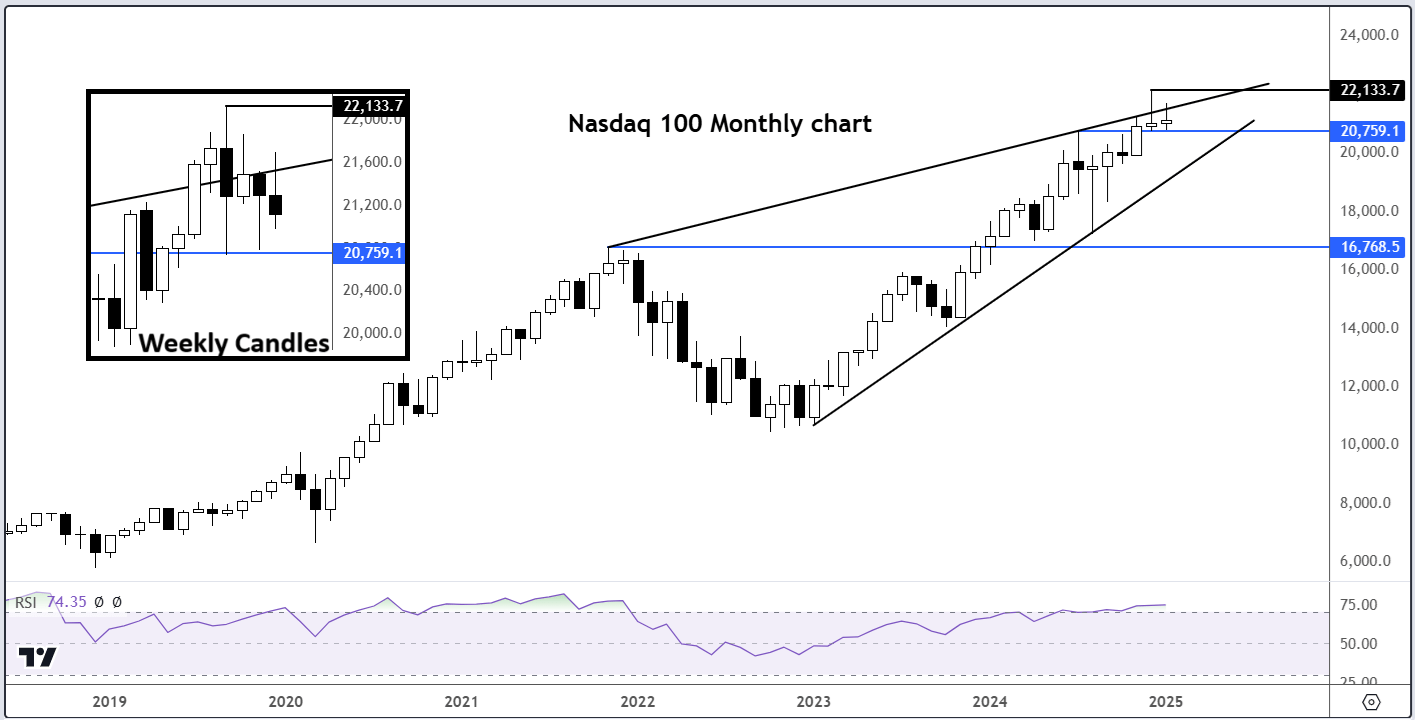

Nasdaq 100 long-term charts need to work off overbought conditions

The long-term chart of the Nasdaq is still looking quite bullish, albeit at technically overbought levels. The RSI has moved and remained above the 70.0 threshold in the last couple of months. This will need to be addressed at some point. It can work off its overbought conditions either with a sell-off or lengthy consolidation.

The Nasdaq is also finding some resistance from the upper trend of the rising-wedge-like pattern on the monthly time frame. In December, it briefly poked above this trend line, before closing back below it, printing in the process an inverted hammer candle. This candlestick formation on its own is not necessarily bearish, as it needs downside follow-through, which we haven’t seen much so far in January. But that could change should support at just below the 20760 gives way. This level was resistance back in July, before it finally gave way in the latter stages of Q4. For as long as this support holds, the bulls will not mind this recent weakness too much, for that will help with unwinding of momentum oscillators from their overbought conditions. However, if support breaks here, then we could see the onset of a correction, which could last several weeks to possibly months. In any case, the support trend of the rising wedge could once again come to the rescue.

Meanwhile, the inset on the monthly chart shows the weekly candles. The key takeaway point here is that the wicks of these candles are long on either side and bodies small, pointing to indecisive price action. Notably, the upper wicks of the last several weekly candles suggest traders are showing respect to the resistance trend line, while the lower wicks are also long, pointing to some mild dip-buying activity.

What’s Grabbing Traders’ Attention This Week?

The spotlight this Friday will be on the US employment report, which is expected to reveal fresh insights into the state of the economy and the Federal Reserve’s interest-rate plans. Traders, however, are treading cautiously—pricing in just one 25 basis-point rate cut this year, a notably more reserved view compared to the two cuts Fed officials hinted at back in December.

Risk sentiment has also taken a hit lately. Continued selling in fixed-income markets has pushed yields higher, and reports suggest President-elect Trump is mulling over a national economic emergency declaration to roll out new tariffs. Rising yields are adding to worries about stock valuations, particularly for growth stocks.

Valuation Concerns in the Spotlight

Valuation fears are mounting. According to a recent Bloomberg analysis, US stocks are approaching their most overvalued levels relative to corporate credit and Treasuries in nearly two decades. The earnings yield—a measure of corporate profitability relative to stock prices—currently sits at 3.7%. This marks its lowest level compared to Treasuries since 2002.

The picture doesn’t look much better when stacked against BBB-rated dollar corporate bonds, which now yield 5.6%. By this metric, stocks are nearing their weakest comparative level since 2008, estimates Bloomberg.

Historically, when equity yields trail bond yields, as has been the case in the early 2000s, the stock market often faces tougher times ahead. Yet, despite these red flags, Wall Street has remained resilient so far. The question is: will 2025 finally bring a shift in the tides?

Source for all charts used in this article: TradingView.com.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R