US futures

Dow future -0.12% at 44,322

S&P futures 0.1% at 6058

Nasdaq futures 0.14% at 21476

In Europe

FTSE -0.4% at 8308

Dax 0.03% at 20390

- US stocks trade in a tight range

- US CPI data on Wednesday is the main focus

- Oracle drops after missing earning & revenue forecasts

- Oil falls after disappointing Chinese imports & exports data

Stocks struggle for direction ahead of tomorrow‘s CPI

U.S. stocks are heading for a quiet open on Tuesday after steep losses in the previous session, and as the focus remains on upcoming inflation data.

US equities fell yesterday as a tech pullback dragged Wall Street's indices off record highs. The Nasdaq 100 underperformed its peers, closing 0.6% lower.

Today, the US economic calendar is quiet. Attention remains firmly on tomorrow's inflation data, which could influence the Federal Reserve's future path for interest rates.

The headline CPI is forecast to increase to 2.7% YoY, up from 2.6% in October, while core CPI is expected to hold steady at 3.3%.

Inflation has fallen steadily throughout most of the year but has been more sticky in recent months amid a resilient U.S. economy. This is raising some concerns over the Fed's ability to cut rates in 2025. The market is pricing in an 85% probability of a 25 basis point rate cut in December, but rate cuts are expected to slow across the coming year.

Corporate news

Oracle is set to open 8% lower after the cloud firm's quarterly earnings missed estimates amid rising competition in the sector. Oracle posted EPS of $1.47, below the $1.48 forecast, and revenue was $14.06 billion, below the $14.1 billion expected. The share price has risen 80% this year.

C3.ai rallied 10% after its quarterly earnings topped estimates owing to solid AI-fueled demand.

Autozone is falling pre-market after the retailer of car parts posted Q1 earnings that missed expectations.

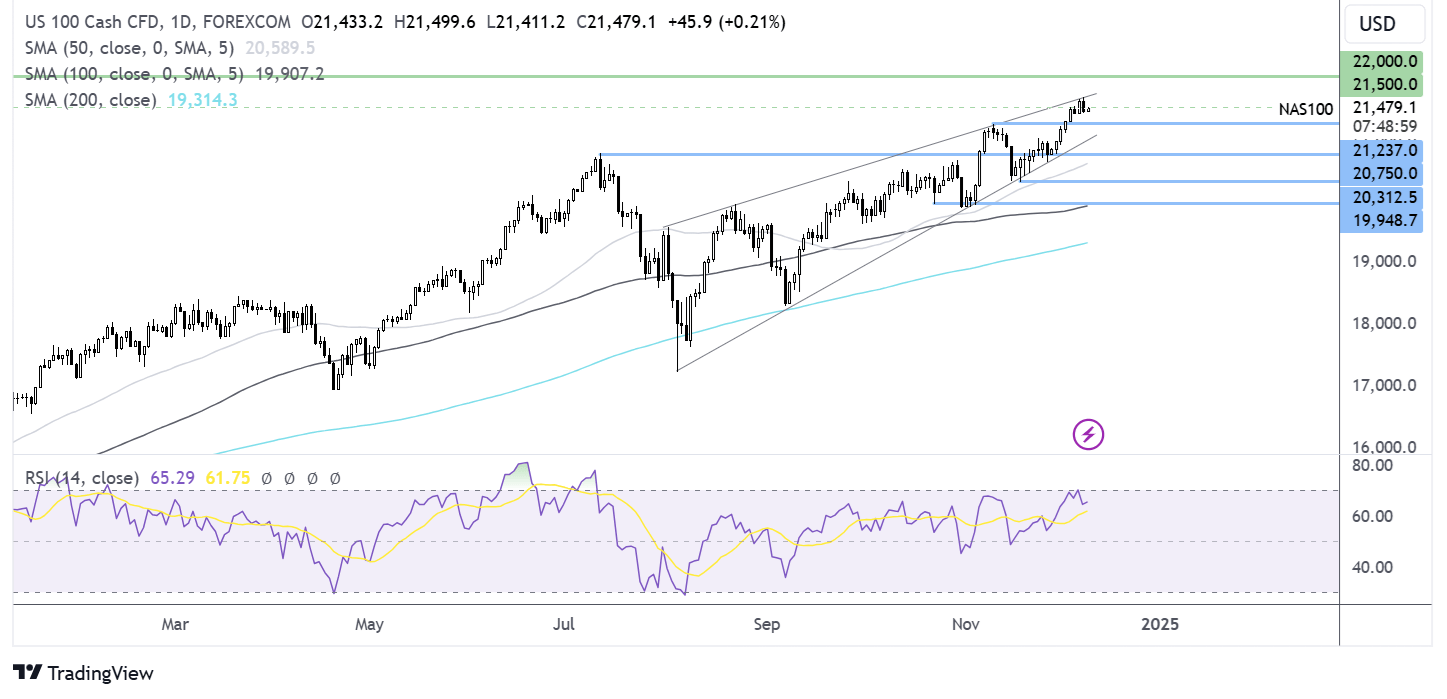

Nasdaq 100 forecast – technical analysis.

The Nasdaq100 trades at the upper band of the rising wedge pattern, which is generally considered a bearish pattern. The price has eased back from the record high of 21500, but the uptrend remains firmly intact. Buyers will look to rise above 21,500, breaking out of the pattern to fresh record highs towards 22k. Immediate support can be seen at 21,232, the November high, and 21k, the rising trendline support. Below here, the 50 SMA at 20,600 comes into play.

FX markets – USD rises, AUD/USD falls

The USD is rising for a third straight day as the market waits for Wednesday’s CPI data for further clues over the future path of rates from the Federal Reserve.

EUR/USD is falling as investors look ahead to Thursday's ECB meeting. The central bank is expected to cut rates by 25 basis points, and some market participants believe it could cut rates by 50 basis points. Given the weak outlook for the economy, more right cots are expected to follow, keeping pressure on the euro.

AUD/USD fell after the RBA left interest rates on hold at 4.35% for a ninth straight month but sounded more dovish than before. This raised expectations that the central bank could start to cut rates sooner than previously expected. The RBA board said it was gaining confidence that inflation was moving substantially towards its target.

Oil falls after Chinese trade data

Oil prices edged lower as concerns eased regarding the geopolitical situation in the Middle East and after disappointing Chinese trade data. However, losses were kept in check by optimism surrounding China's change of policy stance.

Chinese imports declined by -3.9%, and exports rose by a weaker-than-expected 6.7%, pointing to ongoing weakness in the Chinese economy. The data raises concerns over the demand outlook for the world's largest oil importer. However, those worries were, to a degree, stemmed after news yesterday that China will be loosening its monetary policy stance in 2025 as Beijing attempts to spur economic growth. This would mark the first easing stance in around 14 years, although details remained few and far between.

Elsewhere, the geopolitical situation in the Middle East appears contained for now. The rebels that overthrew President Bashar Al-Assad are now working to form a government and restore order.