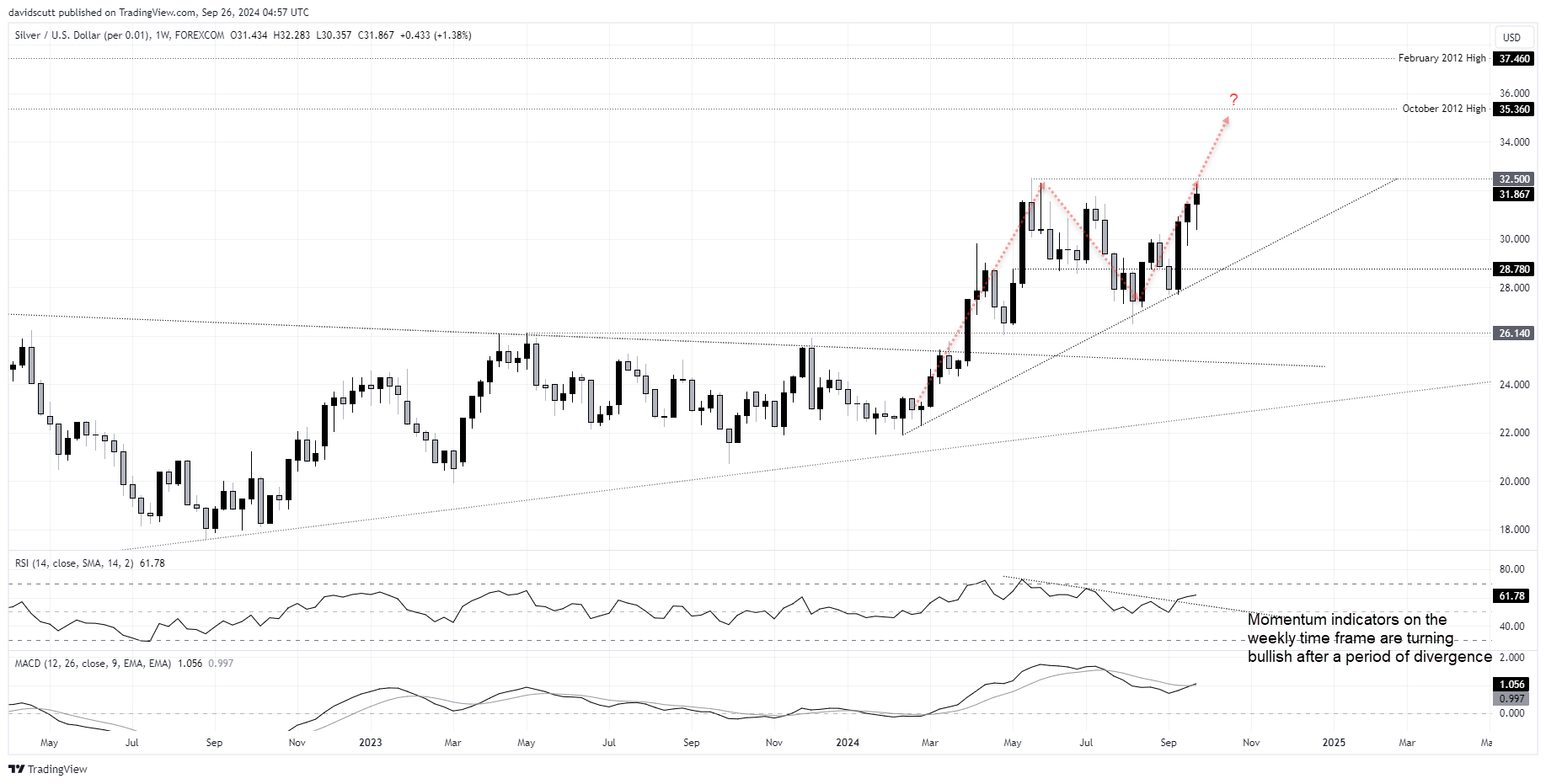

- Silver nearing 12-year peak hit earlier this year

- Weaker USD, mounting Fed rate cut bets providing tailwinds

- Some evidence inflation concerns may also be influencing demand

Overview

Silver looks to be a direct play on near-term US interest rate pricing and how that’s feeding into expectations for inflation in the future. With a lengthy list of Federal Reserve speakers coming up later Thursday, including Chair Jerome Powell, could we see silver break to fresh multi-decade highs today?

Silver liking a dovish Fed

Fresh off delivering a near-unanimous 50 basis point rate cut last week, markets will be treated to four separate Federal Reserve speeches today including from heavy-hitters Jerome Powell and New York Fed President John Williams.

While you could argue we may hear nothing new given there’s been very little top tier data released since the FOMC meeting, especially on the jobs market, for markets that have not needed a second invitation to pile into rate cuts bets recently, the prospect of further dovish commentary could benefit silver.

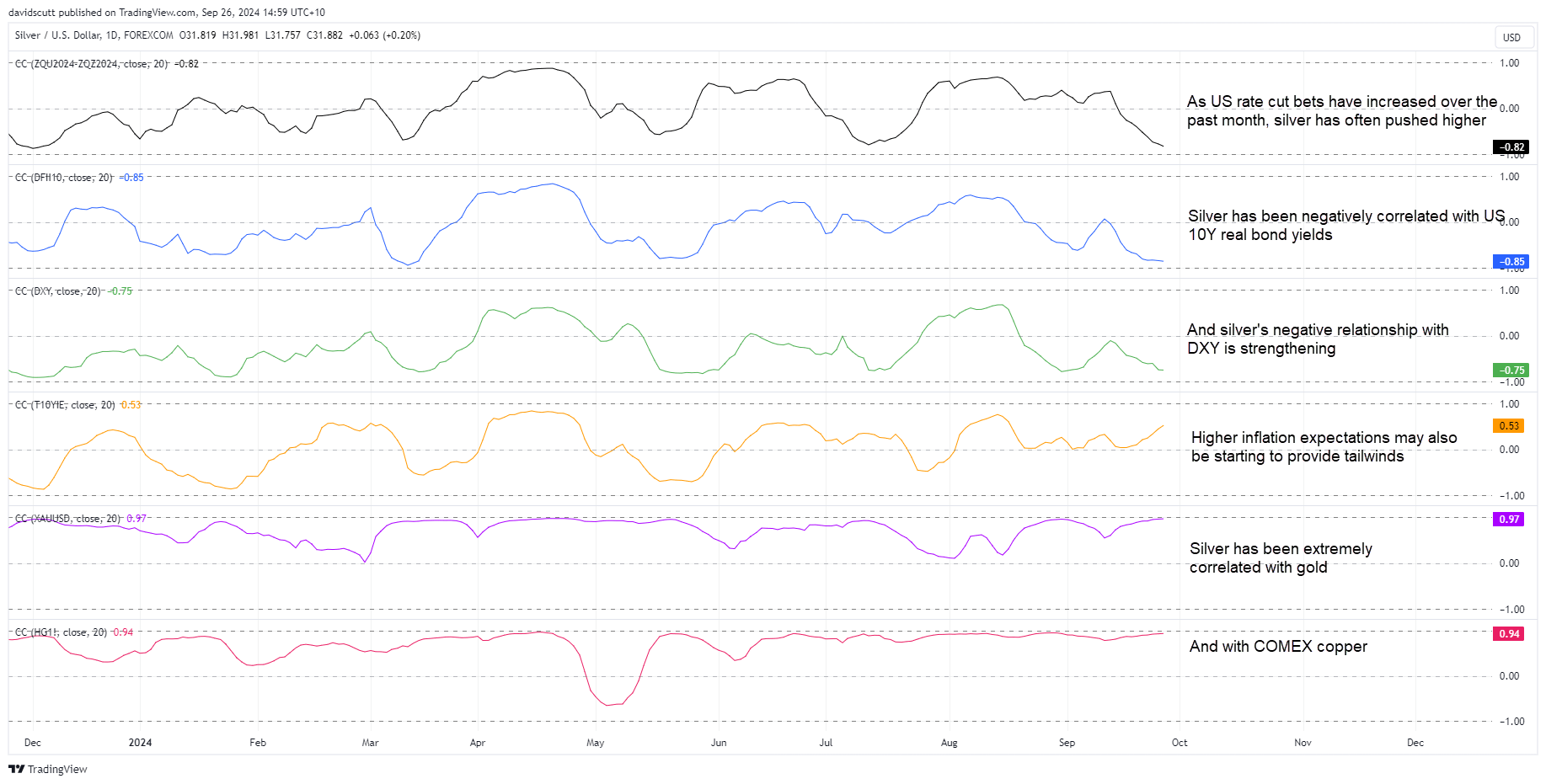

That’s because it looks to be a direct play on Fed rate cut pricing based on the rolling 20-day correlation analysis presented below.

The black line represents 2024 Fed rate cut pricing as derived from Fed funds futures. With a score of -0.82 and strengthening, as rate cut bets have grown (or become more negative in this instance), silver has often moved higher over the past month.

The lift in rate cut pricing has also acted to weaken the US dollar, another factor which has helped to boost not only silver but also other metals such as gold and copper. It comes as little surprise all three have been extremely correlated recently.

Silver is also benefitting from the decline in US 10-year inflation-adjusted bond yields with a strengthening negative correlation of -0.75. There’s also evidence rising market-based inflation expectations, such as 10-year US inflation breakevens shown in yellow, may be starting to influence the silver price. The correlation between the two sits at a weak 0.53 but has been strengthening recently.

Tying the relationships together, it suggests that unless we see a curtailment of rate cuts priced this year, silver may remain buoyant in the near-term. Given other Fed officials have delivered nothing to deter market pricing, it’s highly debatable whether Powell or Williams will either.

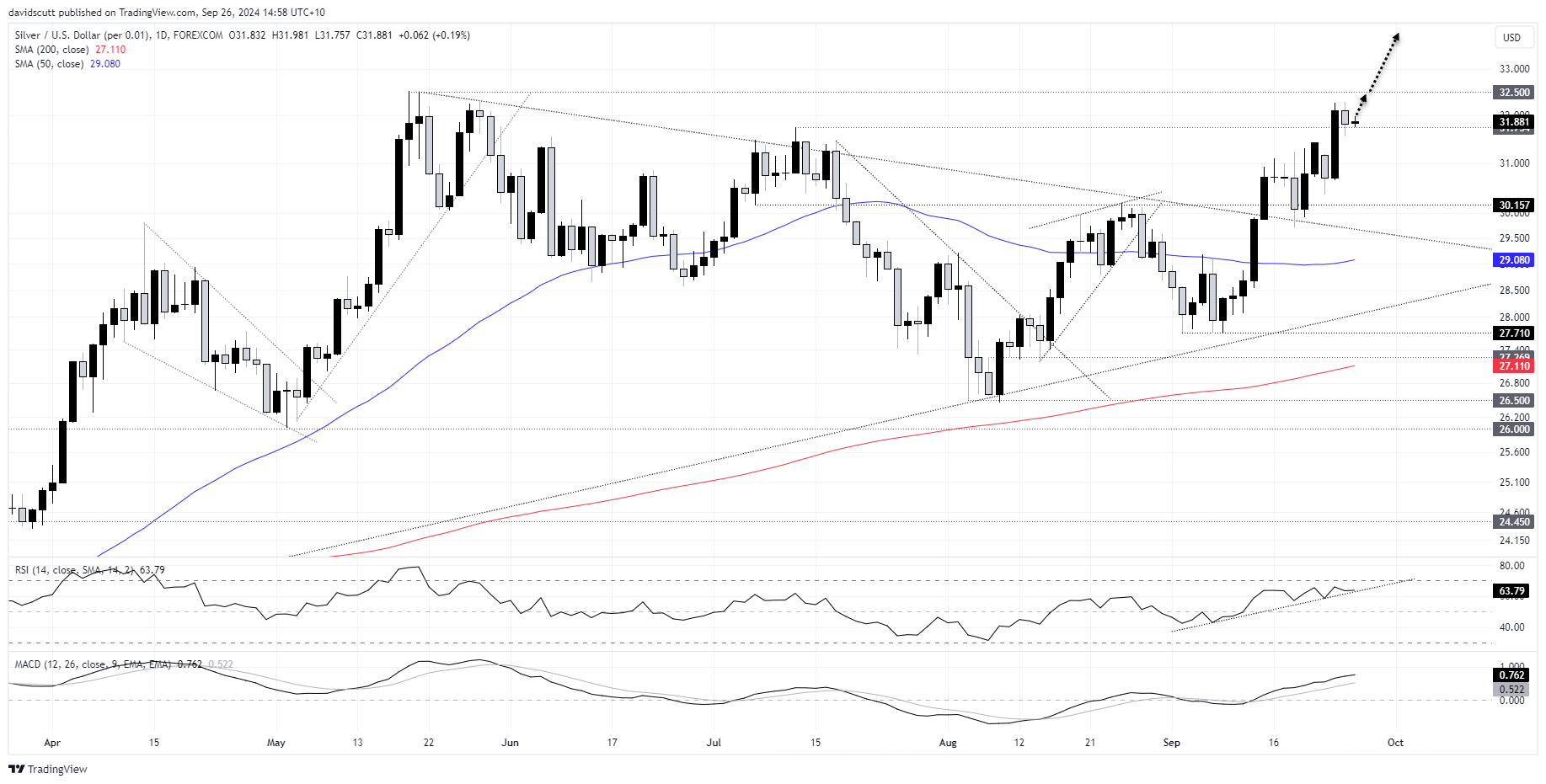

Silver eyeing May's 12-year peak

Looking at silver on the daily chart, the price managed to break above the July high on Tuesday and hold there, backtesting the level on Wednesday before reversing above once again. With bullish signals coming from momentum indicators, the bias remains to buy dips.

One potential setup would be to buy above $31.75 with a stop below Wednesday’s low of $31.60 for protection. On the topside, the obvious trade target would be the double top of $32.50 set in May.

Zooming out to a weekly timeframe, if silver were able to break above $32.50, the next potential upside targets include $35.36 and $37.46, two peaks set in 2012.

-- Written by David Scutt

Follow David on Twitter @scutty