After a prolonged risk-on market environment, where it seemed that nothing short of catastrophe could faze investors, this week has finally seen a marked return to elevated risk aversion and higher market volatility. On Wednesday, this risk-off sentiment continued to be driven in large part by US political concerns, after fired FBI Director James Comey was reported to have written a memo months ago detailing President Trump’s private request to end an investigation into Michael Flynn, Trump’s former national security adviser.

With speculation swirling that the President may have obstructed justice, a potentially impeachable offense, US equity markets took a major hit on Wednesday, with the Dow and S&P 500 each down more than 1% as of mid-morning. At the same time, demand for traditional safe-haven assets like gold and the Japanese yen increased sharply, as investors fled to their perceived safety amid intensifying political turbulence.

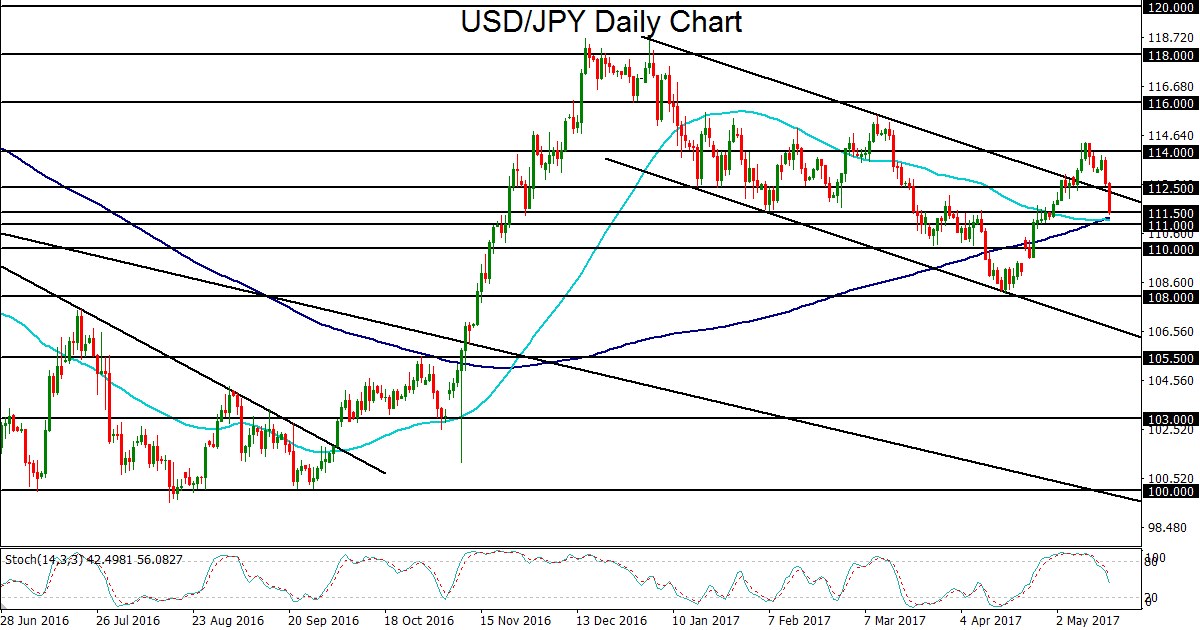

In the case of the yen, the Japanese currency had been in a prolonged state of free fall from mid-April to late last week as investors were undeterred in pushing equity markets toward new highs. This yen weakness helped prompt a sharp climb for USD/JPY that broke out above a key descending trend channel, ultimately hitting a high above 114.00 last week. The current USD/JPY pullback from late last week has been caused partly by the risk-driven rebound in the Japanese yen, but has also been heavily exacerbated by the recent precipitous fall in the US dollar.

Depending on how the current Trump/Comey saga unfolds, markets could well be in for more turbulence, as Trump’s entire economic agenda is now placed in serious jeopardy, especially if the possibility of impeachment proceedings becomes increasingly likely. For now, USD/JPY has reached down below a key area of support around the 111.50 level as of Wednesday morning. This level is just above the current convergence of the 50-day and 200-day moving averages. With any breakdown below this convergence area, the next major support targets on a downside continuation are at the key 110.00 and 108.00 support levels.

With speculation swirling that the President may have obstructed justice, a potentially impeachable offense, US equity markets took a major hit on Wednesday, with the Dow and S&P 500 each down more than 1% as of mid-morning. At the same time, demand for traditional safe-haven assets like gold and the Japanese yen increased sharply, as investors fled to their perceived safety amid intensifying political turbulence.

In the case of the yen, the Japanese currency had been in a prolonged state of free fall from mid-April to late last week as investors were undeterred in pushing equity markets toward new highs. This yen weakness helped prompt a sharp climb for USD/JPY that broke out above a key descending trend channel, ultimately hitting a high above 114.00 last week. The current USD/JPY pullback from late last week has been caused partly by the risk-driven rebound in the Japanese yen, but has also been heavily exacerbated by the recent precipitous fall in the US dollar.

Depending on how the current Trump/Comey saga unfolds, markets could well be in for more turbulence, as Trump’s entire economic agenda is now placed in serious jeopardy, especially if the possibility of impeachment proceedings becomes increasingly likely. For now, USD/JPY has reached down below a key area of support around the 111.50 level as of Wednesday morning. This level is just above the current convergence of the 50-day and 200-day moving averages. With any breakdown below this convergence area, the next major support targets on a downside continuation are at the key 110.00 and 108.00 support levels.

Latest market news

Today 06:00 PM

Today 04:00 PM