- US CORE CPI printed hotter-than-expected in August

- Near-term Fed rate cut pricing has been curtailed, with a 25-pointer now expected in September

- USD/CHF prints key reversal on the daily, putting it on course for a retest of major resistance zone

- USD/CHF looks to be a proxy for perceived hard landing risks

Overview

The hotter-than-expected US core consumer price inflation figure for August provided a timely reminder to traders that disinflationary forces should not be taken for granted, printing above even the most hawkish economic forecast. The readjustment in dovish Fed rate cut pricing has acted to underpin the US dollar, delivering a key bullish reversal in the yield sensitive USD/CHF cross, sending it on a collision course with downtrend resistance.

US CPI provides timely reminder to mega doves

I won’t rehash the entirety of the US CPI report, but the 0.28% increase in the core figure printed above every forecaster, seeing the annual rate hold steady at 3.2%. Most of the gain was driven by shelter costs which rose 0.5%, a chunky increase considering it makes up nearly a third of the core CPI basket.

The “supercore” figure which includes core services prices but strips out housing costs lifted 0.3%, the steepest increase since April. This figure often gets attention given it’s an area Fed policymakers are watching for signs of stickiness in services prices which are linked to wage pressures.

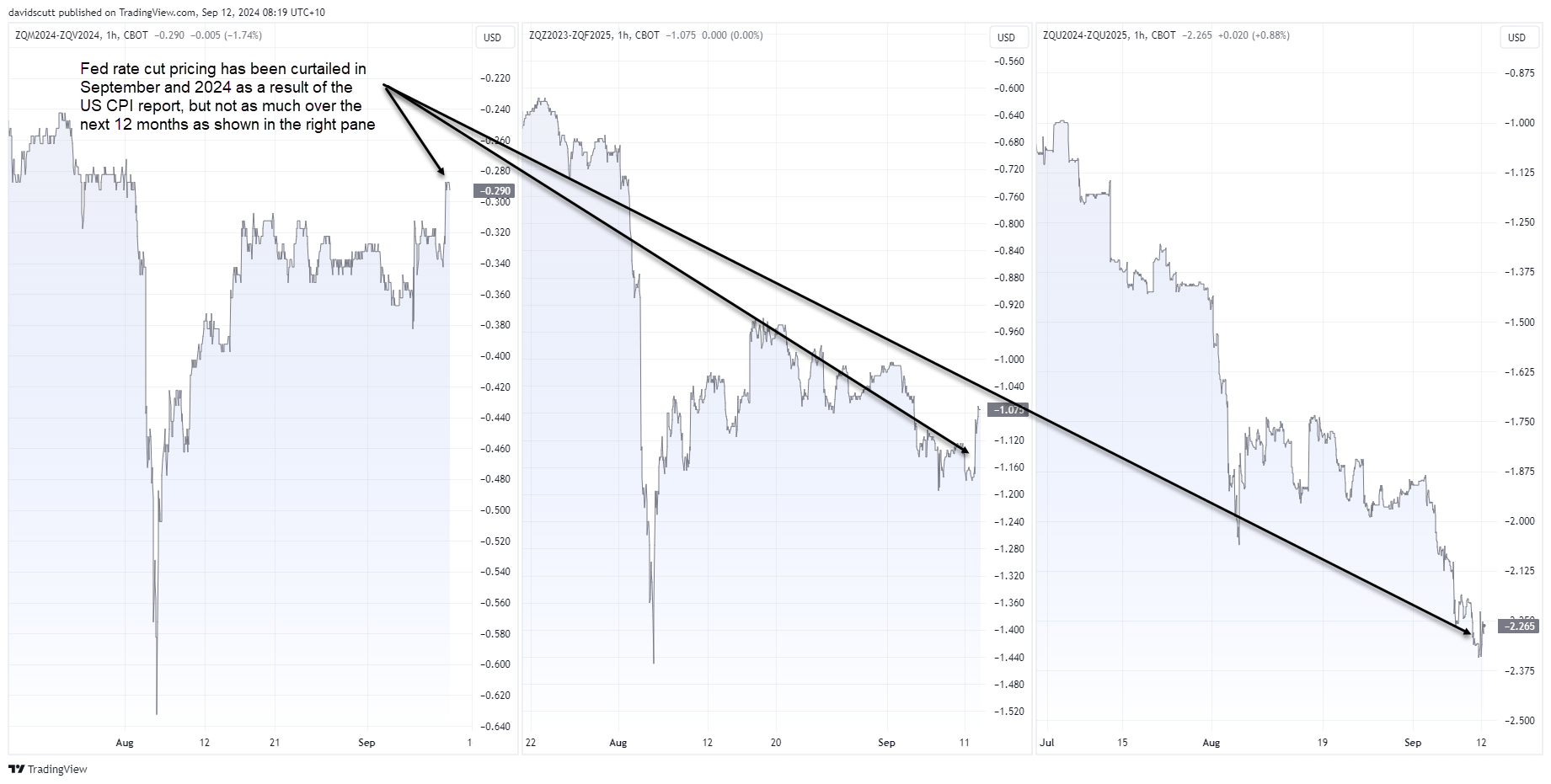

Near-term fed rate cuts bets slashed

While CPI is not the Fed’s preferred inflation measure – that’s the core PCE deflator – the upside surprise had an immediate impact on Fed rate cut pricing with probability of the FOMC kicking off the easing cycle with a super-sized 50 basis point cut in September being slashed to just over 10%. It had been deemed a coin toss earlier this month.

Pricing over the remainder of 2024 was also curtailed with just over 100 basis points of cuts now expected, implying at least one supersized cut with a minute chance of a second. Looking out over the next year, 227 basis points are expected, suggesting traders deem the August CPI report as something that may prevent front-loading of rate cuts but not from cutting consistently over the next 12 months.

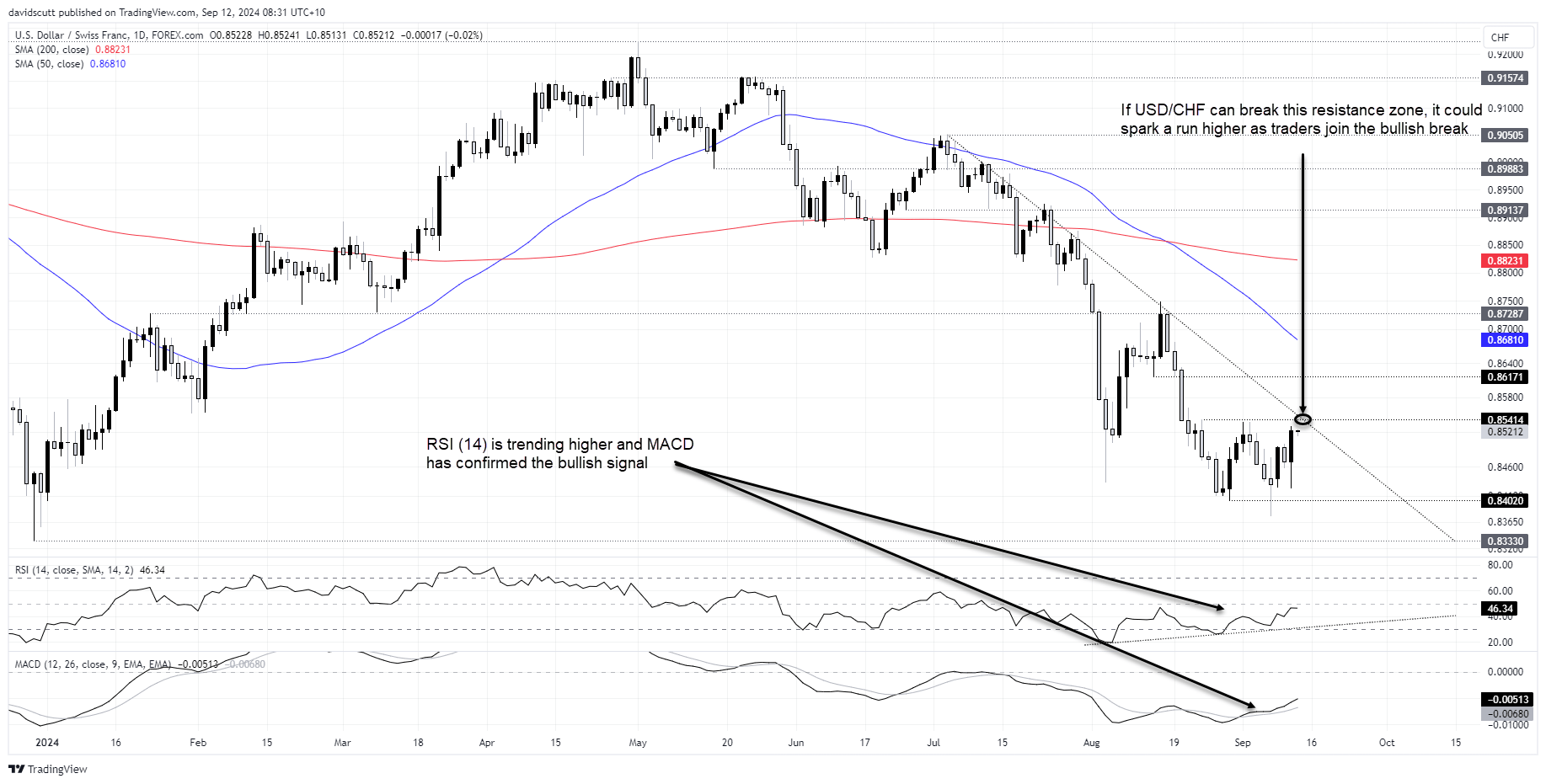

Swing bottom for USD/CHF?

For the yield sensitive USD/CHF, the report was just what the doctor ordered for bulls after the pair skidded to fresh cyclical lows last week. The question now is whether what we just witnessed was a swing low and the start of a dollar comeback?

Looking at the daily chart, you can see USD/CHF printed a key reversal on Wednesday, sending the cross back towards the intersection of horizontal resistance at .85414 and downtrend resistance dating back to early July.

With RSI (14) sitting in an uptrend after demonstrating bullish divergence since August, and with MACD confirming the bullish signal, momentum is turning around for the pair, suggesting we may see a test of this resistance zone in the near-term.

You could buy around here with a tight stop and trust the bullish price and momentum signals, but having missed the reversal already, I’m more inclined to wait to see whether the price can break and hold above the downtrend given the less favourable setup.

If it does manage to crack the resistance zone, you could place a stop beneath .85414 for protection targeting a push towards .86171, the 50-day moving average at .8681 or horizontal support at .87287.

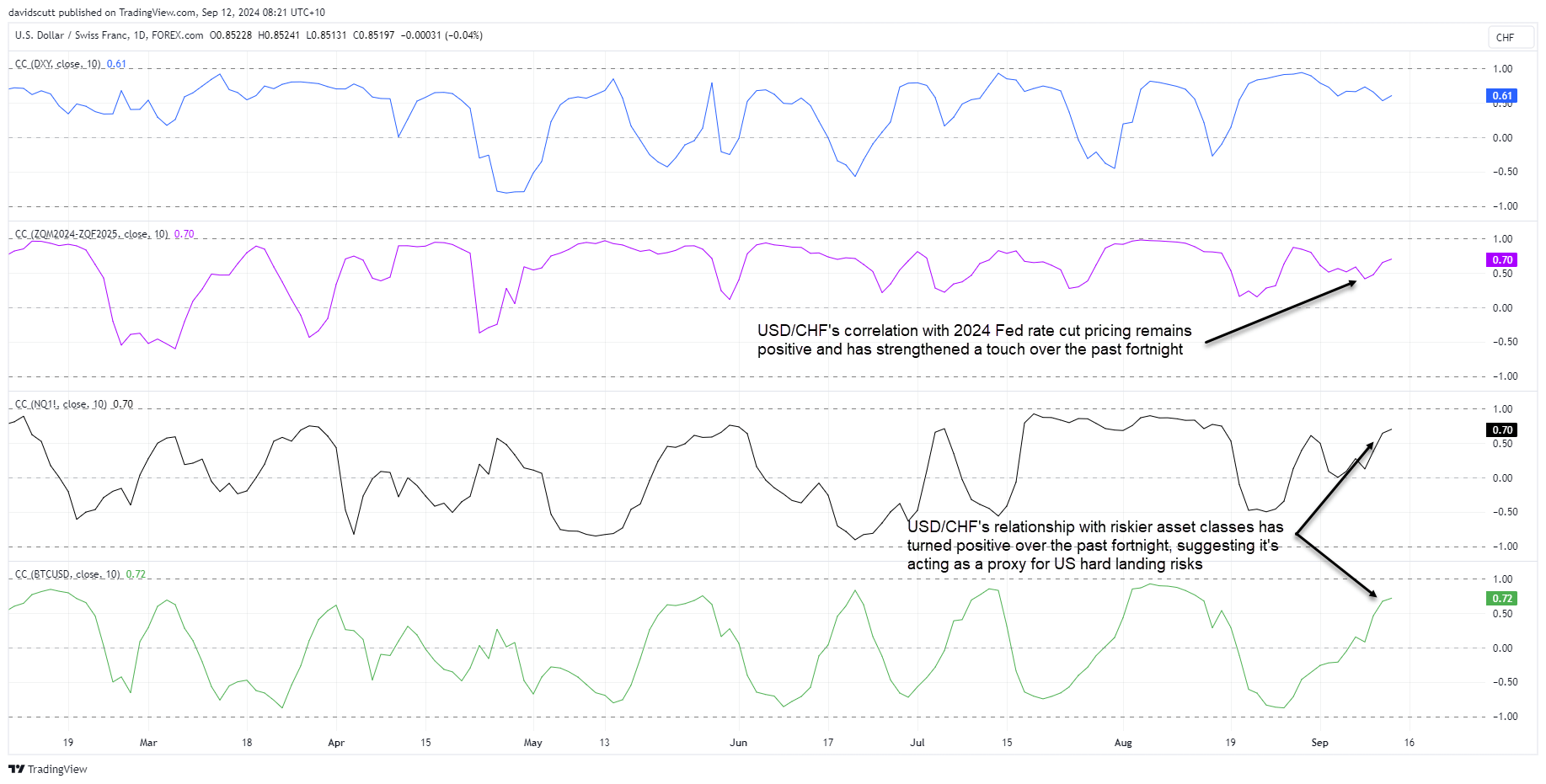

USD/CHF behaving like a hard landing proxy

With every major data release now out before the FOMC rate decision on Wednesday next week, USD/CHF traders should be aware that risk appetite seems to be playing an increasingly influential role in dictating movements with the positive correlation with Nasdaq 100 futures and bitcoin strengthening over the past fortnight, rising to similar levels to where the correlation with 2024 Fed rate cut pricing currently resides.

That suggests the pair is behaving as a soft landing proxy, rising when confidence grows and declining when recession fears ramp.

-- Written by David Scutt

Follow David on Twitter @scutty