- Japanese yen is behaving like a safe haven asset again

- USD/JPY slides violently after breaking 2024 uptrend

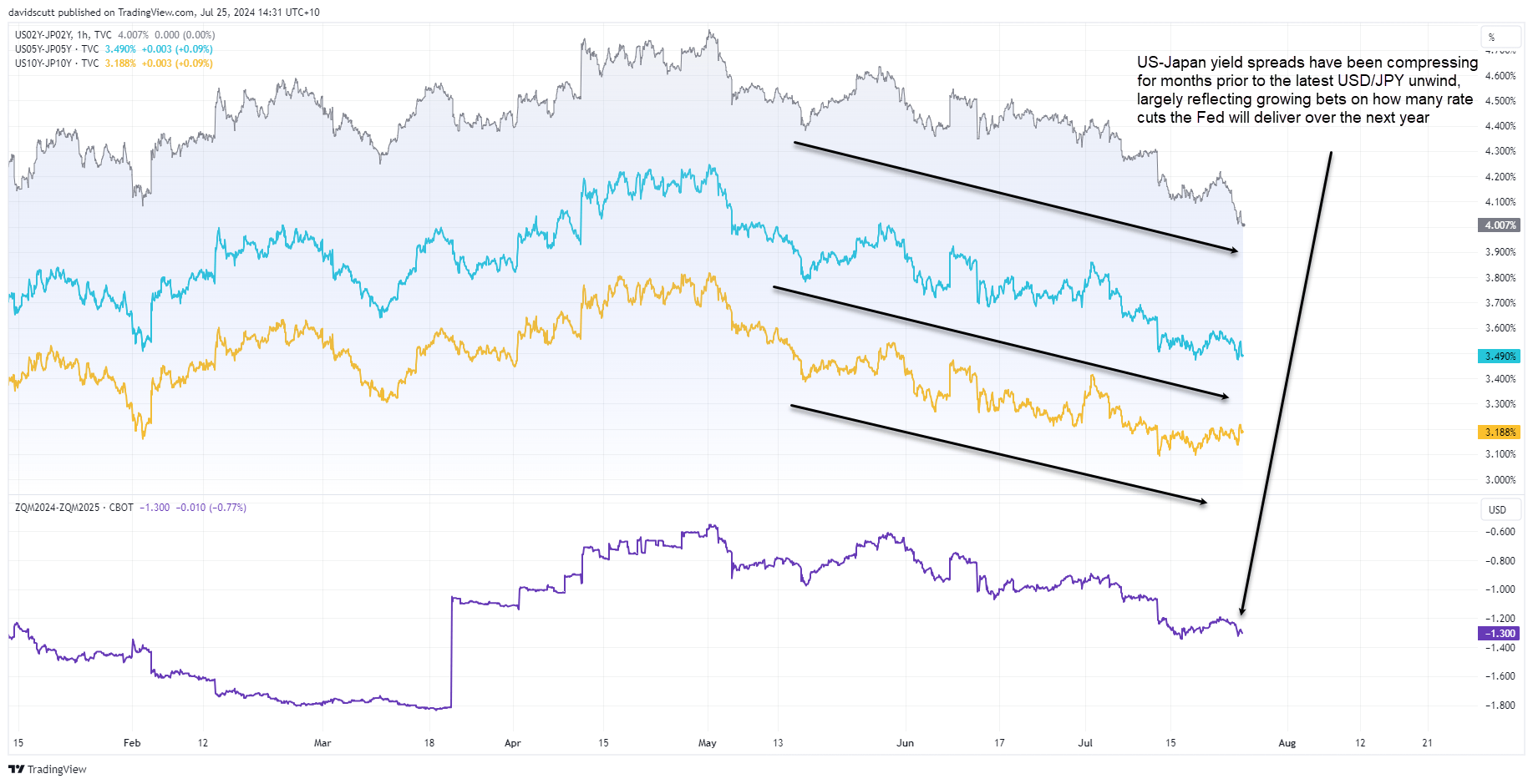

- Fed rate expectations are playing a lesser role in influencing movements

- Relationship with US stock futures has strengthened noticeably in recent weeks

USD/JPY rout nears key inflection point

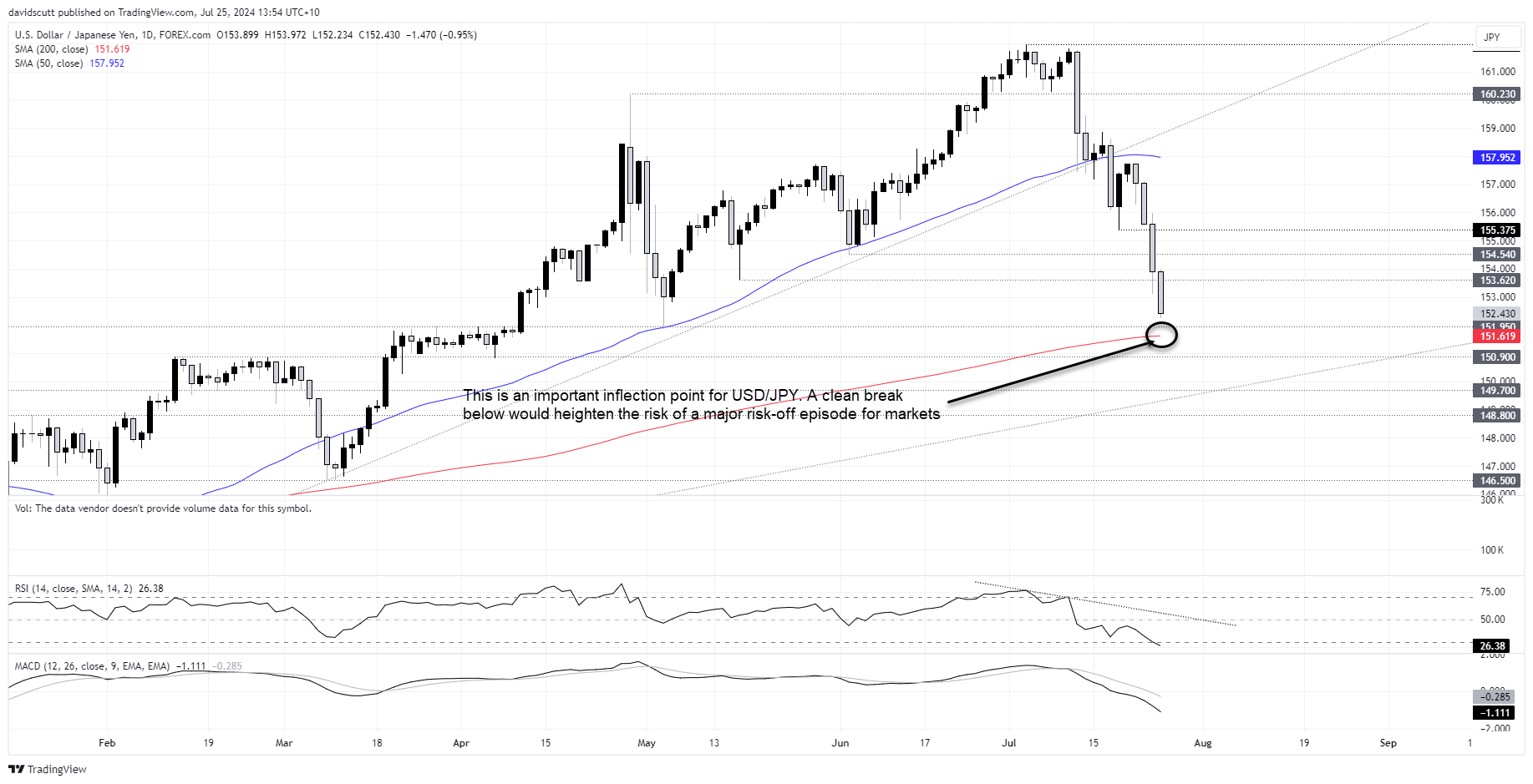

USD/JPY is on a collision course with key support, plunging for a fourth consecutive day as carry trades involving the Japanese yen are unwound. It’s the kind of move you’d normally expect to see in a crisis, although we’re not in a crisis. Yet. The longer this goes on, the closer we get to a seriously large risk-off episode. For now, what happens in the near-term could play a key role in determining just how bad things get.

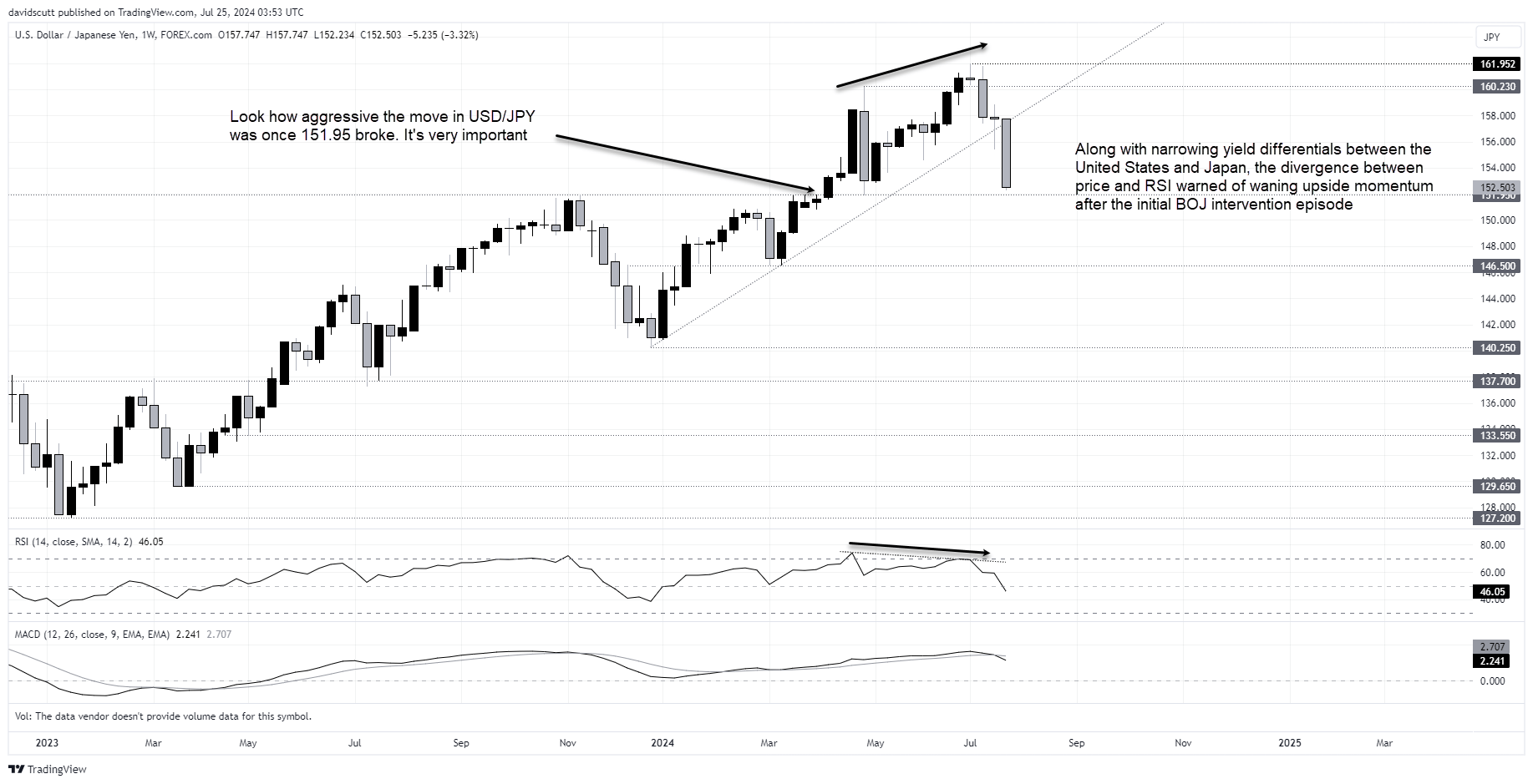

Just look at that weekly candle

To start, I just want to zoom out to the weekly timeframe to get a better sense as to just how significant this downside flush has been. Having taken out the uptrend that began late last year, it’s been nothing but one-way traffic since.

You can see just how close USD/JPY is now to 151.95, a major support zone traders spent months fretting whether to cross earlier this year in fear of the Bank of Japan intervention. You can see how important it is by how far dollar-yen surged after breaking through the level.

151.95 top of key support zone

It’s doubly important when you zoom in to the daily timeframe and see the 200-day moving average is located just below at 151.61. Combined, the 34 pips between the two levels looms as potential fork in the road for USD/JPY. Will it hold and facilitate a short-covering bounce and reestablishment of carry trades, or will it buckle leading to potential turmoil?

I’m questioning whether we’re standing on the precipice of the crisis – it doesn’t feel like one, and I’ve seen a fair few in my time. But I know what I’ll be watching: risk assets

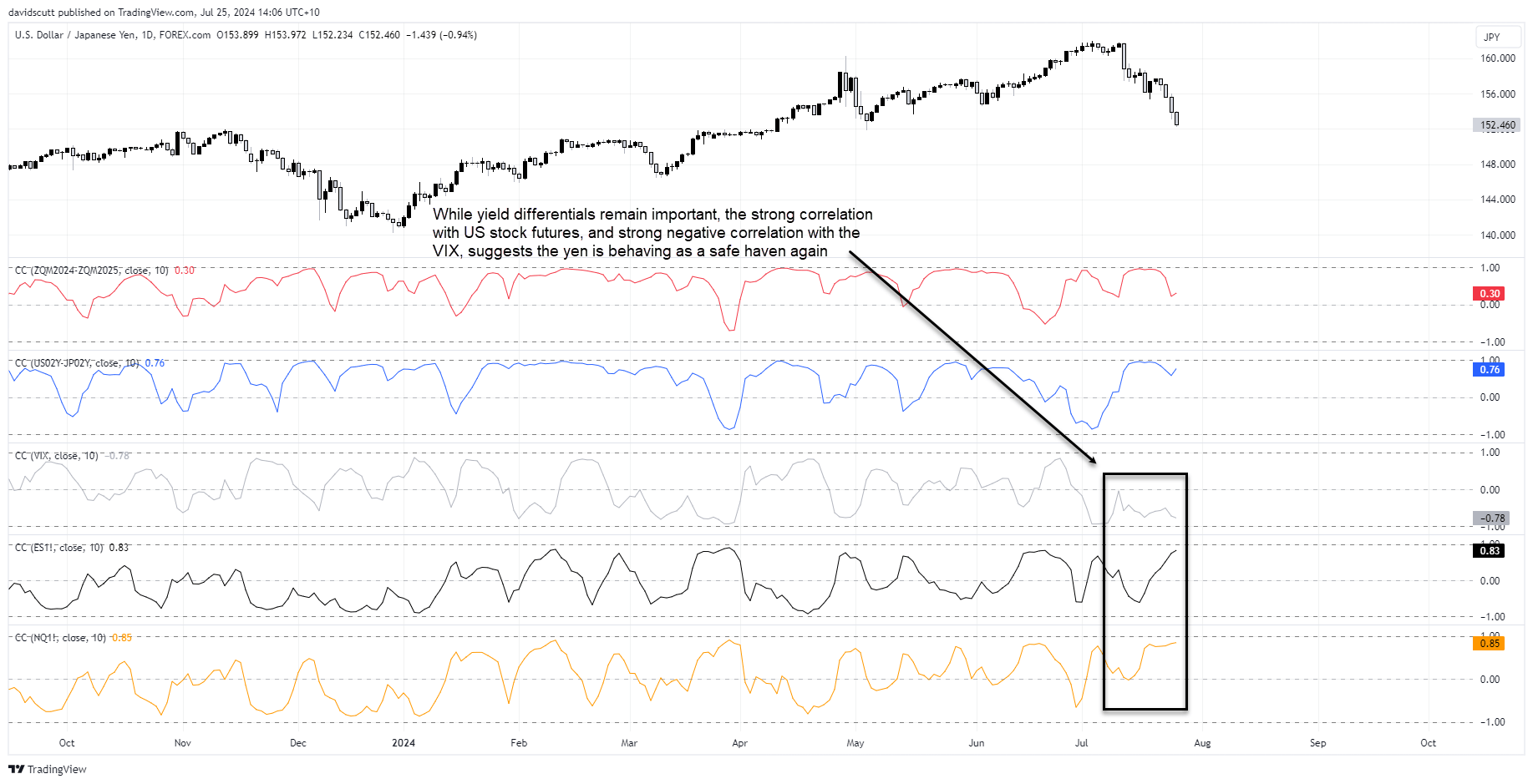

This next chart explains why.

Yen a safe haven again?

It looks at the 10-day rolling correlation between USD/JPY with a proxy for Federal Reserve rate cuts looking one year ahead in red, US-Japanese two-year yield spreads in blue, the S&P 500 volatility index (VIX) in grey, S&P 500 futures in black and Nasdaq 100 futures in green.

It looks at the 10-day rolling correlation between USD/JPY with a proxy for Federal Reserve rate cuts looking one year ahead in red, US-Japanese two-year yield spreads in blue, the S&P 500 volatility index (VIX) in grey, S&P 500 futures in black and Nasdaq 100 futures in green.

While the relationship between dollar-yen and short end rate differentials has remained strong over the past fortnight, there’s been a changing of the guard in terms of market driver.

The correlation with the S&P and Nasdaq has strengthened noticeably over this period. The inverse correlation with the VIX has also strengthened, with the two moving in different directions with increased frequency.

Put simply, it looks like the yen has reverted to its old role as a safe haven, benefitting from repatriation flows from all corners of the globe. That suggests traders should watch for confirmation signals from risker asset classes before initiating positions in USD/JPY.

-- Written by David Scutt

Follow David on Twitter @scutty