USD/JPY Key Takeaways

- Strong ISM and JOLTS surveys in the morning were followed by a mediocre bond auction this afternoon.

- The auction showed below-average demand for US Treasuries, potentially signaling fear about the ongoing deficit and potential for inflation to reaccelerate.

- USD/JPY is essentially unchanged on the day, with tomorrow’s ADP and initial jobless claims reports looming as the next potential injection of volatility into the pair

It’s been a mixed day for US data, with better-than-expected readings on the ISM Services PMI and JOLTS Job Openings surveys raising optimism about the US economy before a mediocre 10-year treasury bond auction in the early afternoon.

The auction showed a 2bps “tail”, indicating less demand for the bonds than expected, and dealers were obligated to take on 15.6% of the issue, above the 13.1% average over the last six months. All in all, the auction showed below-average demand for the benchmark US Treasury bond, potentially signaling fear about the ongoing deficit and potential for inflation to reaccelerate.

Stock indices have seen the morning’s gains evaporate, with the 10yr yield rising to 4.69%, its highest level since last April. More to the point for FX traders, the US dollar is edging higher against most of its major rivals, though the moves are fairly limited as we go to press.

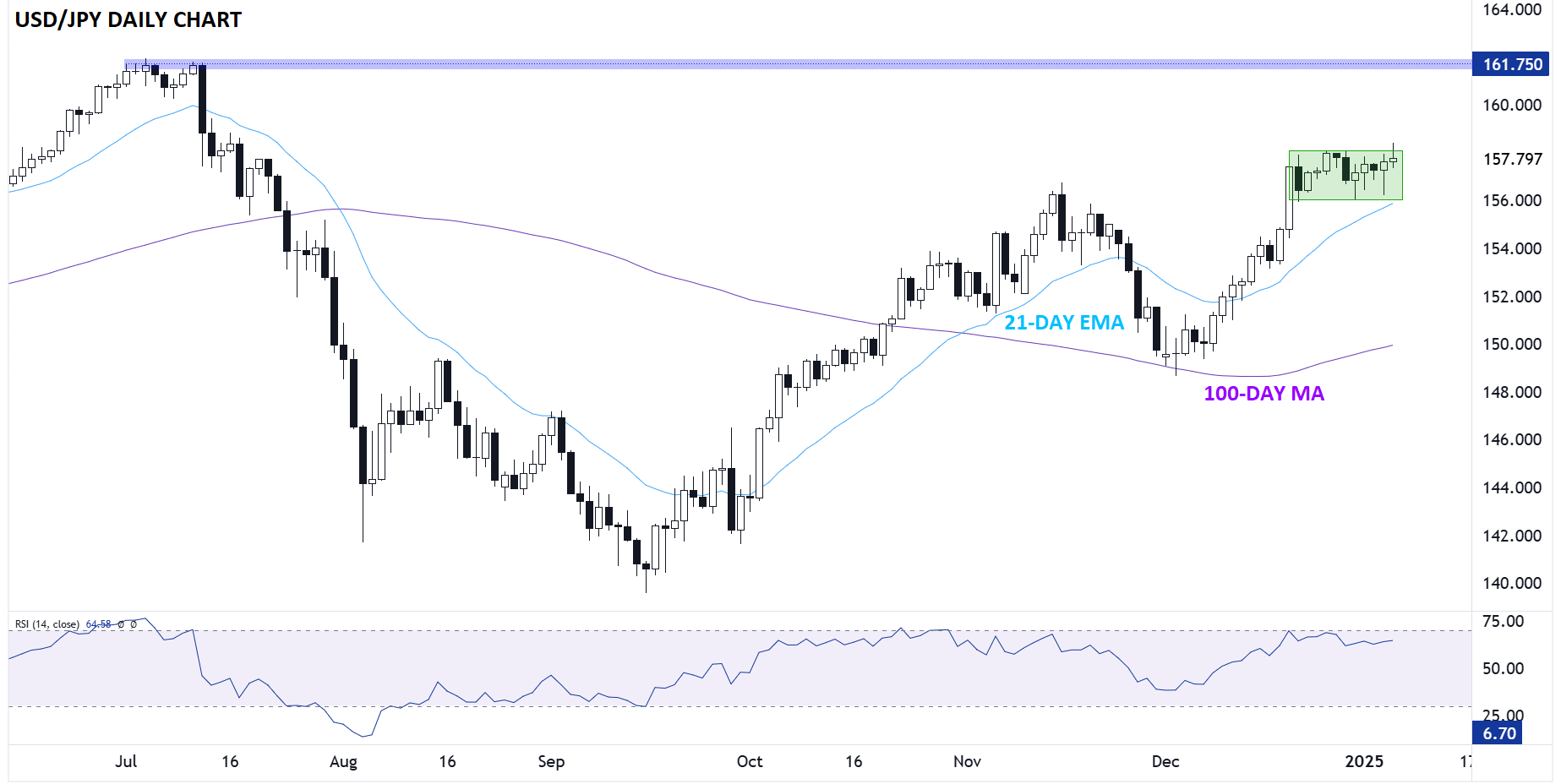

Japanese Yen Technical Analysis – USD/JPY Daily Chart

Source: TradingView, StoneX.

Looking at the chart of USD/JPY, the pair attempted a breakout to 6-month highs above 158.00 on the back of this morning’s data releases before reversing back into the holiday period trading range in short order.

Now, rates are essentially unchanged on the day, with tomorrow’s ADP and initial jobless claims reports looming as the next potential injection of volatility into the pair. A confirmed bullish breakout above the top of the range could target 160.00 in short order, whereas a bearish breakdown could open the door for a deeper retracement toward 154.00.

-- Written by Matt Weller, Global Head of Research

Check out Matt’s Daily Market Update videos on YouTube and be sure to follow Matt on Twitter: @MWellerFX