After all the turmoil in markets last week, traders are seemingly taking a pause in early trade this morning. Equity indices across Asia, Europe, and the US are either trading higher or pointing to a higher open, the “safe haven” Japanese yen is the weakest major currency so far today, and oil is rallying by 3%.

While the two-day weekend break from trading certainly helped to “cool off” emotions, the biggest factor stabilizing markets is the belief that central bankers will ride to the rescue once again. At the Asian open, the Bank of Japan issued a brief statement acknowledging that, “Global financial and capital markets have been unstable recently with growing uncertainties about the outlook for economic activity due to the spread of the novel coronavirus” and vowing to “closely monitor future developments, and… strive to provide ample liquidity and ensure stability in financial markets through appropriate market operations and asset purchases.” The central bank subsequently injected ¥500B in two-week funds to support markets.

Looking ahead, the proverbial elephant in the room will be the Federal Reserve. In an unscheduled statement of his own on Friday, Fed Chairman Jerome Powell said that the Fed would “act as appropriate” to support the economy in the face of risks posed by the epidemic. Following last week’s massive selloff in risk assets, traders believe Powell was hinting at an imminent interest rate cut, perhaps even before the Fed’s scheduled meeting in two weeks’ time.

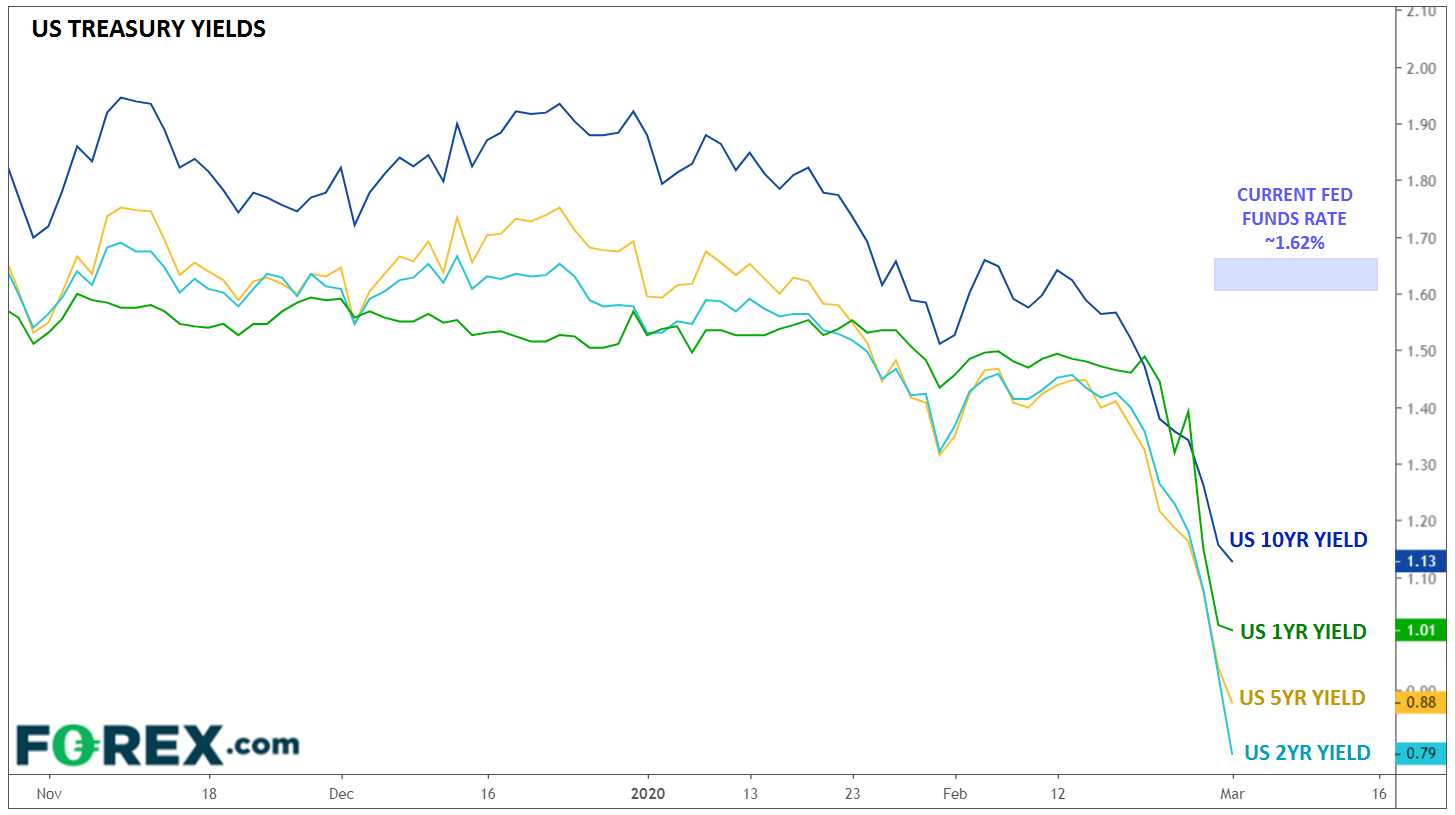

As the chart below shows, US interest rates have fallen off a cliff in recent days, with the 1-year, 2-year, 5-year, and 10-year tenors all shedding at least 40bps over the last two weeks alone.

Source: TradingView, GAIN Capital

For reference, the last time the Fed Funds rate was higher than the entire US yield curve (as we saw briefly last night) was in 2008, in the midst of the Great Financial Crisis. At the moment, the March Fed Funds rate is trading at 1.25%, nearly 40 bps below the current Fed funds rate of 1.62%, signaling that traders believe the central bank will be cutting interest rates dramatically and rapidly, perhaps as soon as today or later this week.

Make no mistake: situations like this are exactly why the Federal Reserve raised interest rates off 0% over the last few years, and the central bank will not be afraid to use the (limited) ammo it has at its disposal. Indeed, the Fed could very well take interest rates below 1.00% this summer in an effort to cushion the blow of coronavirus-related economic disruptions.

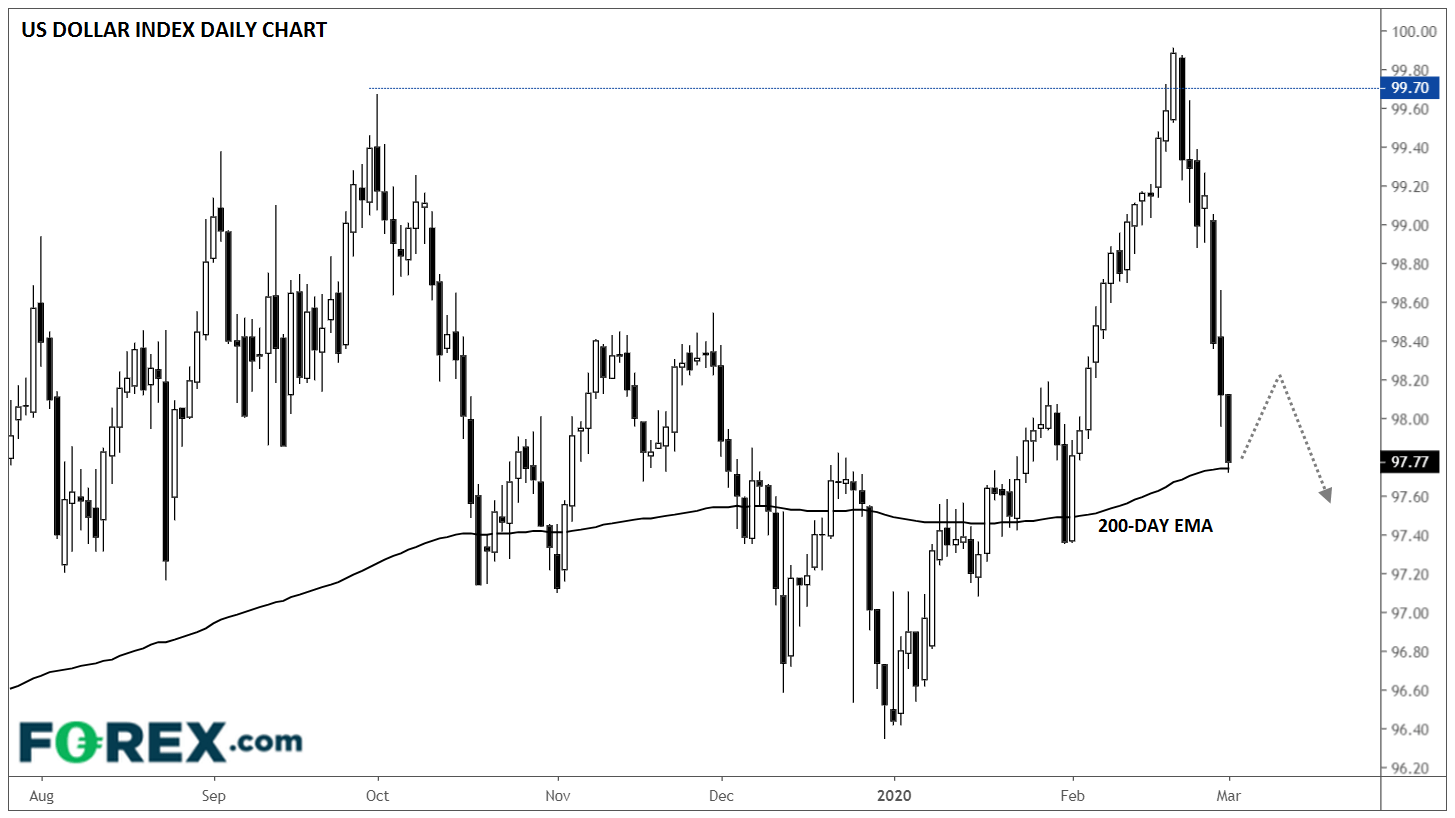

For the FX market, this means that the US dollar’s relative yield advantage over its G10 rivals could soon evaporate, and traders have been consistently selling the greenback as a result. After probing 100.00 less than two weeks ago, the US Dollar Index has fallen six of the past seven days to trade back at its 200-day EMA near 97.75.

If the Fed does follow through with a 50bps interest rate cut, either this week or at its regularly-scheduled meeting in two weeks’ time, the dollar could finally bounce in a “sell-the-rumor-buy-the-news” reaction. That said, the near-term momentum has clearly shifted in favor of the bears, and if the dollar index breaks below its 200-day EMA near 97.70, a move toward the bottom of the 1-year range near 96.00 could be next.

Source: GAIN Capital, TradingView