- Iron ore futures on the SGX are nearing important support

- With fundamentals deteriorating, a downside break may open the door for sizeable downside

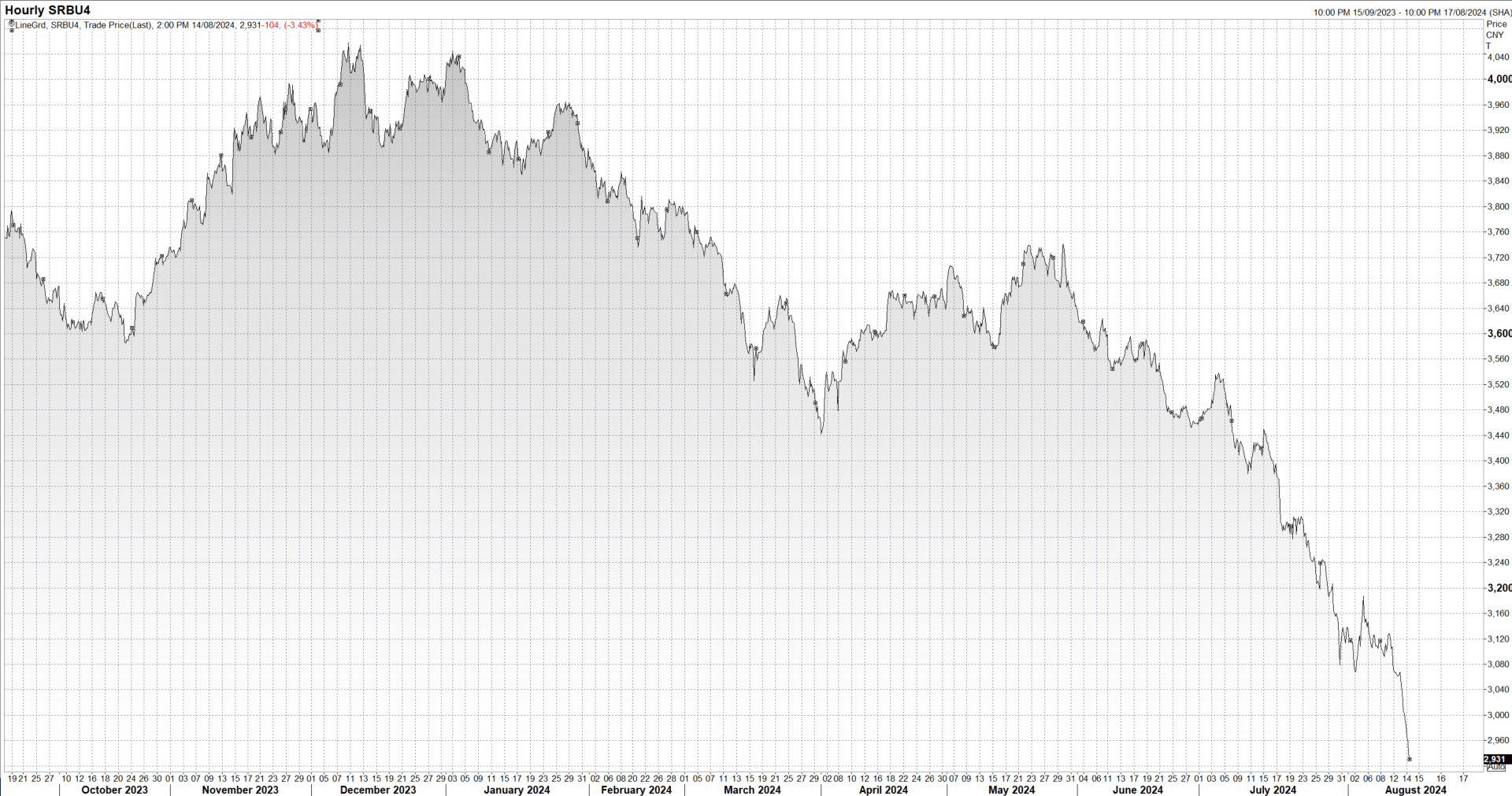

- Chinese steel futures are under extreme pressure as demand concerns amplify

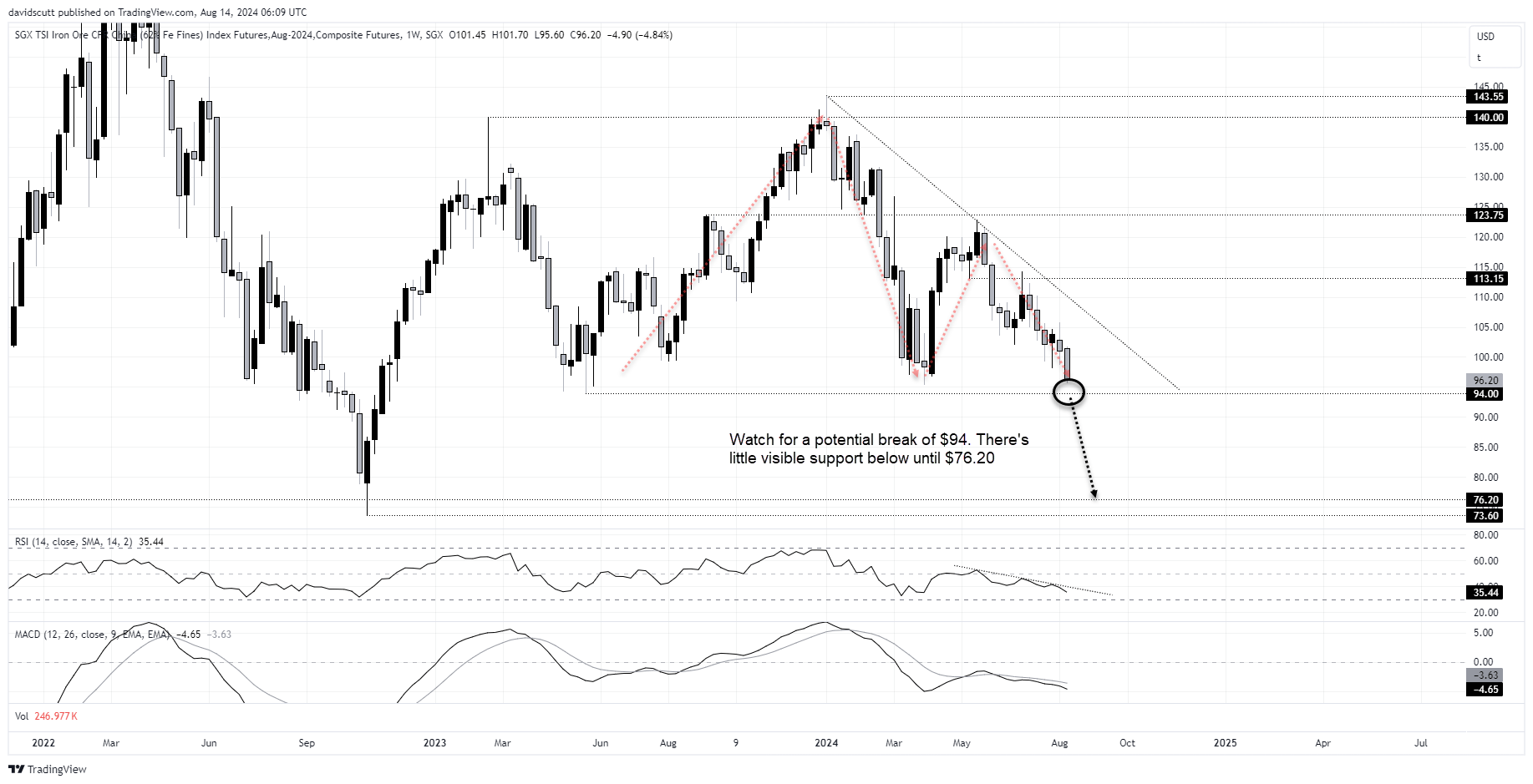

Iron ore looks like a possible waterfall in the making on the weekly chart, closing in on support that may resemble a dam wall disintegrating if and should it give way.

Difficult to be bullish on iron ore

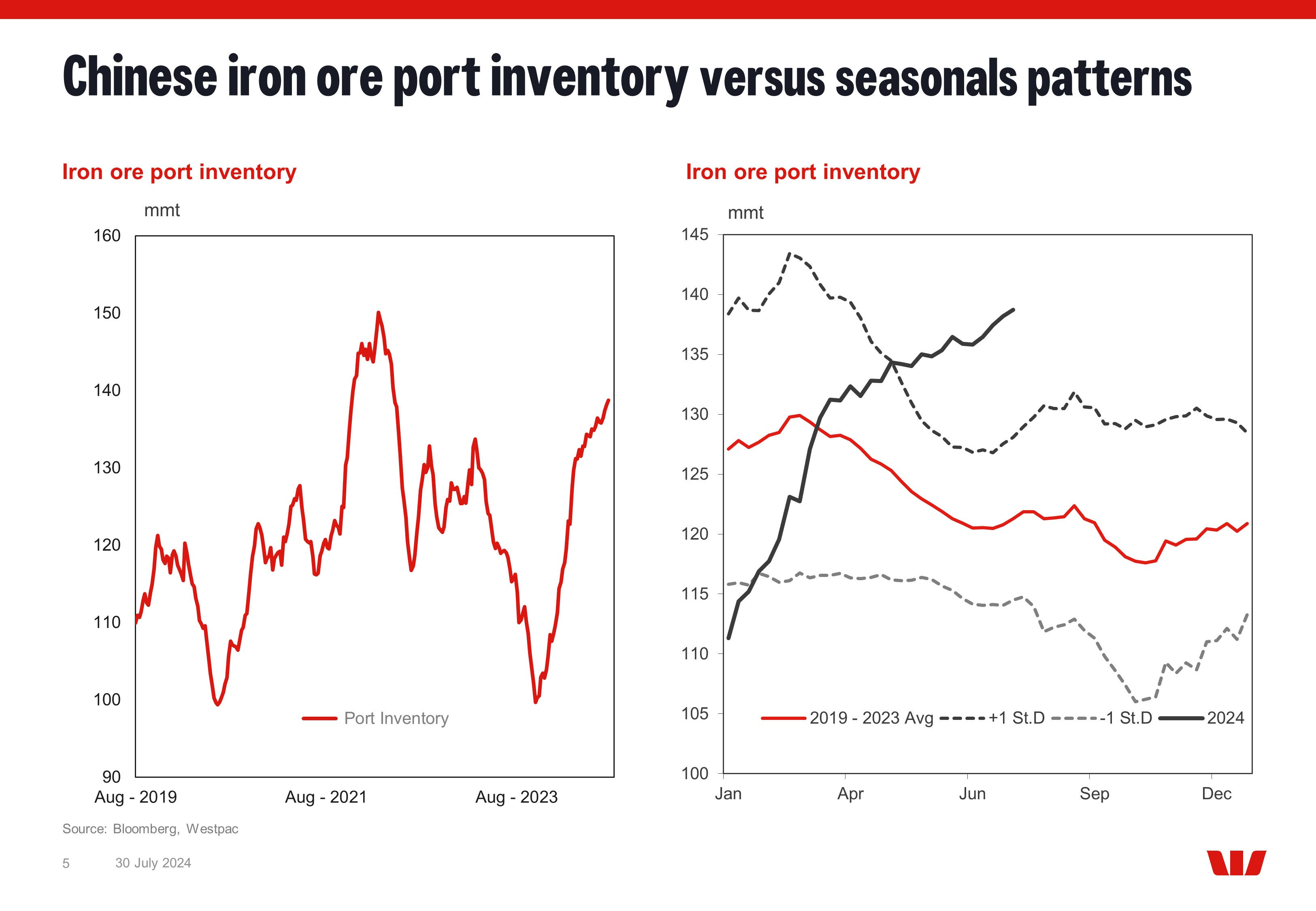

Iron ore faces a perfect storm when it comes to downside risks, undermined by unseasonably elevated inventories at Chinese ports, declining residential property construction in China, tumbling steel prices negatively impacting mill margins and profitability, along with tepid growth in new credit issuance which is amplifying concerns about a more pronounced slowdown in China.

Source: Westpac Bank

Data released on Tuesday did nothing to improve sentiment with Chinese banks extending a paltry ¥260 billion in loans in July, down 88% on June and around half the amount expected by economists.

Household loans fell by ¥210 billion yuan from June, according to calculations by Reuters, delivering another blow to residential construction which was the largest source of global steel demand as of last year. Whether that remains the case is questionable given how rapidly housing starts are declining in China.

It’s little wonder rebar (reinforced steel bar) futures resemble a death spiral on the hourly chart. You have to wonder whether iron ore may be next given it’s a key input for steel product used in the construction sector.

Source; Refinitiv

Descending triangle adds to downside risks

SGX iron ore futures sit in a descending triangle pattern on the weekly chart, closing in on support at $94 which has thwarted bearish probes for well over a year. As such, it comes across as an important level with little visible support evident until you get back to $76.20.

A break below $94 creates a decent short setup, allowing for traders to sell below the level with a stop above for protection. $76.20 or the October 2022 low of $73.60 loom as potential targets.

Alternatively, should $94.20 hold, you can flip the trade, allowing for longs to be established above the level with a stop below for protection. Possible targets include the August high of $105.75, downtrend resistance located around $110, along with $113.15.

-- Written by David Scutt

Follow David on Twitter @scutty