Have a specific question about oil futures? Jump straight to an answer with the links below:

- What is an oil future?

- Who buys oil futures?

- Where to trade oil futures

- How to trade oil futures

- How to day trade oil futures

- How do oil futures affect forex?

- How much is an oil futures contract?

- When are oil futures traded?

- How to buy and trade crude oil futures in the U.S.

What is an oil future?

An oil future is a bounded agreement to buy or sell an amount of crude oil at a future date. A typical oil futures contract represents 1,000 barrels of crude oil and has an expiration date ranging from one month to nine years.

Oil futures are known for their volatility. Crude oil is one of the most in-demand and vital commodities in the world because of its use both as a fuel source and an unrefined base for other products. The demand for crude oil coupled with the commodity’s position as a representative of the world economy at large means futures traders follow the supply and demand of oil closely to anticipate market movement.

This volatility and size in which the contracts are sold has caused oil futures to grow from a niche commodity traded among large companies to a popular speculation for retail traders, specifically swing and day traders who can capitalize on the volatility of crude oil.

Who buys oil futures?

Oil futures were traditionally bought by corporations that physically dealt with crude oil in their business dealings. However, large investment institutions such as hedge funds, mutual funds, and banks are now the biggest players in the oil futures market. Their breadth of monetary and analytical resources allows them to dedicate the time and attention needed to trade the expensive and risky futures contracts.

Oil companies still purchase futures from each other to obtain competitors’ assets at lower prices and limit their exposure to risks. Their insider position within the oil market gives them an advantage over other traders when it comes to future price speculation. Other companies that heavily rely on crude oil such as transportation companies and refineries also purchase oil futures to hedge risks and stabilize costs in the volatile market.

Increasingly more independent investors are also finding their way to the futures market. While it is generally advised traders only risk a small portion of their overall portfolio on these high-risk contracts, playing them right can result in massive returns. Although individual traders still make up a small portion of the crude oil futures trading and have little impact on the price changes in the market.

Where are oil futures traded?

Oil futures are traded on both the New York Mercantile Exchange (NYMEX) and the Intercontinental Exchange (ICE) depending on the benchmark you are looking to trade.

- North America’s benchmark, West Texas Intermediary (WTI), is traded on the NYMEX under the ticker ‘CL’.

- Brent Crude serves as the benchmark across Africa, Europe, and the Middle East and is traded on the ICE under the ticker ‘BZ’.

WTI is primarily sourced from the Permian Basin in Southwest Texas, and Brent Crude is drilled from the North Sea between the UK and Norway. Compared to WTI, Brent Crude is normally priced higher because of its superior quality.

Online brokerages offer access to WTI on the NYMEX and Brent Crude on the ICE. Mini futures with contracts half the normal size can be traded on the CME Globex platform.

Keep reading for more info on both benchmarks and how to trade their futures contracts. Interested in the oil market as a whole? Read our guide to trading crude oil here.

How to trade crude oil futures

You can trade crude oil futures on our affiliate platform FuturesOnline. If you want more experience with the futures market first, 14-day demo accounts are also available.

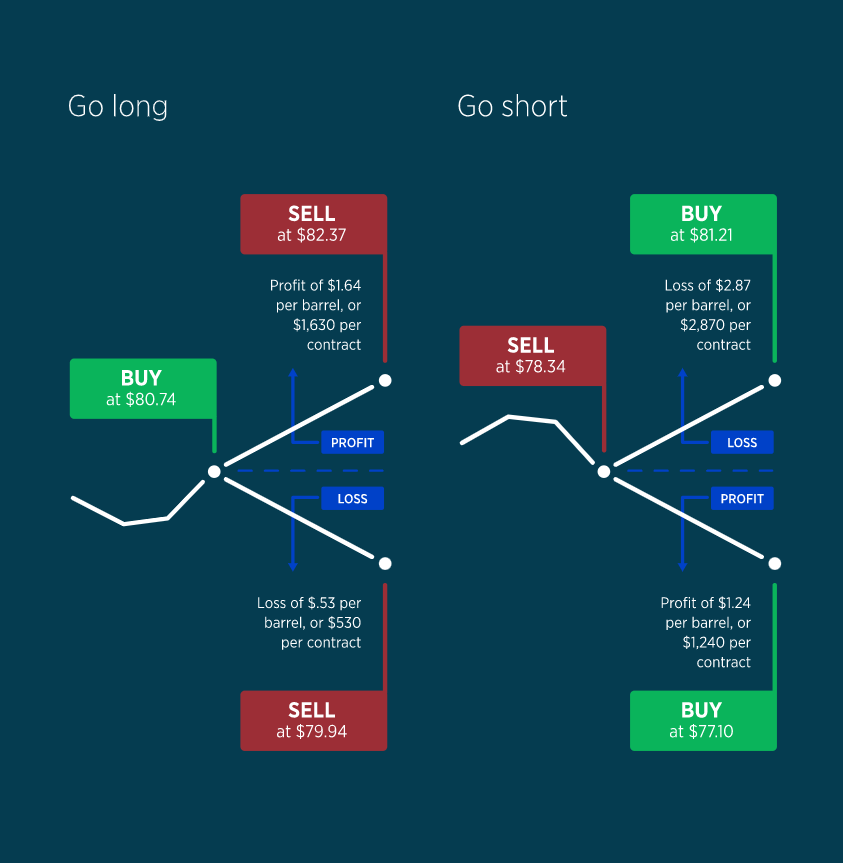

Futures contracts work buy speculating on the price in a future time. You can either buy or sell a contract for a commodity’s spot price with the expectation the price will rise or fall before your contract expires, allowing you to close your position and realize gains or losses from the new spot price.

Trading oil futures is like buying and selling any other futures contract. An expiration date must be determined when you initially buy long or short. Expiration dates are per month, and futures contracts end on the third Friday of the month.

Once approved by a broker to trade futures, you will have to post a performance bond. These bonds are worth two to five percent of the futures contract value. You’ll also be required to post the initial margin requirement and retain the maintenance margin to keep the trade open. The amount you’ll pay varies depending on the capital in your account and the current price of oil futures contracts.

An example of a crude oil futures trade:

How to day trade crude oil futures

Crude oil’s volatility makes it an attractive commodity for day traders, with some brokers offering reduced margins when not holding contracts overnight. When day trading oil futures, it’s imperative to learn the fundamentals and technicals along with understanding the influence of professional traders and hedgers who dominate the oil futures market.

While major news event can cause overnight volatility, there are also frequent opportunities for price swings during the trading day as prices fluctuate at the mere hint of market news. Read more about how oil markets react to supply and demand here.

For an in depth look at how fundamentals can rapidly affect the price of oil, read our analysis of oil prices spiking due to perceived shortages in the UK as of September 2021.

How crude oil futures affect forex

Oil futures greatly affect forex as a prime export of several countries and a major import in nearly every other country. The value of a country’s currency can rise or lower significantly in reaction to the global availability of oil.

When oil prices rise, countries with an excess reserve of oil or significant production of the commodity such as the U.S. or Canada will see their currency rise in value against those of countries without significant oil reserves. Currencies with strong ties to oil exports are sometimes referred to as petrocurrencies. When the price of oil rises, these currencies tend to also rise in value, most affecting currency pairs that include only a single petrocurrency.

As the most traded commodity in the world, experienced forex traders often watch oil prices and speculate on their futures to strengthen their fundamental analysis.

You can trade over 80 currency pairs with Forex.com on our award-winning platform! Open an account today or familiarize yourself to the market with a risk-free demo account.

How much is an oil futures contract?

Despite being a mature commodity, crude oil prices change on a day-to-day basis based on future speculations of supply and demand. These speculations are influenced by a large number of macroeconomic fundamentals, which you can read about in more depth here.

Oil futures contracts are sold in groups of 1,000 barrels, combining the commodity’s volatility with large price movements due to the contract’s size. The minimum price fluctuation in the oil market is 0.01 cent per barrel, magnifying to $10 per futures contract.

The difference in price between the two benchmarks is known as the Brent-WTI spread. Brent is favored worldwide because it is more easily converted into diesel fuel and the reach of its markets better represents the global economy. The price between the two benchmarks has narrowed or inversed only a few times in the spread’s history.

When are crude oil futures traded?

Both WTI and Brent Crude oil futures are traded from Sunday through Friday, 6:00 p.m. to 5:00 p.m.

Monthly contracts are available for each month of the year and close three days before the 25th of the month before the expiration month. So, a contract set to expire in November 2021 would expire on October 22, 2021.

These monthly contracts are listed for the current year up through the next nine calendar years.

You can also trade E-mini crude oil futures online listed on the Small Exchange on the CME Globex. These contracts are only half the size of regular crude oil futures contracts. Refer to the chart below for specs on both benchmarks and E-mini futures.

|

Commodity: |

WTI |

Brent Crude |

E-Mini |

|

Contract Size: |

1,000 U.S. barrels (41,000 gallons) |

1,000 U.S. barrels (41,000 gallons) |

500 U.S. barrels (20,500 gallons) |

|

Settlement: |

Physical Delivery or Financially Settled |

Physical Delivery or Financially Settled |

Physical Delivery or Financially Settled |

|

Market Price: |

Per Barrel |

Per Barrel |

Per Barrel |

|

Per point movement: |

$0.01 per barrel ($10.00 per contract) |

$0.01 per barrel ($10.00 per contract) |

$0.025 per barrel ($12.50 per contract) |

|

Delivery months: |

All months |

All months |

All months |

|

Last Trading day: |

Third business day before the 25th calendar day of the month directly before the expiration month |

Third business day before the 25th calendar day of the month directly before the expiration month |

Fourth business day before the 25th calendar day of the month directly before the expiration month |

|

Trading hours: |

Sunday – Friday, 6 p.m. – 5 p.m. EST |

Sunday – Friday, 6 p.m. – 5 p.m. EST |

Sunday – Friday, 6 p.m. – 5 p.m. EST |

|

Exchange: |

NYMEX |

ICE, CME Globex |

CME Globex |

|

Ticker Symbol: |

CL |

BB |

QM |

When trading futures, it is important to watch for the expiration date. You must either buy or sell the contract buy the expiration date to avoid having to physically buy or sell thousands of barrels of oil once the contract expires. This could leave you stuck with thousands of gallons of crude oil! You also have the option to settle the contract for cash or roll it over to a longer-dated contract.

How to buy and trade crude oil futures in the U.S.

Currently, FOREX.com offers futures options through our affiliate FuturesOnline, additional information regarding futures contracts can be found on the FuturesOnline website.

Not ready to trade? Open a 14-day demo account and practice trading crude oil futures.

FuturesOnline also offers an index consolidating crude oil benchmarks available to trade on the Small Exchange. Find more information on the small exchange here.