- Hang Seng, China A50 charts looks like memes given the scale of recent gains

- Other China-linked markets that surged initially last week have not extended their moves, providing a potential red flag for traders

Overview

Hang Seng and China A50 stock futures continue to rip higher, benefitting not only from continued panic buying following last week’s monumental surge but also the fact they have resumed trade with mainland Chinese markets still closed for golden week holidays.

The charts resemble a meme with huge amount of capital chasing prices higher with little to no consideration for fundamentals. Every headline seems to be bullish whereas just over a week ago they were near-uniformly bearish. Levels that were previously respected have been obliterated in the rush. Overbought? No worries, seems to be the prevailing mindset.

Red flags for stock bulls?

While the price action is undeniably bullish, it’s notable that other China-linked markets caught up in the initial excitement surrounding China’s stimulus announcements have not managed to extend their gains meaningfully.

Copper and iron ore futures remain well below the highs struck earlier this week while USD/CNH has reversed back above 7.0000, providing potential red flags that overflowing optimism in stock futures is not extending into other markets.

Given the nature of the moves we’re witnessing, when looking at levels to build setups around, traders may want to zoom out to get a sense as to what’s important and what’s not. Weekly charts are great for doing that, turning down the noise to help improve the signal.

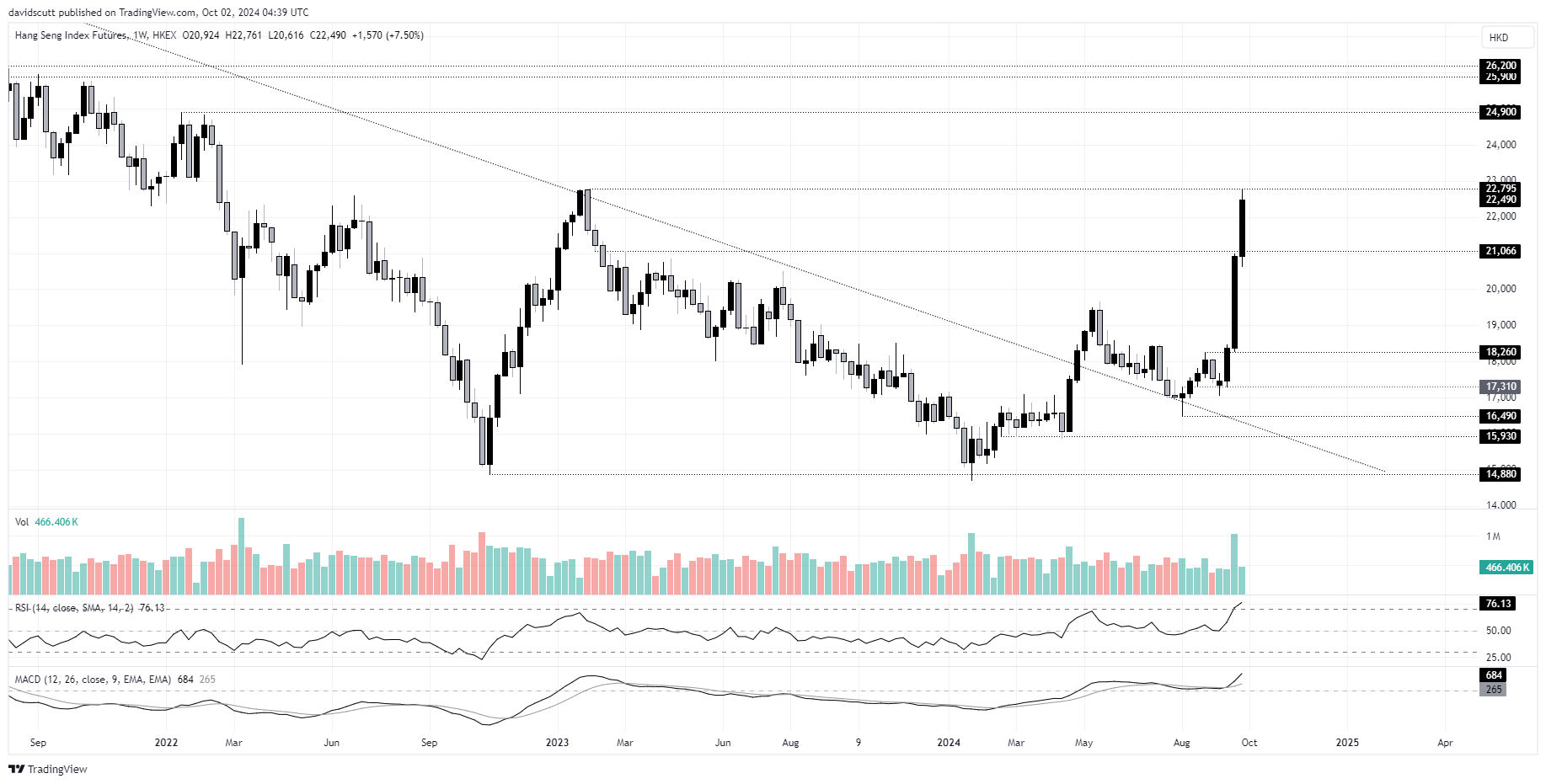

Hang Seng jumps again

Looking at Hang Seng futures, you can see the how abrupt the recent move has been, likely reflecting the impact of short covering and large capital inflows.

On the topside, the price stalled earlier today at 22795, the double top that printed in January 2023. If that were give way, 24900 would be the next topside target with a support zone between 25900 up to 26200 the next after that.

Having obliterated so many levels on the recent upswing, there’s not of visible downside support on this timeframe until 21066, a level where the bullish move stalled last week which also acted as support and resistance in early 2023.

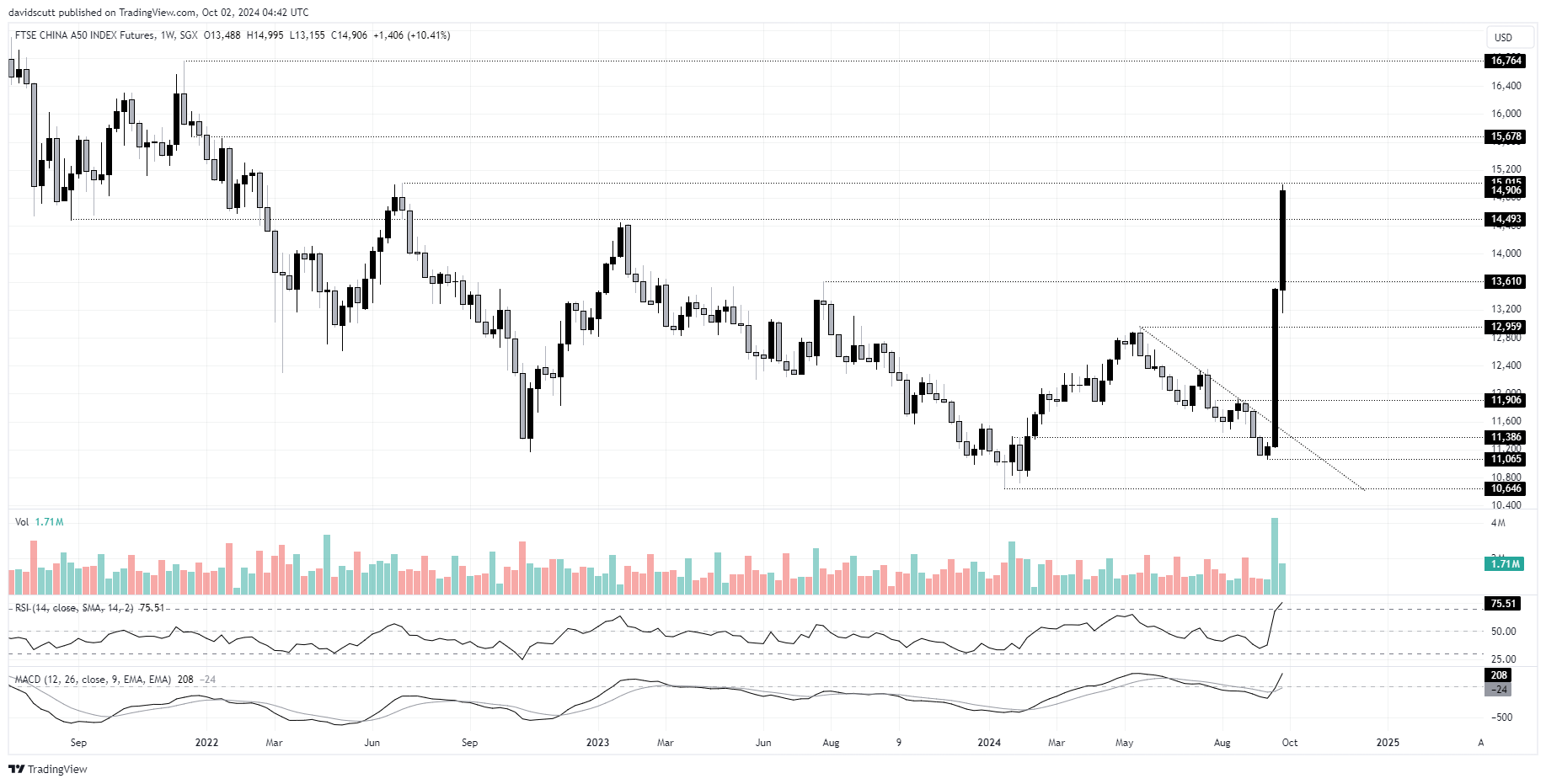

China A50 trades at two-year highs

It’s a similar setup in China A50 futures with the rally stalling today ahead of resistance at 15015, the doble top of June 2022. Above, resistance may be encountered at 15678 and again at 16764, the high set in late 2021.

On the downside, I’ll leave 14493 on the chart for reference given it acted as support and resistance on multiple occasions through 2021 to 2023. I have no idea whether it will be respected again but it was a major level previously. Below, 13610 and 12959 are other levels that may provide support if and when the price gets back there.

Given the scale of moves we're witnessing, keep stop loss orders and position sizing front of mind if operating in these markets.

-- Written by David Scutt

Follow David on Twitter @scutty