The Commitment of Traders report (COT) has been delayed due to the public holiday in the US last week. Even so, we know that large speculators and managed funds remain net-long against gold, silver, and copper futures. And with US data continuing to sour and metals rising on the back of weaker yields and US dollar last week, it seems a safe bet to assume their exposure will be more bullish.

Key risk events this week include Jerome Powell’s testimony to the Senate Banking Committee on Tuesday and a CPI report. Should Powell strike a dovish tone and CPI data come in soft, metals could be poised to rally.

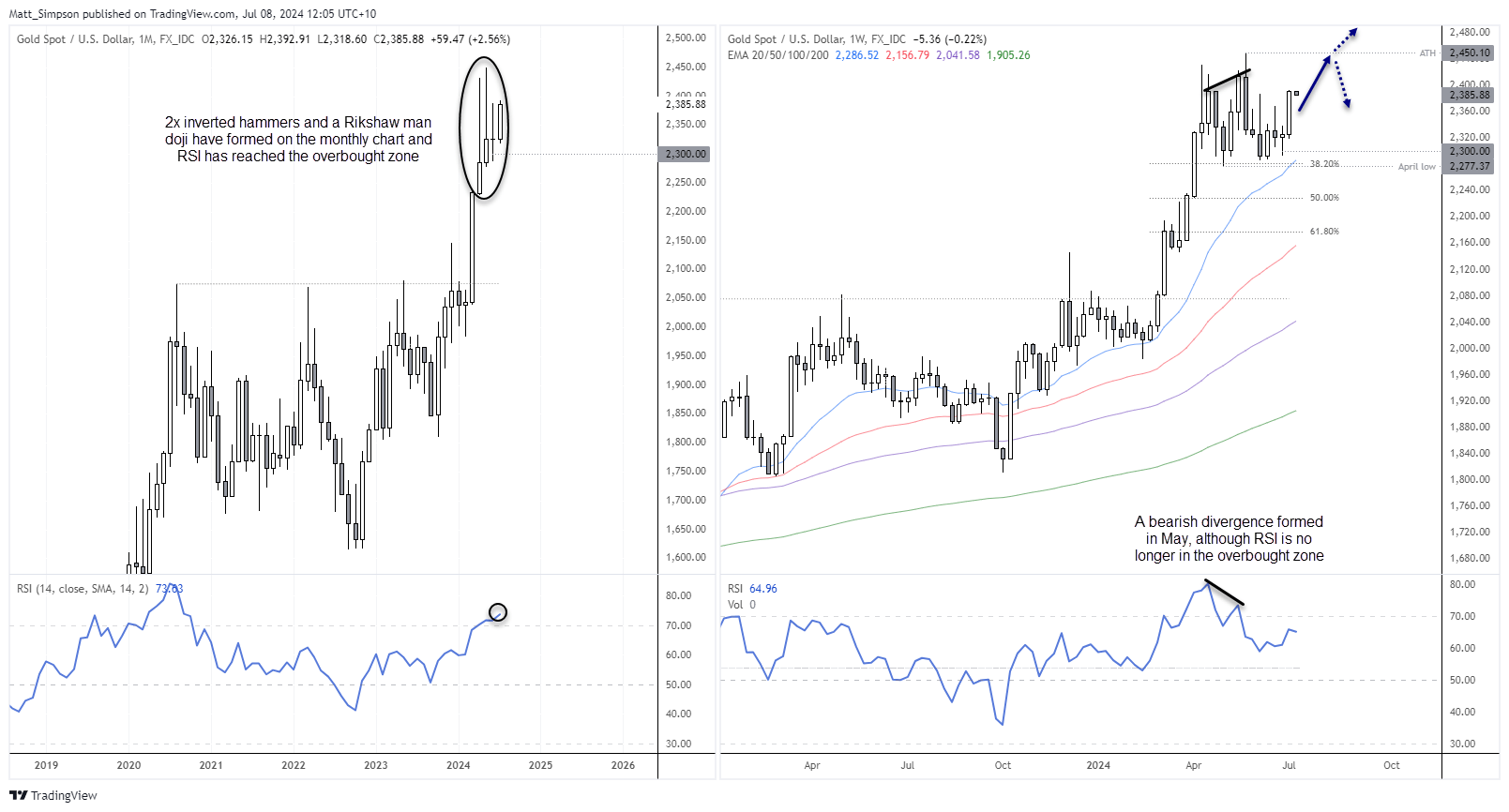

Gold technical analysis

Gold is clearly in a strong uptrend, although there are mixed signals across the monthly and weekly charts. Over the past four months, gold has printed two inverted hammers with large upper wicks and a Rikshaw Man Doji, which was also an inside candle. However, the weekly chart shows that momentum is turning higher after gold repeatedly failed to hold beneath $2300, and it is seemingly looking for a break above $2400 to potentially retest its record high. A bearish divergence formed on the weekly RSI in May, although it is no longer in the overbought zone. Yet the monthly RSI is.

For now, I suspect gold will at least try to retest its record high. But it might require a dovish tone from Jerome Powell when he testifies to the Senate Banking Committee this week alongside softer-than-expected CPI figures to see it smash through $2450 with conviction.

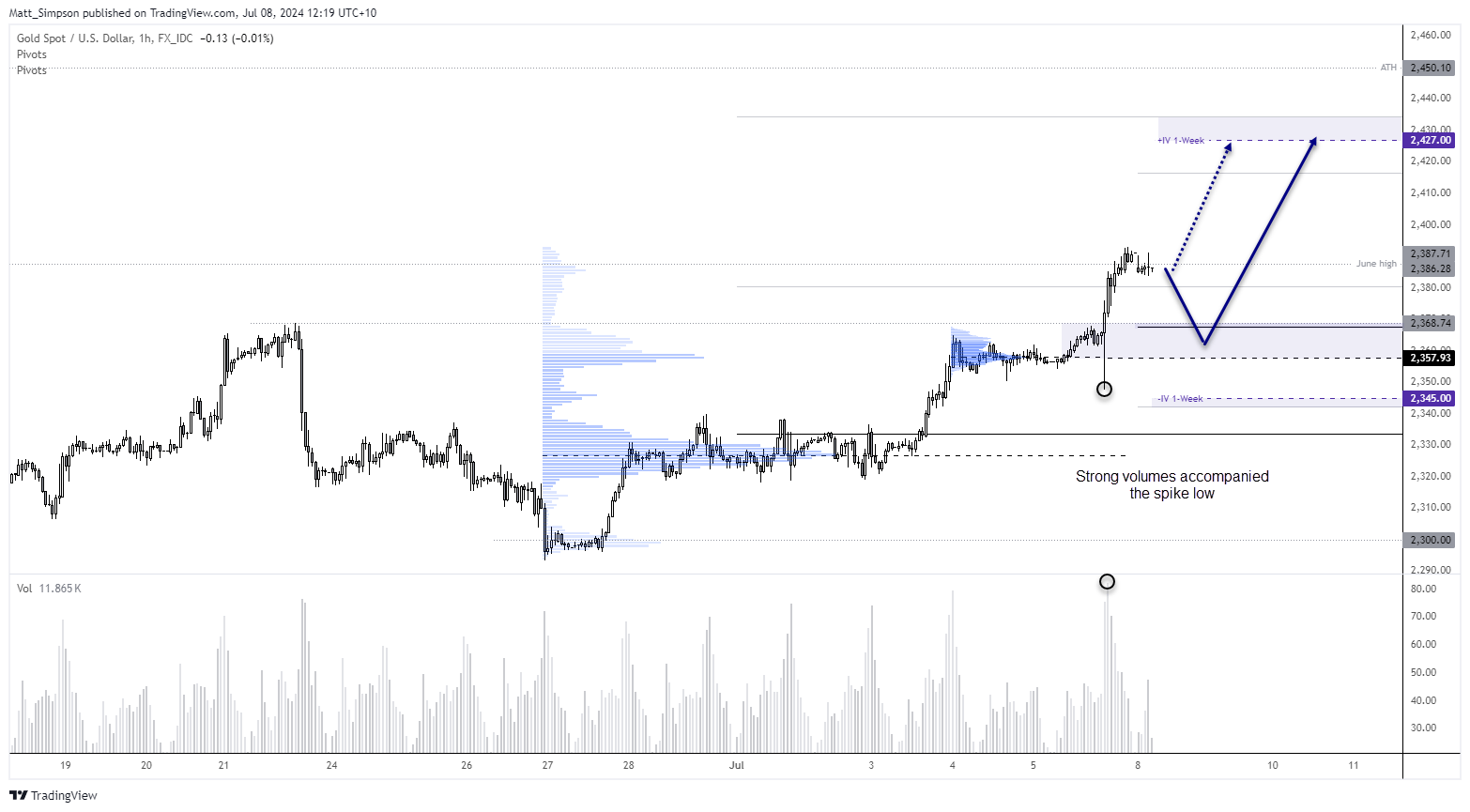

A strong trend has also developed on gold’s 1-hour chart. Friday’s NFP report saw a large lower spike accompanied by high volumes, which suggests strong support around $2350. Prices are trading around the June high, and any retracement towards the weekly pivot point ($2367) or the high-volume node around $2360 could appeal to bullish swing traders.

The 1-week implied volatility band sits at $2345 - $2427. Although we could be looking at a retest of its record high if Powell and CPI data further excite US dollar bears.

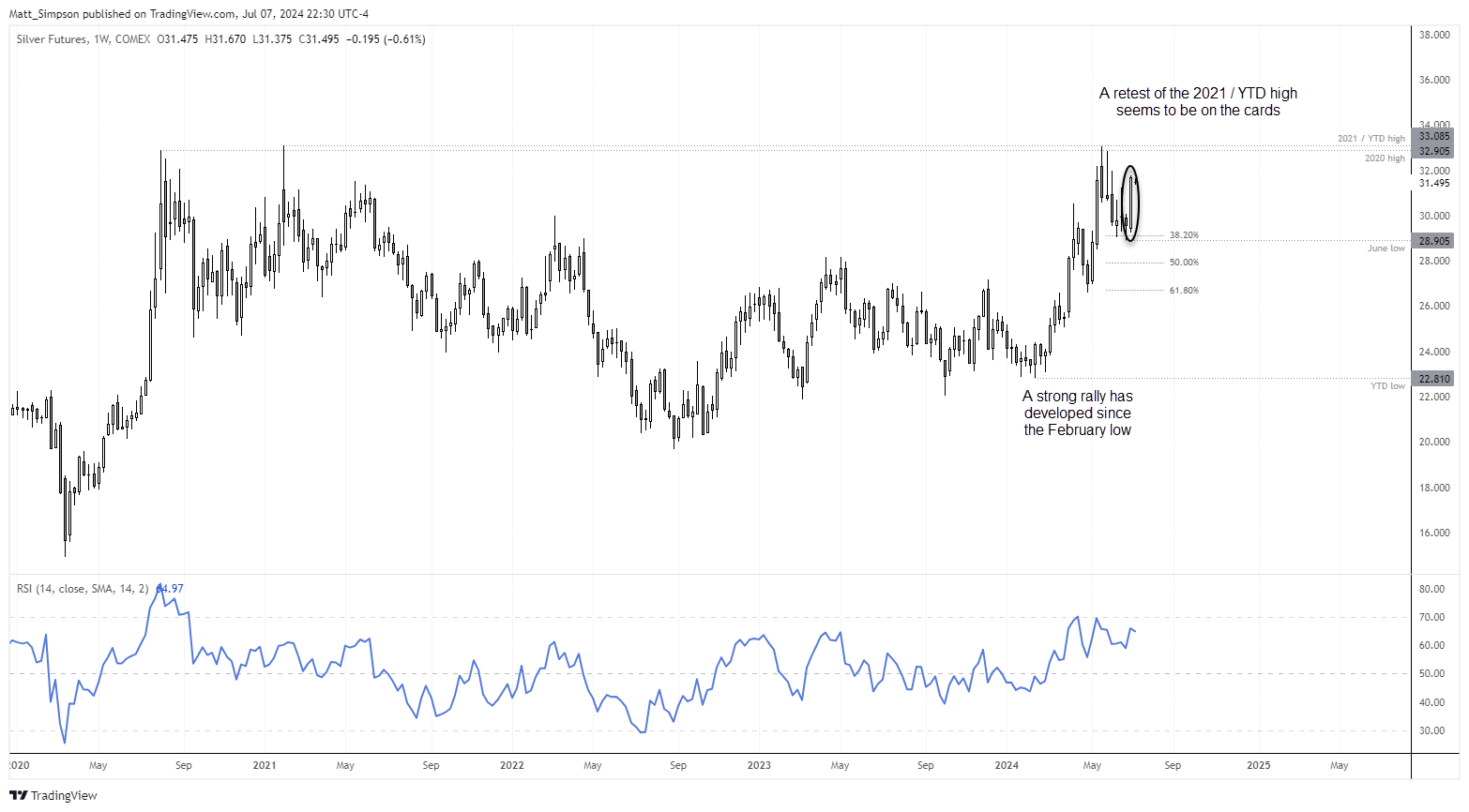

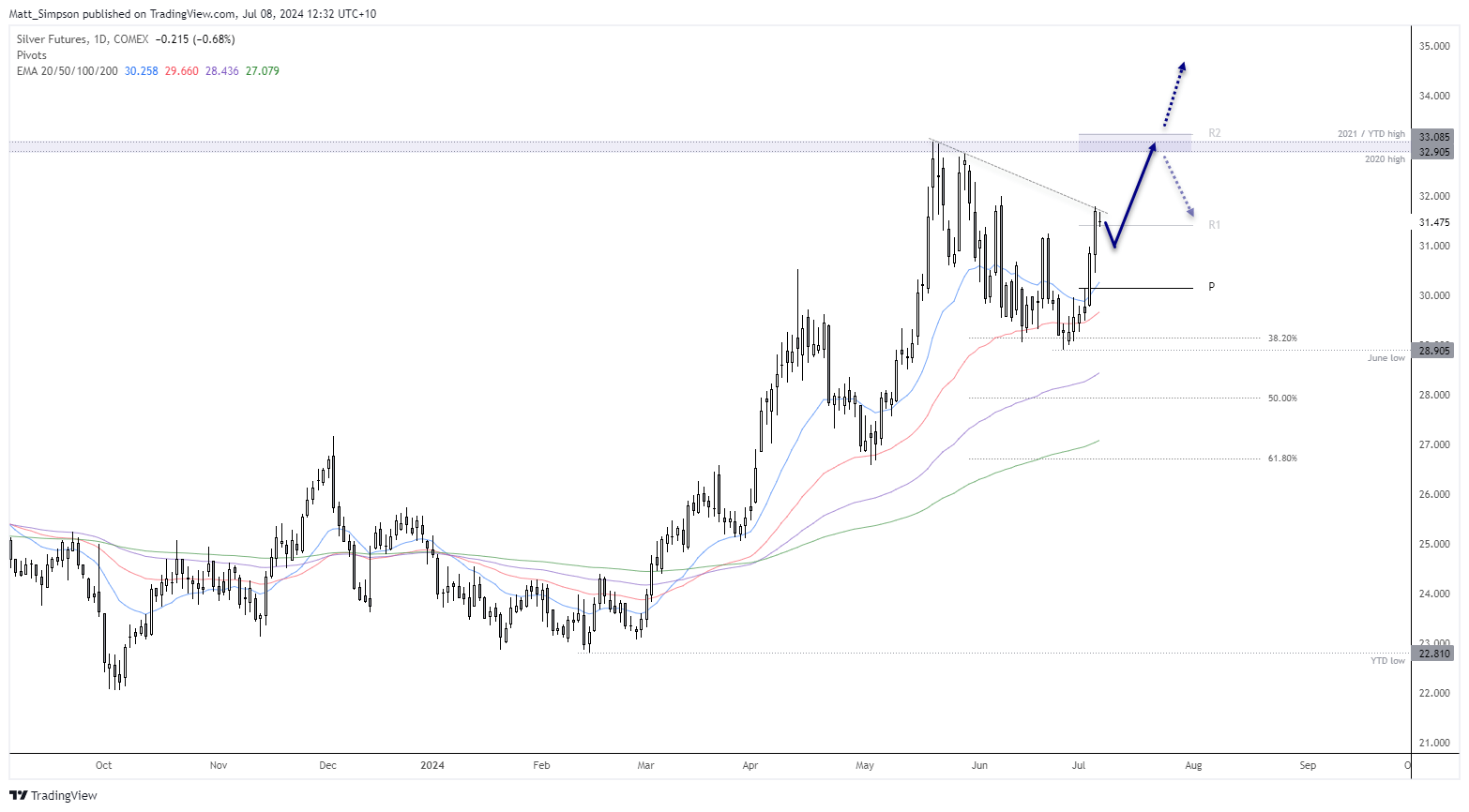

Silver technical analysis:

Silver prices have developed a strong bullish trend since the February low, with last week’s bullish candle suggesting prices will have another crack at breaking above the 2021 and YTD high. RSI is not yet within the overbought zone, and while there is a slight bearish divergence, it is not enough to write off its potential for further gains.

The daily chart shows that bullish momentum has only increased since the June low. Prices cut through the monthly pivot point and $30 handle with ease, although Friday’s high stalled at trend resistance. I use the term ‘trend resistance’ loosely as it is not really a trendline, although the market has taken notice of it. We have a quiet start to the week before risk events kick in, and that leaves the potential for mean reversion lower before the anticipated rise to $33. Whether it can break above that level is likely in the hands of Jerome Powell and incoming CPI data.

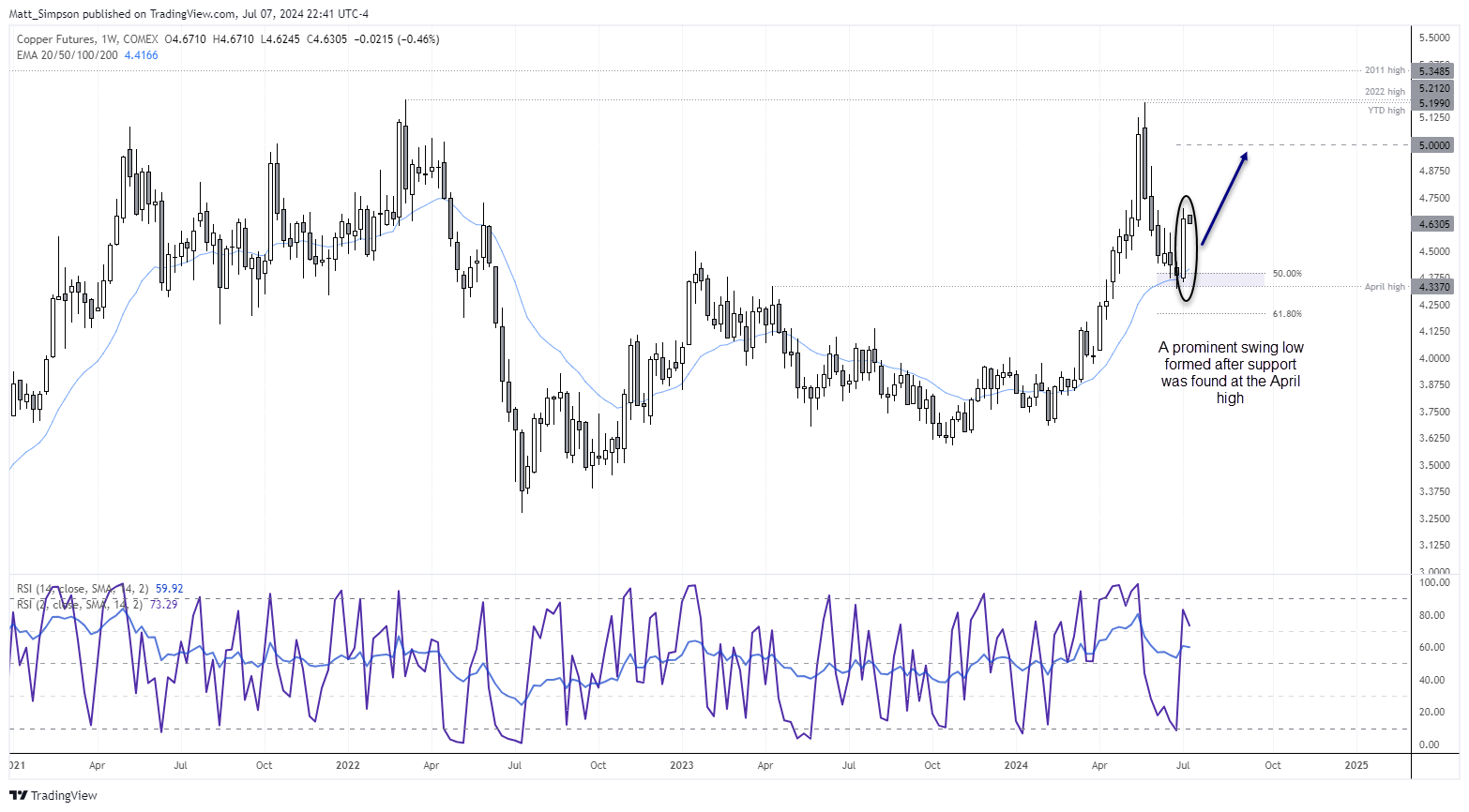

Copper technical analysis:

Between October and May, copper prices rose 44% before handing back around half of those gains during a multi-week retracement. Yet support was found at the April high just as the daily RSI (2) breached the oversold level. The week also closed just above the 20-week EMA, before a swing low was confirmed with the strong bullish candle last week. A move to $5 now appears to be on the cards. But like gold and silver, its ability to break to a new cycle high is likely in the hands of Powell and CPI data.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge