- Gold holds above its 50DMA despite Monday’s sharp pullback

- Silver breaks 50DMA with momentum indicators flashing bearish warnings

- US inflation data looms as the next catalyst for direction

Summary

Gold and silver stumbled out of the blocks this week, with a surging US dollar, elevated bond yields, and renewed hopes for a Middle East peace deal likely contributing to Monday’s sharp falls. Lopsided short-term positioning after a strong start to the year may have amplified the reversal, especially in silver.

Gold, silver slump after strong 2025 start

Both metals enjoyed a strong rally early in 2025, defying the usual drag from a stronger US dollar and rising Treasury yields. Historically, such conditions would be toxic for non-yielding assets priced in dollars. However, concerns over the US inflation outlook may explain gold’s resilience, with bullion showing a modest correlation (~0.7) with US 10-year inflation breakevens and front-month WTI crude oil futures over the past fortnight. While not a perfect relationship, it’s one worth monitoring given recent inflation-linked unease across markets.

Monday’s sell-off brought the bullish run to a screeching halt, with both gold and silver shedding over 1% for the session.

Gold: buying dips favoured despite setback

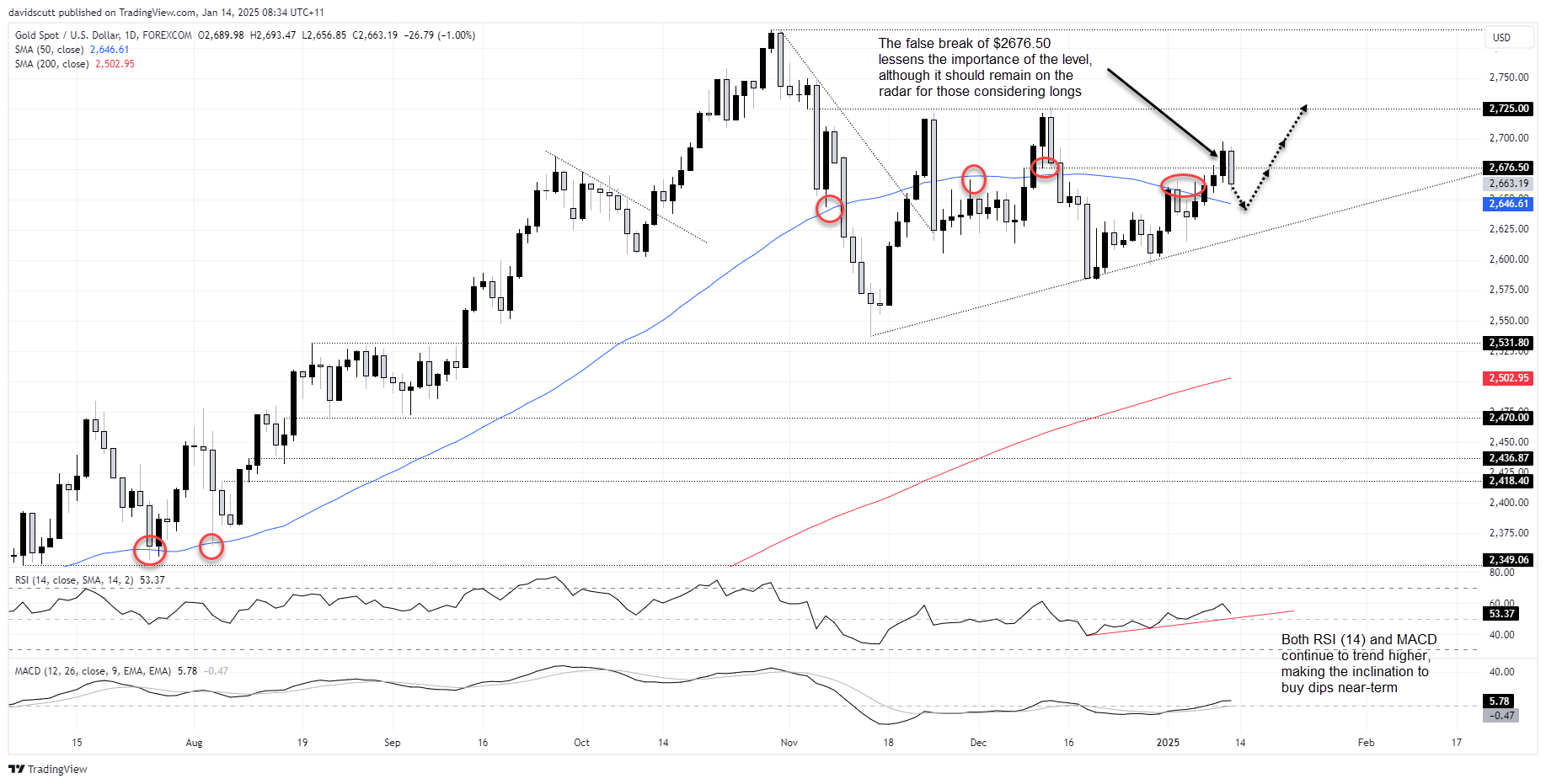

Source: TradingView

The technical picture for gold remains constructive despite the setback. It sits in an established uptrend and continues to trade above the key 50-day moving average, an important level often respected in recent years. RSI (14) and MACD are providing bullish signals, making the inclination to buy dips over selling rallies.

The break above $2676.50 on Friday didn’t stick, and while Monday’s candle is not a bearish engulfing, it would not surprise to see some further near-term weakness as we near key events such as the US inflation report for December on Wednesday.

Given the backdrop, a potential retest of the 50-day moving average should be on the radar for those looking to buy dips. If the price were to bounce off the level it would provide a decent bullish setup, allowing for positions to be established above with a tight stop beneath for protection.

Though the price paid little attention to it on Monday, $2676.50 remains a level of note given it acted as support and resistance on multiple occasions over the turn of the year. Above, Friday’s high around $2698 looms as one potential target with $2725 after that.

If gold were to close beneath the 50-day moving average, it may pay to see if and how the price interacts with the November uptrend when evaluating possible setups.

Silver slammed in ugly reversal

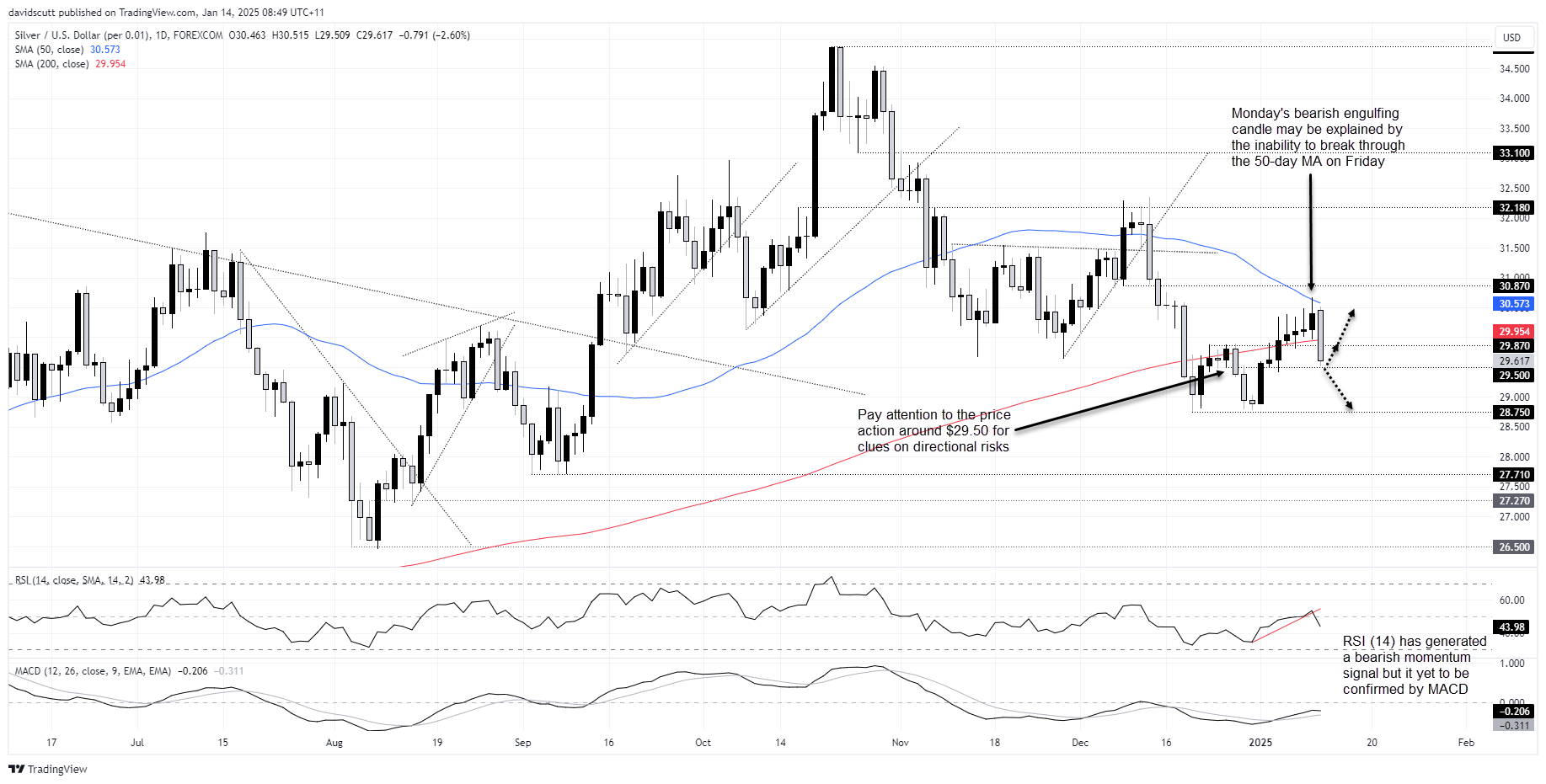

Source: TradingView

The price action in silver has been far more bearish with the sharp pullback delivering a textbook bearish engulfing candle on the daily timeframe, seeing it slide below the 200-day moving average. RSI (14) broke its uptrend with conviction, signalling shifting momentum risks even if not yet confirmed by MACD.

While the technical picture for bulls is dimming near-term, $29.50 is a level to watch considering how much time the price traded either side of it over recent weeks.

If silver were to close beneath this level it would create a bearish setup, allowing for shorts to be established below with a stop above for protection. $28.75 – the low set on December 19 – looms as an initial target.

Alternatively, if the price continues to bounce off $29.50, the setup could be flipped with longs established above with a stop beneath for protection. $29.87 and 200-day moving average are potential initial targets with a break above increasing the risk of a retest of the 50-day moving average.

-- Written by David Scutt

Follow David on Twitter @scutty