Gold Talking Points:

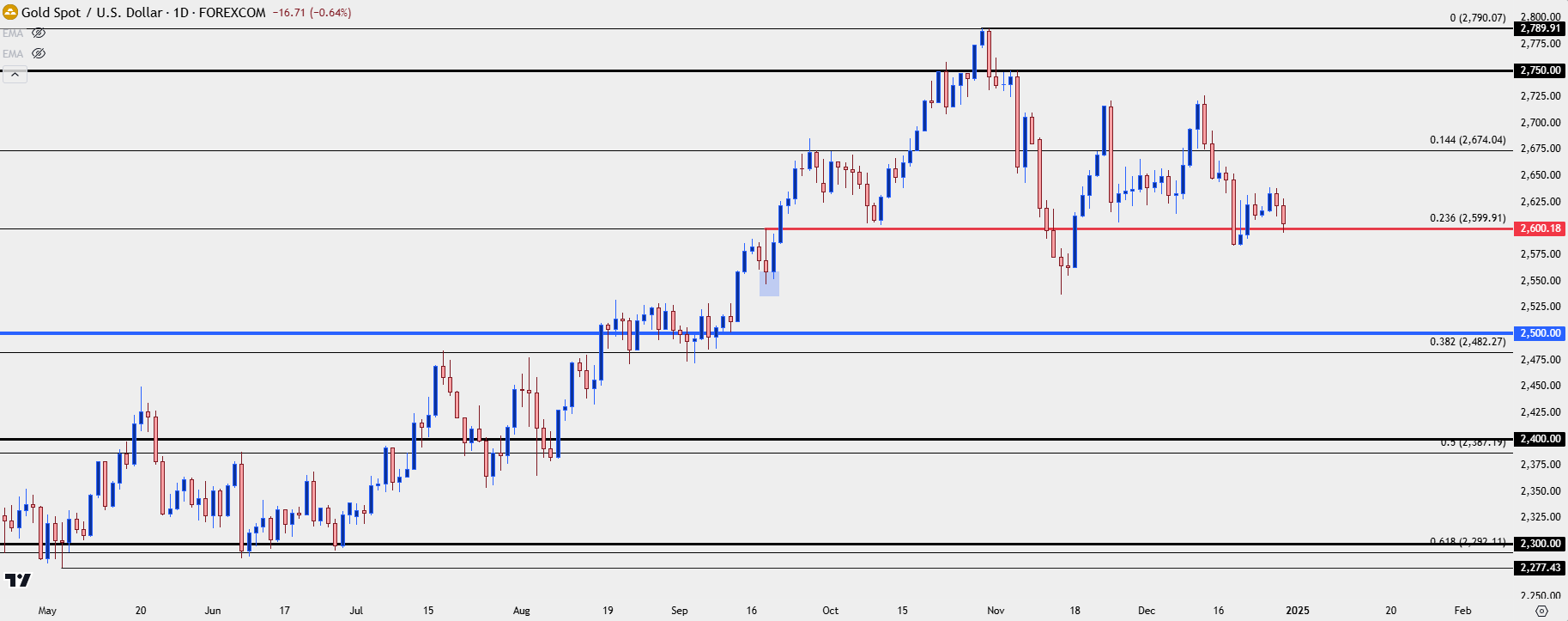

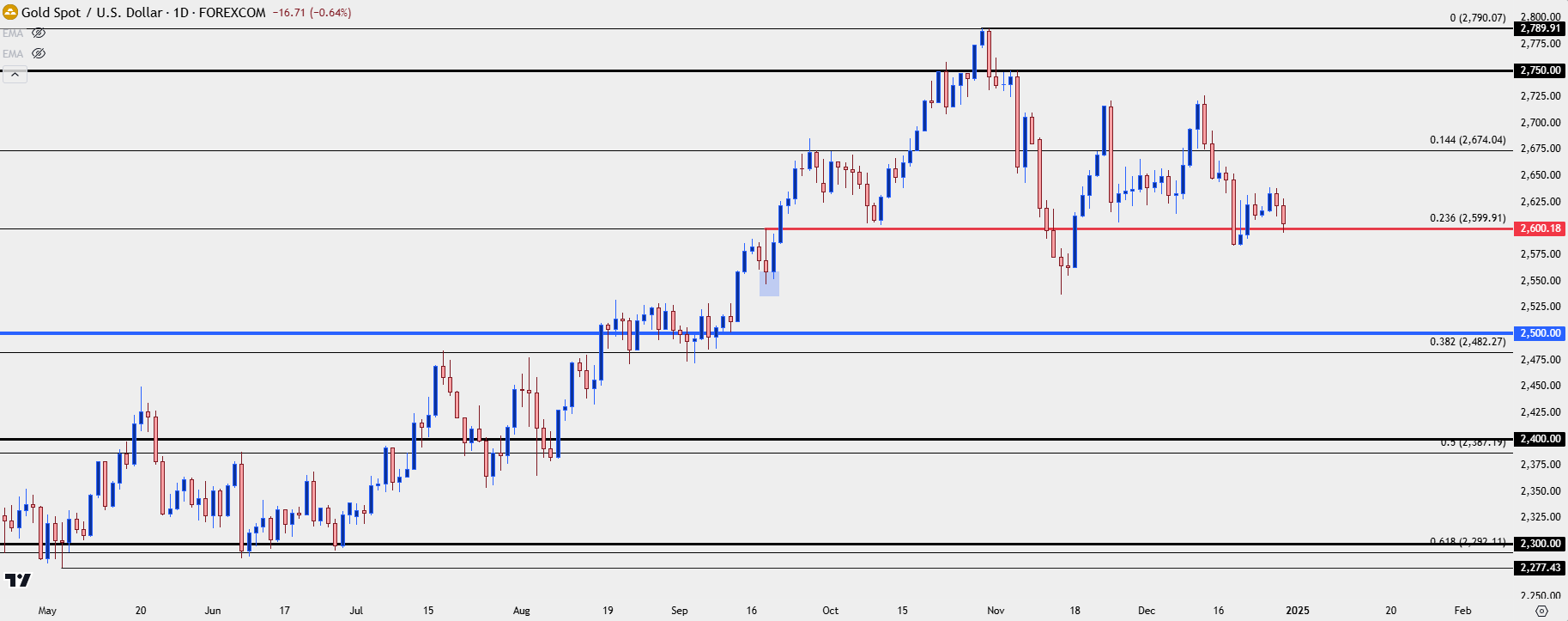

- As of this writing gold price have gained 26.16% in 2024, which would be the strongest yearly performance since 2010 when the metal added 29.39%.

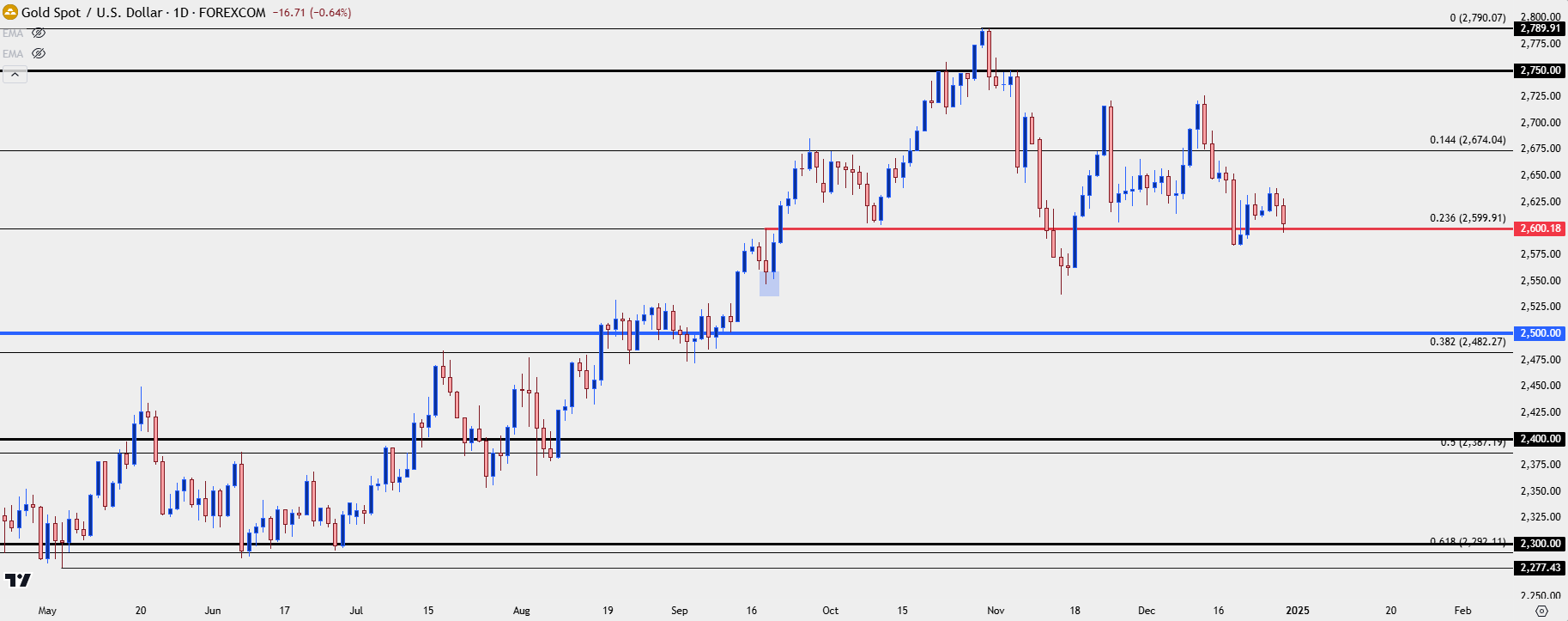

- Much of gold’s strength was concentrated between February and October, with a sizable pullback showing up at the November open which drove a 23.6% retracement of the 2024 bullish trend.

Coming into 2024, gold prices had spent the past three-plus years in a range. The $2,000 level had proven to be a tough nut for bulls to crack going into December of 2023, but there was the early stage of support showing at that prior resistance as the door opened into the New Year.

At the time, the Fed had already started talking up the prospect of rate cuts starting this year, even though inflation data remained high with both CPI reads above 3%. This was centerstage in February, around Valentines Day, as the February 13th CPI release showed yet another above-target CPI print. That was the only day in 2024 that spot gold prices closed below the $2,000/oz level. But, a day later during a television interview, Chicago Fed President Austan Goolsbee opined that markets shouldn’t get ‘flipped out’ about a single inflation print, which helped to stop the bleeding in gold as bulls got back on the bid, driving a trend that continued to run as fresh all-time-highs were formed.

The low from Valentines Day, around when that comment came into the equation, printed at $1,984, leading into a massive 40.61% rally into the October 31st high.

Gold Weekly Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

Gold 2024 Rally as Fed Laid the Groundwork for Rate Cuts

Even as of this writing inflation remains well-elevated above the Fed’s 2% target. And this was a concern as we came into 2024 but it was slowly whittled away throughout the year as Fed-speak leaned largely dovish, all the way until the September rate cut that saw the bank opt for a ‘jumbo’ cut of 50 basis points.

Interestingly, the reaction to that announcement was somewhat counter-intuitive in gold. The initial move in the metal pushed up for the first ever test of $2,600/oz, but that soon dissipated as profit-taking took over and held through the end of that day.

But, bulls returned with gusto later that night and continued driving the trend into the end of Q3 and through the first month of Q4. That same price is what’s helping to set support today as we near the end of 2024 trade.

Gold Daily Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

Gold in Q4: The Trump Retracement

The month of October saw a strong US Dollar come back to life, but that didn’t seem to deter gold bulls too much as the metal continued its climb until, eventually, stalling $10 inside of the $2800/oz level.

But it was around the U.S. Presidential Election that gold finally saw sellers take-over and interestingly, this is a scenario that has some relationship to what showed four years ago when gold prices first started to test the $2,000/oz level.

In the summer of 2020 the Fed was loose and passive, driving markets to fresh highs even as the global economy remained shut down. That helped gold prices to make that initial push in to the $2,000/oz level, which came into play in early-August of 2020. But after only one weekly close above that price, gold began to reverse. At the time, Bitcoin was vying to re-take the $12,000 level and it seems as if that was around the time that demand for anti-fiat venues shifted from gold and to Bitcoin.

That also seems to be similar to what showed after the election of Donald Trump in November, when Bitcoin broke-out from the 70k level and marched all the way to above $100,000. The rationale here is that Trump courted the Bitcoin crowd ahead of his election, and this may carry over into a more friendly stance from regulators into and after his inauguration. In my opinion, this would be a primary risk to the long side of gold going into 2025, and perhaps even higher than the Fed’s softening on rate cuts as inflation remains elevated.

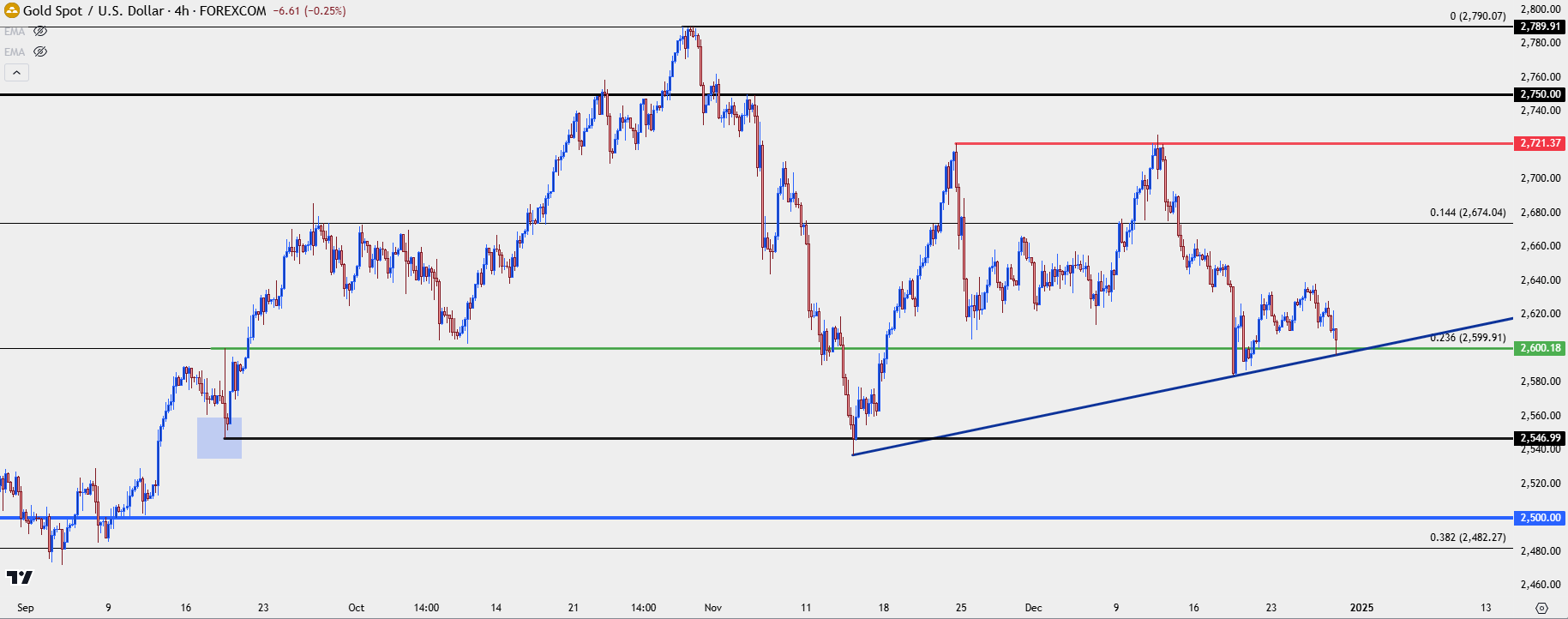

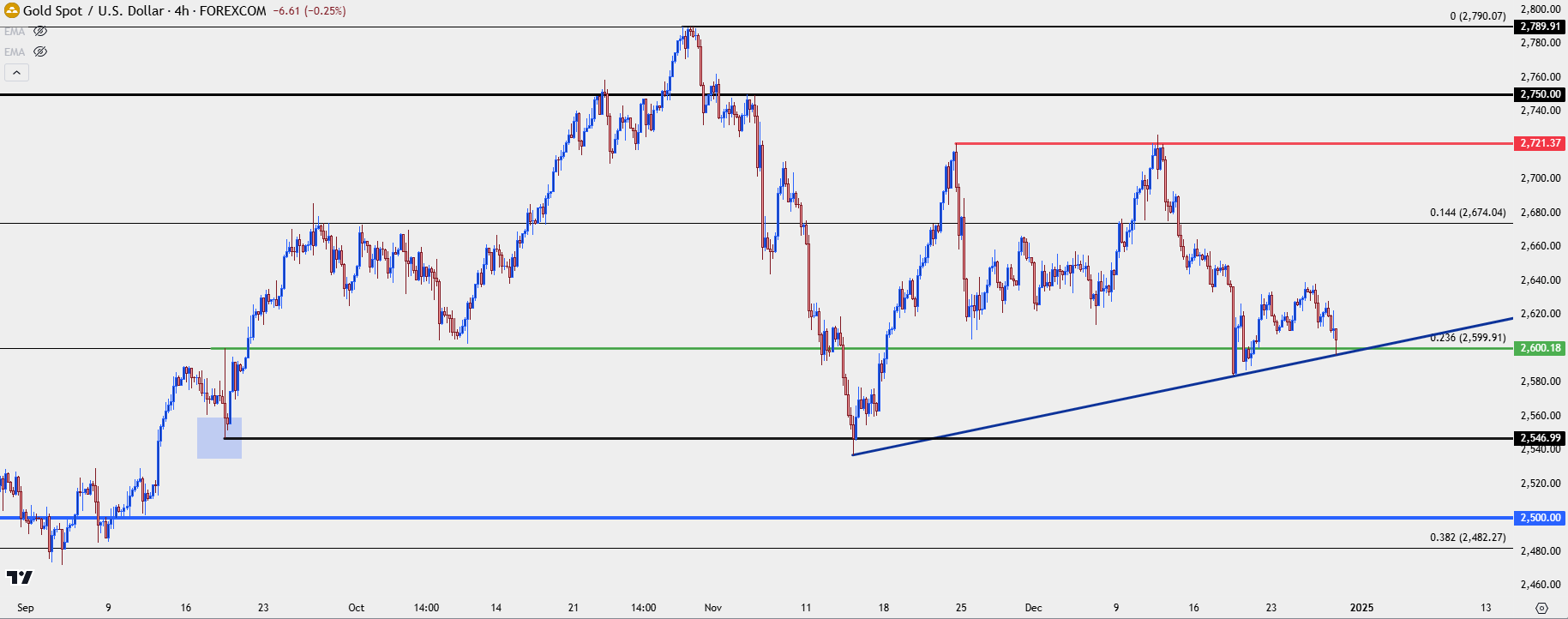

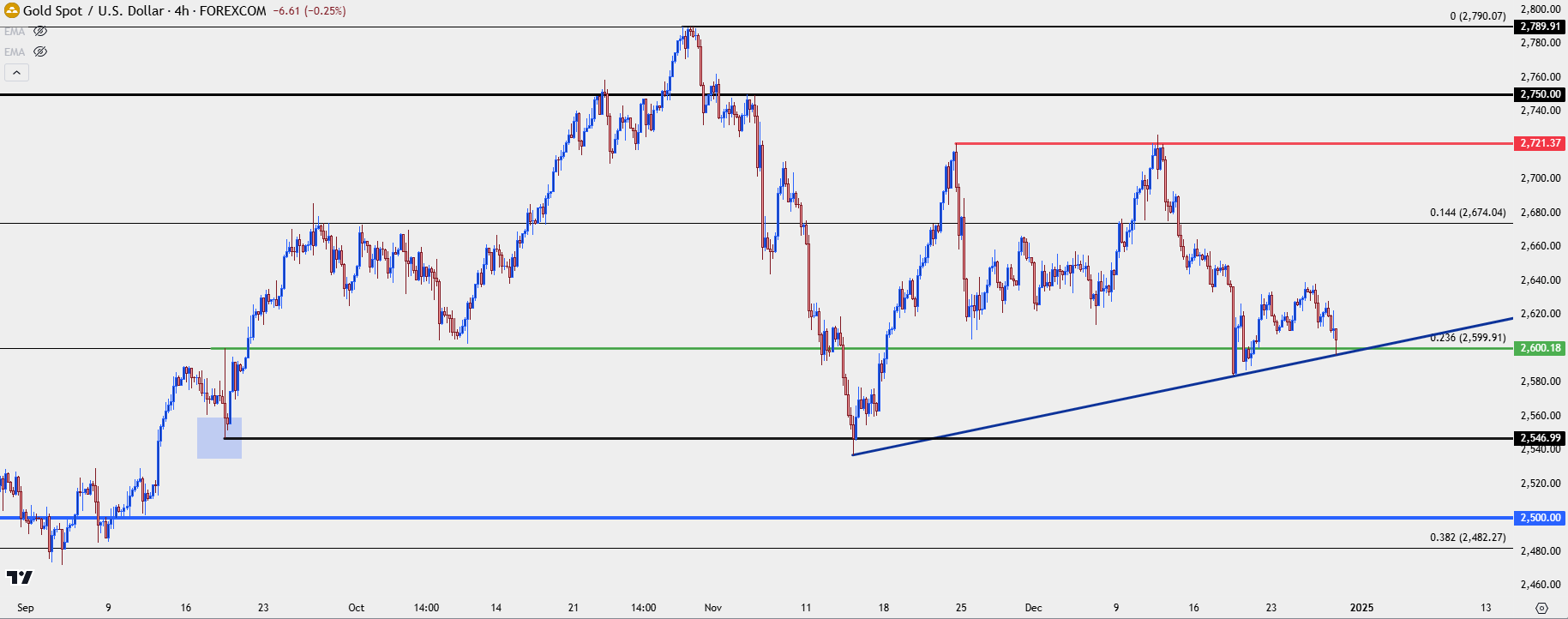

At this stage, there’s still some remaining scope for bulls. There’s an ascending triangle formation that remains of interest on the four-hour chart below, as the $2,600/oz level has held the lows so far today. The $2,721 level of resistance has now held two advances and that provides the horizonal resistance from the formation.

If bulls fail to hold support, the next areas of support on my chart are the $2,547 swing followed by the $2,500 psychological level which was last in-play as support in early-September, before the FOMC’s rate cut.

Gold Four-Hour Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

--- written by James Stanley, Senior Strategist

Gold Talking Points:

- As of this writing gold price have gained 26.16% in 2024, which would be the strongest yearly performance since 2010 when the metal added 29.39%.

- Much of gold’s strength was concentrated between February and October, with a sizable pullback showing up at the November open which drove a 23.6% retracement of the 2024 bullish trend.

GOLD AD

Coming into 2024, gold prices had spent the past three-plus years in a range. The $2,000 level had proven to be a tough nut for bulls to crack going into December of 2023, but there was the early stage of support showing at that prior resistance as the door opened into the New Year.

At the time, the Fed had already started talking up the prospect of rate cuts starting this year, even though inflation data remained high with both CPI reads above 3%. This was centerstage in February, around Valentines Day, as the February 13th CPI release showed yet another above-target CPI print. That was the only day in 2024 that spot gold prices closed below the $2,000/oz level. But, a day later during a television interview, Chicago Fed President Austan Goolsbee opined that markets shouldn’t get ‘flipped out’ about a single inflation print, which helped to stop the bleeding in gold as bulls got back on the bid, driving a trend that continued to run as fresh all-time-highs were formed.

The low from Valentines Day, around when that comment came into the equation, printed at $1,984, leading into a massive 40.61% rally into the October 31st high.

Gold Weekly Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

Gold 2024 Rally as Fed Laid the Groundwork for Rate Cuts

Even as of this writing inflation remains well-elevated above the Fed’s 2% target. And this was a concern as we came into 2024 but it was slowly whittled away throughout the year as Fed-speak leaned largely dovish, all the way until the September rate cut that saw the bank opt for a ‘jumbo’ cut of 50 basis points.

Interestingly, the reaction to that announcement was somewhat counter-intuitive in gold. The initial move in the metal pushed up for the first ever test of $2,600/oz, but that soon dissipated as profit-taking took over and held through the end of that day.

But, bulls returned with gusto later that night and continued driving the trend into the end of Q3 and through the first month of Q4. That same price is what’s helping to set support today as we near the end of 2024 trade.

Gold Daily Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

Gold in Q4: The Trump Retracement

The month of October saw a strong US Dollar come back to life, but that didn’t seem to deter gold bulls too much as the metal continued its climb until, eventually, stalling $10 inside of the $2800/oz level.

But it was around the U.S. Presidential Election that gold finally saw sellers take-over and interestingly, this is a scenario that has some relationship to what showed four years ago when gold prices first started to test the $2,000/oz level.

In the summer of 2020 the Fed was loose and passive, driving markets to fresh highs even as the global economy remained shut down. That helped gold prices to make that initial push in to the $2,000/oz level, which came into play in early-August of 2020. But after only one weekly close above that price, gold began to reverse. At the time, Bitcoin was vying to re-take the $12,000 level and it seems as if that was around the time that demand for anti-fiat venues shifted from gold and to Bitcoin.

That also seems to be similar to what showed after the election of Donald Trump in November, when Bitcoin broke-out from the 70k level and marched all the way to above $100,000. The rationale here is that Trump courted the Bitcoin crowd ahead of his election, and this may carry over into a more friendly stance from regulators into and after his inauguration. In my opinion, this would be a primary risk to the long side of gold going into 2025, and perhaps even higher than the Fed’s softening on rate cuts as inflation remains elevated.

At this stage, there’s still some remaining scope for bulls. There’s an ascending triangle formation that remains of interest on the four-hour chart below, as the $2,600/oz level has held the lows so far today. The $2,721 level of resistance has now held two advances and that provides the horizonal resistance from the formation.

If bulls fail to hold support, the next areas of support on my chart are the $2,547 swing followed by the $2,500 psychological level which was last in-play as support in early-September, before the FOMC’s rate cut.

Gold Four-Hour Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

--- written by James Stanley, Senior Strategist

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview