Gold Talking Points:

- It was a strong outing in 2024 for gold as the metal showed its largest annual gain since 2010, discussed in last week’s article with additional detail.

- Since setting a high in late-October, gold prices have been digesting and consolidating and it’s taken on the form of a symmetrical triangle formation.

- Within that formation, price is testing support at prior short-term resistance. Below today’s low, it’s the $2,600 level that stands out as important, discussed further below.

- I look at gold in-depth during each weekly webinar on Tuesday. You’re welcome to join: Click here for registration information.

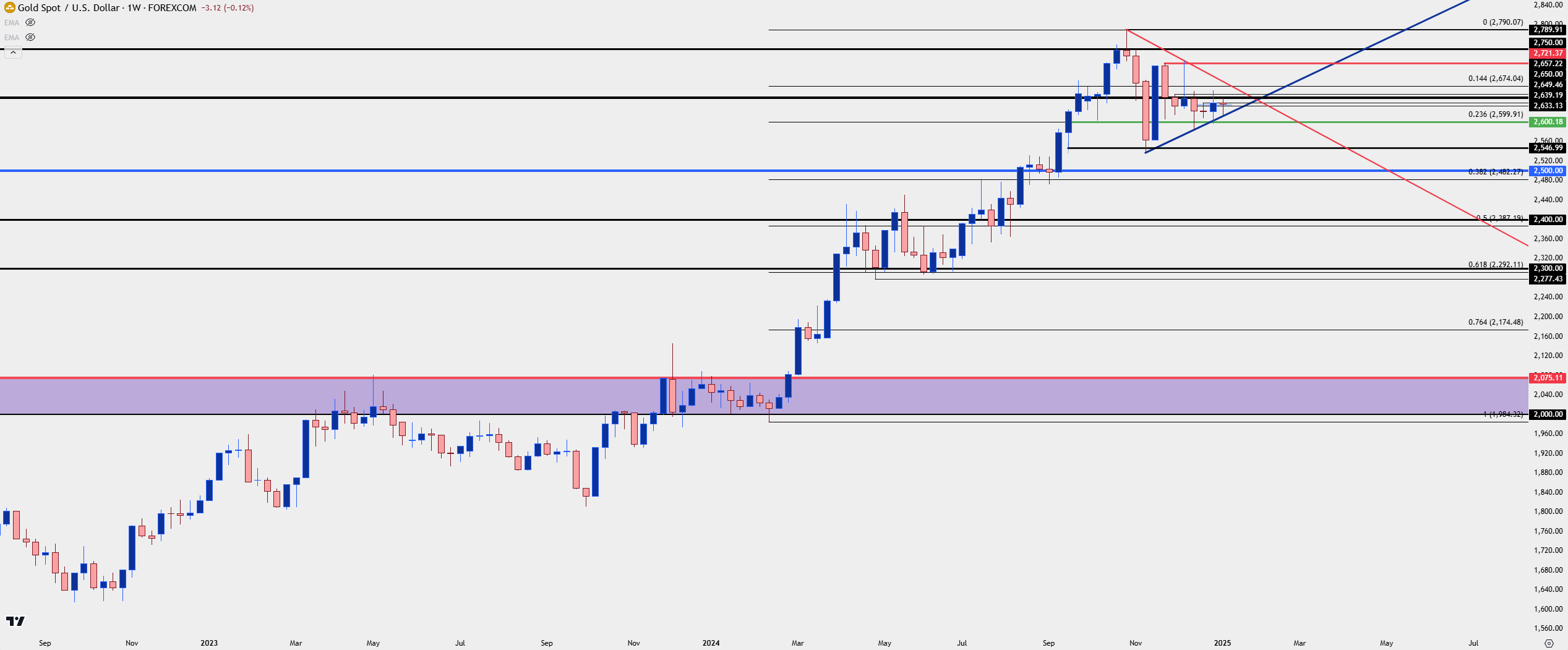

The slowing of volatility in gold has been noticeable of late and that’s particularly true if looking at the weekly chart. After a ripping up-trend started in Q1 of last year and ran clearly through the Q4 open, the past two months and a week have been less enthusiastic for bulls. But this doesn’t necessarily mean that buyers are finished as the symmetrical triangle on the below chart, when combined with the bullish trend that pushed into that formation, can be argued as a bull pennant formation. Such formations are common as an illustration of consolidation after a strong bullish move, as a combination of profit taking from prior longs and late-stage bullish press from buyers trying to bid support on pullbacks can lead to a narrowing in price action, such as we’ve seen since both the late-October and mid-November inflection points.

Normally, bull pennants are approached with aim of topside continuation. I look at the formations more neutrally, however, as prolonged consolidation doesn’t always carry the prior bias. But given the build of higher-lows after a move that priced in as much as a 40.6% gain last year, bulls can’t yet be counted out.

Gold Weekly Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

Gold Shorter-Term

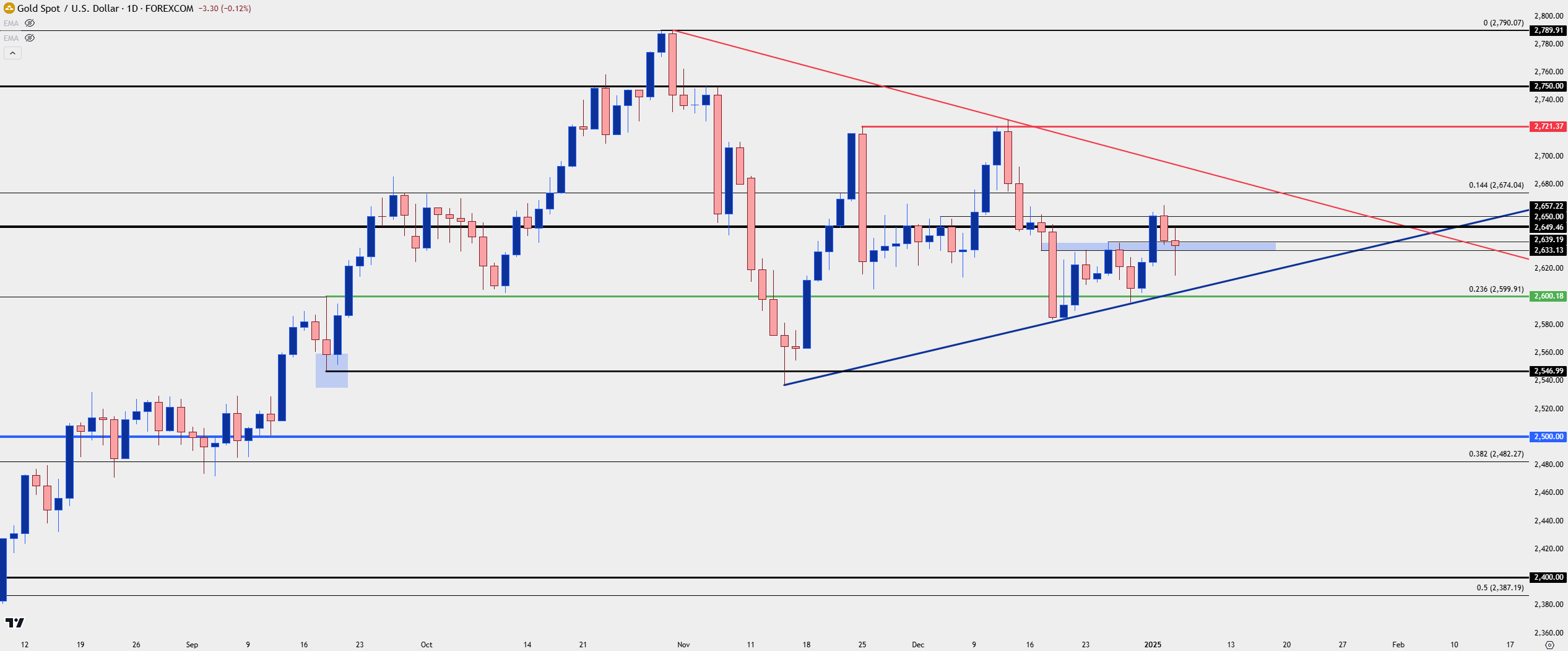

The 2721 level was a big spot for gold last year, helping to set swing highs in both late-November and then in December. That second inflection led to a higher-low along with a test below $2600, which then held the lows last week to allow for yet another higher-low, further substantiating the support trendline making up the triangle formation.

The bounce from the $2600 support test led to a short-term higher-high, and the pullback from that appears to be grasping to retain support around prior resistance from the $2633-$2639 zone.

This could be construed as a bullish short-term bias but it’s important to qualify that this is all taking place inside of the longer-term or bigger picture consolidation of the symmetrical triangle.

Gold Daily Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

Gold Even Shorter-Term

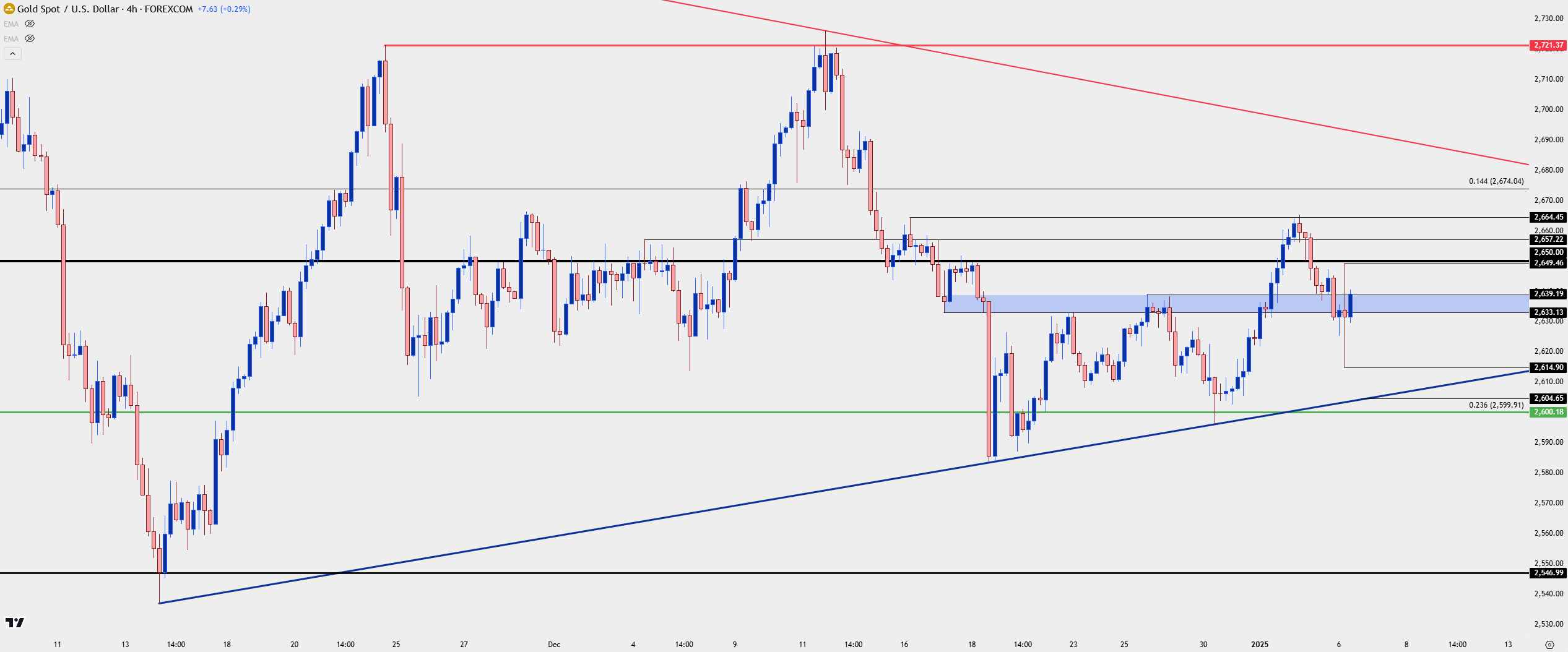

From the four-hour we can see a busy start to the week for gold prices and the most recently completed four-hour candle printed as a long-legged doji. This provides some scope of shorter-term support and resistance levels, as it was the 2650 level that seemed to deter bulls earlier in the morning, after which prices dipped down to just below 2615.

A breach of either of those prices could be construed as a short-term directional move; and for deeper support, there’s the trendline projection currently plotted around $2604, after which the $2600 level comes into the picture. For topside, a breach of $2650 opens the door for re-test of $2657, after which last week’s high comes into the picture at $2664 and that’s followed by the Fibonacci level at $2674.

Gold Four-Hour Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

--- written by James Stanley, Senior Strategist