Gold Price Outlook

The price of gold breaks out of the March range to register a fresh yearly high ($2032), and bullion may attempt to test the 2020 high ($2075) as the Relative Strength Index (RSI) flirts with overbought territory.

Gold price forecast: RSI flirts with overbought territory

The price of gold extends the series of higher highs and lows from the start of the week as the ADP employment report shows a 145K rise in private payrolls versus forecasts for a 200K print, and signs of a slowing economy may keep the precious metal afloat amid the renewed weakness in US Treasury yields.

Speculation surrounding the monetary policy outlook may continue to sway the price of gold as the Federal Reserve alters its forward guidance, and it remains to be seen if the central bank will switch gears over the coming months in an effort to avoid a recession.

Join David Song for the Weekly Fundamental Market Outlook webinar. Register Here

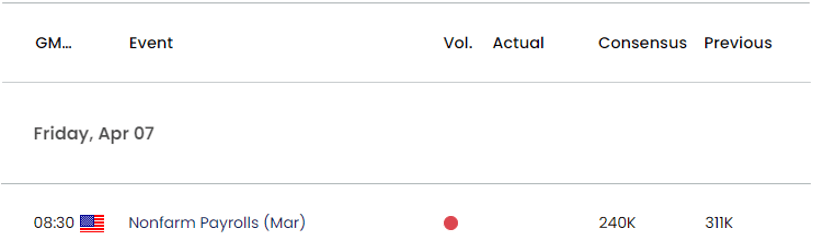

Nevertheless, the update to the Non-Farm Payrolls (NFP) report is anticipated to show the economy adding 240K rise in March, and a positive development may drag on the price of gold as it raises the Fed’s scope to carry out a more restrictive policy.

At the same time, a weaker-than-expected NFP print may produce a bullish reaction in bullion as it puts pressure on the Federal Open Market Committee (FOMC) to adjust the course for monetary policy, and expectations for an imminent change in regime may prop up the price of gold as market participants prepare for lower US interest rates.

With that said, the price of gold may attempt to test the 2020 high ($2075) as the Relative Strength Index (RSI) flirts with overbought territory, but the oscillator may diverge with price if it struggles to push above 70.

Gold Price Chart – XAU/USD Daily

Chart Prepared by David Song, Strategist; Gold Price on TradingView

- The price of gold clears the March high ($2010) to register a fresh yearly high ($2032), with the precious metal, and the recent series of higher highs and lows may lead to a test of the 2020 high ($2075) as the Relative Strength Index (RSI) flirts with overbought territory.

- A move above 70 in the RSI is likely to be accompanied by higher gold prices like the behavior seen earlier this year, but the oscillator may diverge with price if it fails to push into overbought territory.

- Lack of momentum to hold above the $2018 (61.8% Fibonacci extension) to $2020 (78.6% Fibonacci extension) region may push the price of gold back towards the $1973 (78.6% Fibonacci retracement) to $1977 (50% Fibonacci extension) area, with the next zone of interest coming in around $1928 (23.6% Fibonacci retracement) to $1937 (38.2% Fibonacci extension).

--- Written by David Song, Strategist

Follow me on Twitter at @DavidJSong