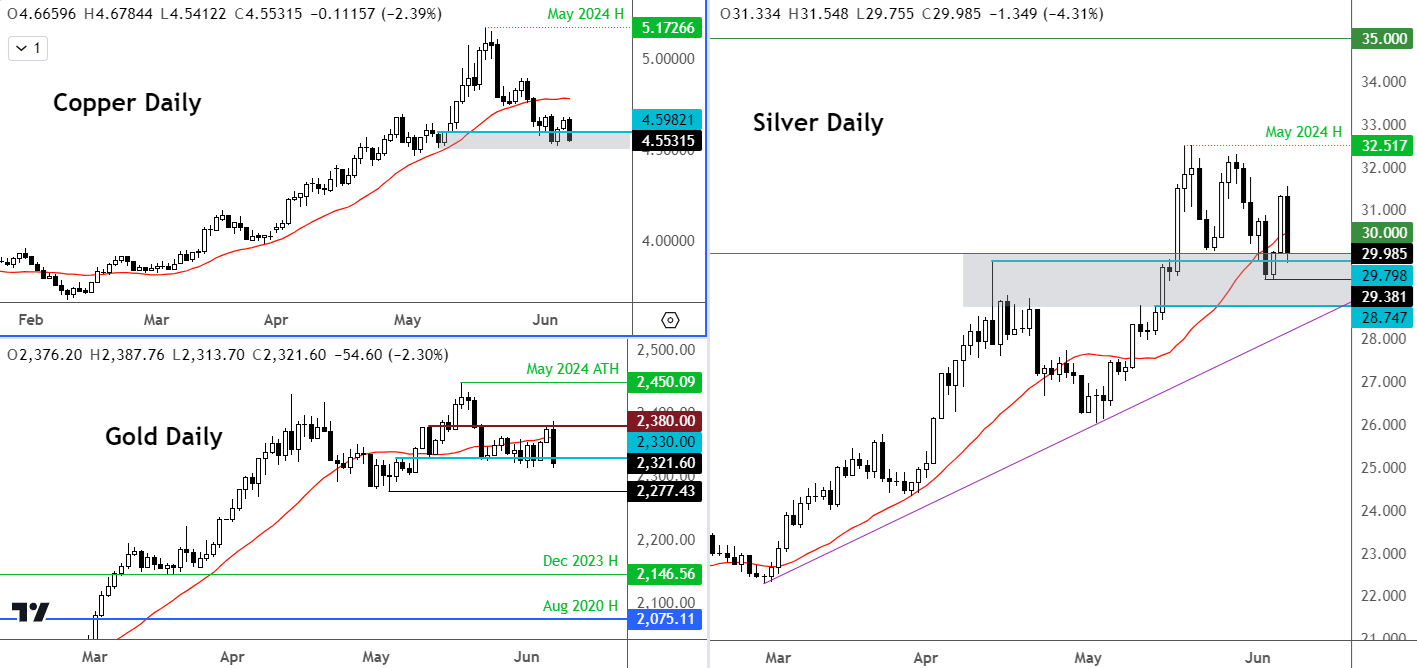

Metals prices have fallen sharply in the first half of Friday’s session, with gold, silver, copper, nickel, platinum and palladium all easing back. In part, the weakness was driven by concerns that Chinese demand for industrial metals is not as high as the market had anticipated amid the drive towards greener energy, with stockpiles of copper surging. As far as gold is concerned, well one of the reasons why it has been rising so sharply in recent months have been due to the People’s Bank of China’s massive buying spree. In May, however, the Chinese central bank didn’t add any more gold to its reserves, ending a run of 18 months that had helped helped push the precious metal to repeated all-time highs. Traders were also holding back ahead of the US jobs report for May, and next week’s release of US CPI and the FOMC rate decision. The headline non-farm payrolls data was much stronger compared to expectations and wages also grew at a stronger pace. The data suggests jobs market is not cooling as fast as indicated by other labour market data released earlier in the week. All told, however, gold’s long-term forecast remains positive despite the recent struggles, even if prices were to weaken further in the short-term outlook.

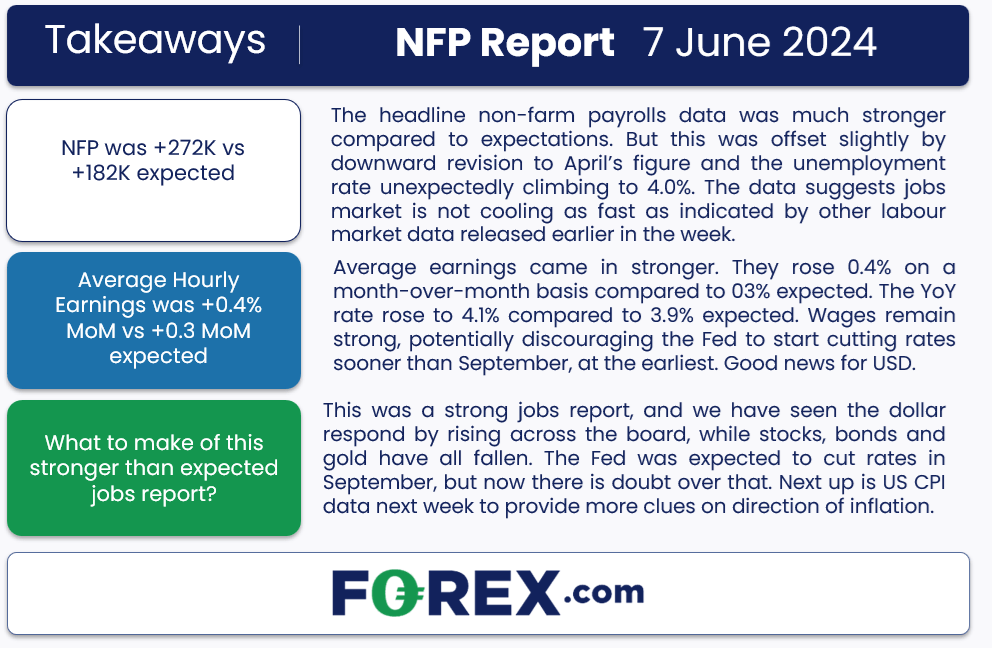

NFP comes in super-hot

Gold forecast: China breaks 18-month gold buying spree

The main factor weighing on gold prices today was news that China has broken its 18-month buying spree for the first time in May. The PBOC’s gold reserves stayed at 72.8 million troy ounces in May, although this not to say they won’t be buying any more gold moving forward. It is likely that record prices have put them off for now. As long as they don’t sell their reserves, this shouldn’t cause too much damage in so far as gold prices are concerned.

Copper forecast: Stockpiles surge in China

Metal prices have also taken note of China's copper inventories swelling right when they should be shrinking rapidly, raising red flags about demand in the world's largest market. Last week, the stockpiles in Shanghai Futures Exchange warehouses were sitting above 300,000 tons. Apparently, this is the highest ever for the end of May. Usually, copper inventories in China peak in March and then drop as factories increase production heading into summer months. But this hasn’t been the case this time, suggesting demand from Chinese processors appears to be lacklustre. China’s economy has been plagued by a prolonged housing crisis, which, despite various government measures, still remain a concern. If copper inventories do not start to fall rapidly soon, then concerns would rise further and may impact prices more meaningfully given that global sentiment on copper has been so bullish, with prices recently hitting an all-time high above $11,000 a ton due to fears of a shortage.

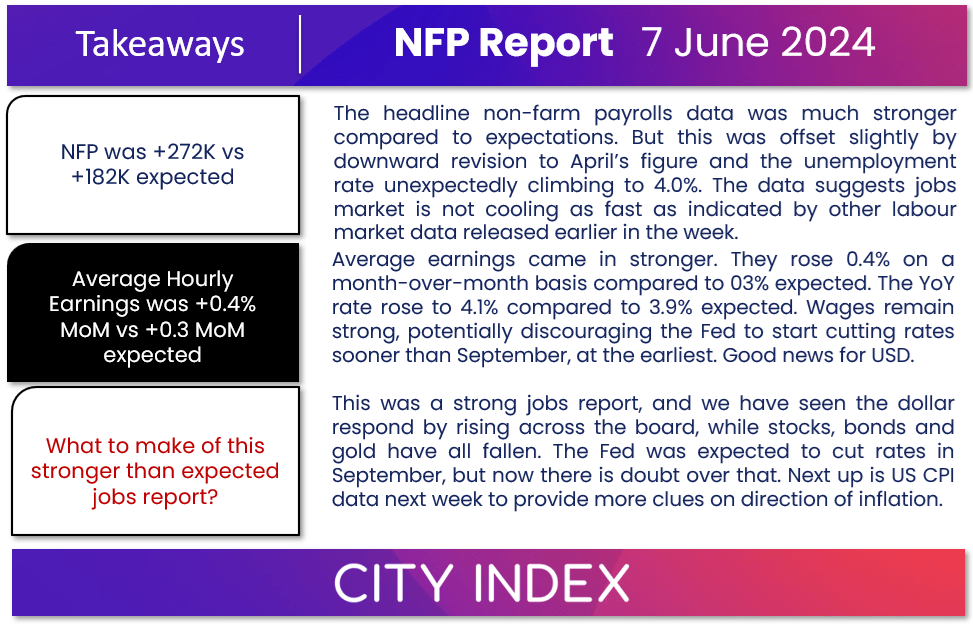

“Higher for longer” narrative fears haven’t gone away

Gold and silver’s price action in recent times have been mixed, with repeated recovery attempts being met with supply. So, precious metals have struggled to hold onto gains. As well as concerns about China, fears over the "higher for longer" narrative haven’t gone away completely despite a few US data pointers coming in sharply below forecasts. Still, the macro outlook remains bullish on gold and silver, and after a bit of consolidation, I am expecting the bull trend to resume, especially on silver with the white metal testing and hold above the upper end of it prior resistance at just below $30.

US CPI and FOMC among key macro highlights next week

The week has been a busy one with lots of key data releases and a few central bank meetings taking place already. But the key highlight of the week was the May non-farm jobs report, which, as mentioned, came in much higher, to provide additional pressure on metals.

The Fed has indicated it is willing to wait until the summer ends before potentially cutting interest rates. Friday’s jobs report and wages data should provide further clues on that front, as too will next week’s CPI release.

A run of below-forecast US data has helped to weigh on bond yields, although this hasn’t benefited gold much yet.

Gold and silver forecast: metals remain in dip-buying mode

With many investors who missed out on the recent surge in gold prices, they are now monitoring for chances to purchase during price dips. Advocates for precious metals emphasise their recent resilience in the face of a strong dollar and rising bond yields. They contend that with prices no longer excessively inflated, the upward trajectory could continue, especially considering the metals’ underlying factors like ongoing central bank acquisitions of gold and the role of precious metals as an inflation hedge. Following years excessive inflation, fiat currencies have significantly depreciated, prompting investors to view precious metals as a dependable safeguard against inflation.

Source: TradingView.com

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R