GBP/USD rises after UK inflation cools

- UK CPI falls to 2.5% YoY from 2.6%

- Service sector inflation falls to 4.4% from 5%

- Rate cut expectations rise 12 basis points

- GBP/USD inches higher

GBP/USD is edging higher after cooler-than-expected inflation helped pull gilt yields lower

UK CPI unexpectedly fell to 2.5% YoY in December, down from 2.6% and below forecasts of 2.7%. Meanwhile, service sector inflation, which the Bank of England is watching closely, cooled by more than expected to 4.4%, well below the 4.8% predicted and down from 5% in November. Sticky service sector inflation has hindered the BoE from cutting interest rates further.

Following the data the market has ramped up BoE rate cut expectations, adding 12 basis points to bets for 2025 cuts, which are now seen at 49 basis points across the year. This is still short of the central bank’s forecast for 4 rate cuts this year.

Usually, with rising rate cut expectations, the pound would fall. However, today's data has also pulled guilty yields sharply lower, dropping by around 9 basis points on the 2-year bond, the most sensitive to Bank of England policy, which is helping to support the pound.

The data is a step in the right direction but it doesn't mean that the UK is out of the woods just yet, particularly given that a recent survey by the British Retail Consortium shows that 2/3 of retailers will raise prices in response to higher employer Social Security costs from the budget which bodes poorly for progress in disinflation outlook. Meanwhile, the same survey of chief financial officers and finance directors at 52 major retailers found that around half plan to reduce staff hours and headcount.

There are also growing worries about UK growth, which has been on a downward trajectory since labour came to power in July. This, combined with the prospect of sticky inflation, means a stagflationary outlook is a very real problem. UK GDP data is due tomorrow and will provide further clues about the health of the UK economy.

Attention also turns to the US CPI, which is due later today and is expected to rise to 2.9% from 2.7%. What inflation could further dampen rate cut expectations, boosting the USD and pulling GBP USD lower?

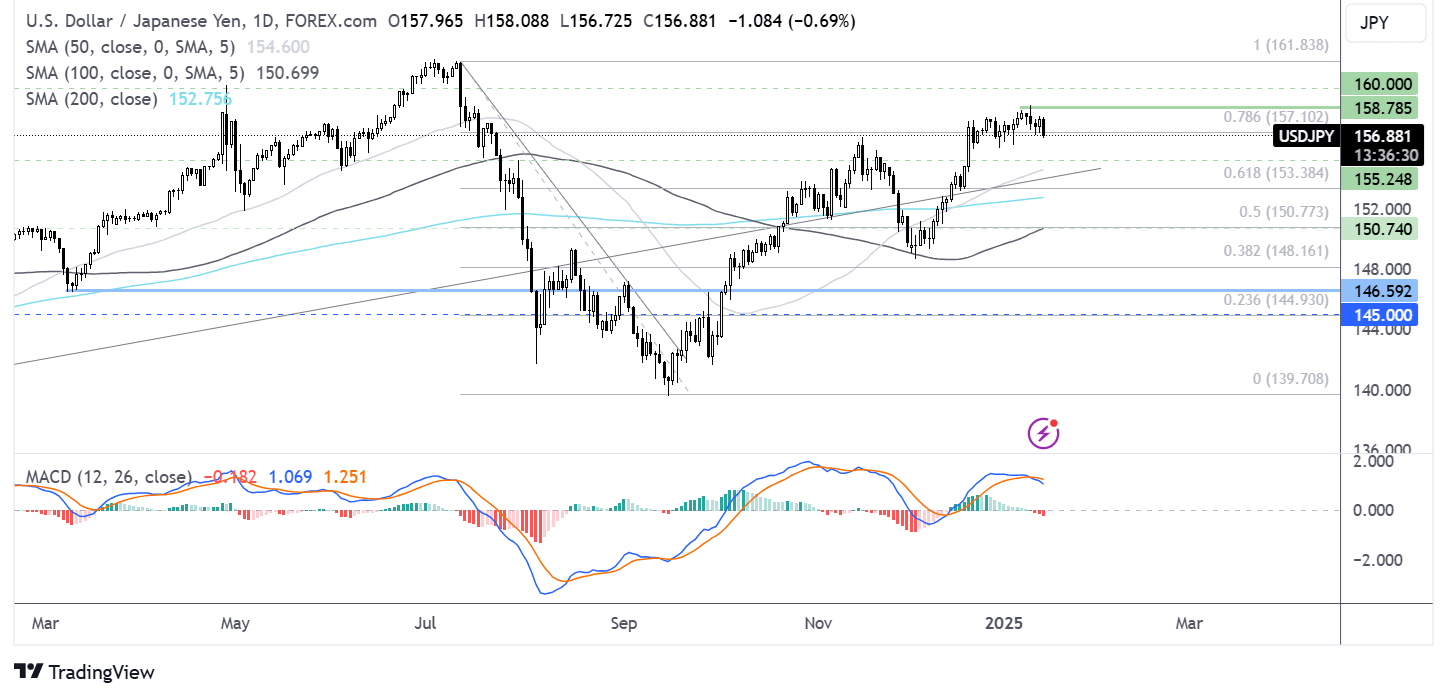

GBP/USD forecast – technical analysis

GBP/USD trended lower from 1.34 to a low of 1.21 at the start of the week. The price recovered from 1.21 and trades back above the 1.22 level, bringing the RSI out of oversold territory. The long-term downtrend remains intact, but the hammer candlestick and the long lower wicks on candles this week suggest that the bottom could be in, and a bullish reversal could be in the cards.

Buyers will look to extend gains above 1.23, the April low, before focusing on 1.25, the December low into focus.

Sellers will need to take out the 1.21 low to extend losses to 1.2050, the 2023 low, and 1.20, the psychological level.

USD/JPY falls ahead of US CPI

- Yen rises after hawkish BoJ comments

- US CPI is expected to rise to 2.9% from 2.7%

- USD/JPY tests 157.1 support

USD/JPY is falling amid a stronger yen following hawkish BoJ’s Ueda remarks. However, those gains could be short-lived ahead of US inflation data.

Governor Ueda reiterated the central bank's commitment to raising borrowing costs if the economy continues to improve. His comments followed days of the OJ deputy governor him me know on Tuesday. The end raise as markets priced in the possibility of a rate hike at next weeks meeting.

Comments from Finance Minister Kato, who revived concerns about potential government intervention in the FX markets, also supported the yen.

Attention is now turning to US inflation data, which is expected to show that CPI increased 2.9% from 2.7% in November, marking its fifth straight monthly increase and moving further from the Fed's 2% target.

Worries about hot inflation are already rampant in the market, with treasury yields elevated. I mean, the resilient U.S. economy and ahead of Trump's administration. Trump is expected to implement inflationary policies.

Hotter-than-expected inflation could see the market further resist Fed rate cut bets. Currently, the market sees just one rate shot right at the end of this year. This could see USD/JPY recover higher above 158.

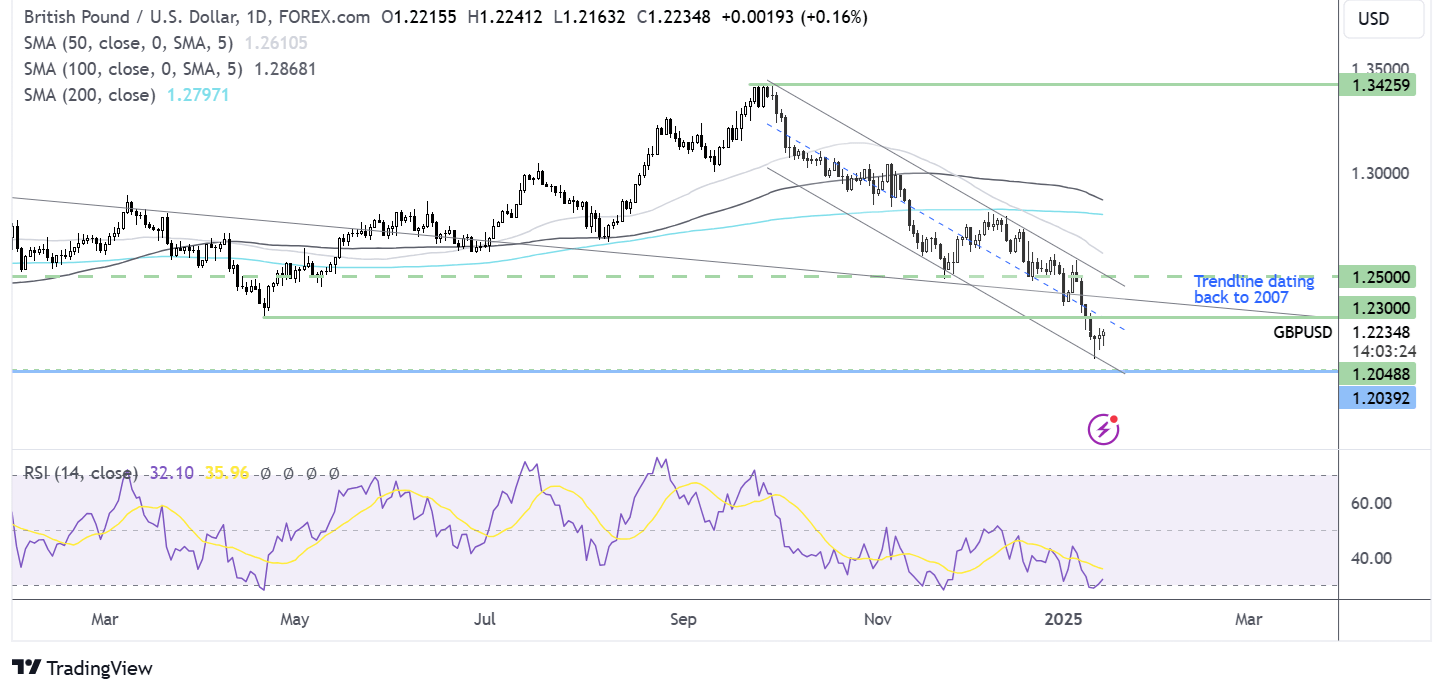

USD/JPY forecast - technical analysis

After a strong run-up from the 148.65 low, USD/JPY has been consolidating just below 158. The price is testing support at the 78.6% fib retracement at 157.10, as the MACD shows a bearish cross-over.

Should sellers meaningfully break below 157.10 and 156.75 the November high, a deeper selloff towards 155 round number and 152.40 the 61.8% fib level could be on the cards.

Should the 157.10-156.75 support zone hold, buyers will look to extend gains above 168.80, the 2025 high, towards 160 and 162, the 2024 high.