US Dollar Outlook: GBP/USD

GBP/USD struggles to retain the advance from the start of the week following a batch of a positive US data prints, but the exchange rate may continue to trade within the 2024 range should it extend the recent series of higher highs and lows.

GBP/USD Recovery Keeps 2024 Range Intact

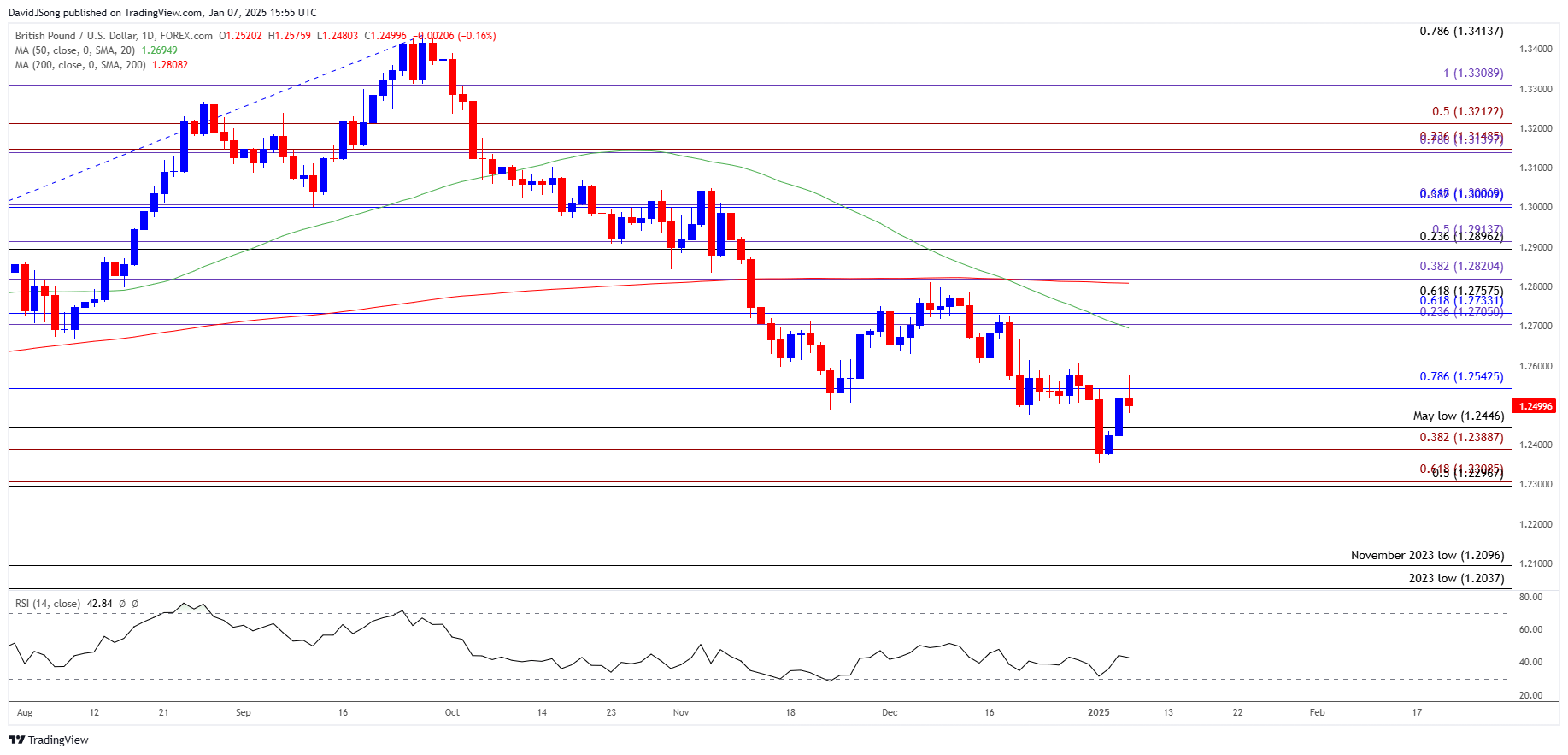

Keep in mind, GBP/USD bounced back ahead of the 2024 low (1.2300) to keep the Relative Strength Index (RSI) out of oversold territory, and the exchange rate attempt to further retrace the decline from the December high (1.2812) as the oscillator moves away from oversold territory.

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

Nevertheless, developments coming out of the US may sway GBP/USD amid the reaction to the ISM Services survey, which showed the index printing at 54.1 in December versus forecast for a 53.3 reading, while Bureau of Labor Statistics (BLS) revealed that ‘the number of job openings was little changed at 8.1 million on the last business day of November.’

Little signs of a looming recession may push the Federal Reserve to the sidelines as the central bank acknowledges that ‘our policy stance is now significantly less restrictive,’ and Chairman Jerome Powell and Co. may pause its rate-cutting cycle as ‘the median participant projects that the appropriate level of the federal funds rate will be 3.9 percent’ at the end of 2025.’

With that said, the recent rebound in GBP/USD may turn out to temporary should it track the negative slope in the 50-Day SMA (1.2695), but the exchange rate may stage a larger over the coming days as it appears to be defending the 2024 low (1.2300).

GBP/USD Price Chart –Daily

Chart Prepared by David Song, Senior Strategist; GBP/USD on TradingView

- GBP/USD registers a fresh weekly high (1.2576) as it carves a series of higher highs and lows, with a close above 1.2540 (78.6% Fibonacci retracement) bringing the 1.2710 (23.6% Fibonacci extension) to 1.2760 (61.8% Fibonacci retracement) zone back on the radar.

- Next area of interest comes in around 1.2820 (38.2% Fibonacci extension), but lack of momentum to close above 1.2540 (78.6% Fibonacci retracement) may curb the bullish price series.

- In turn, GBP/USD may continue to hold below the 50-Day SMA (1.2695), and lack of momentum to hold above the 1.2390 (38.2% Fibonacci extension) to 1.2446 (May low) region may spur another run at the 2024 low (1.2300)

Additional Market Outlooks

Australian Dollar Forecast: AUD/USD Defends 2022 Low

US Dollar Forecast: USD/CHF Pulls Back Ahead of 2024 High

EUR/USD Halts Three-Day Selloff to Keep RSI Out of Oversold Territory

USD/CAD Rebound Pushes RSI Back Towards Overbought Zone

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong