GBP/USD awaits the BoE rate decision

- BoE expected to leave rates unchanged at 5.25%

- Will the BoE prepare the market for a June rate cut

- GBP/USD testing 1.27 support

GBP is inching lower ahead of the Bank of England rate decision at 12:00 BST today.

The Bank of England is expected to leave rates unchanged at 5.25%, a sixteen-year high, despite headline inflation cooling to 2%, the central bank's target level, for the first time since July 2021.

However, stickier-than-expected service sector inflation and strong wage growth still mean the central bank will likely want to see more signs of these indicators cooling before cutting rates.

Furthermore, this is a central bank meeting in an election blackout period. This means that the central bank has limited ability to communicate prior to the meeting and until the 4th of July.

With no rate cut expected, attention will be on forward guidance and whether the central bank signals an August rate cut, provided the data supports a move.

Meanwhile, the US dollar is heading higher after the Juneteenth public holiday yesterday and as investors await fresh catalysts. Jobless claims and PMI data are due today and tomorrow.

The market will be watching to see if claims are expected to ease from a nine-month high of 242k 235k. Higher than-expected jobless claims could point to persistent softness in the US labour market, which could encourage the Fed to cut interest rates sooner and pull the USD lower.

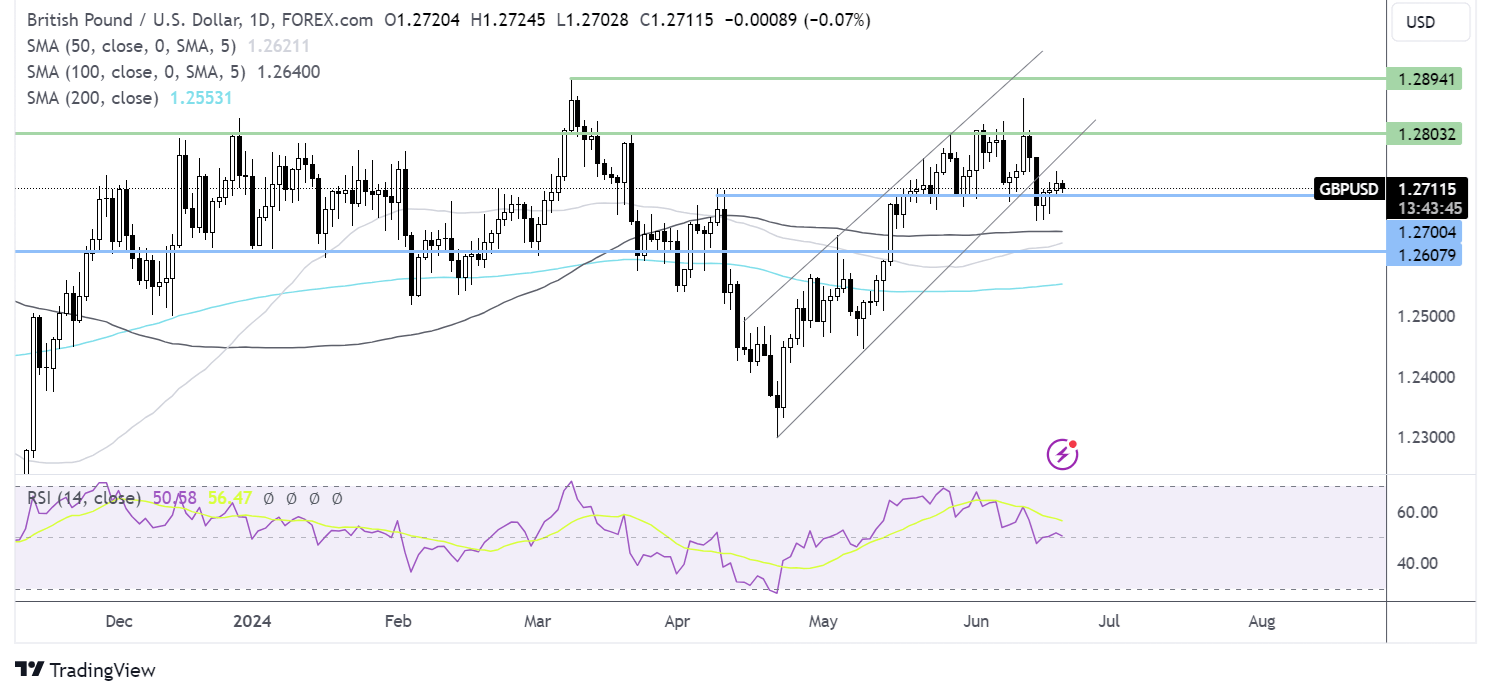

GBP/USD forecast – technical analysis

GBP/USD is testing support at 1.27 ahead of the meeting, having re-entered the familiar range of 1.270-1.18 that the pair has traded since mid-May.

Sellers will look to take out 1.27 support and 1.2650, the June low, to create a lower low. Below, 1.26 comes into focus.

Meanwhile, should 1.27 hold, buyers could test 1.2750 to re-enter the rising channel. Above here, 1.28 comes into focus.

FTSE 100 rises ahead of the BoE rate decision

- Rates are expected to remain unchanged

- Banks, housebuilders & retailers could benefit from a dovish BoE

- FTSE rises above 8200

The FTSE has opened modestly higher and is also focused on the Bank of England interest rate decision. The index is likely to receive a boost should the central bank adopt a more hawkish tone or indicate that it could be cut rates at the August meeting.

Housebuilders, banks, and retailers are most likely to be in demand because the central bank is preparing the market for a rate cut. However, any sense that the Bank of England is adopting a more cautious tone due to sticky service sector inflation and solid wage growth, could see these sectors come under pressure.

Later in the day US data could influence market sentiment, with jobless claims and housing data.

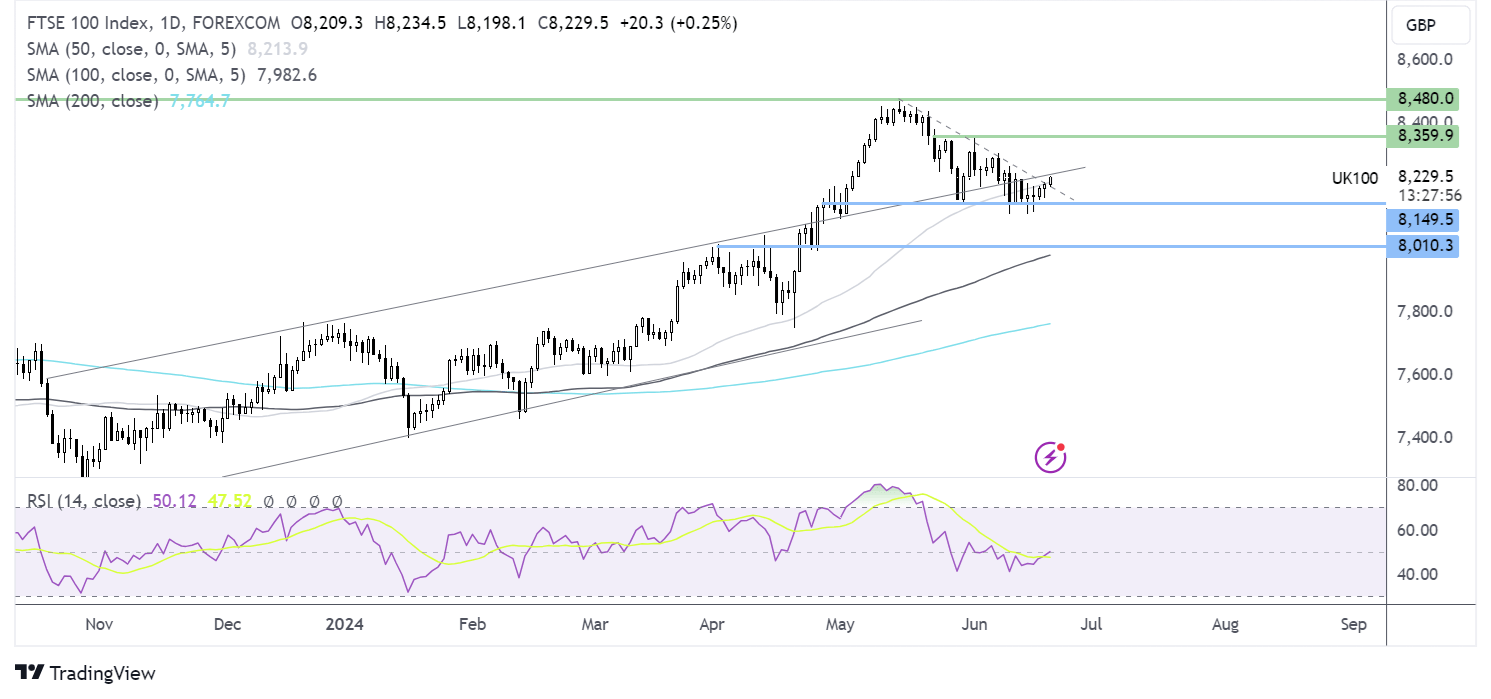

FTSE 100 forecast – technical analysis

The FTSE has risen above 8200, above the falling trendline dating back to mid-May, and brought the multi-month rising trendline resistance at 8240 into focus. A rise above here brings 8350, the June high, into play.

However, should sellers successfully defend the rising trendline resistance, a retest of 8150-8100 zone could be on the cards. A break below here creates a lower low and could open the door to 8000.