GBP/USD tumbles to a 13-month low as government bond yields surge

- GBP drops & gilt yields surge on worries over UK fiscal outlook

- USD rises tracking treasury yields higher

- GBP/USD falls to 1.2250, breaking below a 15-year trendline

The pound has fallen to its weakest level against the US dollar in over a year amid investor concerns over the UK fiscal and inflation outlook.

The drop in sterling comes as the yield on the UK 30-year gilt soared to its highest level since 1998, while the 10-year gilt hit levels last seen in 2008.

The sharp rise in gilt yields combined with the fall in the pound points to capital flight as investors fret over persistent inflation and the fiscal outlook. In short, investors are losing confidence in the government’s ability to control the fiscal backdrop.

Inflation in the UK is proving to be stickier than expected, and the markets are doubting the Bank of England's ability to cut interest rates much more following Labors inflationary budget at the end of October.

The rise in borrowing costs puts pressure on Chancellor Rachel Reeves as her £9.9 billion fiscal headroom dwindles. Traders' worries could deepen without amendments to the government's fiscal plan, which could mean further tax increases or spending cuts in te March Budget.

Meanwhile, the US dollar is tracking treasury yields higher after a series of stronger-than-expected US data, more hawkish Fed minutes, and as the market focuses on Trump's policies when he steps back into the White House on January 20th.

Markets expect Trump to implement policies, including great tariffs and tax cuts, to bolster growth and increase inflationary pressures.

The minutes of the December Fed meeting showed that policymakers were concerned over the revival of inflation. The officials also saw a rising risk to inflation from the incoming Trump administration's plans.

The US economic calendar is quiet today and the US stock markets will be closed on Thursday. Attention will be on Friday's payrolls which could provide further clues over the future path for interest rates.

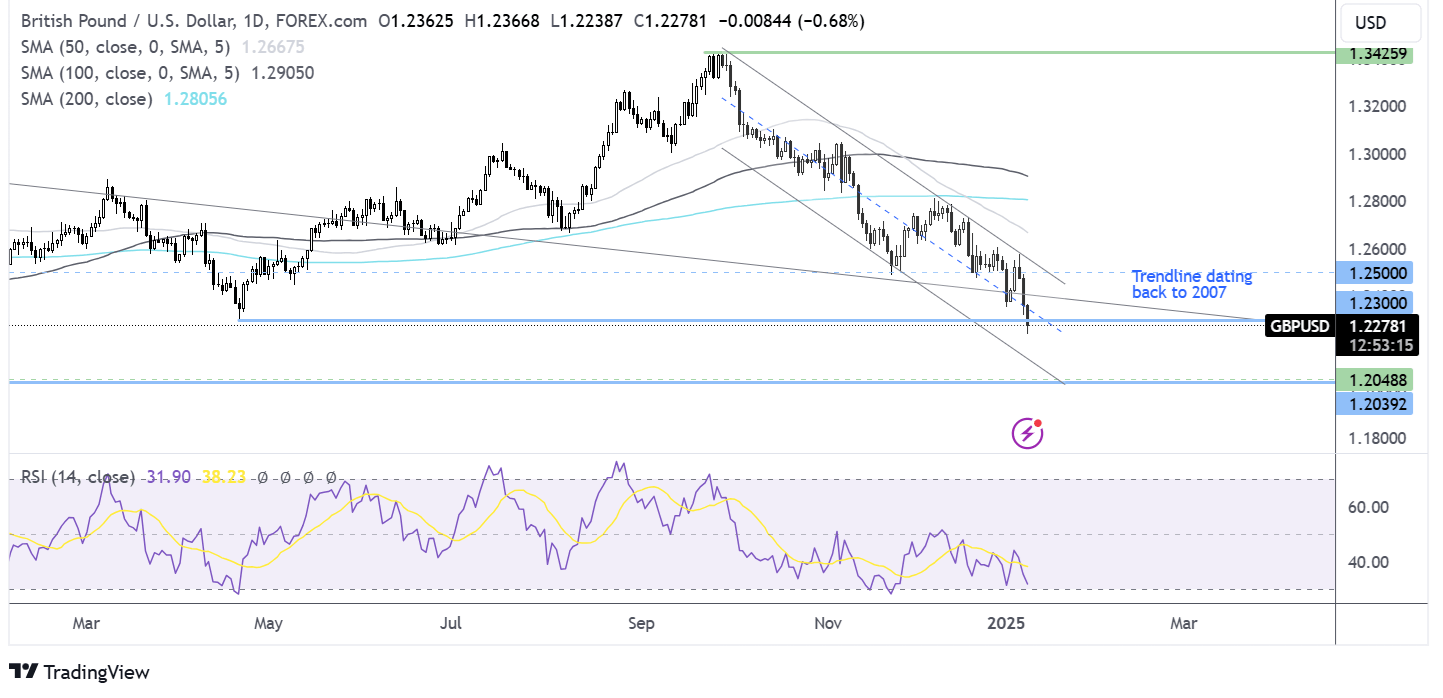

GBP/USD forecast – technical analysis

GBP/USD trades within a falling channel, falling from 1.34 in September dropping to a low of 1.2240, a level last seen in April 2024. The price has also broken below a trendline dating back to 2007 and the April 2023 low. The RSI supports further losses while it trades out of oversold territory.

Sellers will look to extend losses towards 1.2030, the 2023 low.

Any recovery would need to retake 1.2575, the weekly high, ahead of 1.26.

FTSE rises as the pound plunges

- Multinationals rise on the beneficial exchange rate

- Consumer stocks drop sharply

- FTSE rises to an almost 4-week high

The FTSE is rising, boosted by the weaker pound amid the sell-off in UK government bonds. A weaker pound supports the FTSE100 as it provides a more beneficial exchange rate for the multinationals that make up the majority of the index. The FTSE 250 which has a higher proportion of more domestically focused stocks, has fallen sharply on the open.

However, the mood towards UK-focused stocks has worsened significantly, with consumer names falling despite upbeat corporate earnings.

Marks and Spencer is down over 6.5%, Greggs is down 7%, and Tesco is down around 3%.

Tesco reported growth in sales over the Christmas period as it increased market share and benefited from customers switching from rivals. Its like-for-like sales gross was 3.7%, up from 2.8% in the prior four weeks.

Meanwhile, Marks and Spencer posted Q3 sales growth of 5.6%, with notably strong results from its food division. Food sales increased 8.7% over the period, and clothing, home, and beauty saw a weaker performance, with revenue growth performance of just 1%.

Greggs posted full-year sales at 11.3%, in line with expectations, while like-for-like sales improved 2.2% across the quarter. The group will continue to open new stores this year, with a target of 140 to 150 openings.

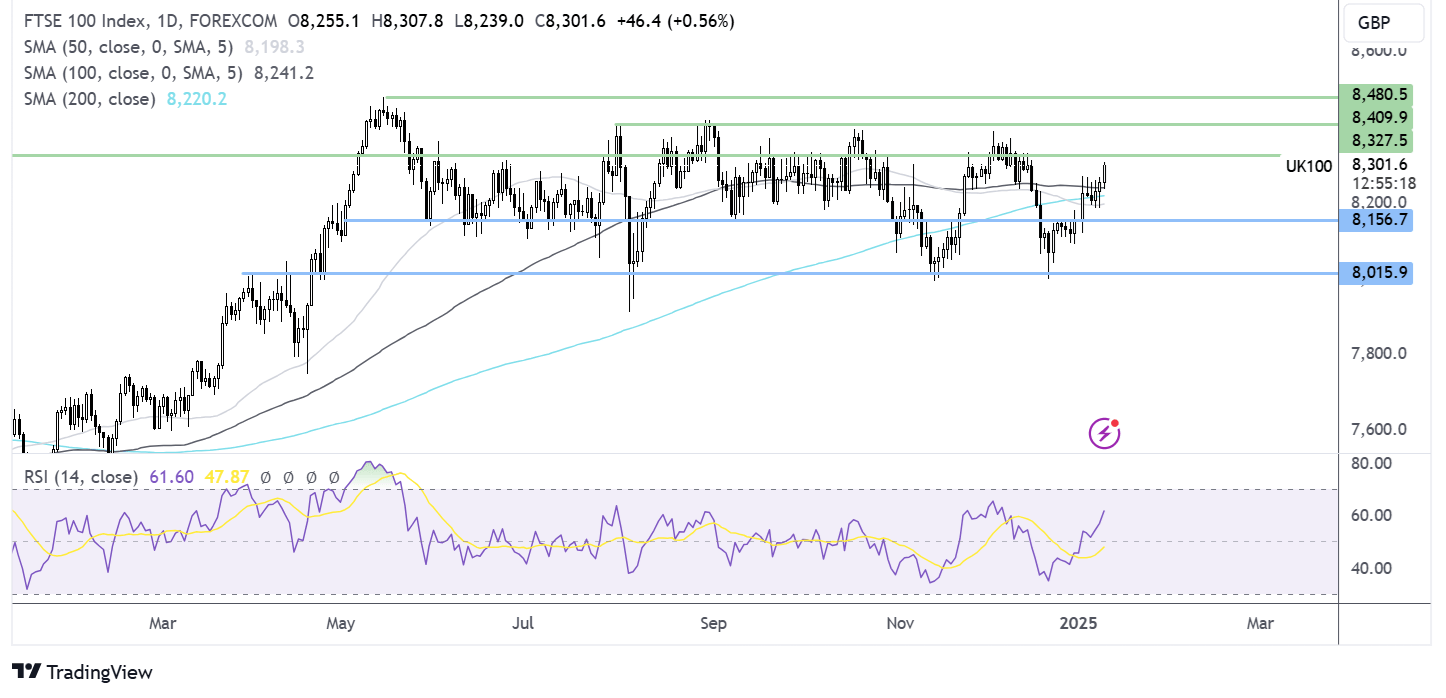

FTSE 100 forecast – technical analysis

The FTSE 100 has extended its recovery from 8000 in late December, rising above the 200 & 100 SMA to its current level of 8290, an almost 4-week high.

Buyers, supported by the RSI above 50, will look to extend gains to 8325 and 8400 to break out of the trading range that it has traded within since April last year.

On the downside, support can be seen at 8220, the 200 SMA. A break below here brings 8000 back into play.