GBP/USD falls on USD strength as Trump is set to win Presidency

- Trump wins the 2024 election, spurring the Trump trade

- GBP looks to BoE rate decision tomorrow

- GBP/USD tests 1.2850 support

At the time of writing, President Trump has won 267 electoral seats against Harris's 224, meaning he needs just three votes to win the 2024 presidential election.

The market is pricing in a Trump win, with the Trump trade in full swing, sending the US dollar to a four-month high against its major peers, tracking treasury yields northwards. Trump's tax and tariff policies are expected to be inflationary, meaning that the Federal Reserve will likely cut interest rates at a slower pace.

Trump has won the Senate and is in the lead to win the House as well, which means a red sweep would give Trump a strong platform to implement such policies.

The pound, along with other major peers, is falling against the stronger U.S. dollar. Attention is starting to turn towards tomorrow's Bank of England rate decision. The central bank is expected to cut rates by 25 basis points. However, Bank of England governor Andrew Bailey is unlikely to raise hopes of another cut in December following the labor budget, which could increase inflationary pressures on growth in the near term.

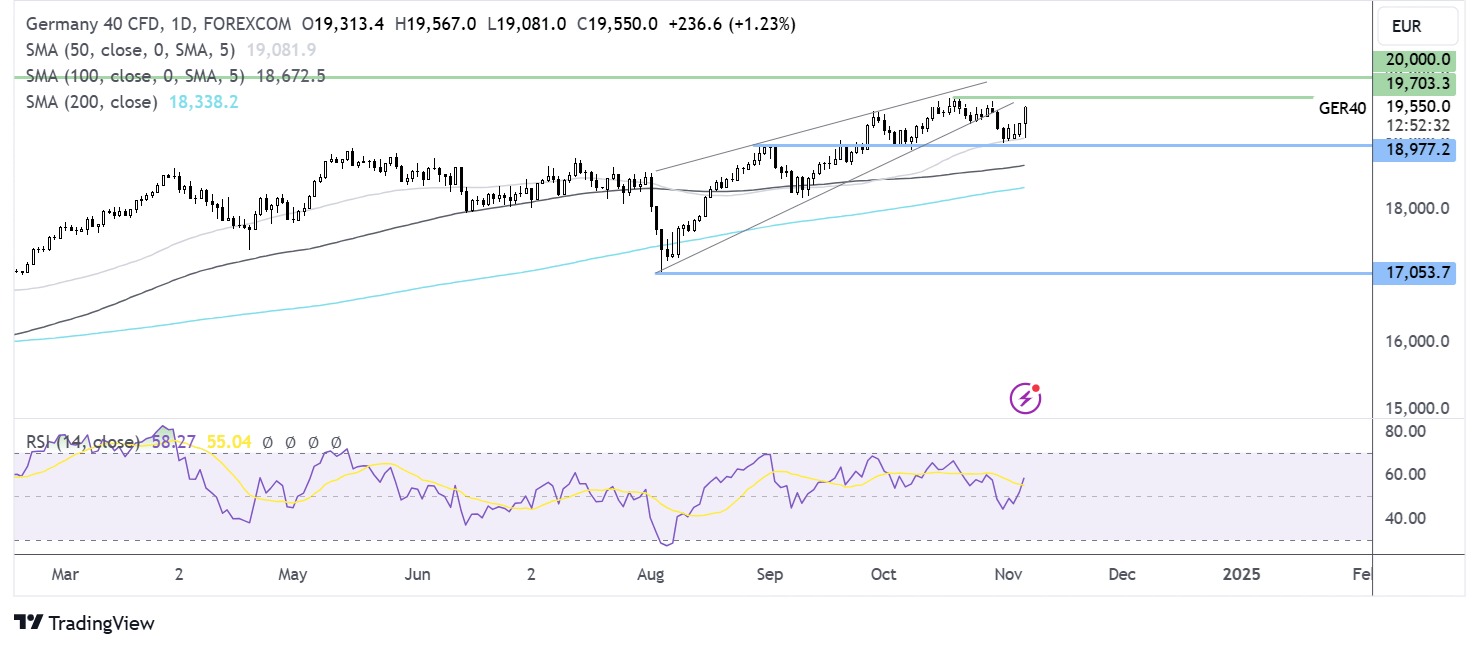

GBP/USD forecast – technical analysis

GBP/USD rebounded lower from 1.3050, taking out support at the psychological level of 1.30 and the rising trend line. The pair found support once again at 1.2850. The long lower wick suggests that there wasn’t much selling demand at the lower level.

Sellers would need to take out 1.2850 to extend the selloff towards the 200 SMA at 1.2810.

Any recovery would need to rise above 1.30 but a rise above 1.3050 is needed to create a higher high and bring 1.31 into play.

DAX rises as Trump claims victory

- European stocks track US futures higher

- Eurozone PMIs revised higher

- DAX rebounds from 50 SMA

European stock markets have opened higher, following record highs on US futures, as Donald Trump claims victory, even before the election has yet to be officially called.

Republicans have also taken a majority in the Senate, raising the likelihood of a red sweep. This would give Trump a powerful mandate and platform to implement his policies, including tax cuts sending US stocks higher.

European stocks are tracking gains even though Trump’s tariff policies could negatively impact European firms.

Whilst US elections will continue to drive sentiment, investors will also be looking at eurozone PPI figures and the composite PMI, which came in stronger than expected thanks to a stronger-than-forecast service sector.

In corporate news, BMW reported a substantial drop in Q3 profits, missing forecasts owing to slumping Chinese sales and brake problems. However, the carmaker said it was on track to meet its adjusted full-year financial outlook.

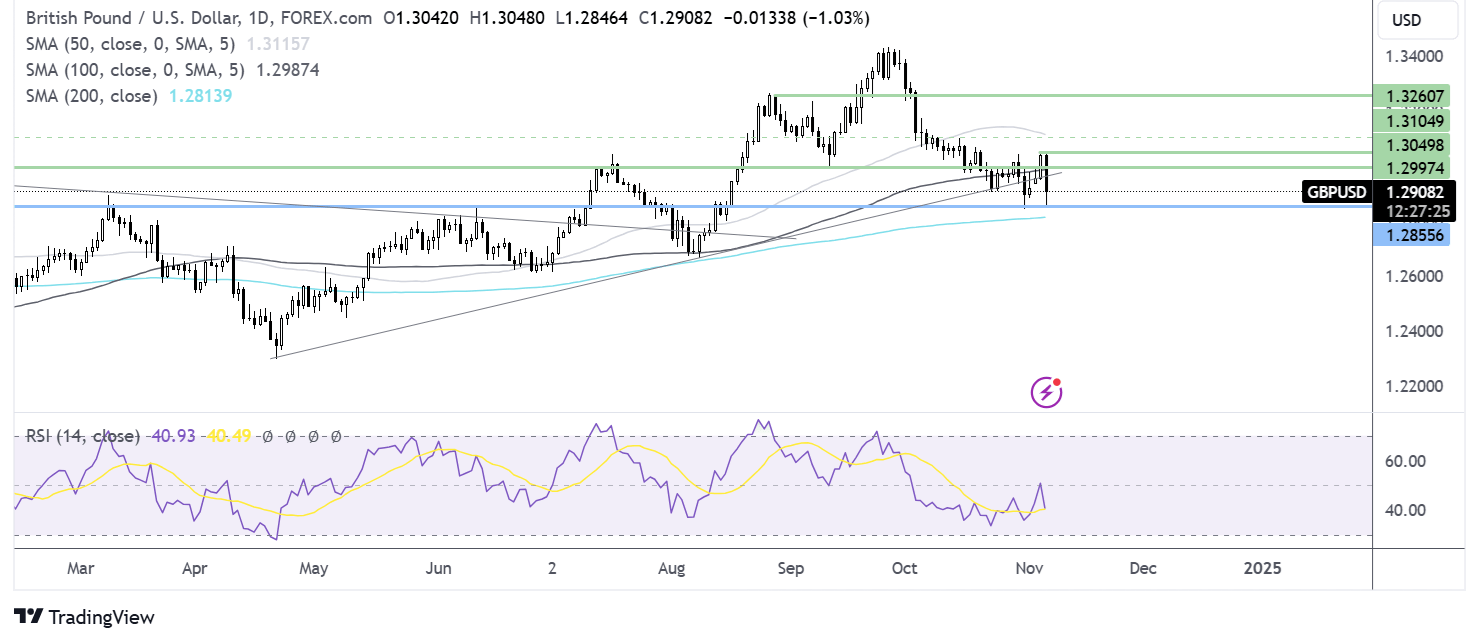

DAX forecast – technical analysis

DAX has recovered from the 50 SMA at just at 19.070, rising towards 19,670 and fresh record highs. Above here 20,000 would be the next logical target.

Support can be seen at the 50 SMA at 19,070 and 19000 round number. A break below here creates a lower low.