GBP/USD gives up earlier gains after hotter inflation

- UK CPI rose to 2.3% o from 1.7%

- The market lowers BoE rate cut expectations through to the end of 2025

- GBP/USD trades caught between 1.26 – 1.27

GBP/USD rose following UK CPI data before quickly giving back those gains. The pair is unchanged at 1.2680.

UK CPI rose to 2.3% YoY, up from 1.7% in September and ahead of forecasts of 2.2%. On a monthly basis CPI rose 0.6% ahead of the 0.5% forecast. Core inflation also rose to 3.3%.

UK inflation was hotter than expected in October, creating a headache for the BoE. Higher energy prices were a key factor, as was hotter than forecast services inflation, a marker policymakers are watching closely.

The hotter inflation comes as BoE governor Bailey has already warned that rates may be cut at a slower pace owing to the uncertain outlook for consumer prices after Labour’s Budget.

A December rate cut is not expected, and the BoE will likely cut rates at a more gradual pace next year, lifting GBP while pulling the FTSE lower.

Markets lowered rate cut expectations to just 60 basis points through the end of 2025, down from multiple rate cuts expected just a few weeks ago.

The US dollar is heading higher, recovering after a bout of profit-taking in recent days. A lack of fresh catalysts saw the greenback ease away from its yearly high reached last week

today, the USD is resuming the uptrend, boosted by expectations that the Federal Reserve will cut interest rates at a more gradual pace over the coming year owing to economic resilience and expectations of inflationary policies from Trump.

The market is carefully examining Trump's cabinet selections, particularly the yet-to-be-announced Treasury Secretary position.

The U.S. economic calendar is quiet again today, but fed speakers will be in focus as attention turns to PMI data later in the week.

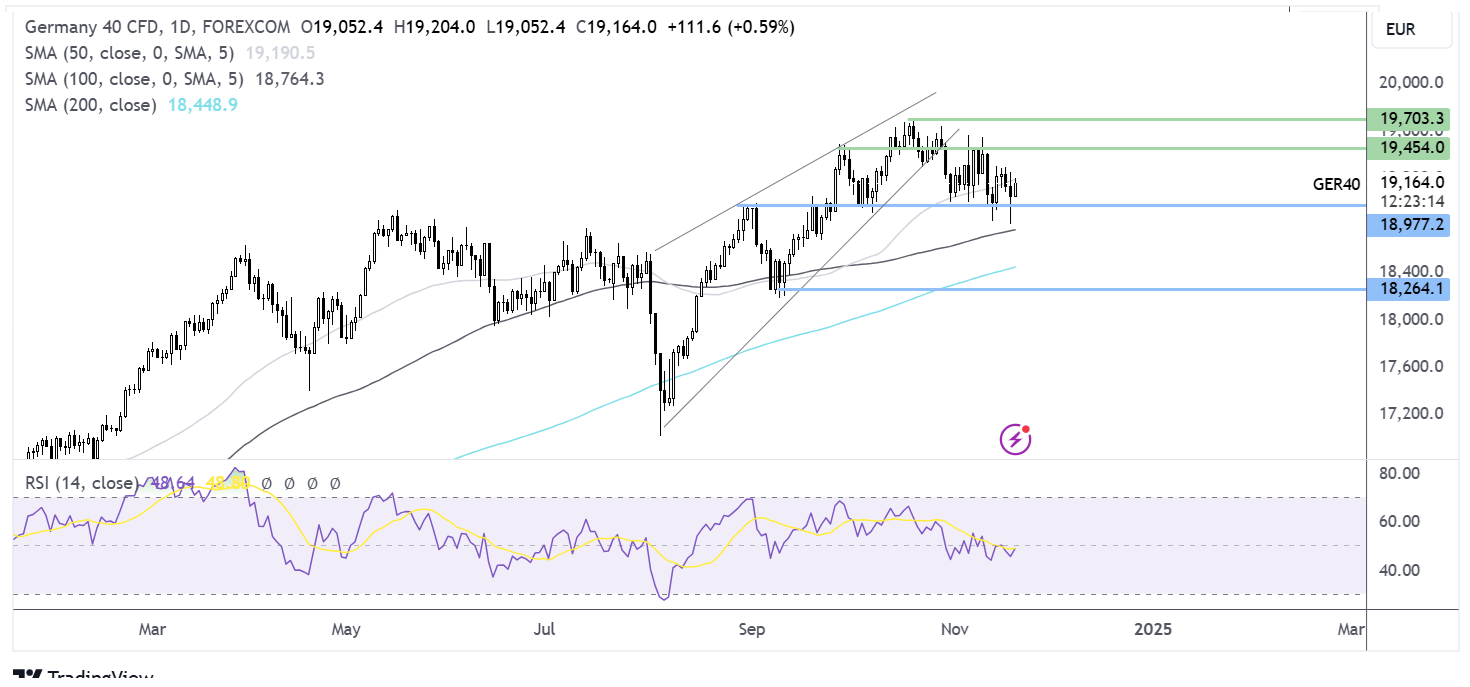

GBP/USD forecast- technical analysis

GBP/USD found support at the 1.26 round number and the falling trendline dating back to August 2021. The price corrected higher but failed to sustain the move above 1.27 and continues to trade in the familiar range of 1.26 – 1,27. The RSI is below 50, supporting further downside.

Sellers will look to take out the 1.26 support, opening the door towards 1.25.

On the other hand, resistance can be seen at 1.27, a rise above here exposes the 200 SMA at 1.2820.

DAX rises as geopolitical worries ease, Nvidia earnings come into focus

- Geopolitical concerns ease

- Nvidia is due to report after the close

- DAX holds above 19000

The DAX opened higher on Wednesday, recovering from yesterday's sell-off as fears over the Russian-Ukraine conflict eased.

News yesterday that Russia had updated its nuclear policy, lowering the threshold for a nuclear war had hurt risk sentiment. The ramping up of geopolitical tensions came amid ongoing jitters surrounding possible U.S. trade tariffs when Trump takes power next year. Europe is in the firing line on both accounts.

Today, the mood is more upbeat as investors look ahead to new Nvidia earnings after the close in the US. Earnings from the eye darling will be a litmus test for the AI trade, which has helped stocks rally to all-time highs this year.

On the economic calendar, German producer prices fell 1.1% year on year in October after falling 1.4% in September. The reading was in line with expectations and supports the view that the ECB could cut rates by a further 25 basis points in the December meeting.

ECB president Christine Lagarde is due to speak later today.

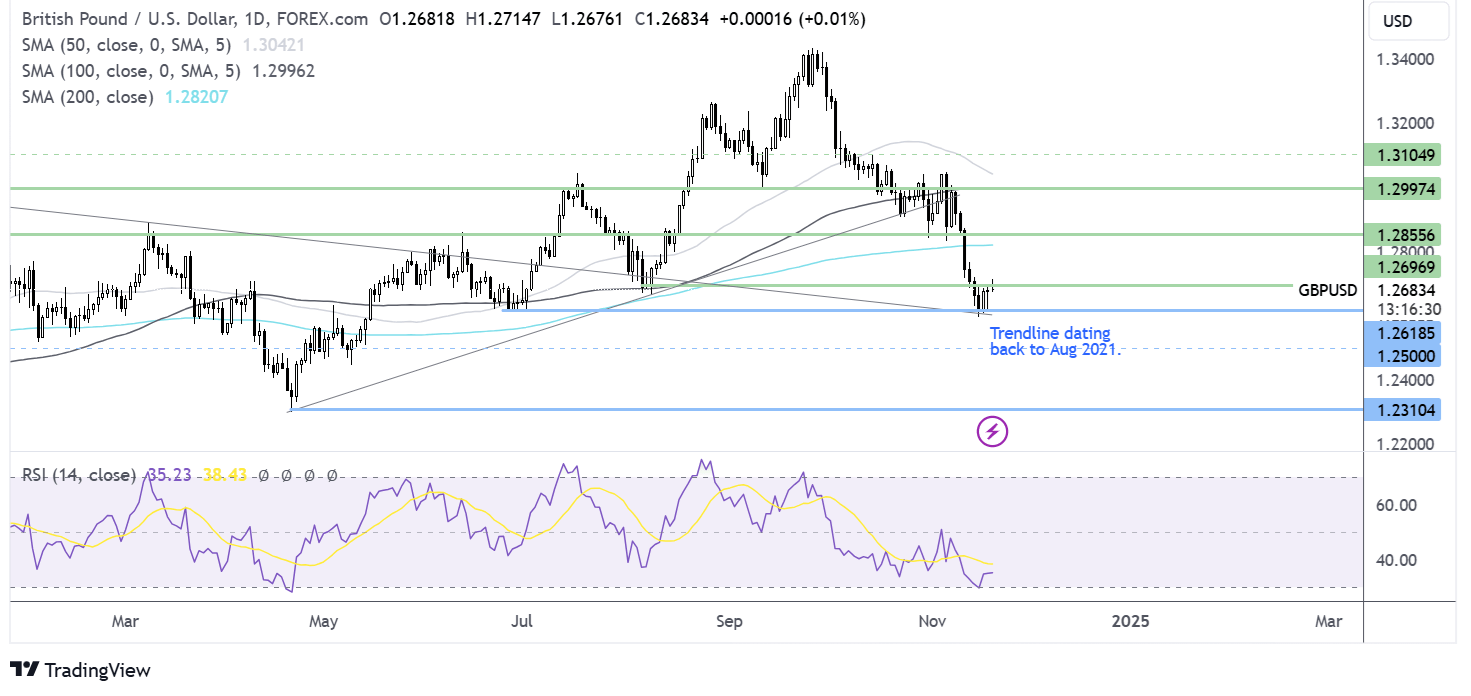

DAX forecast – technical analysis

The DAX has fallen far from its all-time high of 19,684, breaking below 19,500 and forming a series of lower lows. The price has taken out the 50 SMA but continues to close above support at 19,000. The long lower wick on recent candles suggests that selling demand was weak at the lower levels.

Sellers will need a close below 19,000 and to take out 18,810, the November low, to extend losses to the 100 SMA at 18,750 and the 200 SMA at 18,500.

Should buyers successfully defend the 19,000 level, buyers will look to rise towards 19,500. A rise above here creates a higher high and brings 19684 and fresh record highs into focus.